In the context of increasingly fierce competition, businesses always need tools to effectively control finances and ensure resources are used reasonably. Expense reports are not only a management support document but also a tool to help businesses monitor, evaluate and optimize expenses.

Let's learn about the concept business expense report, important reasons to do this report monthly, and how modern tools can help businesses improve financial management efficiency in the article below.

1. What is a business expense report?

An expense report is a document that records, summarizes, and analyzes a company's expenses over a period of time, usually monthly or quarterly. An expense report helps departments, finance departments, and management get an overview of the cost situation, making it easier to make business decisions and adjust budget plans accordingly.

Common types of expense reports:

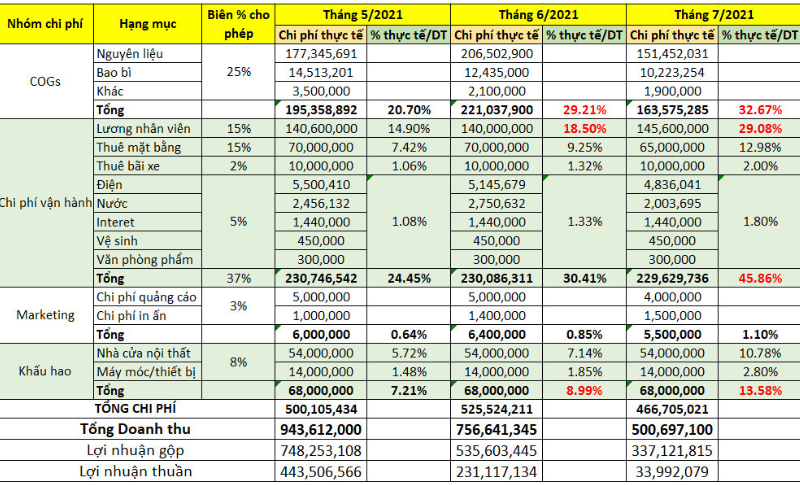

- Monthly expense report: Summary of a business's expenses in a month. This is a type of report often used to update the financial situation on a regular basis.

- Quarterly/annual expense reports: Aggregates expenses by quarter or year, providing a broader view of a business's cost trends.

- Project Expenditure Report: Used for each specific project, helping businesses evaluate the cost effectiveness of each project.

- Expense report by category: Categorizing expenses by category provides a clear and detailed view of how financial resources are allocated.

2. The importance of expense reports in business

In any organization, expense reports play a vital role in managing finances, ensuring efficient spending and maintaining financial health. More than just a summary of data, expense reports help businesses track costs, optimize budgets and evaluate the performance of departments.

Helps control budget

Expense reports help managers control their business budgets. With this report, managers can easily compare actual expenses with the planned budget, thereby promptly detecting excess expenses. This not only helps minimize the risk of out-of-control costs but also contributes to optimizing the use of financial resources.

Performance Evaluation

By looking at each expense in detail, management can evaluate the performance of the business's departments. If a department's expenses are too high compared to its set goals, the expense report will help point out the factors that need to be adjusted. This assessment helps the business improve processes, increase work efficiency and optimize resources.

Business decision support

Periodic expense reports such as monthly, quarterly, or annual provide important data for making strategic business decisions. For example, businesses may decide to cut some unnecessary expenses, invest in areas with potential, or reallocate budget to more important projects. Decisions based on expense reports help businesses adapt flexibly to the market and optimize cash flow.

Increase transparency and reduce risk

Expense reporting is a tool that helps to provide cost transparency, ensuring that all expenses are properly tracked, recorded, and reported. This transparency helps to reduce the risk of fraud, ensuring that each expense is in line with the business’s goals and policies. With modern expense reporting tools, businesses can monitor in real time and detect unusual spending immediately.

Ensuring compliance and managing financial risks

An effective expense reporting system also helps businesses comply with financial and auditing regulations. Expense reporting provides an accurate record of expenses, which supports internal audits and compliance checks. At the same time, it also helps businesses minimize financial risks by providing a comprehensive view of spending, avoiding unexpected expenses.

3. Why is it necessary to report monthly expenses?

Monthly expense reports are documents that help businesses continuously monitor their expenses. This is an important step to assess the financial situation and ensure that the budget is always used appropriately. Monthly expense reports bring many benefits as follows:

Track costs promptly and effectively

Monthly expense reports help businesses track expenses immediately. This allows finance and management departments to control and adjust expenses promptly if problems arise. This helps avoid sudden increases in expenses or over-budgets.

Ensure budget compliance

To ensure that expenses do not exceed the set budget, monthly expense reports are a way for businesses to always monitor the use of their budget. If excess expenses are detected, businesses can quickly adjust and take measures to cut or optimize the budget.

Make quick and accurate decisions

Based on this data, businesses can make quick and accurate decisions to optimize profits, minimize costs, or adjust business strategies. Managers can easily grasp spending trends over time and effectively analyze spending to make the right decisions.

Financial forecasting support

By understanding monthly spending trends, businesses can predict upcoming expenses and prepare more effective resource management measures. Financial forecasting will help businesses build detailed plans for the next stages, ensuring that they do not encounter capital shortages or unplanned spending.

Improve transparency and accuracy in financial management

Monthly expense reports increase transparency in business finances. When all expenses are recorded, tracked and reported clearly, this helps reduce the risk of fraud and errors. The information in monthly reports will help businesses easily control, ensure accuracy and compliance with financial policies.

4. Monthly expense report template on Excel file

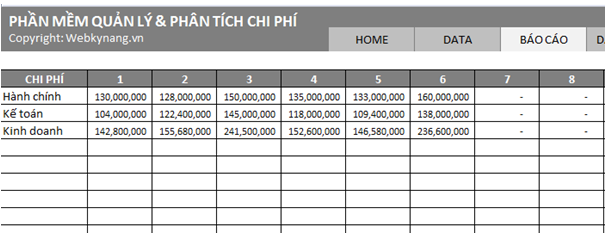

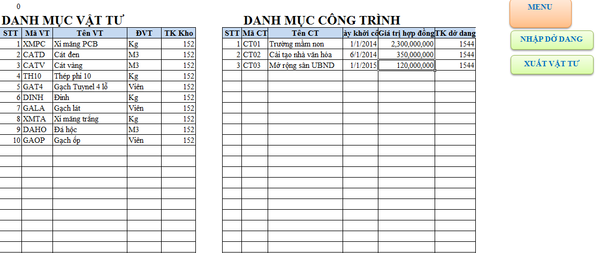

Using an Excel expense report template is the simplest and most popular way for small and medium-sized businesses. Some monthly expense report templates on Excel files include:

- Monthly expense report template by department: Helps track spending by each department.

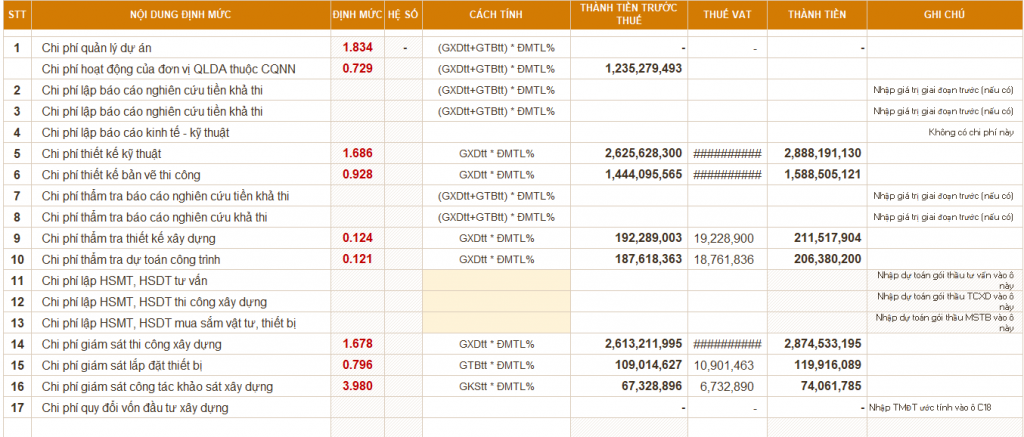

- Monthly Project Expense Report Template: Track spending for each specific project.

- Detailed expense report template: Includes specific expenses, detailed down to each expense category.

- Monthly expense report template by category: Track spending allocations for each available category.

These monthly expense report templates all include columns for date, amount spent, expense category, and department, making it easier to manage business expenses.

5. Some risks when businesses report expenses manually

Job create manual expense report on Excel Although popular, it can be risky. Some risks when businesses report expenses manually include:

Data errors and low accuracy

Manual data entry can easily lead to errors in calculations, errors in individual expenses, or missing information. These errors can affect the accuracy of the entire report, making it difficult to make business decisions.

Takes a lot of time and effort

Manual expense reporting requires a lot of time and effort, especially when the business is large or has many departments and projects. Employees have to check and calculate each expense, which can be time-consuming and increase the workload.

Difficult to control, easy to miss costs

Lack of automation and lack of professional record keeping makes it easy for businesses to miss expenses. In some cases, expenses may not be reported on time, leading to discrepancies between reports and actual situations.

6. Easily track spending reports effectively with Bizzi Expense

Use expense management tool Modern software helps businesses solve problems in managing expenses effectively. In particular, automatic expense management software helps businesses easily track and business cost management without much time and effort.

Bizzi Expense is one of the leading expense management tools today, providing an automated solution for the business expense reporting process.

Outstanding features of Bizzi Expense:

- Set up spending policies: Allows businesses to easily set up and customize spending policies for each department, project, or expense type. Spending limits are clearly defined, and the system will automatically warn when spending exceeds or does not comply with policies.

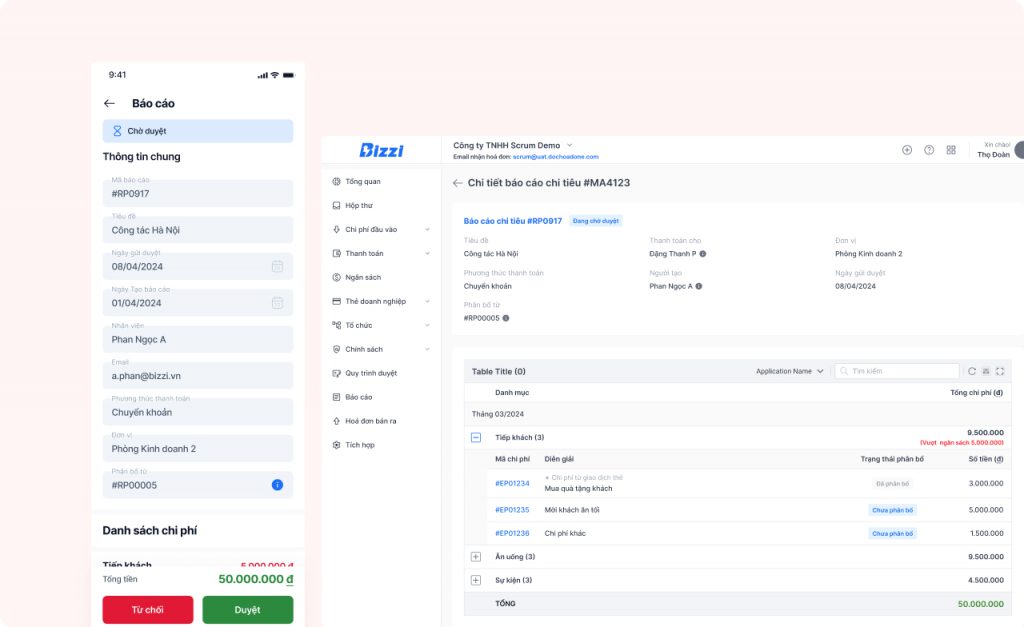

- Flexible expense approval process: Bizzi Expense automates the expense approval process, setting up approval flows based on hierarchy and expense type. Users can easily configure approval steps to meet internal needs, ensuring approvals are done quickly, anytime, anywhere.

- Budgeting for departments and projects: Bizzi Expense helps businesses allocate and manage detailed budgets for each department, project, or specific spending category.

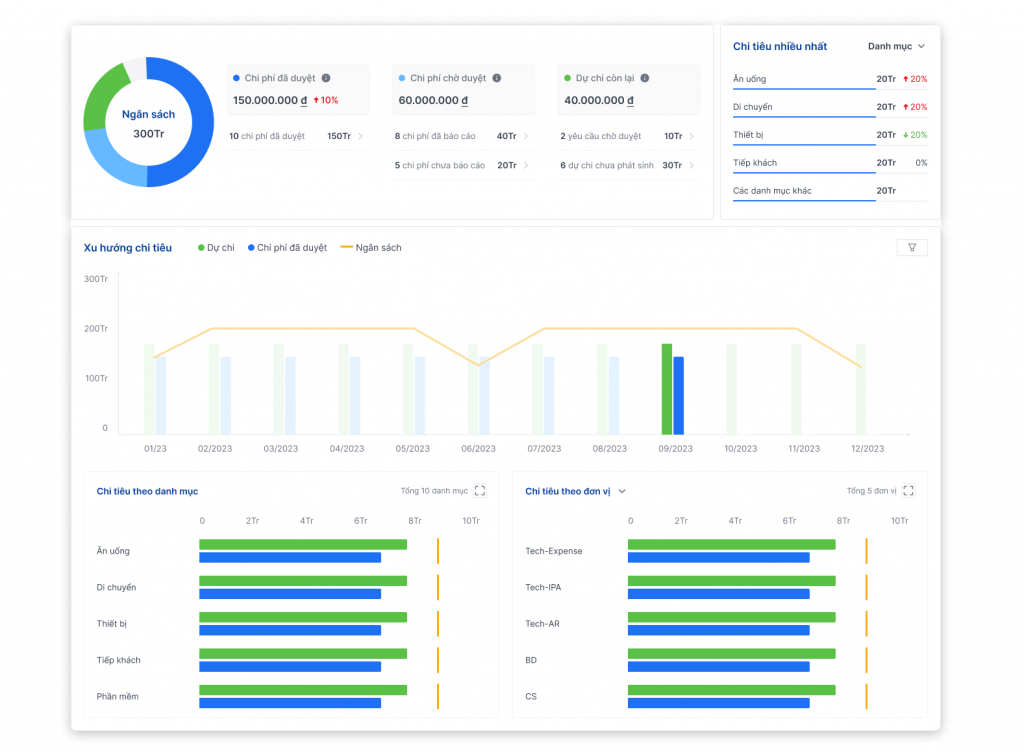

- Track and Real-time cost management: The system updates transactions and expenses as they occur, helping managers stay on top of the company's financial situation in real time.

- Cost and budget reporting dashboard: Provides intuitive dashboards with detailed reports and easy-to-understand charts, helping users easily track costs and budgets at any given time. Automatic reports help managers gain an overview and insight into the efficiency of their business's resource use without the need for complicated operations.

- ERP integration: Bizzi Expense integrates seamlessly with major ERP systems, helping to synchronize expense and budget data from multiple sources into one platform.

Benefits of using Bizzi Expense:

- Save time and money: Bizzi Expense helps businesses save maximum time and effort when creating expense reports.

- Minimize the risk of error: With its automation feature, Bizzi Expense ensures high accuracy for business expense reports.

- Support quick decision making: Real-time updated expense reports help management make business decisions easily.

Sign up for a free trial now at: https://bizzi.vn/dang-ky-dung-thu/

7. Conclusion

Effective expense management is key to helping businesses maintain healthy finances and achieve long-term goals. Monthly expense reports not only help track spending but also support budget control, optimize profits and increase transparency. However, with the risks of manual methods, businesses should consider applying automated expense management tools such as Bizzi Expense to optimize financial management processes.

With Bizzi Expense, businesses can save time, increase accuracy and easily track expenses in real time. From there, the solution not only helps improve the efficiency of expense management but also supports businesses to grow sustainably in today's fiercely competitive environment.