In the digital age, artificial intelligence (AI) is growing stronger and stronger, bringing many benefits but also many challenges. One of the emerging concerns is the ability of AI tools such as ChatGPT in creating highly sophisticated counterfeit receipts. This raises a big question mark about the safety and efficiency of manually checking input receipts and invoices.

The Rise of AI and the Challenge of Counterfeit Receipts

The rapid development of artificial intelligence (AI) has brought about profound changes in many areas of life and business. In particular, in the field of image generation, AI tools have reached a level where they can create incredibly realistic images. Along with the great benefits, this development also poses new challenges, especially in verifying the validity of documents, including receipts and invoices.

In this context, traditional manual methods of checking incoming invoices are facing increasing limitations. The sophistication of fake receipts generated by AI tools such as ChatGPT can easily bypass the checking processes based on human observation and experience. This not only poses financial risks but also has serious potential legal implications for businesses.

The rapid advancement of AI in generating realistic images, exemplified by tools like ChatGPT, marks a fundamental shift in the potential fraud landscape. Creating convincing fake documents used to require highly specialized skills and was time-consuming. Now, AI has democratized this ability, making it more accessible to a wider range of malicious actors.

AI’s ability to create highly sophisticated fake receipts shows that financial fraud is becoming harder to detect. This raises the need for increased vigilance around all types of documentation, including VAT e-invoices. Businesses need to be more aware of the risks and strengthen controls.

>> See more: Only 9% finance leaders are using AI tools that generate

ChatGPT's Sophisticated Fake Receipt Creation Capabilities

Multiple sources have noted ChatGPT's incredible ability to generate highly authentic fake receipts. An article in the Economic Times on April 3, 2025, reported that Internet users were using ChatGPT's photo generator to create fake restaurant receipts for insurance fraud. A viral Instagram post from the site chatgptricks revealed how users edited receipts to claim refunds or insurance claims.

The article highlights that the misuse of these AI tools makes it alarmingly easy to manipulate reality, taking just minutes in ChatGPT to do what previously required Photoshop skills and time.

This information suggests that ChatGPT is not only capable of generating fake receipts, but is also being used for actual fraud, with specific financial consequences such as insurance fraud. The ease and speed with which fake receipts can be generated (minutes compared to the effort previously required) is a particularly worrying factor for businesses.

On Reddit, a post on r/singularity announced that ChatGPT now allows for the creation of highly realistic fake receipts. A commenter on the post also provided an example of using a fake “receipt” to create a false impression in a social situation. While the example is meant to be entertaining, it still demonstrates ChatGPT’s ability to create receipts that look realistic enough to fool people in everyday situations.

This implies that in a business environment where receipts are checked quickly, these fake receipts can easily be overlooked.

One notable comment is that creating a fake receipt takes just 20 seconds with a simple command line, showing a very low technical barrier.

ChatGPT, especially the latest version 4o, has introduced a superior image generator, capable of Create realistic text inside images. This ability was quickly exploited to create fake restaurant receipts. Some social media users even shared images of fake receipts created from real restaurants, showing how surprisingly authentic they were.

Although initial tests showed that the AI sometimes struggled with simple calculations or used the wrong number format, These errors can be easily corrected using photo editing tools or by giving more specific instructions to the AI..

A TechRadar article notes that images generated by ChatGPT are difficult to distinguish from real ones, and fake receipts are a prime example. In fact, an online AI image checker (Sightengine) was fooled by a fake receipt generated by ChatGPT, believing it to be real with a confidence rating of 93%.

The paper also notes that metadata can be stripped away, reducing the effectiveness of the method in detecting fake images. This is particularly worrying because it suggests that traditional methods of detecting fake receipts that rely on image inspection may no longer be effective.

The ease of creating fake receipts opens up new big loophole for fraud, when bad actors can take advantage of this technology to claim payment for completely bogus expenses.

What is the purpose of OpenAI allowing fake receipts?

The purpose of allowing the creation of fake receipts using ChatGPT, according to OpenAI spokesperson Taya Christianson, is primarily to Provides users with maximum creative freedom.

Additionally, OpenAI also suggests that fake receipts generated by AI may have legitimate, non-fraudulent application, such as:

- Teaching people about financial literacy.

- Creating original art.

- developing product advertisements.

So, according to OpenAI, allowing fake receipts to be created is part of providing flexibility and creativity to users, while they also see the technology's potential positive uses beyond fraud.

Who does ChatGPT generate fake receipts affect?

ChatGPT's ability to generate fake receipts affects a variety of audiences, primarily related to the risk of fraud and the loss of credibility of documents. Here are the main audiences affected:

- Businesses and stores:

- Suffer financial loss: Businesses, especially stores and restaurants, can be scammed by fake receipts to claim refunds for non-existent transactions or to fraudulently promote promotions.

- Strengthen verification measures: To cope with this, businesses may have to invest in more complex, costly, and potentially inconvenient receipt verification systems and processes for customers.

- Employers:

- Business expense fraud: Employees can use fake receipts generated by ChatGPT to fraud in payment of business expenses, causing significant financial losses for the company.

- Reduced reliability of documents: Employers may become more suspicious of receipts submitted by employees, leading to a more complicated and time-consuming approval process.

- Insurance companies and financial institutions:

- Insurance fraud on the rise: ChatGPT can be used to creating altered or falsified receipts relating to fictitious accidents for the purpose of insurance fraud. This puts pressure on insurance companies, which can lead to financial losses and increase premiums for genuine users.

- Challenges in verifying claims: Verifying the validity of receipts and documents has become more difficult, requiring insurance companies and financial institutions to develop more advanced verification methods.

- Stricter policy: The increased risk of fraud could force insurers and financial institutions to tighten policies of its own, potentially making it more difficult for people to seek legal redress.

- Individuals and society in general:

- Declining confidence in documents: The ease of creating fake invoices can make decline in public confidence in the authenticity of photographic materials, causing negative consequences in many different areas.

- Risk of being affected by tighter policies: If fraud becomes more prevalent, honest people and businesses may also be affected by tighter regulations and controls from financial institutions and regulators.

In summary, ChatGPT’s ability to generate fake receipts poses significant challenges for businesses, employers, insurers, and society at large, primarily due to the increased risk of fraud and the reduced reliability of image-based documents. This requires effective prevention and control measures to mitigate the negative impacts.

Risk of creating fake VAT electronic invoices from AI technology

AI’s ability to create sophisticated fake receipts shows that financial fraud is becoming increasingly difficult to detect. Worse, when these fake receipts are used as a basis for payment or to legitimize expenses, it paves the way for a larger fraud cycle – fake VAT electronic invoice.

Although VAT e-invoices have higher legal status and stricter management procedures, the possibility of fake VAT e-invoices does not rule out. If fraudsters can create sophisticated fake receipts to “legitimize” non-existent transactions, and then use these receipts to create fake VAT e-invoices (with incorrect information or for virtual transactions), the risk of fraud will be greater.

Technically, AI can be trained to create structured electronic invoice data, including required information fields such as:

-

Name of goods/services,

-

Quantity, unit price, total amount,

-

VAT rate, total payment,

-

Buyer and seller information,

-

Tax code, invoice date, symbol, invoice number.

Not stopping there, AI can also learn how to format electronic invoices in the form of XML file, in accordance with the technical regulations of the General Department of Taxation of Vietnam. In an uncontrolled environment, these invoices can be completely entered into the accounting - tax system of the enterprise without being immediately detected.

In fact, the situation buying and using illegal invoices is still taking place in many localities. According to statistics from the General Department of Taxation, in 2023 alone, authorities discovered hundreds of cases related to the use of fake invoices, with transaction values up to thousands of billions of VND.

Some common tricks include:

-

Set up a "ghost" business to issue fake invoices.

-

Using fake invoices to falsely declare input costs, thereby reducing the amount of VAT and corporate income tax payable.

-

“Virtual” transactions to withdraw cash, legitimizing expenses of unknown origin.

When these tricks are combined with the power of AI – fraud becomes more unpredictable, faster and more sophisticated than ever before.

Potential risks for businesses when testing manually

Manually reviewing large volumes of invoices and payment request documents is a process. time consuming and resource consuming. Accounting and finance teams have to spend hours reviewing each invoice, which reduces operational efficiency and can lead to delays in other processes. Furthermore, humans prone to error during auditing, especially when dealing with large amounts of data or invoices that look similar.

These errors can result in payment of invalid invoices or omission of valid invoices.

In addition, manual testing methods also have potential risk of fraud from inside and outside. Employees may collude with outside parties to create and accept fake invoices. Fake invoices may also be created by dishonest suppliers. Manual detection of these fraudulent activities is often very difficult.

More complex forms of fraud such as Duplicate invoices, fake invoices, or changes to payment information It is also very difficult to detect manually without systematic data comparison and analysis.

A survey by Procurement Magazine found that 62% businesses believe that generative AI is the main cause of the increase in invoice fraud, and 90% organizations lack a dedicated fraud prevention team, causing accounting staff to have to do multiple jobs, causing overload and increasing risk.

Medius describes various forms of invoice fraud, including fake invoices, duplicate invoices, and altered payment information, highlighting the serious financial, reputational, and legal consequences. Pymnts points out that manual payment methods, especially checks and email-based invoices, are “easy prey” for fraudsters.

The increase in transaction volume and supply chain complexity further increases the burden of manual invoice review, making it easier for fraud to be overlooked. As businesses grow, the number of invoices to process increases significantly. At the same time, globalized supply chains involve more suppliers and more complex transaction flows.

Manually reviewing each invoice under these conditions becomes increasingly difficult and error-prone. Human capabilities and simple manual processes cannot scale effectively to handle this volume and complexity, creating an environment where sophisticated AI-generated counterfeit invoices can easily slip through undetected.

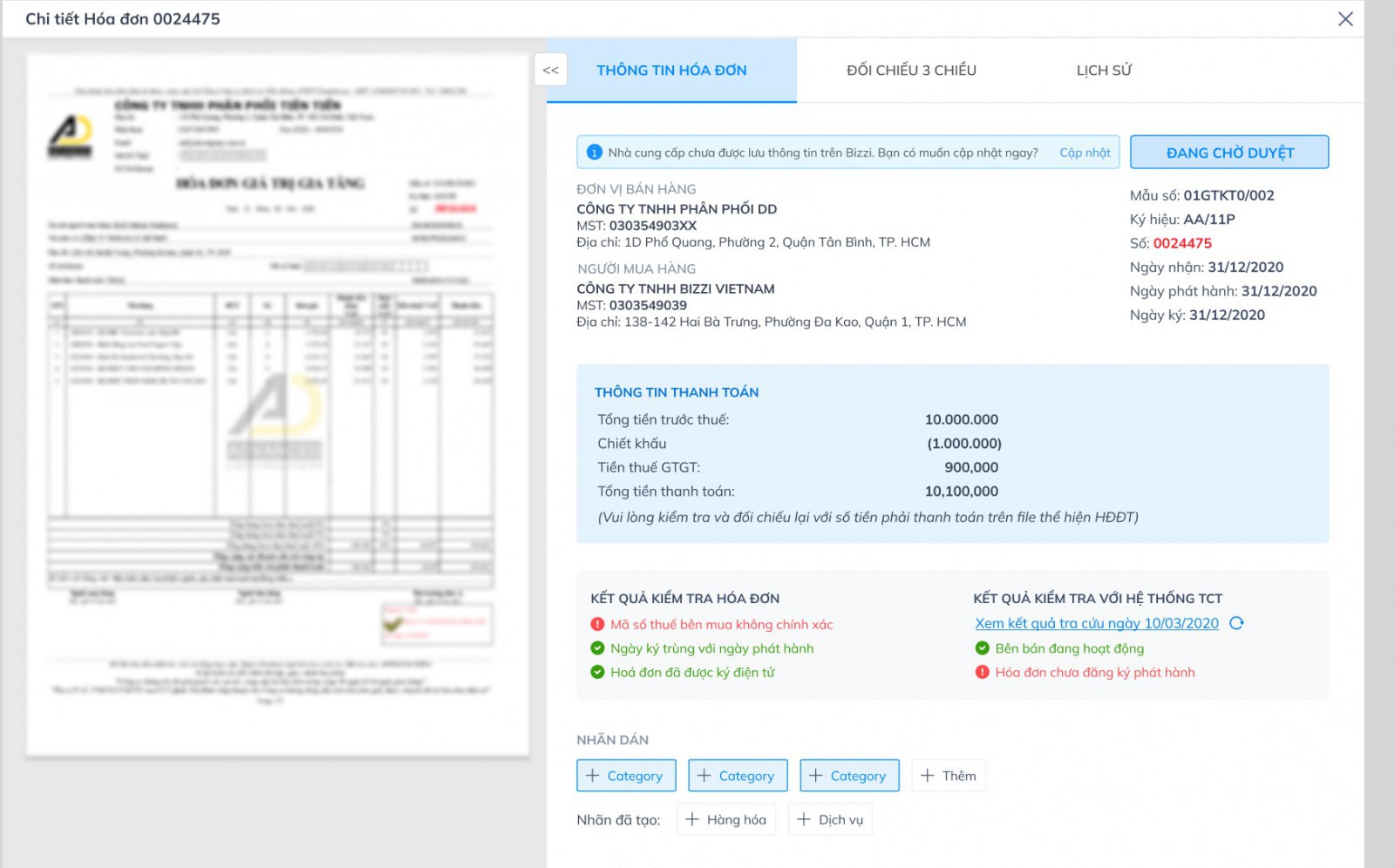

Bizzi – Input invoice processing solution comprehensive, risk reduction

Recognizing the challenges and risks businesses face in processing invoices, especially in the face of the rise of counterfeit invoice generation technology, Bizzi was born as a pioneering solution. Bizzi is software Comprehensive input invoice processing, artificial intelligence (AI) and robotic process automation (RPA) applications.

Bizzi brings many practical benefits to businesses:

- Automatically receive and store electronic invoices: Bizzi provides each business with a unique email address to automatically collect and store electronic invoices on a single platform. This helps Eliminates problems with storage limitations, poor security, and difficulty in searching and retrieving data compared to the accountant's use of personal email.

- Automate invoice processing: Bizzi helps Reduce up to 80% of time and save at least 50% of cost compared to manual processing. This platform is capable of Automatic data extraction with accuracy up to 99.9% in just 10 seconds per invoice. After processing and checking, Bizzi automatically notifies the results, helping the accounting department reduce workload and Reduce errors due to manual operations.

- Smart 3D Auto Matching: Bizzi provides an automatic reconciliation solution between invoices, purchase orders and warehouse receipts with high precision. This feature helps Detect discrepancies quickly, improve data accuracy, and optimize audit processes.

- Minimize the risk of error and fraud: Bizzi Automatically check and validate input electronic invoices according to various criteria, ensuring their validity, including checking electronic signatures, tax codes, and supplier information. This helps businesses Eliminate the risks associated with using counterfeit invoices.

- Easy to integrate and manage: Bizzi's platform is Flexible integration with existing accounting solutions. Electronic invoices are stored visually, helping the accounting department Easy to search and manage by multiple criteria.

- Cost and supplier management features: Bizzi also offers features Manage costs, manage suppliers and speed up approvals, helping businesses manage financial activities more comprehensively.

In addition, Bizzi has the ability to Integration with ERP systems and accounting software popular systems like Odoo, SAP and Oracle through built-in integrations or APIs. This enables seamless data flow and reduces manual data entry between systems. E-invoices and related data are secure storage and management on the Bizzi platform over time, making it easy for businesses to access and manage information when needed for auditing or reporting purposes.

>> Register to use Bizzi's Input Invoice Processing solution at: https://bizzi.vn/dang-ky-dung-thu

According to Bizzi's statistics, on average, a business will spend from 5,000 VND to 8,000 VND/invoice if done manually. If a business uses Bizzi's digital transformation solution for accounting, this cost is only about 1,000 VND/invoice, Bizzi saves at least 50% in costs for the business, which means only 1-2 employees are needed to handle the process. physical.

With Bizzi bot, the risk level is minimized with an almost absolute accuracy of 99.9%. Bizzi is one of the few software on the market that can check the reasonableness and validity of digital signatures and digital certificates.

Besides, the jobs that need 2-3 people to handle, now just need Bizzi to be able to balance the entire accounting department with 24/7/365 productivity without taking time off. Therefore, it can be said that Bizzi contributes to reducing work pressure for accounting staff if before, businesses often needed 2-3 employees to perform repetitive tasks. Now, it only takes Bizzi and 1 employee to be able to handle jobs with higher efficiency.

Currently, Bizzi has been trusted and used by +1200 large enterprises and corporations such as Tiki, GS25, Circle K, PNJ, P&G, VNG, Grab, Ikea, Sabeco, Pharmacity, etc.

Bizzi is not just a tool to automate invoice processing, but also integrates smart mechanisms like 3-way matching and automatic validation, creating a strong layer of protection against fraudulent invoices, including those generated by AI. While automating data entry can improve efficiency, Bizzi goes further by implementing intelligent checks.

Three-way matching ensures that invoices match the purchase order and warehouse receipt, making it difficult for a completely fake invoice (even one that looks authentic) to slip through the system. Automatic validation of tax identification numbers and supplier information adds another layer of security, as AI-generated invoices can contain inconsistencies in these important details.

As AI technology advances and counterfeit invoices become more sophisticated, maintaining manual invoice checking methods poses many financial, time, and error risks. Bizzi, with its comprehensive and automated input invoice processing solution, is a powerful assistant to help businesses effectively deal with these challenges..

By automating processes, validating and intelligently matching, Bizzi not only helps businesses save costs and time while significantly reducing the risk of fraud and errors, ensuring safety and transparency in financial management. Let Bizzi become the “BOT Boss” in processing your invoices, helping accountants “less stressful” and businesses “steadily succeed”.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam