In the digital age, business credit is changing dramatically, especially with the emergence of online credit services. Access to capital has become easier, faster and more convenient than ever. Online business credit not only brings convenience to businesses but also helps optimize processes and reduce costs. This article will help you better understand online credit, its benefits, the loan process, as well as solutions to support business loans.

Index

ToggleWhat is business credit?

Business credit is the process by which financial institutions provide a loan or line of credit to a business, to assist the business in maintaining production operations, expanding scale or investing in new projects. Providing business credit is not only an important part in maintaining business operations but also a factor that helps businesses grow and expand.

There are many different forms of business credit, the most common of which are short-term, medium-term and long-term loans. In addition, open credit is also a popular form of credit, helping businesses to borrow capital flexibly without having to re-apply or approve each loan.

- Short term loans: Often used to meet a business's working capital needs in the short term, from a few months to 1 year.

- Medium term loan: Usually has a loan term of 1 to 3 years, suitable for loans to expand production or purchase assets.

- Long term loan: These are loans with a repayment period of 3 years or more, often used for large projects and long-term investments.

- Open Credit: This is a form of credit that allows businesses to borrow up to a certain amount of money without having to reapply, saving time and effort for the business.

The importance of credit for businesses cannot be denied, especially in the context of today's competitive economy. Credit helps businesses maintain stable business operations, while expanding scale and improving production efficiency, contributing to enhancing competitiveness in the market.

Online Business Credit: New Trend

Online business credit is increasingly becoming a prominent trend in today's digital economy. Different from traditional credit methods, online credit offers many outstanding advantages, making it an attractive choice for businesses, especially small and medium enterprises.

Advantages of online business credit:

- Fast and convenient: Businesses can apply and receive loan approval in just minutes, minimizing paperwork and waiting time.

- Simple and transparent procedure: Loan processes are automated through online platforms, eliminating the need for businesses to waste time traveling or meeting in person.

- Flexibility in capital use: Businesses can adjust loans and credit limits according to their actual needs.

Compared to traditional credit, online credit granting is superior in its ability to save time, costs and effort. Businesses do not need to provide too many documents, do not have to meet bank staff directly, and can complete procedures right on the online platform.

In Vietnam, the online credit market is growing strongly. With the rise of financial technology (Fintech) platforms and the trend of digital transformation in businesses, online credit promises to become an important part of the development strategy of financial institutions and businesses.

Benefits of online business credit

Online business lending brings significant benefits not only to businesses but also to financial institutions and the economy as a whole.

For businesses:

- Save time: Loan procedures Fast, no need to meet in person, helping businesses save time and effort.

- Cost reduction: Online credit platforms do not require management fees or additional charges, helping businesses reduce borrowing costs.

- Flexibility in capital use: Businesses can easily adjust their credit and borrowing limits according to their actual needs, providing flexibility in meeting financial needs.

For financial institutions:

- Market expansion: Financial institutions can reach previously unreachable small and medium-sized businesses thanks to online credit platforms.

- Reduce risk: Due to transparent, automated and thoroughly vetted lending processes, financial institutions can minimize credit risks.

For the economy:

- Promoting small and medium enterprise development: Easy credit provision helps small and medium enterprises to access capital quickly, thereby promoting the development of the national economy.

- Ensuring financial stability: Online business credit helps businesses maintain operations, especially during difficult times such as pandemics or economic downturns.

Conditions and procedures for granting online business credit

To be able to borrow credit online, businesses need to meet certain conditions and prepare the necessary documents.

General conditions:

- Business must have stable revenue for at least the last 6-12 months.

- Good profit and no bad debt.

- Businesses need to have at least 1 to 2 years of business experience to ensure stable financial capacity.

Loan application:

- Business license of the business.

- Financial report in the last 1-2 years.

- Business contract or documents related to the business activities of the enterprise (if any).

Loan process:

- Registration information: Businesses register and submit basic documents via the online loan platform.

- Assessment: Lending institutions will review the business's profile and financial information.

- Sign the contract: Once approved, the business will sign a credit loan contract.

- Disbursement: Loan funds will be disbursed and transferred to the business account.

Loan support solution – online credit for businesses – Bizzi Financing

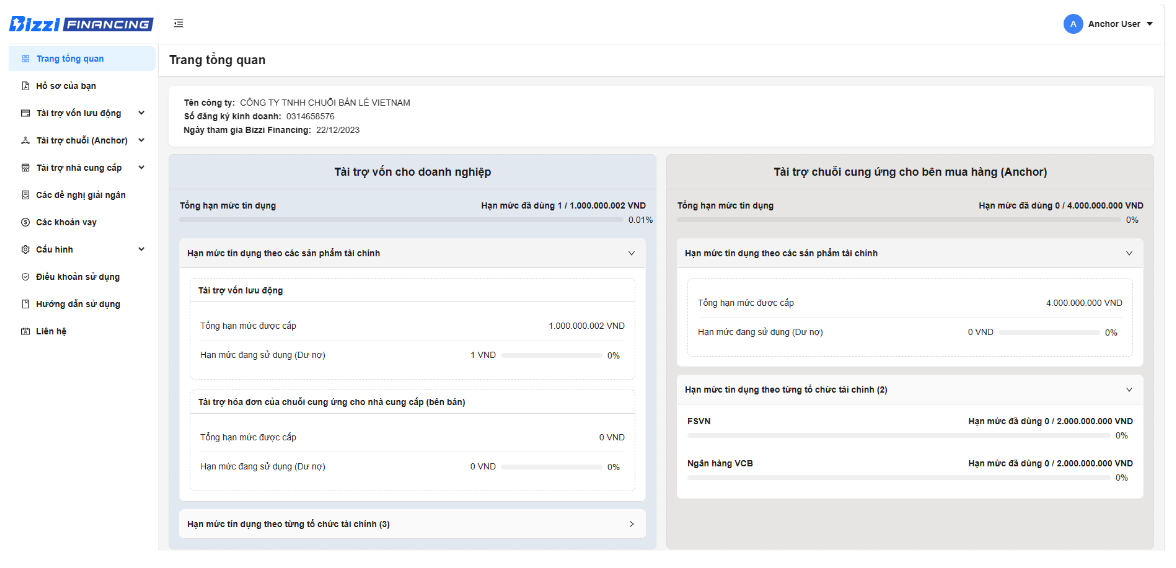

Bizzi Financing is an online financial platform designed to connect businesses with investors, bringing loan solutions fast and efficient. In particular, Bizzi Financing focuses on supporting small and medium-sized enterprises (SMEs) to access capital easily, simply, and conveniently. With the goal of promoting the development of businesses, Bizzi Financing provides a flexible lending platform with outstanding advantages.

Advantages of Bizzi Financing:

- Quick and simple process: Businesses only need to register online, then the system will automatically process the application and notify the approval results.

- Competitive interest rates: Bizzi Financing is committed to providing reasonable interest rates, helping businesses save on borrowing costs.

- Professional financial consulting services: Bizzi Financing not only provides loan services but also provides financial consulting to help businesses optimize capital usage.

With the above advantages, Bizzi Financing is the perfect loan support solution for businesses, especially small and medium enterprises looking for a quick, simple and effective loan solution in the digital age. Try Bizzi Financing now and open up new development opportunities for your business!

Risks and risk management in online credit granting

Although online credit offers many obvious benefits, such as speed, convenience and low cost, it cannot be denied that this form of credit carries some risks that financial institutions and businesses need to closely manage. To ensure that online credit becomes an effective financial support tool, it is extremely important to identify and manage risks.

Types of risks in online credit granting

- Credit Risk: This is one of the biggest risks when providing online credit. Credit risk arises when a business that borrows money is unable to repay its loan on time or defaults on its loan. This can happen for a variety of reasons, such as a decline in business revenue, economic instability, or poor financial management. If this risk is not well controlled, it can cause damage to financial institutions and affect the reliability of the online credit system.

- Interest Rate Risk: Interest rates on loans can change over time, especially for floating rate loans. When interest rates rise, the borrowing business may have difficulty repaying the loan due to increased borrowing costs. Particularly in a volatile economy, changes in interest rates can have a major impact on the business's ability to repay.

- Liquidity Risk: Liquidity risk occurs when a business has difficulty paying its loans due to a lack of cash flow. Some businesses may not be able to predict the cash flow shortage or face difficult business conditions, making it impossible for them to pay their loans on time. This is an issue that cannot be taken lightly, because if not resolved promptly, it will affect the business's ability to maintain operations as well as the stability of the online credit market.

How to manage risk in online credit granting

To minimize these risks and ensure sustainable development of online credit, financial institutions and investors need to implement effective risk management measures:

- Thorough customer reviews: One of the important measures to manage credit risk is to carefully assess the financial capacity of enterprises before granting credit. Financial institutions need to collect and analyze financial information of enterprises, such as financial statements, credit history, and debt repayment ability. Automated credit assessment systems, together with modern data analysis tools, can help accurately forecast the payment capacity of enterprises, thereby minimizing credit risk.

- Diversify your portfolio: To minimize risk, investors in the online credit system should diversify their investment portfolio. Instead of focusing on just a few businesses, investors should allocate capital to many different sectors and businesses. This helps to minimize dependence on a single business and limit losses in case a loan cannot be collected.

- Building an effective risk management system: Financial institutions need to develop advanced risk management systems to continuously assess and monitor the financial health of their businesses. This system not only helps monitor current loans but also warns of potential risks from changes in interest rates, customers' financial status or market fluctuations. Through technology and big data, financial institutions can predict problems early and take timely preventive measures.

- Control and monitor cash flow: Businesses need to establish a tight cash flow monitoring system to ensure that they have enough capacity to repay loans. Closely monitoring cash flow helps businesses identify liquidity problems early and can adjust their business strategy or seek additional sources of capital. In addition, financial institutions should also require businesses to regularly report on their financial situation and cash flow to monitor their ability to repay loans.

- Accept and prepare for unexpected situations: It is important to have a contingency plan for emergencies or unforeseen situations. Businesses need to have a financial contingency plan to be able to cope with unexpected market fluctuations, and financial institutions also need to develop policies to promptly support businesses in difficult situations.

Online lending brings many opportunities and benefits to businesses, but also carries many risks. To ensure that online loans are used effectively and safely, strict risk management is essential.

Conclude

Providing online business credit not only brings convenience but also helps optimize financial processes in the business. With outstanding advantages such as speed, convenience and flexibility, this form of credit is becoming more and more popular and chosen by many businesses. If you are a business owner, do not hesitate to learn and use online credit services to help your business grow stronger in the digital age.

Monitor Bizzi To quickly receive the latest information: