Issuing fraudulent invoices only needs to "exceed" the threshold in terms of consequences or the nature of the act to be transferred from administrative penalties to criminal prosecution. Businesses should not trade legal risks for the sake of legitimizing short-term costs, as the consequences can directly affect leadership, legal entity, and the long-term survival of the business.

To better understand how to issue invoices without incurring penalties, let's explore this in the article below by Bizzi.

What is a fictitious invoice? Common types of fictitious invoices.

A fictitious invoice doesn't always result from intentional fraud.However, how businesses respond will determine the legal consequences.

1. What is a fake invoice?

Fake invoices is an invoice that has been issued not linked to actual economic transactions, or There is only an invoice, but no corresponding goods or services. This has actually occurred.

In other words, a fictitious invoice shows:

- Goods/services are not bought, sold, or supplied; or

- The actual transaction does not match the content and value recorded on the invoice, with the aim of legitimizing expenses, claiming tax deductions, or evading taxes.

Fake invoices are classified as the act of using illegal invoices In accordance with the law on taxation and electronic invoices.

2. Common types of fraudulent invoices

In reality, fraudulent invoices don't just exist in one form; they often appear in many sophisticated ways:

2.1. Issuing invoices for transactions that did not occur.

This is The most typical and common type of fake invoice..

- No buying or selling of goods, no provision of services.

- The two parties are simply "buying and selling invoices" to legitimize expenses, inflate input costs, or claim VAT deductions.

2.2. Transactions occurred but the invoice value was inflated.

- The actual transaction did take place, but:

- The quantity of goods listed on the invoice is higher than the actual quantity.

- The unit price was artificially inflated.

- The difference is intended to either increase expenses or increase the amount of tax deductible.

Essentially, the inflated value is still considered a fraudulent invoice.

2.3. Issuing invoices for goods and services that do not reflect the actual situation.

This method is often used to "legitimize" expenses that do not qualify for other services.

- The goods/services listed on the invoice are incorrect in type and transaction details.

- For example, you might purchase item A but issue an invoice for item B to match the business expenses.

2.4. "Ghost" businesses or businesses that have absconded issue invoices.

- Issuing company:

- There is no actual business activity.

- Lack of personnel, warehousing, assets, and supply capacity.

- The invoices are issued solely for the purpose of selling invoices.

This is the group Fake invoices carry a very high tax risk., which are often on the tax authorities' warning list.

2.5. Issuing fictitious invoices to claim VAT refunds or deductions.

- Create a series of fake input and output invoices.

- Use for:

- VAT refund.

- Reduce the amount of tax payable.

Often associated with organized tax fraud.

3. Differentiating between fraudulent invoices and invoices with common errors.

The penalties for issuing fictitious invoices are a matter of concern for many businesses. Fictitious invoices pose a serious tax risk, distinctly different from ordinary erroneous invoices. Businesses need to clearly distinguish between these errors to avoid confusion between operational mistakes and legal violations, and proactively control input invoices to minimize the risk of disallowed expenses, tax arrears, and penalties.

| Criteria | Fake invoices | Common invoice errors |

| Actual transaction | Absent or not true in nature | There are actual issues that have arisen. |

| Purpose | Fraud, expense manipulation, tax evasion | Operational errors, mistakes |

| Invoice content | Misrepresented nature of the transaction | Incorrect technical information (name, address, amount, etc.) |

| Adjustable | Not legally regulated | Adjusted and replaced as required. |

| Risk Level | Very high | Low - medium |

| Legal consequences | Heavy fines, recovery of funds, and possible criminal prosecution. | Administrative penalties (if any) |

Legal basis related to issuing fictitious invoices

What are the penalties for issuing fraudulent invoices? Issuing fraudulent invoices is a violation of the law and is regulated by multiple legal layers: from electronic invoices and tax management to administrative penalties and criminal liability.

Businesses not only face the risk of fines and back taxes, but also risk criminal prosecution if violations are systemic or involve organized fraud.

1. Decree 123/2020/ND-CP on electronic invoices and documents

Decree 123/2020/ND-CP is the foundational document regulating the principles for the creation, management, and use of electronic invoices.

Regulations related to fraudulent invoices:

- Invoices are only issued when an actual economic transaction occurs (sale of goods, provision of services).

- The invoice must accurately reflect the nature of the transaction, including the goods or services, quantity, unit price, and total value.

- It is prohibited to issue invoices when no sale has occurred, or to issue invoices that do not reflect the actual situation.

Issuing invoices that are not linked to actual transactions or that misrepresent the nature of the transaction directly violates Decree 123, even without considering the penalty aspect.

2. Decree 125/2020/ND-CP on administrative penalties for violations related to taxes and invoices.

Decree 125/2020/ND-CP specifies the penalties for violations related to invoices, including the issuance of fictitious invoices.

Some typical penalty frameworks:

- A fine of 20 to 50 million VND will be imposed for the following actions:

- Issuing invoices without goods or services.

- Issuing invoices that do not reflect the actual situation.

- The issued invoice must be canceled, and the related tax records must be adjusted.

- Collect back taxes and calculate late payment penalties.

- If there are signs of tax evasion, the case will be transferred to the investigative agency.

Decree 125 serves as the basis for direct and regular penalties applied in tax inspections and audits.

3. Tax Administration Law 2019

The 2019 Tax Administration Law establishes the principle of risk-based tax management and the responsibility of taxpayers.

Contents related to fraudulent invoices:

- Taxpayers have the following obligations:

- Declare the transaction truthfully, completely, and accurately reflecting its nature.

- Keep records and documents proving the legitimacy of the expenses.

- Using illegal invoices is a violation of tax laws.

- The tax authorities have the right to:

- Determine the tax.

- Tax collection and penalties.

- Transfer the case file to the investigative agency if there are signs of criminal activity.

This law provides the general legal basis for tax authorities to handle acts of using and issuing fraudulent invoices.

4. The Penal Code of 2015 (amended and supplemented in 2017)

What are the penalties for issuing fraudulent invoices? In cases of serious fraudulent invoice issuance, the act may not only be subject to administrative penalties but may also lead to criminal prosecution.

Related charges:

- The crime of illegally printing, issuing, and trading invoices and documents for collecting state budget revenue.

- Tax evasion (if using fraudulent invoices to evade taxes).

Possible penalties:

- Large fines (up to billions of VND).

- A non-custodial correctional sentence.

- Imprisonment will be imposed on individuals who violate the law.

- Commercial legal entities can also be subject to criminal prosecution.

This is the strictest legal framework, applied when the act is organized, large-scale, and causes serious damage to the state budget.

5. What are the penalties for issuing fraudulent invoices?

According to regulations on administrative penalties for violations in the field of taxation and invoices:

- The statute of limitations for penalties related to invoices is two years.

- Time of calculation of the statute of limitations:

- From the date the violation was committed.

- Or the date the violation ceased (if it was a prolonged violation).

Important Note:

- The expiration of the statute of limitations for penalties does not automatically mean that expenses can be deducted or recognized.

- The tax authorities still have the right to:

- Type of expense.

- Tax collection.

- Calculate the late payment penalty.

- If there are signs of criminal activity, the statute of limitations for administrative penalties will not apply; instead, the case will be handled according to the Criminal Code.

What are the administrative penalties for issuing fraudulent invoices? (Decree 125/2020)

Issuing fictitious invoices is one of the most severely penalized invoice violations under Decree 125/2020, not only resulting in fines of 20-50 million VND but also leading to tax arrears, late payment penalties, and the risk of criminal prosecution.

1. The act is considered to be issuing fraudulent invoices.

This includes one or more of the following behaviors:

- Issue invoices when no goods are sold or services are provided.

- Issuing invoices that do not reflect reality (falsifying quantities, values, or misrepresenting the nature of the transaction).

- Issuing invoices to businesses that have not had actual transactions.

This is a group of behaviors involving the use of illegal invoices.

2. Main fine amount

A fine of 20,000,000 to 50,000,000 VND will be imposed. Applicable to the following behavior:

- Issuing invoices without accompanying goods or services.

- The invoices do not accurately reflect the actual transactions.

Applicable penalty amount for each violation, regardless of whether the invoice value is large or small.

3. Remedial measures (mandatory)

In addition to fines, violating businesses will also be subject to the following measures:

- The invoices that were issued incorrectly must be canceled.

- Require adjustments to the relevant tax return records.

- Recover any taxes that were incorrectly deducted, refunded, or reduced.

- Calculate late payment penalties for taxes as per regulations.

In reality, the amount of back taxes plus late payment penalties is often much larger than the administrative fines.

4. Cases where the punishment goes beyond administrative penalties.

If the act of issuing fraudulent invoices:

- There are signs of tax evasion.

- It must be done in an organized manner and repeated many times.

- This caused significant damage to the state budget.

The tax authorities will forward the case to the investigating agency for processing as follows:

- Tax Administration Law 2019

- Penal Code 2015 (amended 2017)

In that case, Decree 125 would not apply; instead, criminal sanctions would be applied.

When does issuing fraudulent invoices lead to criminal prosecution?

Not all cases of issuing fraudulent invoices are subject to criminal prosecution. The penalties for issuing fraudulent invoices only apply when the act reaches a level of danger to society as defined by the Criminal Code, primarily falling under the following two offenses:

1. The acts constituting the crime of tax evasion.

Constituent elements:

The act of issuing fraudulent invoices. considered tax evasion When:

- Issuing or using fictitious invoices to:

- Declare a reduction in the amount of tax payable.

- Increase the amount of VAT that can be deducted or refunded.

- The amount of tax evaded reached the threshold for criminal prosecution., specifically:

- From 100 million VND or more, or

- Under 100 million VND, but has been fined for administrative violations. Regarding tax evasion, there were also other violations.

The focus isn't on "having fake invoices," but rather... actual consequences of tax evasion.

2. The acts constituting the crime of illegally printing, issuing, and trading invoices and documents for collecting state budget revenue.

(Article 203 – Penal Code)

Constituent elements:

The act of issuing fictitious invoices is handled according to Article 203 when:

- Creating, issuing, and selling invoices not linked to actual transactions.

- Buying and selling invoices to gain illicit profits.

- No proof of tax evasion is required, just proof of:

- Behavior Buying and selling invoices illegally..

- There is an element profit or large scale, large quantity as required by law.

This is the charge. Directly address the act of "trading in invoices"., independent of tax evasion.

3. Penalty framework for individuals

Regarding the crime of tax evasion (Article 200):

- Fines: from 100 million to 4.5 billion VND, or

- Imprisonment: from 3 months to 7 years (depending on the severity and amount of tax evaded).

- Possible causes:

- Prohibited from holding office.

- Prohibited from practicing a certain profession or performing a certain job.

Regarding the crime of illegal trading of invoices (Article 203):

- Fines: from 50 million to 500 million VND, or

- Imprisonment sentence: From 6 months to 5 years.

- Particularly serious cases:

- Fines can reach up to 1 billion VND.

- Imprisonment for up to 7 years.

4. Penalty framework for commercial legal entities

The Criminal Code allows criminal prosecution of legal entities, if the violation is committed:

- In the name of the legal entity.

- For the benefit of the legal entity.

- With the direction, management, or approval of a legal entity.

Legal entities committing the crime of tax evasion (Article 200):

- Fine: from 300 million to 10 billion VND.

- Possible causes:

- Suspension of operations for a specified period.

- Business activities and fundraising are prohibited.

Legal entities committing the crime of illegal trading of invoices (Article 203):

- Fine: from 300 million to 10 billion VND.

- Possible causes:

- Operations have been suspended.

- Prohibited business activities in certain sectors.

What are the tax, financial, and operational consequences of issuing fraudulent invoices, and what are the penalties?

Issuing fictitious invoices is not just a "violation of invoices" but a systemic risk, with cascading consequences for taxes, cash flow, operations, and business reputation. Businesses may benefit in the short term from legitimizing expenses, but they pay a long-term price in terms of money, time, and business stability.

1. Regarding VAT

Issuing fictitious invoices has a direct and serious impact on VAT tax obligations:

- All related input/output VAT is disallowed. leading to fake invoices.

- Recover the VAT amount that was incorrectly deducted or refunded..

- Calculating late payment penalties for taxes (per day, lasting for the duration of the inspection/examination).

- Serious cases:

- Bag tax assessment.

- Bag Placed under high-risk tax monitoring.

In reality, the amount of back taxes + late payment penalties often far exceeds administrative fines..

2. Regarding corporate income tax

Regarding corporate income tax:

- Expenses recorded from fictitious invoices are disallowed. when settling

- Increases taxable income → increase the amount of corporate income tax payable..

- Subject to retroactive collection of corporate income tax for previous periods, along with late payment penalties.

Regarding personal income tax (indirectly related):

- Expenses: Salaries, bonuses, payments made on behalf of others, personal services… if you use fake invoices to legitimize them, you may face consequences:

- Recalculate personal income tax..

- Collection of arrears and penalties for late payment.

- Individuals involved (accountant, manager, invoice signatory) may be subject to separate penalties.

3. Regarding cash flow and financial statements

Issuing fictitious invoices causes cash flow shock and distorting financial reports:

- Businesses must:

- Submit Sudden tax collection.

- Paying fines and late payment penalties within a short period of time.

- Cash flow is being disrupted:

- Financial planning has been disrupted.

- This impacts the ability to repay debts, pay suppliers, and pay employee salaries.

- Financial report:

- Right retroactive adjustment.

- Loss of integrity, impact on audits.

- Easily manipulated by banks and investors. negative reviews.

Many businesses don't "die because of fines," but rather Dying from inability to generate cash flow. after tax collection.

4. Regarding risk rating and corporate image

When caught issuing fraudulent invoices, businesses typically face the following consequences:

- Classified as a high-risk tax risk.

- Increase frequency:

- Inspect.

- Check.

- Post-audit of electronic invoices.

- The company's reputation has declined:

- With banks, partners, and investors.

- With government agencies.

- Some long-term consequences include:

- Tax records were scrutinized for many years to come.

- Large transactions are more likely to require accountability.

- Restrictions on tax refunds or pre-refund audits.

- The accounting and finance department is under immense pressure.

- It takes time to provide explanations and supplement the documentation.

- Disruption of core business operations.

Common situations that lead to the issuance of fraudulent invoices.

Issuing fictitious invoices rarely stems from "intentional law violations," but usually from operational pressure, catering to customers, or a lack of process control.

Businesses can only truly reduce risk by controlling invoices right from the time they are created, rather than dealing with the consequences after a tax audit.

1. Issue invoices before any actual transaction takes place.

This usually happens due to:

- Drive to meet revenue and sales targets.

- Serving the needs of settlement, loan applications, and bidding processes.

Legal risks

- Bill Does not reflect actual transactions at the time of creation..

- If the transaction then No generation or incomplete generation. → considered a fraudulent invoice.

Valid only if it falls under this category. Allowed to issue invoices in advance according to regulations. and there is sufficient documentation to prove it.

2. Issue invoices to legitimize expenses.

Describe the situation.

- There are actual costs involved, but:

- No valid invoice.

- The supplier does not have the legal standing.

- Businesses seek third parties to:

- Issuing invoices helps to reduce costs.

Legal risks

- There was no actual transaction with the invoice issuer.

- Identified as purchase and sale invoices, very high risks regarding:

- Tax collection.

- Administrative penalties.

- It can even be a criminal offense if the value is high.

3. Issue invoices as requested by the buyer.

Describe the situation.

- The buyer requests:

- Issue an invoice for increased value.

- Issuing additional invoices for services that did not exist.

- The seller "goes along with the customer" to maintain the relationship.

Legal risks

- Despite the buyer's offer, The invoice issuer remains legally responsible..

- Tax authority handle both sides simultaneously..

"Exported upon customer request" This is not a reason for exemption from liability..

4. Issuing invoices between related parties.

Describe the situation.

- Transaction between:

- Parent company – subsidiary company.

- Companies with the same owner.

- Invoice:

- Internal services are unclear.

- There is no supporting documentation.

Legal risks

- Easily perceived as:

- Fraudulent transaction.

- Transfer profits, transfer expenses.

- The tax authorities usually Carefully examine related-party transactions..

Complete documentation is required: contract, service description, acceptance certificate, and valuation report.

5. Issuing invoices that misrepresent the nature of the transaction due to lack of control.

Describe the situation.

- Actual transactions did occur, but:

- The invoice content is inaccurate.

- Incorrect type of goods/services shipped.

- Reason:

- The control process is weak.

- It depends on personal experience.

Legal risks

- If the link between the invoice, contract, payment, and actual transaction cannot be proven, the invoice may be invalidated. considered illegal or partial fictitious invoices.

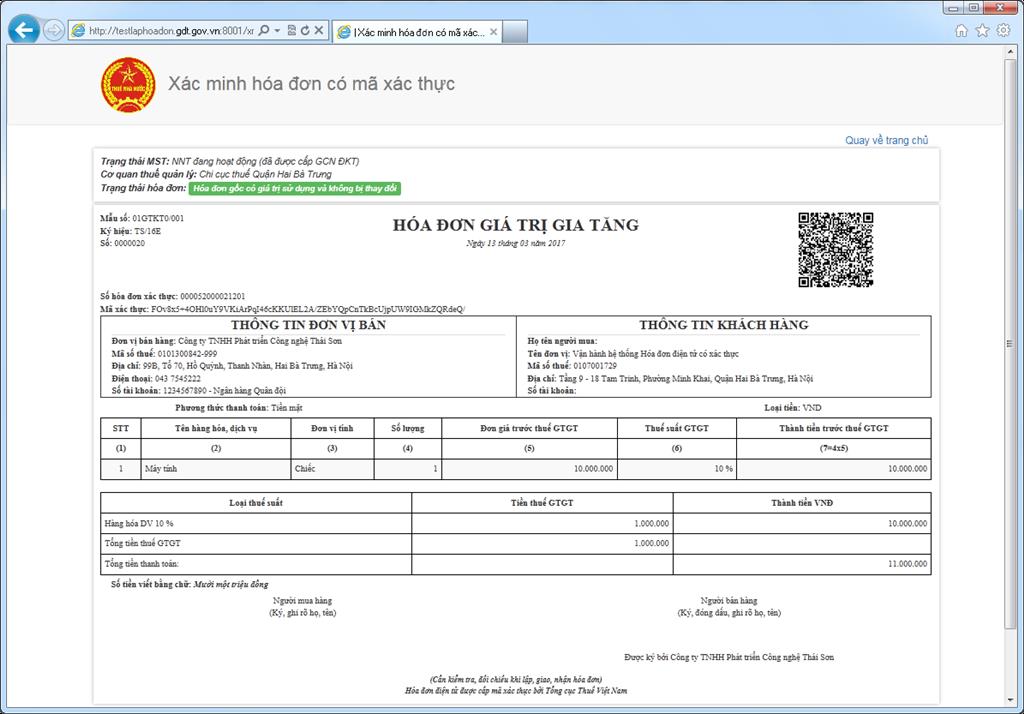

How do tax authorities detect fraudulent invoices?

In the context of electronic invoicing and risk-based tax management, detecting fraudulent invoices no longer relies primarily on manual inspections, but rather on centralized data systems and automated analysis.

1. Matching data from multiple sources

The tax authorities cross-check data from multiple sources, including:

- Electronic invoice data:

- Input-output between businesses.

- Tax return form:

- VAT, corporate income tax, personal income tax.

- Company profile:

- Registered business activities.

- Scale of capital, labor, and assets.

Commonly detected risk factors include:

- Revenue and expenses are disproportionate to the size of the business.

- Buying and selling invoices across businesses that have no legitimate economic relationship.

- An unusual series of invoices.

Just one unusual link can trigger a review of the entire invoice chain.

2. Risk Management System (TMS) and e-Invoice

The tax authority operates a centralized Tax Management System (TMS) that is directly connected to:

- Electronic invoicing system (e-Invoice).

- Real-time tax filing data.

Automated system:

- Business risk scoring.

- Raise a "red flag" to any unusual invoice.

- Create a list of high-risk businesses regarding invoices.

Common risk indicators:

- Issue high-value invoices within a short period of time.

- The newly established business experienced a sudden surge in revenue.

- Issuing invoices with duplicate content, value, and partner.

Many fraudulent invoices are discovered before businesses have a chance to finalize their accounts.

3. Connect with banking data and other systems.

The tax authority does not operate independently but connects its data with many other agencies, including:

- Bank:

- Is the cash flow for payments real?

- The payment process is circuitous, with closed-loop money transfers.

- Custom:

- Compare incoming and outgoing invoices.

- Business registration and social insurance agencies:

- Number of workers.

- Practical operational capabilities.

Risk factors:

- The bill is large, but:

- No bank transfer payments are accepted.

- The payment was merely a formality.

- High revenue, but:

- There are no suitable personnel.

- No warehouses or assets.

When cash flow cannot substantiate the transaction, the invoice is easily deemed fraudulent.

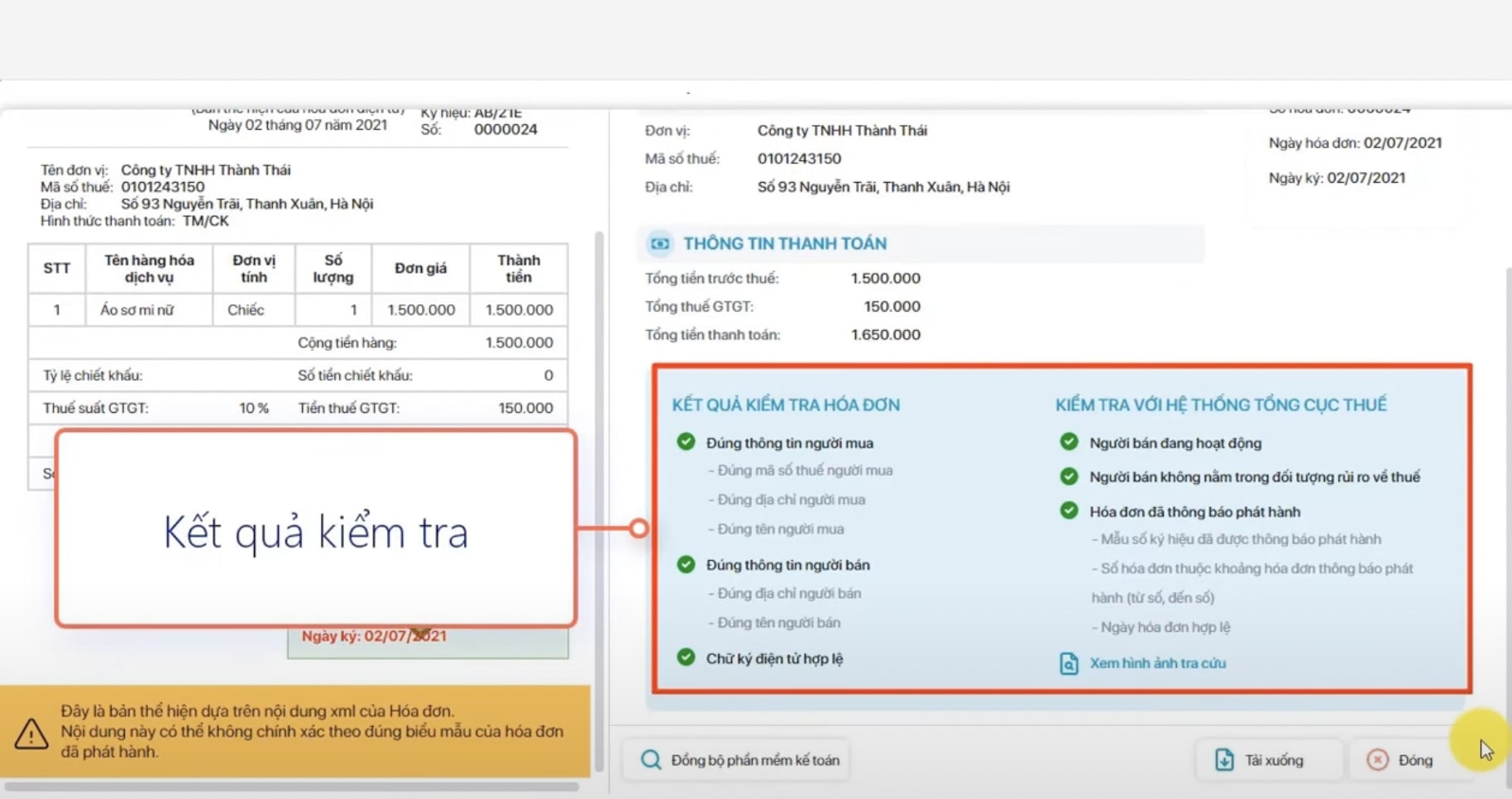

4. Notification and request for explanation

Upon detecting signs of risk, the tax authorities will:

- Send out risk invoice notifications.

- Business requirements:

- Explanation.

- Provide additional documentation to prove the transaction.

Documents typically required:

- Economic contract.

- Acceptance and handover report.

- Payment voucher.

- Documentation proving the supplier's capabilities.

Consequences:

- If Unable to provide an explanation:

- The invoice was rejected.

- Tax collection.

- Punishment.

- If there are serious symptoms:

- On-site inspection and audit.

- The case file has been transferred to the investigating agency.

What should a business do if it accidentally issues a fraudulent invoice?

A fictitious invoice doesn't always result from intentional fraud, but how a business responds will determine the legal consequences.

Accurately identifying the root cause, addressing issues promptly, and tightening procedures are three key factors that help businesses minimize losses and avoid recurring risks.

1. Review all records for each invoice.

The first thing Not to be edited or canceled immediately., which is Determine the nature of each invoice:

- Check:

- Is there an actual economic transaction?

- Transaction time – invoice time.

- Complete comparison:

- Contract.

- Acceptance/Handover Report.

- Payment voucher.

- Emails, price quotes, internal documents.

- Invoice classification:

- There was a real transaction.

- No real transaction took place.

- The transaction occurred, but the content/value was incorrect.

2. If it's a technical or operational error but a real transaction occurred.

Applicable cases

- The transaction was real.

- The invoice is incorrect because:

- Wrong timing.

- Incorrect content.

- Incorrect amount.

- Incorrect buyer information.

How to handle it

- Perform:

- Issue an adjustment or replacement invoice. According to regulations on electronic invoices.

- File an amended tax return (if already filed).

- Prepare:

- Complete documentation proving the actual transaction.

This case is not considered a fraudulent invoice if the business handles it promptly and in accordance with regulations.

3. If it is indeed a fake invoice.

Token

- There were no actual economic transactions.

- No goods/services were generated.

Practical approach

- Proactively work with the tax authorities (if you haven't been audited yet):

- Supplementary declaration.

- Adjust your tax records.

- Accepting invoice cancellation, tax collection, and late payment penalties.

- Evaluate:

- Level of violation.

- The possibility of administrative penalties or criminal charges.

Important Note:

- No hiding, no dragging out.

- Do not "amend records" after receiving inspection notices.

Proactive early intervention typically reduces the level of risk and its consequences.

4. Review and tighten internal procedures.

After resolving an incident, businesses need to prevent recurrence by shifting from incident handling to system prevention.

- Establish the process:

- Verify the transaction before issuing the invoice.

- Clearly define the roles of creator, controller, and signatory.

- Supplier/Partner Control:

- Legal status.

- History of invoice risk.

- Standardize documentation: Contract – Acceptance – Payment.

- Technology application: Automated invoice risk checking and warning.

How to set up a control system to prevent the issuance of fraudulent invoices.

To establish a system to prevent the issuance of fraudulent invoices, businesses need to build a rigorous internal control process, compare invoices with original documents (contracts, delivery notes), implement an electronic invoicing system with monitoring features, and conduct cross-checking between departments.

1. Design a three-tiered control process.

Businesses need to shift from individual control to system control, with 3 distinct layers:

Level 1 – Business Units (Sales / Purchasing / Operations)

- In charge of:

- Confirm that the transaction has actually occurred.

- Provide all original documents.

Grade 2 – Accounting / Finance

- Check:

- Validity of the documents.

- Date, content, and value of the invoice.

- Refuse invoice If the application is incomplete.

Level 3 – Internal Management/Control

- Final approval:

- Large value invoices.

- Unusual transaction.

- Responsible for monitoring compliance.

Don't let One individual controls the entire process from transaction generation to invoice issuance..

2. Three-party verification is mandatory before issuing an invoice.

Before issuing an invoice, a thorough verification is necessary:

- Contract / Purchase Order

- Service Acceptance/Delivery/Completion Report

- Payment documents (or payment plan)

Only when 3 factors that match in the nature of the transaction.The new accountant is authorized to issue invoices. This is the most effective "checkpoint" to eliminate fraudulent invoices right from the start.

3. Control suppliers and customers

Billing risks often come from risk partner:

- Periodic review:

- Legal status (active, fugitive, enforced).

- Is the industry suitable for trading?

- Classify:

- A regular business partner.

- High-risk partners (new businesses, unusual size).

- Implement stricter controls on:

- Big deal.

- Repeated, high-value transactions.

Don't "automatically trust" something just because you've traded with it before.

4. Implement an early warning system.

Instead of waiting for a tax audit, businesses should:

- Establish internal risk indicators:

- Issue an invoice before the transaction.

- Revenue/expenses increased dramatically.

- Invoices with duplicate content and value.

- Technology application:

- Automatically check invoices.

- Supplier risk warning.

- Track control.

Early warning systems help businesses. Prevention instead of dealing with consequences..

5. Training for accounting, purchasing, and sales teams.

Invoice control It's not just the accountant's job.:

- Regular training for:

- Sales: the time when the invoice is issued.

- Purchasing: valid documentation required.

- Accounting: Identifying invoice risks.

- Reaching a consensus:

- "Exporting upon customer request" ≠ legal.

- "Having an invoice" ≠ "having the expense recorded".

When all departments understand the risks correctly, they are reduced right from the source.

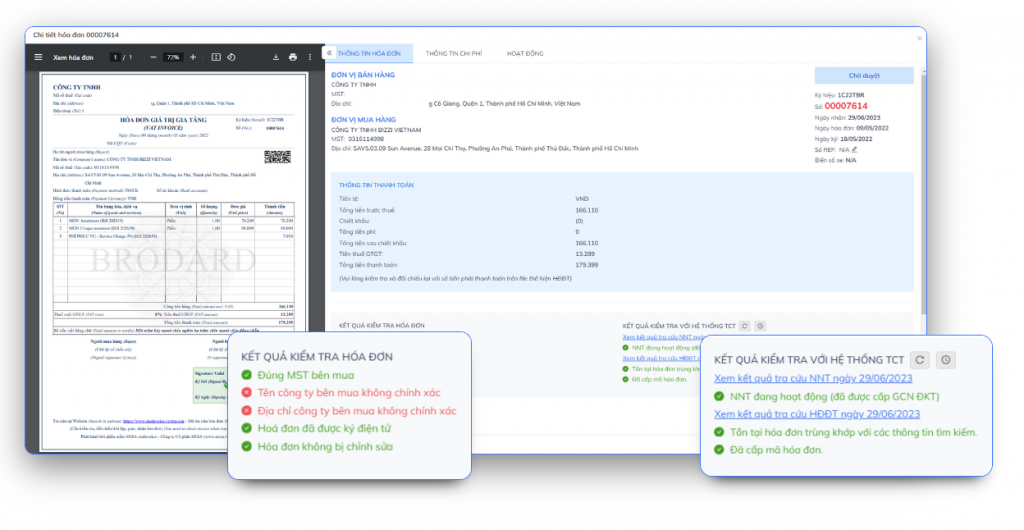

How does Bizzi help businesses control the risk of being penalized for issuing fraudulent invoices?

In a digital tax management environment, combining a proper understanding of risks, standardized processes, and control technologies like Bizzi is the way businesses can sustainably protect their costs, cash flow, and legal security.

Bizzi IPA + 3-Way Matching: Lock down risk right from the first invoice.

Bizzi IPA employs a 3-way matching mechanism between:

- Invoice

- Purchase Order (PO)

- Goods Receipt/Acceptance Slip (GR)

The goal is to confirm that the transaction actually exists, not just on paper.

Core values:

- Immediately detect the following cases:

- There is an invoice but no purchase order/retailer.

- The value, quantity, and items do not match between the documents.

- Prevention:

- Obtaining fictitious invoices to legitimize expenses.

- Record expenses when goods/services have not yet been rendered.

The risk is mitigated before the invoice is recorded and taxed, rather than waiting until an audit.

Bizzi B-invoice: Reducing the risk of issuing fraudulent invoices at the output end.

Bizzi B-invoice helps businesses standardize their invoice issuance process, ensuring:

- An invoice can only be issued when:

- There were actual sales/service transactions.

- The release conditions have been checked according to internal procedures.

- Control:

- Invoice issuance time.

- Customer information – contracts – related revenue.

Core values:

- Reduce risk:

- Issue an invoice before the transaction takes place.

- Issue invoices based on the partner's "verbal request".

- Minimize errors by:

- Sales pressure.

- Lack of coordination between sales and accounting.

Businesses protect themselves from the risk of issuing fictitious invoices or invoices that misrepresent the nature of the transaction.

Bizzi Expense: Control costs – reduce the need for “legalization”

One of the biggest reasons for fraudulent invoices is: Expenses are incurred but there are no valid invoices, leading to the need to "search for invoices."

Bizzi Expense addresses this problem at its root by:

- Standardize the spending process:

- Request for payment.

- Pre-approval required.

- Set clear goals and budgets.

- Real-time cost tracking:

- Who said that?

- What did the money go towards?

- Is it within the budget?

Core values:

- Reduce the pressure of "covering costs" at the end of the period.

- Restrict behavior:

- Purchase invoices.

- Received an invoice for an incorrect transaction.

When expenses are managed transparently, the incentive to use fictitious invoices naturally disappears.

Bizzi – as an “AI financial and accounting assistant” for businesses

Bizzi doesn't replace humans, but plays the role of:

- The correct tasks to do are: checking, comparing, and approving.

- Early warning: invoices, suppliers, and expenses show signs of risk.

- Remembering transactions on behalf of others: storing the entire transaction history and supporting documents.

For CFOs and Chief Accountants, Bizzi helps:

- Identify the risks before the tax authorities see them.

- Shift from reactive management to preventative management.

In short, Bizzi doesn't just process invoices; it builds a control ecosystem that prevents businesses from creating fraudulent invoices in the first place. In the era of data-driven and risk-based tax management, this is a crucial advantage.

Frequently Asked Questions about the Penalties for Issuing Fake Invoices

Fraudulent invoices are no longer a "rare" risk, but a hot topic in current tax management. Businesses are only truly safe when they combine a proper understanding of the law with the application of appropriate control systems like Bizzi.

1. What is the penalty for issuing a fraudulent invoice?

According to Decree 125/2020/ND-CP, the act of creating and using fictitious invoices (without actual transactions) may be subject to the following penalties:

- A fine of 20 to 50 million VND will be imposed for the act of using illegal invoices.

- Forced Cancel invoice, adjust tax return records.

- Collection of back taxes, late payment penalties, and related fines.

In serious cases, the matter may be referred to the investigative agency.

2. Can issuing fake invoices lead to imprisonment?

Yes, if all the elements constituting a crime are present.

Issuing fraudulent invoices can lead to legal prosecution:

- The crime of tax evasion (Article 200 of the Penal Code), or

- The crime of illegally trading invoices (Article 203 of the Penal Code)

Penalty level:

- Individuals: large fines or imprisonment (depending on the value of the invoices and the amount of tax evaded).

- Legal entities: fined up to billions of dong, and may have their operations suspended.

3. Can fictitious invoices be used to deduct VAT?

Are not. Fake invoices:

- It does not reflect real economic transactions.

- Not eligible legality – reasonableness – validity.

VAT on fictitious invoices excluded from deduction, simultaneously:

- Bag Tax collection.

- Calculate late payment penalty.

- They may face administrative or criminal penalties.

4. What should be done if a fraudulent invoice is discovered after the tax return has already been filed?

Businesses need:

- Stop using that invoice immediately.

- Prepare documents for adjusting and supplementing tax returns.

- The type of expense and VAT declared were incorrect.

- Proactively provide explanations to the tax authorities (if notified).

Early detection and correction will help reduce penalties and avoid criminal risks.

5. How do tax authorities detect fraudulent invoices?

Tax authorities currently detect fraudulent invoices primarily through:

- Matching electronic invoice data across the entire system.

- Risk analysis by TMS system.

- Compare with:

- Bank data.

- Tax returns of the relevant parties.

- List of risky or absconding businesses.

Many cases No direct inspection required. It was still discovered.

6. How can businesses avoid inadvertently issuing fraudulent invoices?

Businesses need:

- Only issue invoices when The transaction actually occurred..

- Establish the process:

- Approve the transaction before issuing the invoice.

- Matching the contract – delivery – payment.

- Training sales and accounting personnel on Risk of fraudulent invoices.

- Applying technology to Reduce reliance on manual control..

7. Can software like Bizzi help reduce the risk of fraudulent invoices? At which stage?

Yes, and it is very effective if applied correctly. Bizzi provides support in 3 key stages:

- InputBizzi IPA + 3-way matching ensures that invoices are only recorded when a real transaction occurs (Invoice – Purchase Order – GR).

- OutputBizzi B-invoice helps standardize the invoice issuance process, preventing the issuance of invoices when the necessary conditions are not met.

- ExpenseBizzi Expense controls spending, reducing the need to "legitimize" expenses with fictitious invoices.

Bizzi helps businesses Risk prevention starts at the system level.Instead of dealing with it after it has been discovered by the tax authorities.

Conclude

Issuing fictitious invoices is no longer a "distant" risk, but a real threat to the existence and reputation of businesses. In the context of data-driven tax management, electronic invoices, and risk analysis systems, any act of issuing invoices not linked to actual transactions is likely to be detected – sooner or later.

The consequences of issuing fraudulent invoices go beyond fines or tax arrears; they also extend to:

- The risk of criminal prosecution for individuals and legal entities.

- Loss of tax deduction rights, inaccurate financial reporting, impact on cash flow.

- Businesses classified as high-risk will experience increased frequency of inspections and audits.

- This causes serious damage to brand reputation, fundraising ability, and partnerships.

Therefore, preventing the risk of fraudulent invoices must start from the system, not just rely on people. Applying support tools like Bizzi helps businesses:

- Risk mitigation is implemented right from the start through three-way verification, ensuring the transaction is genuine.

- Standardize the process of issuing outgoing invoices to avoid misinterpreting the nature of transactions.

- Control costs transparently and reduce the need for "legitimizing" expenses with fictitious invoices.

- Proactively identify and address risks before the tax authorities get involved.

Managing fraudulent invoices is not just a matter of legal compliance, but a matter of survival in modern financial management. Businesses choose to invest in control systems like Bizzi not to "deal with" legal issues, but to build a foundation for transparent, secure, and sustainable operations in the long term.

Register here to receive a customized solution tailored specifically for your business: https://bizzi.vn/dang-ky-dung-thu/