In businesses, invoice processing costs is an important but often overlooked factor. It is not only the direct monetary cost, but also includes time, human resources, legal risks and opportunity costs. Understanding this cost helps CFOs, chief accountants and operational managers optimize cash flow, reduce the risk of errors and improve operational efficiency.

Why do businesses need to learn about “invoice processing costs”?

The invoice processing process seems simple but it has many hidden costs. An invoice goes through the steps of receiving, checking, entering, approving, and storing, each creating its own costs:

- Time cost: Employees spend time checking, entering data, and submitting for approval.

- Personnel costs: Cost of paying AP, accounting, management approval.

- Operating costs: Printing, scanning, storage, software, infrastructure.

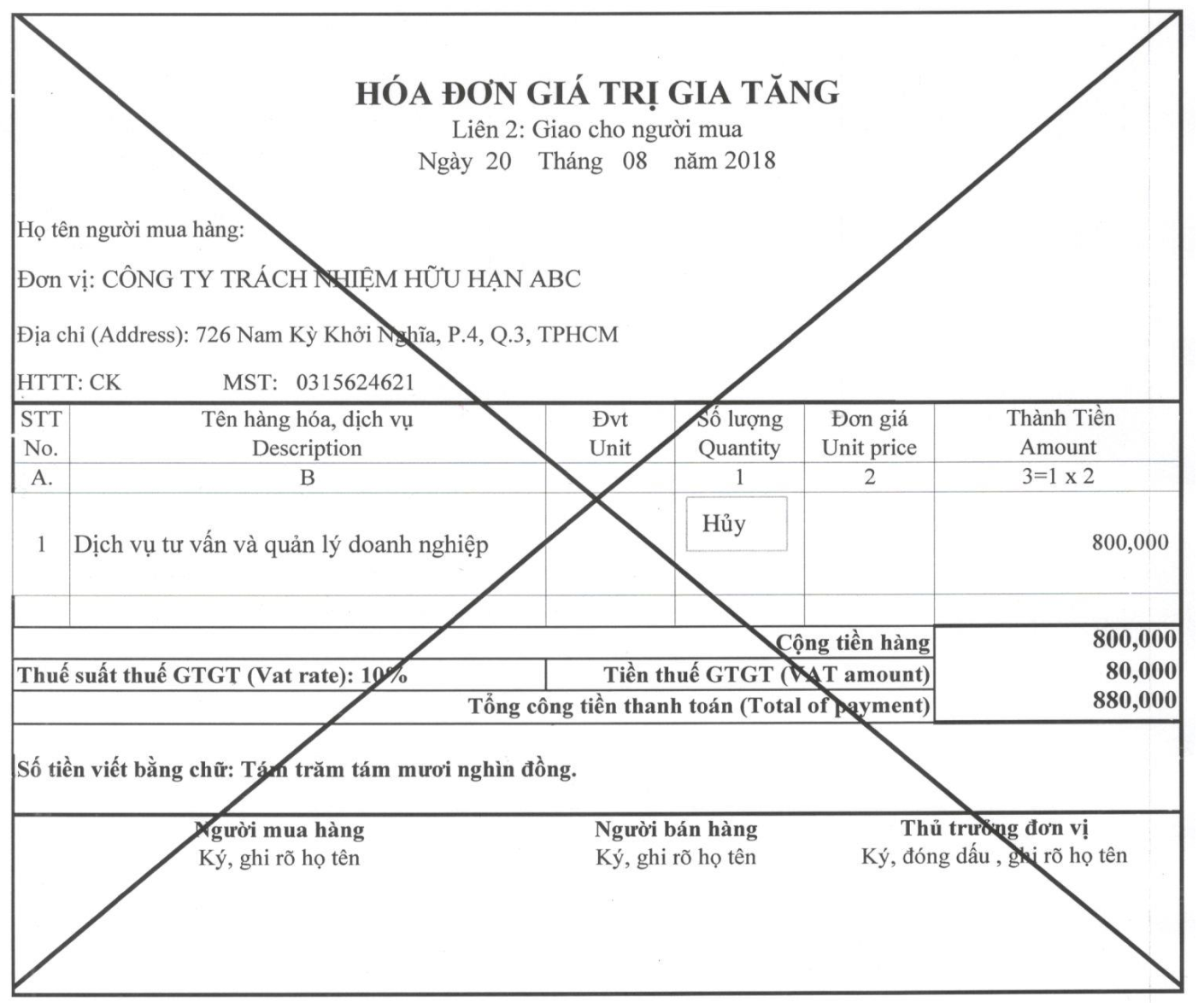

- Legal risk costs: VAT errors, fake invoices, duplicates, excluded expenses.

- Opportunity cost: Late payment results in early loss of discounts, delayed reporting, and impacts cash flow management.

The real question isn't “how much does invoice processing cost?”, but rather: “How to optimize total cost per invoice?”

According to a survey in Vietnam, 80–90% businesses still process invoices manually (Accounts Payable – AP):

- Download files from provider or email.

- Check information, compare with contract or PO.

- Enter data into the system ERP / accountant.

- Submit for multi-level approval.

- Store paper or scanned documents.

Consequence:

- Operating costs high due to personnel and time.

- Tax compliance risks and data errors.

- Slow process, easy to miss early payment discount.

AP staff often spend hours on one invoice, leading to increased personnel costs and difficulty measuring ROI of the process.

Businesses are interested in invoice processing costs because:

- Not sure how much AP actually costs per month.

- Concerns about fake, incorrect, duplicate invoices.

- Cannot optimize human resource costs but still have to ensure compliance with taxes and internal policies.

- Want to reduce processing time, speed up approvals and budget reconciliation.

Key insight: they don't just want to know “current costs,” they also want to measurement formula and how to minimize.

This article will help businesses:

- Define invoice processing costs full, including direct costs, hidden costs, compliance costs, and failure costs.

- Analysis how costs are inflated, from data entry to multi-level approval.

- Introduce Standard CPI & KPI formula, helps measure cost effectiveness.

What are the invoice processing costs?

Understanding what invoice processing costs are will help CFOs, chief accountants and operations managers effectively measure AP (Accounts Payable), optimize human resources, reduce errors and legal risks.

Definition of “Invoice Processing Cost”

Invoice Processing Cost (IPC) is the total cost a business must spend to receive - check - enter data - reconcile - approve - pay - store and retrieve each input invoice.

IPC includes:

- Direct Cost – human resources, operations, systems.

- Hidden Cost – errors, exceptions, delays, duplication.

- Risk Cost – loss of tax deductions, penalties, incorrect financial reporting.

Many businesses only see the cost of human resources, but ignore the hidden costs and risk costs – which are the most expensive part.

Scope of invoice processing (End-to-End)

Input invoice processing procedure includes the following steps:

- Receive invoice: Email, tax authority e-invoice portal, or vendor portal.

- Check validity: VAT, MST, date, tax authority code, format.

- Check the legality of the supplier: Is the supplier still active? suspended? at risk?

- Compare PO – GR – Invoice:Compare invoice with purchase order and acceptance report. Correct quantity? Unit price? Purchase terms?

- Approve: Multi-level approval, multiple departments involved.

- Accounting into ERP / accounting system: Assign cost center, GL, project, department, contract codes.

- Pay: Transfer by limit, bank, PR–PO–Payment.

- Document storage: Paper / cloud / e-invoice (must be kept for 10 years by law).

- Retrieval & Auditing: When auditing internally, tax, vendor reconciliation.

Each step in this process creates private expenses, and if handled manually, costs will increase very quickly.

Components of invoice processing costs

Invoice processing costs include direct/visible costs and hidden/indirect costs. Each type of cost directly or indirectly affects AP efficiency and tax risks.

1. Labor Cost (accounts for 60–70% CPI)

This is a cost group that can be measured directly by the number of hours worked and the salary of the processing personnel.

- Manual data entry time.

- Comparison time PO – GR – Invoice.

- Invoice processing time error / wrong / missing information.

- Exchange time – verification via email between departments.

2. Operating Cost

- Printing – stamping – circulating paper documents.

- Paper file storage + warehouse space + filing cabinets.

- Storing electronic invoices on multiple decentralized platforms → double the cost + time consuming to search.

3. Exception Cost

Occurs when invoice non-compliance with input standards:

- Invoice with wrong amount → return to vendor → reprocess.

- Invoice missing PO → must verify with buyer.

- Duplicate invoices → detect – check – cancel.

Exception costs tend to increase with the number and complexity of purchasing processes.

4. Compliance Cost

- Check valid invoices according to Decree 123/2020.

- Check MST, supplier activity status.

- Prepare additional documents for VAT deduction and tax validation.

5. Hidden Cost (the biggest)

These are the groups of costs that have direct & indirect financial consequences:

| Type of risk | Impact |

| Lost VAT deduction | 3–10% invoice value |

| Expenses are excluded when calculating corporate income tax. | Increase actual costs |

| Duplicate Payment | Cash loss |

| Administrative fines according to Decree 125/2020 | 20–50 million / violation |

| Incorrect accounting data - incorrect financial statements | Audit / Legal / Reputation Risk |

5 factors that increase invoice processing costs

Factors that increase invoice processing costs often come from manual processes, errors, non-compliance, and high volume of invoices,…

1. Large volume of invoices and number of vendors

Fiber cost increases exponentially — cost per invoice does not increase linearly but increases steeply with quantity.

- The more invoices → the workload increases exponentially.

- Each vendor has different processes, forms, and ways of sending invoices → increasing processing complexity.

2. Percentage of invoices without PO (non-PO invoice)

This is the most time consuming element in the AP process. The inability to automatically reconcile results in manual verification with the buyer & related departments. Processing time is usually 3–5 times longer than invoices with PO.

3. Multi-level approval process

Opportunity cost increases, early payment discount is lost. 3–5 approval levels → cycle time increases from a few hours to a few days. Vendor complains about late payment → affects relationships and reputation.

4. High rate of incorrect, duplicate, and missing documents

Costs double or triple Because the End-to-End process must be redone, it must be returned, supplemented, corrected → processed again from the beginning. At the same time, duplicate invoices need to be manually reconciled → wasting time.

5. Low level of automation

This is Main reasons for CPI (Cost per Invoice) in Vietnam always 3–5 times higher than automated businesses. Manual data entry → errors, slow, waste of human resources. No AI/OCR to reconcile PO-GR-Invoice → must be done manually.

Compare the costs of manual invoice processing with automation

In general, automation not only replaces data entry personnel, but also optimizes the entire AP process from receiving - checking - approving - paying - storing.

1. Manual Invoice Processing Cost

According to APQC, the cost of processing a manual invoice ranges from:

- 12–30 USD/bill (international – APQC benchmark)

- In Vietnam: 20,000 - 80,000 VND / bill

Processing time: 20–30 minutes/bill, include:

- Receive email / file / paper copy

- Checking for validity

- Manual ERP data entry

- PO – GR – Invoice reconciliation

- Send emails/multi-level approvals

- Error handling, additional documents

- Store and retrieve documents when needed

CPI (Cost per Invoice) increases sharply with the number of invoices and exception rate.

2. Cost of automated invoice processing (AP Automation)

Using OCR + AI + automatic review + reconciliation process PO–GR–INV:

- 2,000 – 8,000 VND / bill

- 1–3 minutes/bill instead of 20–30 minutes

Virtually touchless process:

- Extract data automatically from invoices

- Check VAT, Tax Code, validity

- Automatic PO–GR reconciliation

- Automatically push to ERP

- Browse online, traceable

- Centralized storage, instant search

3. Benefits & ROI of Automation

Below is Summary of core benefits that automation brings in invoice processing (Invoice Processing Automation / IPA) — from an operational, financial and management perspective:

| Target | Handmade | Automation |

| Cost per Invoice | 20k–80k | 2k–8k |

| Processing time | 20–30 minutes | 1–3 minutes |

| Data entry error rate | High | Reduce 90% |

| First-pass match rate | 30–50% | 85–95% |

| Duplicate payment risk | High | Reduce 99% |

| Touchless ratio | < 10% | 60–85% |

Financial ROI

- Reduce 60–80% in personnel costs

- Reduce 90% input errors

- Shorten cycle time

- Increase vendor satisfaction

- Reduce tax & audit risks

KPIs to measure invoice processing costs

The invoice processing KPIs are a system that measures the health of financial operations, helping businesses: Control costs - optimize processes - reduce risks - increase productivity - support investment decisions.

1. Cost per Invoice (CPI) – Cost of processing each invoice

CPI = (Personnel Cost + System Cost + Risk Cost + Storage Cost) / Number of Invoices Processed

- The most important KPI to measure AP process performance.

- The lower and more stable the CPI over time, the better the process is standardized and automated.

- Benchmark:

- Manual: 20,000 – 80,000 VND / bill

- Automation: 2,000 – 8,000 VND / bill

2. Invoice Processing Time

TProcessing time from receipt → approval → accounting → payment

- Reflects processing speed & process congestion level.

- Manual: 20–30 minutes/bill

- Automation: 1–3 minutes/invoice

3. Approval Cycle Time

Average approval time from submission of approval request to completion

- Often prolonged due to multi-level processes or slow internal feedback.

- Directly affects vendor experience and ability to receive early payment discounts.

4. First-pass Match Rate

Percentage of invoices processed correctly the first time without returns/replenishments

- KPI for accuracy & level of automation.

- Manual: 30–50%

- Automation: 85–95%

5. Invoice Exception Rate

Percentage of invoices with errors that need to be reprocessed

- Including: incorrect information, missing PO, duplicate, incorrect tax, missing documents.

- High exception rate = high hidden cost + lost cycle time.

6. Error Rate

% Invoice data entry error or incorrect reconciliation

- Manual: high due to manual input from Excel/PDF.

- Automation: Reduce 90% error.

7. On-time Payment Rate

Rate of on-time payment as committed

- Demonstrate AP effectiveness & vendor relationships.

- Low → affects reputation & loses early payment discount

Risks & Losses if invoice processing costs are high

High invoice processing costs are not just a matter of “money”, but of:

- Finance

- Tax & Compliance

- Risk management

- Operating efficiency

- Business reputation

1. Financial risks

- Late payment

- Early payment discount lost (2%–3% invoice value)

- Fined by vendor for overdue or service interruption

- Duplicate Payment

- Direct budget loss if not detected in time

- Increased costs of review, refund processing, and reconciliation

2. Tax risks

- Invalid invoice / incorrect information: VAT not deductible (loss of 3–10% invoice value)

- Incorrect accounting:

- Expenses excluded when calculating corporate income tax

- Fined according to Decree 125/2020 (from 20-50 million or more)

Small errors in invoice processing can have a big impact on financial reporting & auditing.

3. Fraud Risk

Invoice fraud is the most common fraud group in AP according to ACFE.

- Fake invoice / ghost invoice

- Vendor collusion: colluding to raise prices, increase quantities, and create fake invoices

- Reimbursement claims abuse

4. Operational Risk

- Accounting department overloaded with large number of invoices and manual process

- Long cycle time causes cash flow congestion

- Vendor complaints, poor reputation rating, affecting cooperation & price negotiations

In short, AP Process Automation is the core solution to reduce risk and protect corporate finances.

Solution to reduce 50–70% invoice processing costs

Core solution to reduce invoice processing costs by 50–70% = Process standardization + OCR/AI automation + Approval workflow + ERP connection + KPI. Automation does not replace people, but helps them focus on higher-value work.

Standardize AP processes

- Develop and issue unified SOPs for the entire department

- Eliminate redundant steps & bottlenecks in the process

- Clearly define the roles of each party: buyer – AP – approver – vendor

PO required for at least 90% purchase transactions

- Reduce manual verification

- Increase automatic reconciliation capabilities

- Reduce exception rate

TSet up a transparent approval workflow with time SLAs

- Shorten Approval Cycle Time

- Reduce payment delays & improve vendor experience

Automated OCR + AI extraction

- Automatically read & extract data from PDF invoices, images, scans

- Automatically check VAT, MST, date, tax authority code

This brings benefits:

- Reduces manual data entry time by 80–90%

- Reduce 90% input errors

Automatic 3-way matching

- Automatically match quantity - unit price - total amount

- Automatically flag exceptions for fast handling

This brings benefits:

- First-pass match rate reached 85–95%

- Reduce duplicate & fraud

Switch to 100% eInvoice

Dramatically reduce operating costs & record keeping for 10 years

- Centralize all invoices on a single platform

- Integration with ERP/accounting

- Search & audit in seconds

Improve vendor compliance

- Vendor is required to send according to the following standards: format – PO – required documents – time

- Create a Vendor Portal for direct upload, limiting email exchanges

- Sample checklist guide for new vendors

This brings benefits:

- Reduce exception rate

- Reduce processing time by 3–5 times

Optimize invoice processing costs with Bizzi

Bizzi is the leading technology solution in Vietnam providing automation solutions for invoice processing and business cost management.Using artificial intelligence technology and robotic process automation (RPA), Bizzi helps businesses save up to 80% of invoice processing time, minimize errors and automate financial operations such as reconciliation and payment.

In addition, the Bizzi Expense solution also helps businesses comprehensively manage spending and work processes, from advance requests to invoice reconciliation and payments.

Bizzi IPA – Automate the entire processing process

Bizzi uses OCR + AI + approval workflow to optimize end-to-end AP process:

- Automatically receive – read – extract data from PDF/scan/email invoices

- Check VAT validity, tax authority code, tax code, business operation status

- Warning of risky invoices: fake, duplicate, different PO information

- Fully automatic 3-way matching (PO – GR – Invoice)

- Push data into accounting ERP with just 1 click

Financial results

- Reduced CPI to 10–30% compared to manual processing

- Shorten processing time from 20–30 minutes → 1–3 minutes

- Increased First-pass match rate to 85–95%

Bizzi Expense – Control costs from the root

Optimize costs not only in invoice processing, but also when invoices arise:

- Control spending by budget / cost center / department / project

- Prevent unplanned invoices right from the purchase order

- Transparent approval workflow with time SLA

- All spending data is centralized and easy to analyze

Impact

- Reduce unplanned expenses 15–30%

- Transparency of responsibilities between Buyer – AP – Approver

- No more lost costs due to missing documents / missing POs

ERP Integration – Eliminate Manual Entry

Bizzi connects directly to most popular ERP systems: SAP, Oracle, Odoo, Bravo, MISA, FAST, AMIS, Base, Bravo, Infor…

- Synchronize master data: Vendor, PO, Product, GL account

- Push accounting entries into ERP automatically, no need to type in Excel or enter manually

- Avoid errors due to manual data entry, thereby reducing the cost of financial reporting and auditing risks

- Reduce 90% input errors

Conclude

Most businesses underestimate the true cost of invoice processing. When the process relies on manual data entry and multiple levels of approval, errors, delays, and hidden costs multiply — making CPIs much higher than imagined.

Automation is no longer an option, but a necessity to:

- Sharp reduction in CPI and personnel costs

- Improve operational efficiency & increase tax compliance

- Eliminate the risk of duplicate payments, invoice fraud, and lost discounts

Go automated now — because every day of delay is a day your business loses money. Contact Bizzi now for a free consultation on a custom-tailored solution for your business: https://bizzi.vn/dat-lich-demo/