Analyzing a business's cash flow is an important step in financial management, helping businesses understand their actual cash generation capacity, balance capital sources and make reasonable investment decisions. Depending on the management or valuation goals, businesses can choose different cash flow analysis methods, from simple to in-depth.

The article below will outline the role of business cash flow analysis as well as the most common methods.

What is cash flow analysis? The role of cash flow in financial management

Cash flow analysis helps businesses ensure solvency, balance capital and optimize the efficiency of cash flow use in business operations.

1. What is cash flow analysis?

Cash flow (Cash Flow) To be all the actual cash flows into and out of a business within a certain period of time. Business cash flow analysis is the process of monitoring, classifying and evaluating these income and expenditure flows to determine the business's ability to generate cash, liquidity and capital efficiency.

Unlike accounting profit, cash flow represents the reality of whether a business has money or is short of money to operate.

2. Main types of cash flows

Businesses often analyze cash flow into 3 groups:

- Operating Cash Flow: reflects cash generated from core business operations.

- Investing Cash Flow: relating to the acquisition, investment, or divestment of assets.

- Financing Cash Flow: including borrowing - repaying debt, issuing shares or paying dividends.

Synthesizing and analyzing these three groups helps businesses understand where money comes from and how it is being used.

3. The role of business cash flow analysis in financial management

Analysis business cash flow (cash flow analysis) is a core content in financial management, because it reflects the ability creating, maintaining, and using cash of business – vital to sustain operations, investment and growth.

- Ensuring solvency and continuous operations

Cash flow analysis helps businesses proactively forecast cash deficits or surpluses, thereby planning appropriate payments, investments or loans.

- Control and optimize capital usage efficiency

Businesses can clearly identify which cash flows bring real value, avoiding the situation of “virtual profits but lack of cash”. This is especially important in industries with long revenue-expenditure cycles (manufacturing, construction, retail, etc.).

- Connecting cash flow to profits and business performance

Cash flow analysis helps assess the quality of earnings, whether the business is generating real cash from core operations or relying solely on debt or investments.

- Support accurate financial decision making

From cash flow reports, managers can make investment, expansion, or cost restructuring decisions based on actual data rather than gut feelings.

4. Applying technology in analyzing business cash flow

With digital platforms like Bizzi, businesses can:

- Automatically synthesize revenue and expenditure data from Expense, ARM, Invoice.

- Track real-time cash flow.

- Warning of short-term cash flow risk.

- More accurate cash flow forecasting and planning, especially when combined with Sactona.

Structure and classification of cash flow in business

Cash Flow represents the total actual cash flow into and out of the business during the accounting period. Cash flow analysis helps businesses understand the source of capital, the purpose of capital use and the actual ability to generate cash, thereby maintaining liquidity and financial stability.

Operating Cash Flow (OCF)

Reflects the ability to generate cash from core activities such as sales, service provision, supplier payments and operating costs. This is the most important indicator showing whether a business is "self-sustaining" or not.

For example: collecting money from customers, paying employees, paying operating expenses, receiving/paying from inventory.

Investing Cash Flow (ICF)

Indicates the company's investment strategy to expand or contract. Includes transactions such as purchasing machinery, investing in shares, selling fixed assets, or investing in new projects. Negative cash flow in this category is often a signal that the company is investing for future growth.

Financing Cash Flow (FCF)

Related to borrowing, issuing shares, paying dividends or repaying loans. Cash flow analysis helps assess the level of dependence of the business on external sources of capital.

Free Cash Flow (FCF) – A measure of long-term financial health

FCF (Free Cash Flow) = Operating Cash Flow (OCF) – Capital Expenditures (CAPEX)

This ratio shows the amount of money left after the business has spent on maintenance and expansion activities.

A positive FCF indicates a strong ability to generate cash, which can be used to repay debt, pay dividends, or reinvest. Conversely, a persistent negative FCF may indicate a risk of cash shortages or overinvestment.

Applying technology in cash flow management

With Bizzi, businesses can automatically record and classify cash flows in real time through modules:

- Expense: Track expenses, reimbursements, and control over-budgets.

- Invoice: Manage input and output invoices, reconcile accounts receivable.

- ARM: control revenue and expenditure, forecast cash flow by period.

The system helps businesses grasp the actual cash flow situation, reduce manual errors and make more accurate financial decisions.

Understanding and managing cash flow structure well helps businesses maintain liquidity, balance capital and grow sustainably. When digitized by platforms like Bizzi, the entire business cash flow will be more transparent, automatic and easier to control than ever.

Popular methods of business cash flow analysis

Business cash flow analysis can be done using direct, indirect or discounted cash flow (DCF) methods – helping businesses evaluate their ability to generate cash and their future financial value.

Direct Method

This method tracks in detail the actual cash flow of receipts and payments, including cash receipts from customers, payments to suppliers, operating costs, salaries, taxes, etc. This method helps businesses observe real cash flow in real time, suitable for short-term cash flow control and monthly budget planning.

Indirect Method

Cash flow analysis starts from accounting profit and adjusts non-cash items (such as depreciation, difference in debt, inventory, etc.) to get actual cash flow. This method helps to link profit – cash flow, reflecting the quality of profit and the level of efficiency in asset management.

Discounted Cash Flow (DCF)

DCF is used in business or investment project valuation, based on future cash flows discounted to the present at an expected rate of return. Helps assess intrinsic value and long-term profitability - often applied in investment decisions, M&A, or capital mobilization.

Trend Analysis

Businesses compare cash flow over multiple periods (months, quarters, years) to identify increasing/decreasing trends, seasonality, or irregularities. Useful for cash flow planning next year and forecast “best – base – worst case” scenario.

Plan vs Actual Analysis

This method of analyzing the company's cash flow compares the actual cash flow with the planned or budgeted cash flow, helping to identify overspending, delayed revenue, or forecast deviations. This is an important tool in FP&A (Financial Planning & Analysis) - ensuring that the financial plan is based on reality.

Application of technology in business cash flow analysis

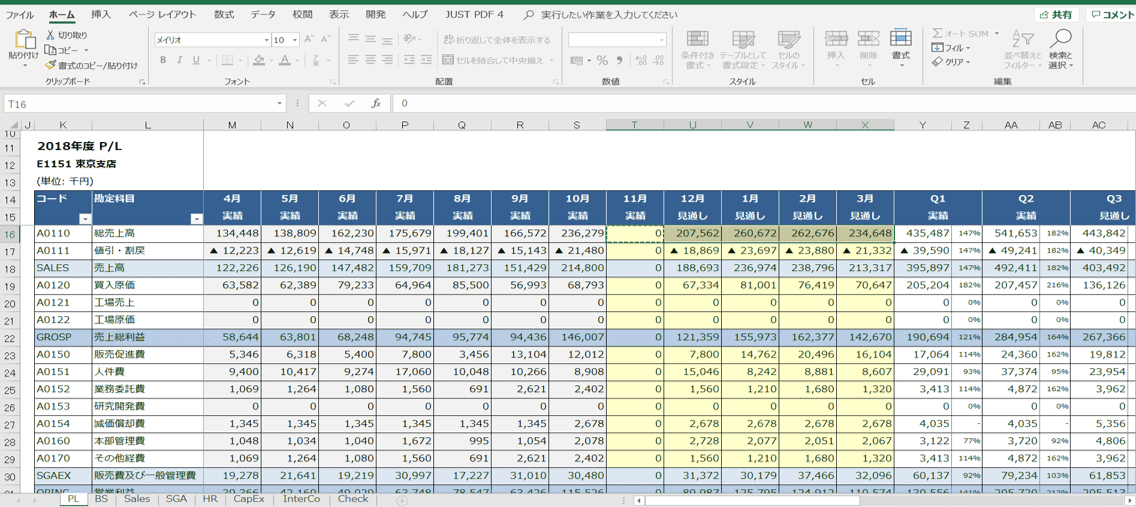

Businesses can now automate the entire cash flow analysis process thanks to the platform. Sactona – Japanese standard financial performance management solution exclusively distributed by Bizzi Vietnam

Sactona supports:

- Consolidate cash flow data from multiple sources (ERP, accounting, Excel).

- Automatically analyze Actual – Plan – Forecast in real time.

- What-if Scenario.

- Intuitive reporting, supporting fast and accurate decision making.

In short, each cash flow analysis method has different objectives, but when used correctly, it can be Automation by Sactona, businesses can Grasp the financial situation immediately, reduce the risk of capital shortage and optimize the efficiency of cash flow use.

4 Important Business Cash Flow Analysis Indicators

Discover 4 important cash flow ratios that help evaluate a business's financial health: CCC, FCF Ratio, OCF-to-Debt, DSO/DPO.

1. CCC (Cash Conversion Cycle)

The cash conversion cycle reflects how quickly a business turns inventory and receivables into cash.

- Shorter CCC → faster cash flow → higher operating efficiency.

- Long CCC → warns of slow-moving inventory or lax credit policies.

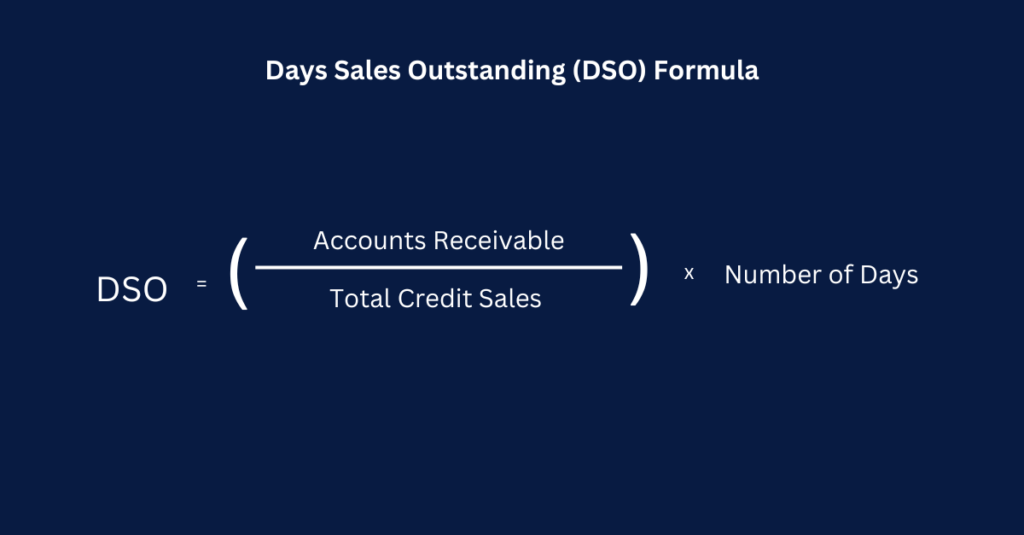

2. DSO / DPO (Days Sales Outstanding / Days Payable Outstanding)

This pair of indexes shows cash receipts and disbursements velocity, directly affecting the ability to maintain liquidity.

- DSO: Average number of days to collect payment from customers.

- DPO: Average number of days it takes for a business to pay its suppliers.

3. FCF Ratio (Free Cash Flow Ratio)

Measures the ability to generate free cash flow after deducting investment costs.

- FCF Ratio > 1: the business has the ability to expand and pay dividends.

- FCF Ratio < 1: warns of lack of funds for long-term investment or operations.

4. OCF-to-Debt Ratio (Operating Cash Flow to Total Debt)

This ratio shows the ability to repay debt from operating cash flow. The higher this ratio → the lower the financial risk.

Application of business cash flow analysis in financial management

Corporate cash flow analysis is a core part of corporate financial management, helping managers understand clearly Where is the money coming from and how is it being used?. By monitoring and analyzing cash flow, businesses can maintain financial stability and make more accurate investment and financing decisions.

Short-term and long-term cash flow forecasting

Help businesses predict future cash inflows and outflows, thereby:

- Plan your payments, investments, and cash reserves.

- Avoid unexpected cash flow shortages or suboptimal surpluses.

Liquidity management and spending limits

Cash flow analysis helps control the ability to meet financial obligations, from payroll, operating costs to debt obligations. Businesses can set spending limits in real time, ensuring efficient use of capital.

Decision making on borrowing – investing – dividend payment

A steady positive cash flow allows for investment expansion or dividend payments to shareholders. Conversely, a persistent negative cash flow signals the need for financial restructuring or cost cutting.

Assessment of solvency and performance

Cash flow indicators such as OCF, FCF, CCC, DSO/DPO helps assess real financial health, beyond accounting profit figures.

Business cash flow analysis using Excel or EPM – which is better?

In many businesses, Excel is still a familiar tool for planning and analyzing cash flow. However, as operations expand and data becomes more complex, EPM (Enterprise Performance Management) solution become the optimal choice to help upgrade financial management capacity.

Excel – Flexible but Limited

Advantage:

- Familiar interface, easy to operate.

- Suitable for small businesses, simple data scale.

- Low cost, fast deployment.

Limit:

- Error-prone when entering data or merging multiple files.

- Lack of simulation and scenario forecasting capabilities.

- Does not guarantee data consistency and security.

EPM – Multidimensional Cash Flow Automation and Forecasting

Solution EPM like Sactona Helps automate the entire cash flow analysis and forecasting process:

- Connect real-time data from accounting systems, ERP, expenses, and debts.

- Analyze and simulate Cash Flow Forecast under multiple scenarios (Plan vs Actual, What-if).

- Instant and intuitive cash flow forecasting with administrative dashboard.

- Accelerate ROI by reducing reporting time from weeks to hours.

When to switch from Excel to EPM?

- When a business has many branches / accounting units.

- When multidimensional financial data consolidation and accurate forecasting are needed.

- When the FP&A team needs to simulate financial scenarios quickly.

Case study: Improving business cash flow thanks to Sactona solution

In the context of business needs make quick decisions and control cash flow tightly, many large Japanese corporations have switched from manual management to systems. EPM (Enterprise Performance Management) – specifically Sactona, because Outlook Consulting development and Bizzi Exclusive deployment in Vietnam.

Panasonic – Accelerate cash flow forecasting from 14 days to 5.5 days

Panasonic once lost nearly two weeks to synthesize and forecast cash flow for the entire system. After applying Sactona EPM, businesses:

- Shorten forecasting time from 14 days left 5.5 days.

- Consolidate plan-actual data in real-time.

- Significantly reduce manual errors and improve forecast accuracy.

Fujifilm – Synchronize global cash flow via Excel interface

Fujifilm (Imaging Solutions) has many branches and discrete data areas. With Sactona:

- Automatically aggregate global PSI (Production – Sales – Inventory).

- Keep the Excel interface familiar and easy to adopt by the FP&A team.

- Speed up planning and report cash flow instantly.

Marubeni Logistics – Multi-branch cash flow management without IT

Marubeni Logistics had trouble consolidating data from dozens of branches.

Sactona solution helps:

- Automatically aggregate cash flow data by unit.

- Reduce dependence on IT department, help finance department proactively update.

- Make cash flow transparent and improve spending control efficiency.

Application in Vietnam – Enterprises >200 billion can reproduce this model

In Vietnam, Bizzi is the exclusive partner Sactona distribution and deployment. Suitable solutions for businesses:

- Revenue from 200 billion VND or more.

- Have an FP&A or financial planning team that needs to forecast and consolidate data quickly.

- Want to convert from Excel manually to platform EPM data transparency modern without spending much money and time.

In short, Sactona helps businesses Control cash flow, speed up planning and make more accurate decisions – is an important step in the journey of digitalizing financial management in Vietnam.

Frequently asked questions when analyzing business cash flow

Below are answers to common questions about how to read cash flow reports, analysis tools and EPM software applications in corporate financial management.

1. How to analyze business cash flow?

Businesses need to monitor cash inflow and outflow, classified by business, investment and financial activities, then compare Plan vs Actual (plan and reality).

2. How do you know if your business is running out of cash?

Common symptoms:

- Persistent negative operating cash flow.

- CCC (Cash Conversion Cycle) increase

- DSO (Days Sales Outstanding) increase – collect money slower.

Track these metrics on Bizzi help businesses detect risks early and proactively balance capital.

3. Is there a standard cash flow statement template?

Yes. Sactona offers Cash Flow Template, helps accountants and FP&A to create, reconcile and track cash flow easily.

4. Which software best supports business cash flow analysis?

Medium sized businesses can use Bizzi to:

- Automatically collect income and expenditure data.

- Track cash flow instantly.

- Generate cash flow reports automatically on a regular basis.

Large businesses can upgrade Sactona to manage and forecast multidimensional cash flow.

5. How does EPM help in analyzing business cash flow?

Sactona supports:

- Short and long term cash flow forecasting.

- Consolidate multi-branch, multi-subsidiary cash flow.

- Scenario Planning for more accurate strategic decision making.

Conclude

Analyzing a business's cash flow is not only a financial health check, but also a foundation for businesses to make timely decisions, control costs and maintain stable liquidity. A transparent, automated and real-time cash flow management system is the key to optimizing capital resources and increasing operational efficiency.

With Bizzi, businesses can:

- Automatically collect and reconcile revenue and expenditure data.

- Real-time cash flow monitoring and alerts.

- Easily create and compare financial plans and cash flows right on the familiar Excel interface.

When your business enters the expansion phase and needs to forecast, consolidate, and simulate complex cash flow scenarios, upgrade to Sactona – a Japanese EPM solution trusted by hundreds of corporations such as Panasonic, Fujifilm, and Marubeni.

Registration here to experience Sactona solution and get advice on the solution suitable for your business size and financial goals!