Carbon accounting is no longer just about "environmental reporting," but has become an integral part of modern corporate financial management. Under pressure from regulatory requirements, global supply chains, and future carbon costs, CFOs need to approach carbon as a fundamental indicator. Data stream that can be measured, recorded, and controlled.Similarly, costs or cash flow are important factors in making accurate and timely decisions.

What is carbon accounting and how does it differ from carbon management in a business?

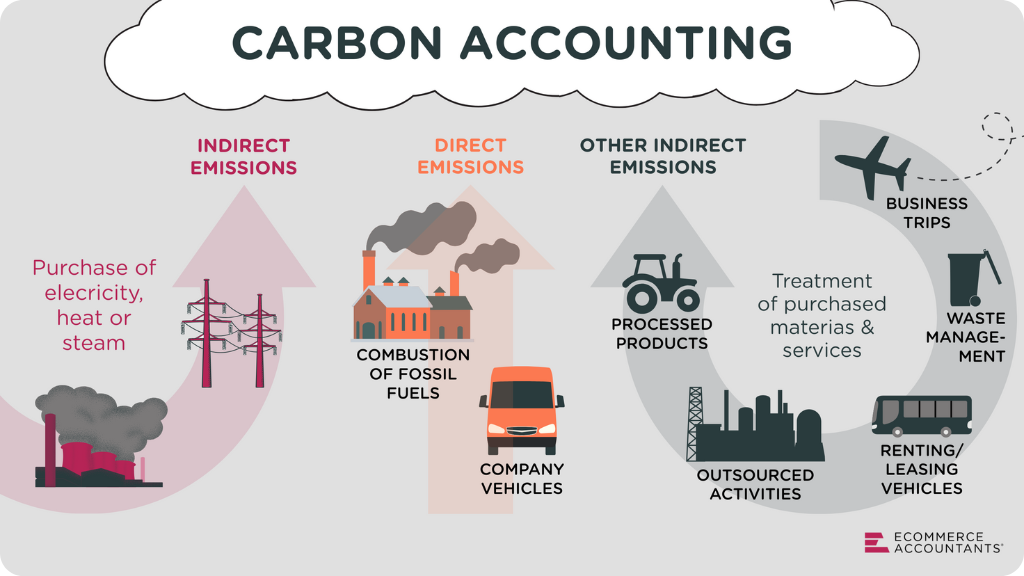

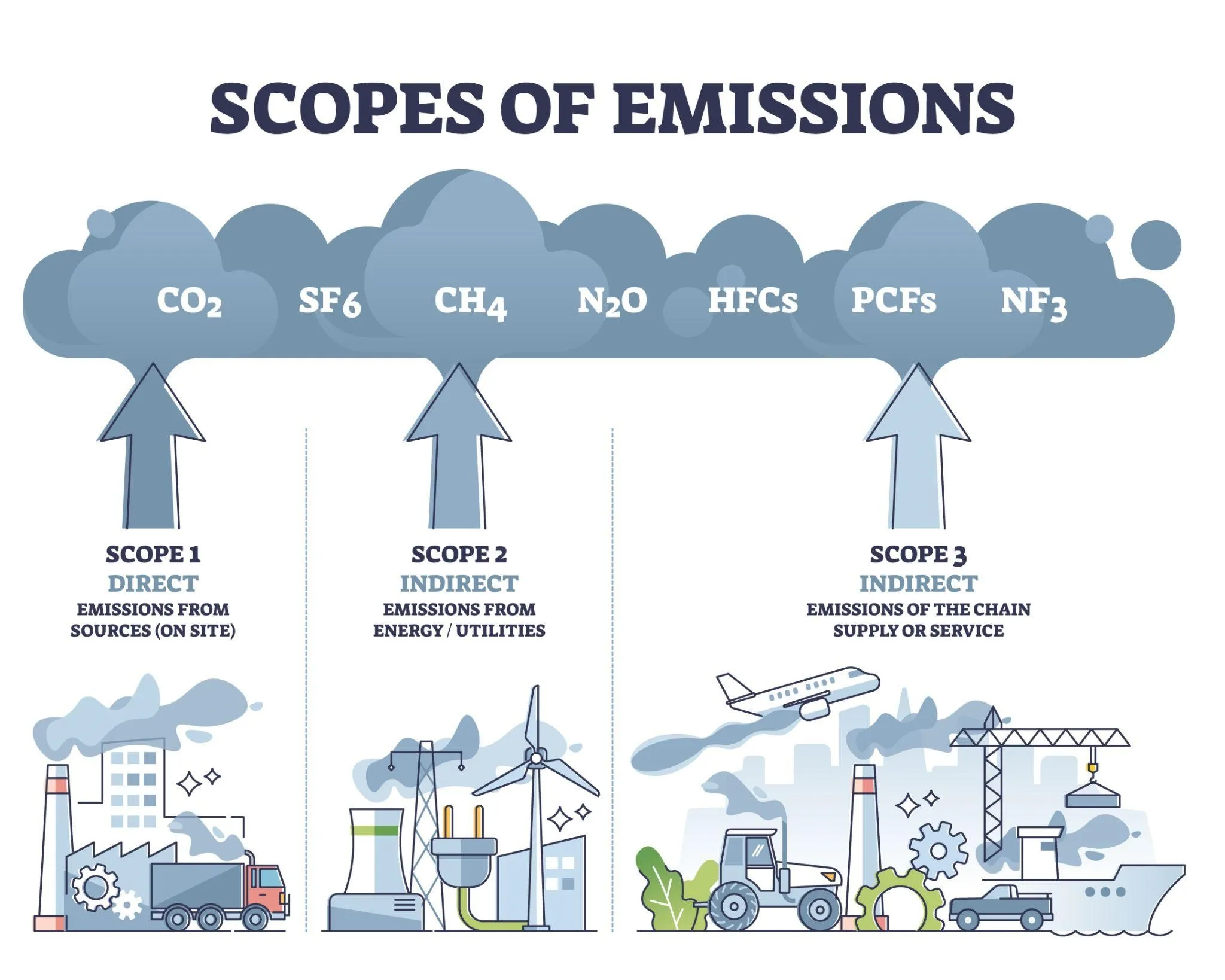

Carbon accounting is the process of measuring, recording, and reporting a company's greenhouse gas (CO₂e) emissions according to Scope 1–2–3, while carbon management uses that data to control costs, risks, and make decisions to reduce emissions.

From a professional standpoint, Carbon Accounting focus on creating reliable numbers: How much is emitted, where does it originate, during which period, and is it traceable? Meanwhile, Carbon Management Starting with these figures, we can develop emission reduction plans, allocate budgets, assess the effectiveness of green investments, and prepare for future carbon-related financial obligations.

The core difference lies in data usage objectivesIf carbon accounting answers the question "How much does the business emit?", then carbon management answers "How does that number affect costs, risks, and business decisions?".

Technically, emissions are calculated using the following basic formula:

Emissions (tCO₂e) = Activity Data × Emission Factor × Global Warming Potential

In this formula, Activity Data refers to operational data such as kWh of electricity, liters of fuel, and kilometers traveled; Emission Factor is the corresponding emission factor; and GWP converts greenhouse gases to CO₂ equivalent (CO₂e). For the CFO, what matters is not just the formula, but the substance. audit trail – The ability to trace back from carbon reports to original data, similar to financial accounting.

In practice, Bizzi does not act as an emissions calculator, but rather as a tool for calculating emissions. input and control data layers, where cost data linked to emissions (electricity, water, fuel, travel expenses) are standardized as financial documentation, ready for carbon accounting.

Understanding the concept correctly is the first step, but to implement carbon accounting, businesses must have a thorough understanding of the emissions structure according to Scope 1–2–3.

What are Scope 1, 2, and 3, and why is Scope 3 the biggest challenge for CFOs?

Scope 1 includes direct emissions from internal operations, Scope 2 includes indirect emissions from purchased energy, and Scope 3 encompasses all emissions from the supply chain and external operations, often representing a large proportion but being the most difficult to collect data on.

Essentially, Scope 1 and Scope 2 are relatively "easy to control" because they are directly linked to internal operations such as fuel for machinery and vehicles, or electricity consumption in offices and factories. Data from these two Scopes usually already exists in the accounting system in the form of electricity, water, and fuel bills.

Conversely, Scope 3 covers the entire area. Value chain emissionsFrom purchasing raw materials, logistics, and operating expenses, to the product's use and disposal phase. For many businesses, Scope 3 can encompass... 60–90% total emissionsHowever, this is the most difficult part to control because it depends on external data.

To assess the effectiveness of carbon management, CFOs often use indicators. central carbon, measured as tCO₂e per unit of revenue or per unit of output. This index helps compare efficiency between periods, units, or between businesses and the industry.

The core issue with Scope 3 doesn't lie in the calculation formula, but in... data and internal controlsWhen the input data is inconsistent, all the numbers become difficult to verify.

In that context, Bizzi helps the CFO take advantage of available financial data such as purchasing costs, logistics, and travel – which are already recorded and controlled – to form the basis for a controlled Scope 3 estimate, instead of waiting for suppliers to submit full carbon reports.

Once the scope is defined, the CFO's next question is: where within the company's system will carbon data be recorded and managed?

What is a Carbon Ledger and why do CFOs need a "carbon ledger" alongside the financial ledger?

The Carbon Ledger is a CO₂e emissions tracking system structured like a financial ledger, allowing for traceability from operational data to carbon reporting, helping CFOs control errors, prepare for audits, and make decisions based on reliable data.

A complete carbon ledger not only saves the final emissions figure, but also includes the whole picture. data lineageFrom activity data, emission factors used, calculation versions, to supporting evidence. The core principle of the carbon ledger is traceabilityThis is equivalent to an audit trail in accounting.

In a practical implementation model, Bizzi acts as a control and evidence-tracking layer for carbon ledgers by linking emission data to expense documents, granting access rights, and recording change history as accounting data. With the carbon ledger in place, the next challenge is how to collect accurate and automated input data.

Standard enterprise carbon accounting process from data collection to verification.

A standard carbon accounting process includes defining the scope, collecting operational data, selecting emission factors, calculating CO₂e, reconciling and documenting evidence, helping businesses report consistently and prepare for carbon audits.

Unlike the theoretical description, the key point in this process is Reconciliation and number locking by periodThis is similar to carbon closing in financial accounting. Without this step, carbon data is highly susceptible to manipulation, leading to a loss of confidence during audits or when reporting to partners.

Bizzi supports automated data collection from incoming electronic invoices, reconciliation, and significantly reduces manual data entry errors – one of the biggest pain points in carbon accounting today.

Of the steps above, data collection is always the most difficult, especially with daily invoices and expenses.

How can we extract emission data from electronic invoices to reduce Scope 1 and 2 errors?

Electricity, water, and fuel consumption data from electronic invoices is the most accurate activity data source for Scope 1 and 2; automatically extracting and standardizing this data reduces errors, increases verifiability, and saves time for the finance department.

Data fields such as kWh, m³, liters, time, and location of consumption are the “raw data” for calculating emissions. When this data is extracted automatically, the error between actual and estimated data can be significantly reduced, typically by 30–60% compared to manual entry.

Bizzi Bot support download electronic invoiceThis process extracts consumption data, normalizes it into activity data, and creates a reconciliation trace, making Scope 1–2 data ready for carbon audits.

While Scope 1-2 still had invoices for verification, Scope 3 presents a much more difficult challenge.

Solving the Scope 3 problem when the supplier does not have a carbon report.

When suppliers do not yet have carbon reports, businesses can use cost data, purchase invoices, and industry averages to estimate Scope 3, and build a roadmap for data upgrades as they mature.

Instead of waiting for "ideal" data, the practical approach is to start from scratch. spend-based alwaysThen, gradually transition to vendor-specific data as maturity increases. Most importantly, ensure transparency of methodology and adequate evidence storage.

Bizzi supports collecting invoices and supplier contracts via ARM, linking costs to Scope 3 categories, and storing data for gradual upgrades according to the roadmap.

Once the carbon data is available, the CFO's next question is: how will costs and cash flow be affected?

How does carbon impact the CFO's costs, cash flow, and budget?

CCarbon is not only an environmental indicator but also a financial variable, affecting operating costs, green technology investments, and provisions for future carbon credit purchases, forcing CFOs to integrate carbon into their budgets and financial plans. One increasingly important indicator is carbon cost, calculated by multiplying tCO₂e by the expected carbon price. From this, the CFO can create a plan. carbon provisionEvaluate the ROI of green CAPEX and simulate cost scenarios.

Bizzi combined with the system EPM For example, SACTONA allows for a comparison of planned, actual, and simulated impacts of carbon on the budget.

Frequently Asked Questions about Carbon Accounting & Carbon Management

Below is a summary of answers to frequently asked questions related to carbon accounting and carbon management.

Is carbon accounting mandatory for all businesses?

Depending on emission thresholds and regulations at each stage, large businesses should prepare early to reduce compliance risks.

Does Carbon Ledger need to change its current accounting system?

No, if designed in parallel and linked to existing financial data.

Is it acceptable to estimate Scope 3?

Yes, if the methodology is transparent and there is a roadmap for data upgrades.

How much does automating carbon data reduce errors?

In practice, manual data entry errors can be reduced by 30–60%.

Will carbon impact future taxes?

Yes, through CBAM and domestic carbon taxes.

In what areas does Bizzi support carbon accounting?

Collecting data, controlling documentation, and supporting decision-making for the CFO.

Comparing manual carbon management with automated financial data-driven carbon management.

With manual methods, carbon accounting remains limited to reporting, detached from the financial system and offering little support for decision-making. Conversely, when carbon data is built upon a stream of cost, invoice, and accounts receivable data, businesses can manage carbon as a financial variable, controlling risks and costs in the medium to long term.

This is also why CFOs choose to automate data input rather than investing directly in complex computing tools: without clean financial data, there will be no reliable carbon accounting.

| Criteria that CFOs care about | Manual carbon management (Excel / discrete synthesis) | Automated carbon management based on financial data. |

| Data sources | Manually collected from multiple departments, loose files, and supplier emails. | The data is taken directly from electronic invoices, expenses, and purchases – which already exist within the financial system. |

| Data Accuracy | Data-dependent, prone to errors, and difficult to detect. | Automated normalization and reconciliation → low error rate, consistency between periods |

| Audit Trail capability | Almost none or very weak | Trace from CO₂e → activity data → expense voucher |

| Carbon Closing Time | Prolonged, often out of sync with financial reporting. | It is possible to finalize payments monthly/quarterly alongside financial closing. |

| Scope 3 Management | Dependent on supplier reports, passive, lacking data. | Proactive cost estimation based on expenditure data, with an upgrade roadmap. |

| Auditability/Assurance | High risk, lack of evidence. | Audit readiness is ensured thanks to original data and change logs. |

| Integration with budget and cash flow | Carbon is detached from finance. | Carbon is directly linked to cost, budget, and contingency. |

| CFO Decision Making | It's a case of "reporting just to make up the numbers." | Suitable for simulating costs, ROI, and emission reduction strategies. |

| Compliance risk (CBAM, carbon tax) | Late detection, reactive approach | Identify financial impacts early and proactively plan for scenarios. |

| Long-term operating costs | Low initially – high later (personnel, errors, penalties) | Higher initially – lower and stable in the long term |

| Strategic value | Meets minimum requirements | Creating a competitive advantage in governance and financial transparency. |

Conclude

Carbon accounting and carbon management cannot function effectively if they are viewed merely as a separate "environmental reporting system" detached from finance. In reality, carbon only truly has governance value when it is properly addressed. firmly anchored to cost data, documentation, and internal control procedures. – This aligns with how the CFO is running the business.

Throughout this entire process, Bizzi did not act as an emissions calculator, but rather as a tool for calculating emissions. financial data infrastructure layer This helps businesses implement carbon accounting in a practical and controlled manner.

LIVE data collection phaseBizzi helps businesses leverage existing data sources within their financial systems, such as electronic electricity, water, and fuel bills, purchasing costs, logistics, and travel expenses. Automated data extraction reduces reliance on manual data entry, thereby minimizing errors – the biggest bottleneck in carbon accounting.

When switching recording and control phaseThese data are standardized and linked to accounting documents, creating a foundation for development. Carbon ledger in parallel with the financial ledger.As a result, each emission figure can be traced back to its source, ensuring consistency and readiness for future carbon audits.

LIVE carbon management perspectiveBizzi helps CFOs use financial data as a foundation to estimate and control Scope 3, instead of waiting for complete carbon reports from suppliers. This approach allows businesses to implement a data maturity roadmap that is both compliant and practical with existing resources.

Finally, when carbon becomes financial variablesStandardized data from Bizzi can connect to operational planning (EPM) systems, allowing CFOs to simulate the impact of carbon on costs, budgets, and cash flow. At this point, carbon accounting is no longer just a "report to submit," but becomes a tool. decision-making tools in business management.

In short, Bizzi plays a role data backbone and controlThis helps businesses move from measuring emissions to managing carbon sustainably, aligning with modern financial thinking and future compliance requirements. Register here to try Bizzi's solutions for your business's operational and financial management processes: https://bizzi.vn/dang-ky-dung-thu/