The Lunar New Year season is the time of year when businesses incur the most "tax-sensitive" expenses: gifts in kind, vouchers, subsidies, and bonuses in cash or gifts. If we only look at these expenses from a tax-sensitive perspective... Debit/Credit entryBusinesses can easily overlook the underlying tax implications, leading to the disallowance of expenses during corporate income tax settlement, the generation of unforeseen output VAT, or the failure to deduct personal income tax for employees.

This article approaches the problem from three levels: Understand the true nature – control the process correctly – operate the system properly.This helps CFOs and Chief Accountants both comply with taxes and proactively control employee benefits costs, with Bizzi acting as the foundation for control right from the point of purchase.

Is the cost of buying Tet gifts for employees considered "welfare expense" or "business operating expense"?

With the same amount spent on Tet gifts for employees, the tax results can be completely different depending on how the business determines the tax. incorrect in natureThis is the root cause of many businesses being disqualified despite having correct accounting records.

In essence, Cost of buying Tet gifts for employees It usually falls into one of two branches. The first branch is employee welfare expenses, that is, expenses aimed at taking care of the spiritual and material well-being of employees, not directly linked to revenue from each order. The second branch is production cost - businessThis applies in cases where businesses consider Tet gifts as part of a compensation policy that is considered "payoff in lieu of salary" or linked to work performance.

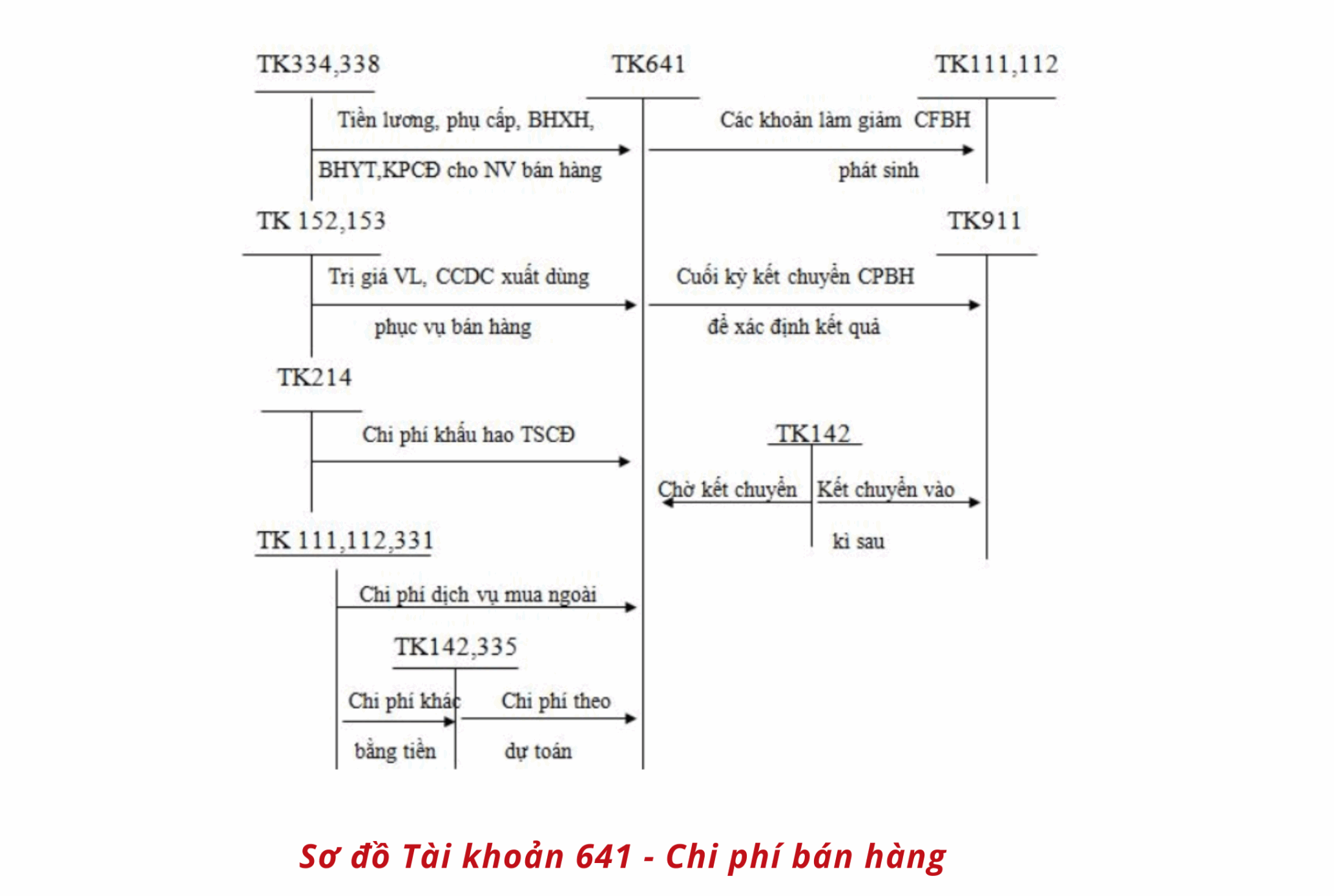

The key lies in the principle. substance over formThey are both "Tet gifts," but if their essence is... income instead of salaryThe expenditure may entail personal income tax liability; if applicable. pure welfareThe expenditure will be subject to limits when calculating corporate income tax. This determines how accounts such as 353 (welfare fund), 641/642/154 (expenses), 334 (payable to employees) are used, as well as whether 3331 (output VAT) or 3335 (personal income tax) is generated.

- See more articles about Deductible expenses for corporate income tax: Conditions, documentation, and actual list (Updated 2026) here

From a management perspective, the problem lies not in the year-end accounting entries, but in... The tree determines the nature of the expenditure right from the moment the purchase proposal is made.This is a gap that many businesses encounter when managing expenses using fragmented Excel spreadsheets.

With Bizzi, businesses can set up right from the start. Category "Benefits - Tet Gifts" In Bizzi Expense, clearly define the cost center and expense nature label. The system only allows the expense to proceed if it has complete documentation matching the selected expense nature, thereby creating audit trail Consistency will be beneficial for accounting and tax purposes later on.

Are Tet (Lunar New Year) gift expenses for employees deductible when calculating corporate income tax?

The short answer is maybe, but not in all cases. The cost of buying Tet gifts for employees is classified as... welfare expensesThe corporate income tax law poses a significant barrier: The total welfare expenditure for the year must not exceed one month's average actual salary..

The real problem is that many businesses only check this ceiling at the end of the year, when all expenses have already been incurred. Meanwhile, total welfare expenses include not only Tet gifts but also bereavement leave, vacations, birthdays, and other allowances. Without cumulative tracking, the risk of exceeding the ceiling is very high.

The formula for determining the ceiling is relatively simple: Average monthly salary = Actual salary fund for the year / 12.

The total eligible benefit expenditure must be less than or equal to this amount.

However, the CFO's challenge isn't simply "calculating correctly," but rather... Control yourself to avoid overspending right from the moment you start shopping.This is where Bizzi sets itself apart. When configuring the annual benefits budget in Bizzi Expense, businesses can track... Budget vs. Actual in real timeFurthermore, it establishes a warning system for when the cost of Lunar New Year gifts threatens to push the total welfare benefits beyond the limit. Proposals exceeding the limit will be subject to an exceptional approval process, rather than being handled only after they arise.

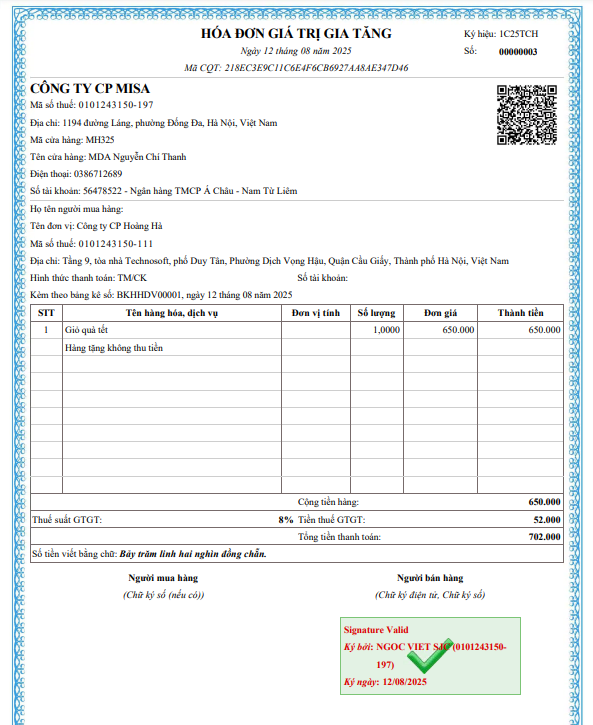

Do Tet gifts given to employees require invoices, and under what circumstances should input/output VAT be handled?

This is the most contentious question in practice, especially when businesses purchase goods. gifts or internal consumption for staff

The general principle is: when a business exports goods/services to gifts, internal consumption, or payment in lieu of salary., then Invoices still need to be issued. According to current regulations, output VAT is determined based on the corresponding taxable price, except for special cases excluded by regulations.

Input VAT is only deductible if all conditions regarding valid invoices, proper payment procedures, and use for taxable activities are met. In reality, the risk doesn't lie in "whether or not invoices are issued," but rather in... The documentation is insufficient to prove the intended use..

Bizzi handled this issue by asking the accountant. Specify the intended use immediately upon receiving the input invoice.When an invoice is labeled "gift/welfare," the system automatically activates the corresponding document checklist, such as the recipient list and handover record. If any documents are missing, the invoice cannot proceed to the payment or accounting stage, significantly reducing the risk of VAT errors during settlement.

Where should Tet bonus expenses be accounted for when the bonus is given in cash, and when the company "pays on its behalf" with gifts/vouchers?

When Tet bonuses are paid in cash, the accounting logic is quite clear: the business records the obligation to pay employees through account 334, then allocates the cost according to department (641, 642, 154). This bonus is usually considered taxable income, except for very narrow exceptions.

The issue becomes more complicated when businesses reward employees with gifts or vouchers. If this is essentially income instead of salary, the business may have to gross up personal income tax, making the actual cost much higher than the value of the gift. This is a point CFOs often overlook when only looking at the purchase price.

Bizzi helps mitigate this risk by connecting data from HR (personnel list, hierarchy) to Bizzi Expense, allowing for the correct targeting of expenses from the outset. The allocation of bonus expenses by cost center is also automated, avoiding the situation of "putting everything into account 642," which distorts management reports.

What supporting documents are needed to cover the expenses of purchasing Tet gifts for employees during the tax settlement process?

A Lunar New Year gift expenditure is only truly "safe" when a business can demonstrate three factors: legitimate purchase – proper allocation of funds – transparent handover. In reality, the problem lies not in the lack of individual supporting documents but in the inability to organize a large number of records, especially when purchasing from multiple suppliers during peak season.

1. Legal documents – original certificates (required)

This is the group necessary conditions to cost have a chance Acceptable; otherwise, it will almost certainly be disqualified.

- Valid VAT invoice

- Enter the correct business name and tax identification number.

- The goods/services offered should be suitable for Tet gifts (gift baskets, vouchers, physical items, etc.).

- Invoice date corresponds to the accounting period.

- Non-cash payment voucher

- Applicable to invoices of 20 million VND or more.

- Bank statement / UNC / electronic payment document

- Sales contract / quotation / Purchase Order (PO)

(Especially important when buying in large quantities or in multiple batches)

2. Internal records proving "employee expenses" (a crucial factor in financial settlement)

This is the file group. most often in short supply, and this is also a common reason why Expenses for purchasing Tet gifts for employees are disallowed when calculating corporate income tax..

- Decision/Announcement from the company regarding Tet gift giving.

- Signed by the Director/General Manager

- Specify: the target audience, the type of gift, and the time period.

- List of employees who received gifts

- Full name, department, employee code

- Matches the personnel list at the time of expenditure.

- Minutes of the Tet gift handover

- Show the number of gifts distributed.

- It has the signature of the business representative.

- List of employees signing to receive gifts.

- Sign in person or sign electronically.

- It must match the employee list.

3. Documents for tax classification (VAT – Corporate Income Tax – Personal Income Tax)

This group helps defending tax arguments, especially when disputes arise regarding the nature of the expenditure.

3.1. Regarding corporate income tax (deductible expenses)

- Summary of welfare expenses for the year

- This includes: Tet gifts, gifts for weddings and funerals, vacations, birthdays, etc.

- Average monthly salary spreadsheet

- Salary fund implemented / 12

- Comparison table: Total benefits ≤ 1 month's average salary

This is a standard set of documents. completely missingThis makes it impossible for businesses to justify the benefit ceiling even if they spend the money correctly.

3.2. Regarding VAT

Depending on the situation, the following may need to be added:

- Invoice issued for goods given as internal gifts. (if applicable)

- Internal Consumption Release Record

- Proof of use for production and business purposes. (if you wish to deduct input VAT)

3.3. Regarding personal income tax (when Tet gifts are considered income)

- Salary and benefits regulations

- Table for determining taxable personal income (if applicable)

- Personal income tax withholding certificate / gross-up statement (if the business is responsible for paying the tax on behalf of the applicant)

4. Internal control and governance records (not mandatory but highly recommended)

This group is not a strict tax requirement, but Help the CFO protect the business when Thorough inspection.

- Proposal for expenses / Proposal to buy Tet gifts

- Internal approval flow

- Cost allocation by cost center/department

- Welfare Budget Report: Budget vs. Actual

Instead of scattering emails and scanned files, Bizzi allows you to consolidate all invoices, purchase orders, handover records, and signature lists into a single unified "Tet gift file." Each expenditure is linked to a complete file, easily accessible by supplier, program, or fiscal year when tax authorities request explanations.

What is the process for approving expenses for Tet gifts?

The safest approach is to manage Tet gifts as a "cost project": with a budget, approval process, supplier criteria, and documentation requirements. Doing it right from the proposal stage helps avoid exceeding welfare limits and reduces tax risks later on.

Step 1. Identify needs & propose expenses

The need to purchase Tet gifts usually arises from HR, Administration, or the Executive Board, based on the year-end welfare plan. The proposing department prepares a proposal for Tet gift purchases, specifying the recipients, the type of gift, the estimated budget, and the implementation time.

At this stage, many businesses have not yet linked their proposals to the approved benefits budget, so the risk of exceeding the spending limit has begun to emerge.

Step 2. Compare budgets and check benefit ceilings.

The accountant or finance department will compare the proposal with:

- Welfare budget for the year

- The payroll fund is used to estimate the average monthly salary ceiling for corporate income tax purposes.

This verification process is often done manually in Excel, which is prone to errors if salary, benefit, and expenditure data are not updated synchronously. This is a crucial step but is often done superficially, leading to the discovery during final accounting that total benefits have exceeded the limit.

Step 3. Request quotes and choose a supplier.

Purchasing or Administration Department:

- Gather quotes,

- Compare unit price, quality, and delivery conditions.

- Present your proposed supplier selection options.

In many small and medium-sized enterprises, this step lacks a formal purchase order (PO), stopping at emails or fragmented price quotation files. Without a PO/procurement record, the expense of purchasing Tet gifts for employees becomes difficult to explain if the tax authorities inquire about the reasonableness of the price.

Step 4. Expenditure Review & Budget Approval

The documents for purchasing Tet gifts (expenditure request + price quotation + budget estimate) have been submitted:

- Department Head,

- Chief Accountant / Finance Manager

- Director or General Manager.

This process often involves handwritten signatures, emails, and chat messages, leaving no centralized trace. From a CFO's perspective, this is a control blind spot: it's very difficult to prove who approved what and when, especially during internal audits or tax explanations.

Step 5. Complete the purchase and payment.

After approval, the business:

- sign contract/place order,

- receive,

- Receive the invoice,

- Make the payment (bank transfer or advance payment - reimbursement).

Common occurrences:

- The invoice arrived later than the gift distribution time.

- Payment is divided into multiple installments.

- The documents are scattered among the administrative, accounting, and banking departments.

This increases the risk of accounting period mismatch, meaning expenses are recognized at the wrong time.

Step 6. Distribute gifts and have staff sign for receipt.

HR/Administration organizes gift distribution and prepares:

- List of employees who received gifts,

- Receipt or handover record.

Many businesses handle this step very superficially, or simply save the image file instead of directly linking it to their accounting records. During the final accounting process, this is a common reason why expenses for Tet gifts to employees are disallowed because the recipients cannot be identified.

Step 7. Accounting & record keeping

The accountant proceeded as follows:

- Accounting for the cost of Tet gifts for employees.

- Classification of VAT, Corporate Income Tax, and Personal Income Tax.

- Keep both paper and digital files.

In the manual model:

- Documents are distributed across multiple folders.

- Difficult to retrieve information from the "Tet Gift Program Year X".

- Tax audits take a long time.

Bizzi allows for the setup of multi-level approval workflows and the linking of benefits budgets to cost centers. When a purchase proposal is created, the system displays the information immediately. Budget Remaining, including the part installations (Approved but not yet paid). This allows the CFO to avoid exceeding the payment limit at the end of the period.

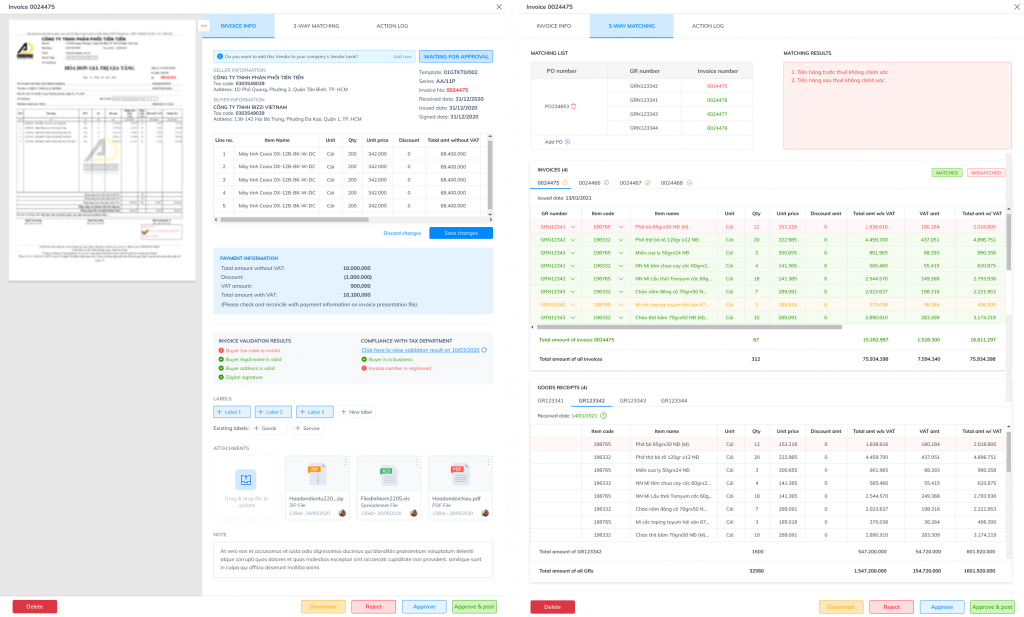

In the next step, reconciliation. PO – GR – Invoice This helps ensure the correct quantity, unit price, and supplier. Deviations exceeding the threshold are automatically flagged and will not be processed for payment until resolved.

Three-way reconciliation of Purchase Order (PO), General Merchandise Item (GR), and Invoice when purchasing large quantities of Tet gifts: How to ensure "correct quantity, correct price, and correct supplier"?

With the terms Cost of buying Tet gifts for employees When dealing with large quantities, the three-way reconciliation of Purchase Order (PO), Retail Price (GR), and Invoice is a core control mechanism that helps businesses avoid discrepancies in quantity, unit price, or invoices that do not accurately reflect actual deliveries. This is also the first line of defense against tax risks and accounting errors. Accounting for the cost of Tet gifts for employees..

In essence, 3-way matching It involves comparing three independent but closely related data sources: PO (Purchase Order) The GR (Goods Receipt) reflects the commitment to purchase, the GR reflects the actual receipt of goods, and the Invoice is the legal basis for recording costs and taxes. Only when all three match within an acceptable tolerance threshold should the business allow accounting and payment.

In reality, during the Tet holiday season, discrepancies often don't stem from large-scale fraud but from numerous small discrepancies: underdelivery compared to the purchase order, unit prices higher than the initial quotation, splitting invoices to avoid inspection, or invoices arriving late after the goods have been shipped. Without a control mechanism in place from the start, these discrepancies are easily "swallowed up" as expenses and only come to light during tax settlement.

From a management perspective, the issue isn't whether the accountant detects the error or not, but rather... Is there a mechanism to prevent errors before money leaves the business?This is precisely the gap that many general accounting articles fail to address.

With Bizzi, the control flow is designed for prevention: purchase requests and purchase orders are created and stored centrally; upon receipt of goods, GR data is updated for automatic matching; when the invoice arrives, Bizzi Bot extracts the data and performs 3-way matching. Any deviations exceeding tolerance are flagged and payment is blocked until a clear resolution is reached. As a result, Cost of buying Tet gifts for employees It is only recognized when it is "the right quantity - the right price - the right supplier".

Even if the Purchase Order, Gross Price, and Invoice match, the risk doesn't end if the supplier later encounters legal issues. This is why supplier verification should be prioritized before payment approval.

Checking the risks of Tet gift suppliers (Tax Identification Number, operating status, risk invoice): how to prevent problems before payment?

During the year-end peak season, the biggest risk isn't buying at high prices, but rather... You buy the right product, but from a supplier that is "no longer safe" in terms of taxes.Many businesses only check suppliers at the time of signing the contract, while in reality... A valid invoice issued today may still be subject to post-issuance risks..

A minimum verification process must ensure the consistency of the Tax Identification Number (TIN), operational status, invoicing information, and transaction history. This is not just a tax matter but an integral part of the overall process. vendor master data governance – a factor that directly affects the ability to protect costs during settlement.

The management perspective here is the "risk lifecycle": supplier risk is not static but fluctuates over time. Businesses need evidence that, at the time of payment approval, they have performed all reasonable checks.

Bizzi supports this layer of control by automatically verifying the Tax Identification Number (TIN) and supplier status as soon as the invoice is received. If the invoice or supplier is flagged as risky, the system will block the payment request step and send an alert to the AP/Tax department. The entire inspection history is logged, helping businesses to track their progress. audit trail Clearly explained.

After controlling supplier risks, the next challenge lies in the large volume of invoices and the speed of processing them within the short timeframe before Tet (Lunar New Year).

How can I automate the data entry of Tet gift purchase invoices from multiple suppliers and synchronize them into ERP/accounting systems to reduce errors?

In reality, most errors in accounting for Tet gift expenses for employees do not stem from tax policies, but from data entry: incorrect tax identification number (MST), incorrect tax rate, incorrect assignment to expense accounts or cost centers. When the number of invoices increases dramatically, manual data entry almost certainly creates risks.

To address this effectively, businesses need to standardize data from the outset: supplier lists, Lunar New Year gift/welfare expense lists, cost centers, and accounting periods. Automation will only truly be effective when supported by this standardized data.

Bizzi Bot allows for automatic extraction of invoice data (PDF/XML), which is then pushed into the processing queue. Accountants only need to handle exceptions – invoices with missing or incorrect data – instead of re-entering the entire system. Standard invoices will be synchronized to the ERP/accounting system according to the established account mapping, along with complete supporting documents.

From a CFO's perspective, the value lies not only in saving time, but also in reducing the probability of tax errors on each invoice, especially with Lunar New Year gift expenses for employees, which are easily scrutinized during tax audits.

Once the data is clean and in the right system, the next question is often: how effectively is this cost being allocated and utilized?

How can the CFO evaluate the effectiveness of employee welfare benefits by allocating Tet gift costs according to the cost center?

Many businesses stop at simply "accurate accounting" while overlooking the management question: which department is spending how much on employee benefits and whether they are exceeding their budget. Allocating the cost of Lunar New Year gifts to employees according to a cost center helps CFOs transform accounting data into management information.

The most common allocation method is headcount, as it reflects both actual benefits and is easy to account for. In this method, the cost of Tet gifts for each cost center is determined based on the ratio of its staff to the total headcount of the entire enterprise. It is crucial that this method is applied consistently over the years to avoid disputes when comparing budgets.

Bizzi Expense provides support right from the proposal stage, requiring the attachment of a cost center and corresponding budget. CFOs can track budget versus actual spending by department and receive alerts when there is a risk of exceeding benefit limits. This is a proactive control method, rather than waiting until the end of the period to discover problems.

From this, many leaders are asking a more strategic question: should they buy physical gifts or switch to vouchers to optimize cash flow and operations?

Comparing purchasing Tet gifts in-house and then giving them away versus using vouchers/e-vouchers: differences in cash flow, tax risks, and operational volume?

These two models differ not only in form but also in cash flow impact and operational level. Purchasing physical gifts provides clear inventory control but entails costs for warehousing, delivery, and inventory reconciliation. Conversely, vouchers/e-vouchers reduce logistics and working capital, but require robust digital proof to protect costs during settlement.

From a CFO's perspective, choices should not be based on emotion but on a decision matrix: cash flow impact, tax risk, volume of documents, and the ability to control issuance. With vouchers, the risk lies not in the purchase invoice but in the allocation process: how many to buy, how many to issue, and how many remain in stock.

Bizzi supports both models. With vouchers/e-vouchers, Bizzi Expense manages the distribution list linked to personnel, while Bizzi Bot stores invoices, contracts, and activation code proofs to create complete digital profiles. The purchase-distribution-inventory reconciliation is performed continuously, ensuring that Tet bonus expenses are clearly accounted for and supported.

After addressing operational and management issues, the final questions often revolve around taxes and financial settlements.

Frequently Asked Questions about Accounting for Tet Gift/Bonus Expenses for Employees

Do Tet gifts given to employees need to be accompanied by an invoice?

Normally yes, because these items fall under the category of gifts or internal consumption, invoices must be issued in accordance with current VAT regulations.

Is there a limit on the cost of Tet gifts for employees, based on one month's average salary?

If classified as welfare expenses, the total welfare expenditure for the year must not exceed one month's average actual salary.

Are Tet bonuses subject to personal income tax?

Tet bonuses are taxable income from salaries and wages and are subject to tax deductions according to the progressive tax rate schedule.

How does accounting for Tet gifts from the welfare fund (Account 353) differ from accounts 641/642?

The difference lies in the source of expenditure and the timing of recognition; account 353 reflects the source already allocated, while accounts 641/642 represent current period expenses.

How can we control our spending habits and avoid exceeding our benefit limits right from the start of the purchase?

Budget control should be based on cost centers, and budget versus actual figures should be tracked in real time, instead of waiting until the end of the year.

Conclusion: Accounting for the cost of Tet gifts for employees is not only about tax compliance, but also about overall control.

Accounting for the cost of Tet gifts for employees is, in essence, an intersection of tax, operational, and cash flow management. Correctly handling VAT, corporate income tax, and personal income tax is only a necessary condition; the sufficient condition is controlling the entire process from proposal, procurement, reconciliation, allocation, to archiving and explanation of expenses.

Bizzi supports businesses throughout this entire journey: from procurement control and 3-way matching, supplier risk verification, invoice automation, to cost center allocation and benefits budget tracking. With this approach, the cost of Lunar New Year gifts for employees is no longer a "blind spot" during the tax season, but becomes transparent management data enabling CFOs and leaders to make more proactive decisions.

Register for a consultation here and try Bizzi's solutions for free: https://bizzi.vn/dang-ky-dung-thu/