In context Electronic invoice It has become a legal norm in Vietnam, the need Converting electronic invoices to paper invoices It still exists in many operational situations: internal record keeping, serving audits, reconciliation with partners, or internal signing. However, if this issue is viewed simply as a printing operation, businesses can easily overlook the risks related to legal compliance, cost control, and accounting data integrity.

From the CFO's perspective, How to convert electronic invoices to paper invoices correctly according to regulations. It's not just about "printing correctly," but it's part of an overall financial control system where every document needs to have a clear origin, history, and traceability.

What is a converted invoice from an electronic invoice according to current regulations?

Conversion Invoice An electronic invoice is a printed document derived from a legally valid electronic invoice, used for archiving, record-keeping, or presentation as required by management; it is not an original paper invoice and does not replace the legal validity of electronic data.

- See a detailed analysis of the Conversion Invoice at: https://bizzi.vn/hoa-don-chuyen-doi-la-gi/

From a professional standpoint, many accountants still implicitly understand that: "An electronic invoice printed on paper is still an invoice."

This is the biggest risk. The essence of an electronic invoice (e-invoice) lies in its XML data – which contains the digital signature, authentication code, and all the legal information recognized by the tax authorities. XML data is the sole legal source of the invoice.

Opposite, converted invoice from electronic invoice It's just:

- One converted document so that people can read it.

- One audit for inspection and verification

- Not inherently legal.

Points to note: from July 1st, 2022 onwardsThe law no longer considers this a "paper invoice" but correctly refers to it as... "Paper documents versus electronic invoices".

Misusing terminology often leads to consequences. misuse, especially in payment and expense accounting.

At the CFO level, the risk isn't about "printing the wrong template," but rather:

- Use paper documents for payment when the XML has not been validated.

- Storing paper copies makes it impossible to trace back to the original data.

- During the audit, the link between the transaction, the invoice, and the cash flow could not be proven.

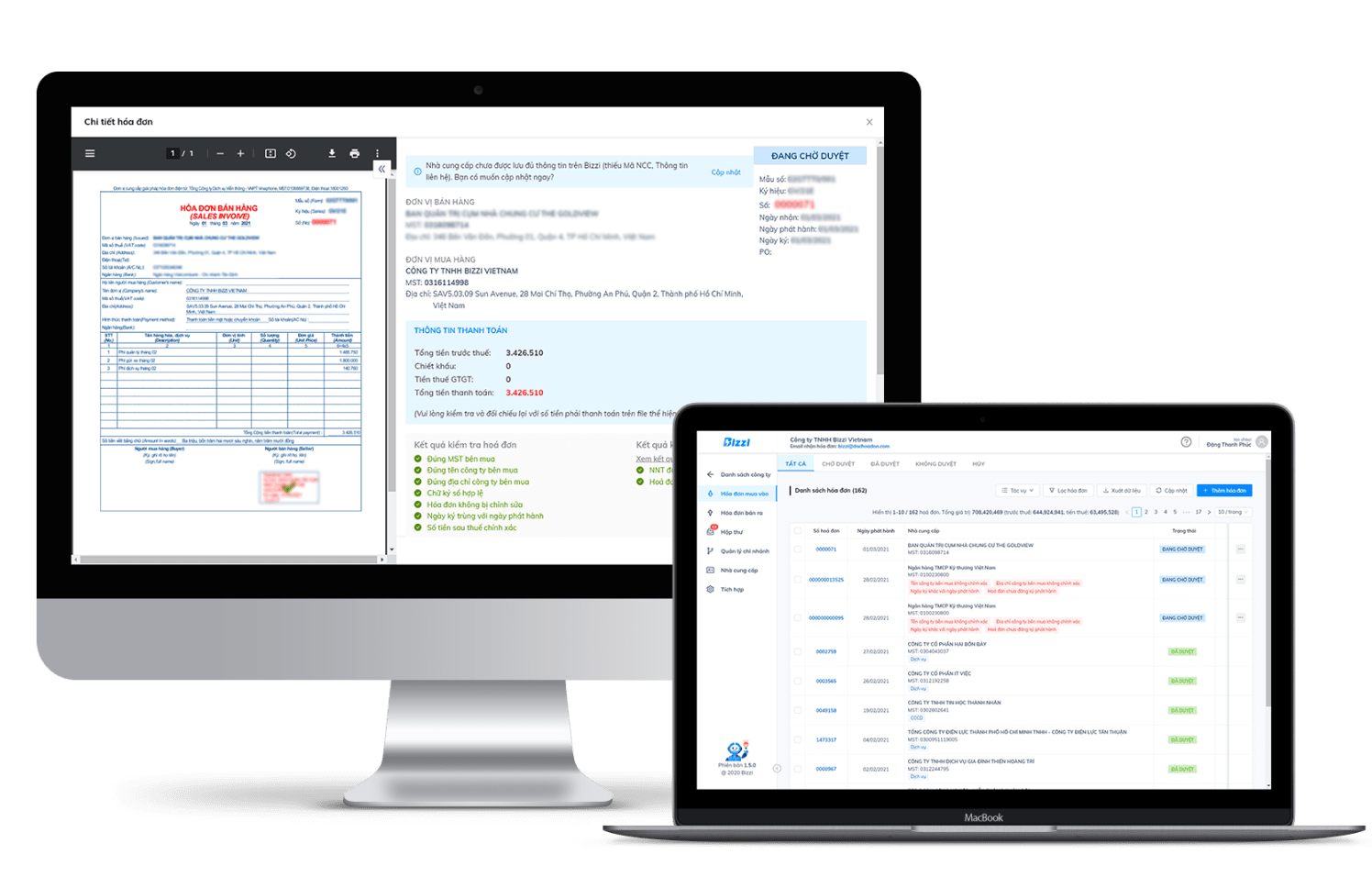

This is why Bizzi doesn't approach conversion invoices as a printing operation, but rather as a link in the document control chain.

How did Bizzi handle this problem?

Before discussing printing or conversion, Bizzi asks: "Has the original data been properly controlled?"

- Bizzi Bot automatically downloads and saves the original XML file as soon as an invoice is generated.

- Each PDF or printout is only permitted to exist when directly linked to its corresponding XML file, creating a continuous audit trail.

Understanding the concept correctly helps businesses avoid misuse; but understanding its legal value correctly is what helps businesses avoid paying the price.

What is the legal validity of an invoice converted from an electronic invoice?

Conversion of electronic invoices For archiving, recording, and presentation purposes only., which has no independent payment or tax deduction value, except in certain specific cases as stipulated separately.

Conversion Invoice Not to be used as a substitute. give:

- Pay

- Tax deduction

- Acknowledging independent legal obligations

Conversion Invoice for use only in:

- Storing accounting records

- Inspection, examination, and auditing.

- Explanation of the arising business transactions

From a legal validity and audit trail perspective, the conversion document is merely a supporting document, not the "original basis." Instead of asking "Is this invoice valid?", the CFO should ask: What are the cash flow and tax risks if the conversion document is used incorrectly?

Bizzi is designed to “block risk at its source.” Bizzi doesn’t just store invoices, it integrates them into the AP process:

- Electronic invoices will only be processed for payment if the XML is valid.

- Paper documents cannot be selected as a basis for independent payment.

- Every action leaves a clear audit trail.

The legal value lies not in the form of the document, but in how the business controls it within its operational flow.

Conditions for converting electronic invoices to paper invoices in accordance with regulations.

Businesses are only permitted to convert electronic invoices to paper invoices when the electronic invoice is legally valid, the content of the converted version completely matches the original XML data, includes information about the person who performed the conversion, and serves the correct business purpose.

The conditions for conversion are not intended to control the printing format, but rather to preserve it. data integrity and non-repudiationA printed document is only truly valuable when it accurately, completely, and undeniably reflects the original data.

In practical operation, risks typically arise when:

- PDF displays differently than XML.

- The printout is generated from an intermediate data source.

- The person who performed the conversion is unknown.

These discrepancies, however small, are enough to undermine the ability to explain oneself during an audit by regulatory authorities. Bizzi Bot automatically checks the invoice status on the Tax system and compares the XML data with the physical version before allowing it to be stored. This eliminates the need for legal compliance based on personal memorization, making it a reliable system. system rules.

How to convert electronic invoices to paper invoices using a risk control process.

Converting electronic invoices to paper requires following a process of valid verification, correct printing format, confirmation of the converter, and controlled storage to ensure traceability back to the original data.

Invoice conversion process (manual control)

For each invoice, the conversion should not be a separate operation but an integral part of the process. Accounting SOPXML validation, printing, and archiving should be linked to the corresponding business documentation such as Purchase Order (PO) and General Receipt (GR), so that each invoice has a copy. complete audit evidence.

Bizzi assists by directly attaching invoices to the relevant purchase orders/clearance prices, making tracing effortless and eliminating the need for memorization or manual searching.

Mass Conversion: Risks & Essential Control Points

Bulk data conversion saves time but increases the risk of data inaccuracies without automated verification mechanisms. A small error on a large scale often leads to processing costs, remediation time, and accountability pressure.

Bizzi Bot processes bulk conversions on the original data, while also alerting to unusual invoices to avoid disrupting control discipline.

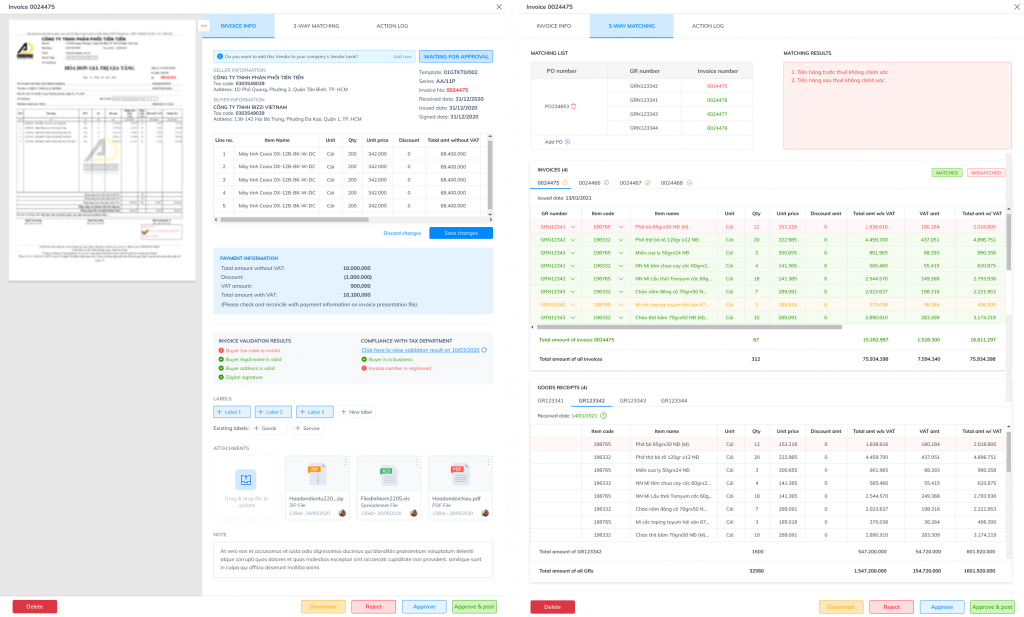

Three-way reconciliation between the converted invoice – purchase order – gross receipt to ensure the transaction is correct.

Three-way matching helps verify that converted invoices accurately reflect the order and goods received, thereby eliminating the risk of invoices not matching the actual transaction.

In cost management, the essence of control lies not in the form of documents, but in... The relationship between invoice – order – actual goods receivedThe core formula is: Invoice Amount = PO Amount = GR Amount

When converted invoices only reflect the data but not the actual transaction, the risk of incurring additional costs is unavoidable.

Bizzi automatically performs a 3-way reconciliation, allowing only matching invoices to go through Expense/AP, thereby protecting your budget and maintaining financial discipline.

Storing conversion invoices for 10 years: A cost and retrieval challenge.

Manually storing conversion invoices for 10 years increases operating costs, makes them difficult to retrieve, and carries the risk of loss; whereas centralized storage reduces costs and improves control.

The actual cost of document storage lies not only in space, but also in personnel, search time, and the risk of losing documents. From a CFO's perspective, this total cost is often underestimated until an audit occurs.

Bizzi allows for centralized storage of electronic invoices and their conversions for a minimum of 10 years, with retrieval by tax code, date, or invoice number in just seconds, reducing long-term operational pressure.

Common risks when converting electronic invoices to paper invoices.

Risks associated with converting electronic invoices to paper invoices often arise from data discrepancies, misuse for legal purposes, and breakdowns in traceability, which can lead to misclassified expenses, tax arrears, or cash flow mismatches.

Risk of discrepancies between the converted version and the original XML data.

The most common, yet often overlooked, risk is that the paper or PDF version may not accurately reflect the original XML data. Discrepancies can arise from various sources: printing from an intermediate data source, manual editing during PDF export, or using software that doesn't synchronize data.

From a CFO's perspective, the issue isn't about "how much of a discrepancy" there is, but rather that when tax authorities or auditors cross-reference the XML, the converted version becomes invalid. In that case, even invoices linked to actual transactions risk being rejected because the business cannot prove data integrity.

Bizzi mitigates this risk by requiring all transformations to be created and stored on validated native XML, and maintaining a direct link between the electronic data and the instance to ensure traceability.

Risks of using converted invoices for purposes other than legal purposes.

A more serious risk lies in using converted invoices beyond their legally permitted role. In practice, paper invoices are sometimes used as a basis for payment, expense recording, or advance payments before the electronic invoice is fully authenticated.

The consequences of this approach are not only tax risks, but also cash flow risks. Businesses may pay for invalid invoices, face difficulties in recovering payments when disputes arise, and lose control over payment priority in the AP process.

Bizzi addresses this issue by integrating electronic invoices into the payment approval process. The converted invoice only serves as supporting documentation and cannot be considered a standalone payment basis, thus maintaining financial discipline from the system level.

Risk of audit trail breakage when storing manually.

When converted invoices are stored separately by department or in separate paper files, the audit trail is fragmented over time. Initially, this risk is often not apparent, but it becomes clear when the business needs to account for periods spanning many years.

The inability to trace the connection between invoices, transactions, purchase orders (POs), general merchandise prices (GRs), and cash flow forces businesses to dedicate significant resources to reconstructing records, and may even prevent the full recovery of lost documents.

Bizzi approaches the storage of converted invoices as part of a centralized document management system, where each conversion is always linked to the electronic invoice, the transaction, and the processing history, ensuring audit trail throughout the lifecycle.

Hidden cost risks and long-term operational pressures

In addition to legal risks, conversion and electronic invoice storage Paper-based accounting also creates hidden costs that CFOs often only realize when the business has grown. These costs aren't just about paper or storage; they include search time, personnel for record management, and opportunity costs when the finance department has to deal with document errors instead of focusing on analysis.

When processes are not standardized and digitized from the outset, each inspection or audit becomes a separate document processing project, increasing operational pressure and reducing financial management efficiency.

Bizzi helps shift this problem from “store to cope” to store to control, where invoice conversion doesn’t generate exponentially higher operating costs as the business expands.

FAQ – Frequently Asked Questions from CFOs & Accountants on How to Convert Electronic Invoices to Paper

Below are answers to frequently asked questions regarding the conversion of electronic invoices to paper invoices.

Can a converted invoice be used for payment?

No. Payment must be based on the original electronic invoice (XML).

How many times can an electronic invoice be converted?

There is no limit to the number of uses, but each copy is for illustrative purposes only.

Is it necessary to stamp the converted invoice?

Not mandatory, except as per internal company regulations.

What are the risks associated with a converted invoice if the supplier abandons their business address?

The risk lies not in the paper version but in the legality of the original XML.

How do I handle discrepancies between PDF and XML files?

If not used, the original data must be retrieved and reprinted.

What do tax authorities usually inspect?

XML matching – representation and audit trail.

How long should conversion invoices be stored?

A minimum of 10 years is required by accounting regulations.

Is it necessary to keep both a paper copy and an electronic copy?

Yes. XML is the original data; paper documents only serve as supporting material.

Conclude

The process of converting electronic invoices to paper, if viewed solely from the perspective of "printing according to the template," can easily be simplified into a mere administrative task. However, from an accounting perspective, and especially from a CFO's perspective, this is a crucial step. a crucial link in the financial, tax, and cash flow management chain..

Understanding what a converted electronic invoice is, where it's used, what its legal validity is, and how it's stored directly impacts:

- Cost control capabilities

- Discipline in payment

- Ability to explain matters to tax authorities and auditors.

- The long-term safety level of financial statements.

In the context of ever-increasing invoice volumes, the conversion of electronic invoices to paper invoices can no longer rely on personal experience or fragmented manual processing. The solution lies not in printing more or less, but in... Develop an invoice processing system capable of tracing, controlling, and linking data.Businesses need a systems approach where the original data is controlled, the transformation is placed in its proper place, and every transaction leaves a clear audit trail.

At this point, Bizzi is not just a bill processing solution, but... financial document management platformFor accountants, Bizzi helps reduce operational pressure, minimize errors, and standardize the process of converting electronic invoices to paper. For CFOs, Bizzi acts as a layer of financial control, ensuring invoices are always closely tied to actual transactions, cash flow is managed in a disciplined manner, and risks are identified early.

When invoices are properly managed, conversion is no longer a risk to be avoided, but becomes a proactive part of a sustainable financial control system for the business.

To learn more about Bizzi's solutions and experience their financial management and invoice processing tools firsthand, register here: https://bizzi.vn/dang-ky-dung-thu/