Invoice errors are mistakes that occur during the process of creating, issuing, receiving, and declaring invoices, resulting in invoices that do not comply with tax laws and electronic invoicing regulations. These errors can stem from: Technical errors (incorrect information entry, system issues), Operational errors (misunderstanding regulations, weak control procedures), and Risks from partners (risky suppliers, businesses absconding, illegal invoices).

This article by Bizzi will analyze common invoice error risks and how to prevent and handle them correctly according to legal regulations.

What are invoice errors and why should businesses be more concerned than ever?

Invoice errors are mistakes that occur during the process of creating, issuing, receiving, or declaring invoices, resulting in invoices that do not comply with tax laws and regulations regarding electronic invoices. These errors can stem from internal operations, technical systems, or from the risk provider.

Common mistakes

- Incorrect business information, tax identification number, invoice date.

- Incorrect product description, unit price, and tax rate.

- Incorrect declaration period, duplicate declaration, or declaration that does not meet the eligibility requirements for deduction.

- Receive risk invoice from businesses that have absconded or ceased operations.

Why do businesses need to pay attention more than ever?

In context Electronic invoice management is becoming increasingly stringent.Even small mistakes can lead to:

- VAT not deductible

- Expenses disallowed during tax settlement

- Subject to penalties, tax arrears, and placed in the high-risk category.

Invoice errors are no longer isolated operational mistakes, but have become a widespread issue. financial risk and compliance risk which businesses need Proactive control from an early stage.

What laws and regulations currently govern invoice errors?

Currently, errors on invoices are primarily regulated by the following legal documents in Vietnam:

1. Tax Administration Law

- Law on Tax Administration No. 38/2019/QH14

As the highest legal framework, it regulates the principles of invoice management and use, the responsibilities of taxpayers, and penalties for invoice-related violations.

2. Decree on electronic invoices

- Decree 123/2020/ND-CP

Detailed regulations on the creation, issuance, and use of, Correcting incorrect electronic invoicesReplacing and correcting errors in electronic invoices.

3. Circular providing guidance

- Circular 78/2021/TT-BTC

Specific guidance on the implementation of electronic invoices according to Decree 123, including:- Cases of invoice errors

- How to handle adjustments and replacements. cancel electronic invoice

4. Administrative penalty document

- Decree 125/2020/ND-CP

The regulations stipulate penalties for errors and violations related to invoices and taxes, ranging from administrative offenses to the use of illegal invoices.

Invoice errors are not handled by a single document, but are subject to simultaneous regulation by Laws, Decrees, Circulars, and penalties, forcing businesses to understand and tightly control them from the outset.

How are common invoice errors categorized?

In reality, errors on invoices can be... classified into 3 main groupsbased on the nature of the error and the extent to which it affects tax obligations.

1. Incorrect information on the invoice.

These are errors related to Identification information and basic content of the invoice, include:

- Incorrect business name, tax identification number, and address.

- Incorrect buyer/seller information

- Incorrect product/service name, unit of measurement

Impact:

- This makes comparison and verification difficult.

- An adjustment or replacement invoice may be required.

- In serious cases, administrative penalties may be imposed.

2. Errors regarding value and tax obligations

These are the affecting errors. directly related to the amount and tax liability payable., like:

- Incorrect quantity, unit price, or total amount.

- Applying the wrong VAT rate.

- Incorrect calculation of tax and total payment amount.

Impact:

- VAT not deductible

- Subject to back taxes and late payment penalties.

- It is a group of errors. high risk, which are often closely scrutinized by the tax authorities.

3. Errors in the technical aspects, timing, and management of invoices.

Arose during Invoice creation, issuance, and management process, include:

- Issuing invoices at the wrong time according to regulations.

- Incorrect declaration period, duplicate invoice declaration.

- System errors, digital signatures, slow or incorrect data transmission.

- Inadequate invoice management and failure to properly archive invoices.

Impact:

- Increased risk of violating regulations on electronic invoices.

- Easily subject to risk warnings and tax audits/inspections.

- Impact on business transparency and reputation.

Clearly categorizing these three types of errors helps businesses. accurately assess the level of risk., select appropriate handling and build a more effective invoice control system..

How do common invoice errors impact a business's tax declarations, expenses, and tax risks?

Errors on invoices are not just isolated operational mistakes; they directly affect tax declarations, deductible expenses, and the level of tax risk for businesses.

1. Impact on tax filing

- Invoices containing incorrect information, wrong values, or issued at the wrong time may not be eligible for valid declaration.

- Businesses have to make adjustments and submit supplementary declarations, increasing their workload and the risk of further errors.

- Invalid invoice declarations may result in penalties and late payment fees.

2. Impact on deductible expenses

- Incorrect invoices are easily disqualified from deductible expenses when settling corporate income tax.

- Particularly with input invoices from risky suppliers, even if a transaction is actual, the cost may not be accepted.

- This increases taxable income and the amount of tax payable.

3. Impact on tax and audit risks

- Businesses with a high number of erroneous invoices will be assessed as high-risk in the tax authority's management system.

- They are easily subject to frequent inspections and audits, which can prolong the process and disrupt operations.

- Accumulated risk can impact a business's reputation, cash flow, and scalability.

In summary, every common invoice error has a “hidden cost,” not only in terms of fines but also long-term tax risks. Therefore, businesses need to control errors from the outset, rather than reacting passively when the tax authorities have already intervened.

What penalties will businesses face if they encounter invoice errors under the new regulations?

Administrative penalties related to invoice errors are mainly regulated by Decree 125/2020/ND-CP and are currently being amended and supplemented by Decree 310/2025/ND-CP (effective from...). January 16, 2026) with increased penalties and a clearer calculation method for each invoice category.

Content violation – invoice information error

Examples of errors:

- Incorrect name, tax identification number, address, or buyer/seller information;

- The content, quantity, unit price, and import tax rate are incorrect.

Penalties (according to Decree 125):

- 3-5 million VND If it is incorrect but does not cause a delay in tax payment;

- 4-8 million VND If the invoice issued is incorrect according to regulations.

Note: If the invoice is adjusted promptly and correctly, it may be possible. not penalized in some cases.

Violation of invoice timing

According to the new regulations (Decree 310/2025): Instead of fines Each invoice has a fixed amount.The penalty will depend on the number of invoices involved in the same violation.

| Incorrect invoice number | Applicable penalty levels (for organizations) |

| 1 invoice | Warning |

| 2–<10 | ~0.5 – 1.5 million |

| 10–<20 | ~2 – 5 million |

| 20–<50 | ~5 – 15 million |

| 50–<100 | ~15 – 30 million |

| ≥100 | ~30 – 70 million |

This is the new penalty rate, effective from... January 16, 2026This replaces the old regulation which stipulated a fine of only 3-8 million for issuing documents at the wrong time. [The text then abruptly changes to:] Failure to issue invoices upon sale/invoices issued at the wrong time. bag identified as a separate violation and carries a larger penalty.

Late submission of reports, late sending of invoice data.

Error on the data transfer side. Electronic invoice Even going to the tax office resulted in penalties:

- 2-5 million If delivery is delayed by 1–5 days;

- 5-8 million if delayed by 6–10 days;

- 10 – 20 million If it is delayed by ≥11 days or not sent at all.

This is especially important for electronic e-invoice systems.

Other violations may be subject to penalties.

| Behavior | Penalty amount |

| Use illegal/fake invoices | 20 – 50 million and request cancellation |

| Failure to report and submit invoices on time. | ~1 – 16 million |

| Selling/legalizing unissued invoices | ~15 – 50 million |

In practice, how are common invoice errors categorized by risk level (Low/Medium/High)?

Below is how invoice errors are classified according to risk levels (Low / Medium / High) in practice, based on how tax authorities assess risk, the impact on tax obligations, and the likelihood of an audit:

Low Risk

Characteristic:

- The error is of a formal or technical nature.

- This does not change tax obligations.

- Easy to detect, easy to adjust.

For example:

- Misspelled buyer's name

- Incorrect address but correct tax identification number

- Lack of non-essential information

- Display errors, system formatting errors

Risk assessment: Usually only an invoice adjustment/replacement is needed, with little or no penalty if handled promptly.

Medium Risk

Characteristic:

- Impact on declaration and accounting

- There is potential for misrepresentation of expenses or taxes, but no evidence of fraud.

- You need to provide an explanation when being inspected.

For example:

- Invoiced at the wrong time.

- Incorrect declaration period, duplicate invoice declaration.

- Incorrect unit price and quantity, but have been adjusted.

- Delayed submission of invoice data to the tax authorities.

Risk assessment: Administrative penalties and increased risk score may occur with repeated offenses.

High Risk

Characteristic:

- This directly affects tax obligations.

- There are indications of serious violations or fraud.

- Easily subject to inspection and tax recovery.

For example:

- No invoices are issued when selling goods/services.

- Using illegal invoices

- Inflating expenses and inflating invoice values.

- Received invoices from businesses that have absconded or ceased operations.

- Incorrect tax rate results in a reduction of the amount of tax payable.

Risk assessment: Potential consequences include tax arrears, heavy fines, increased frequency of inspections, and even referral of the case to the investigative agency.

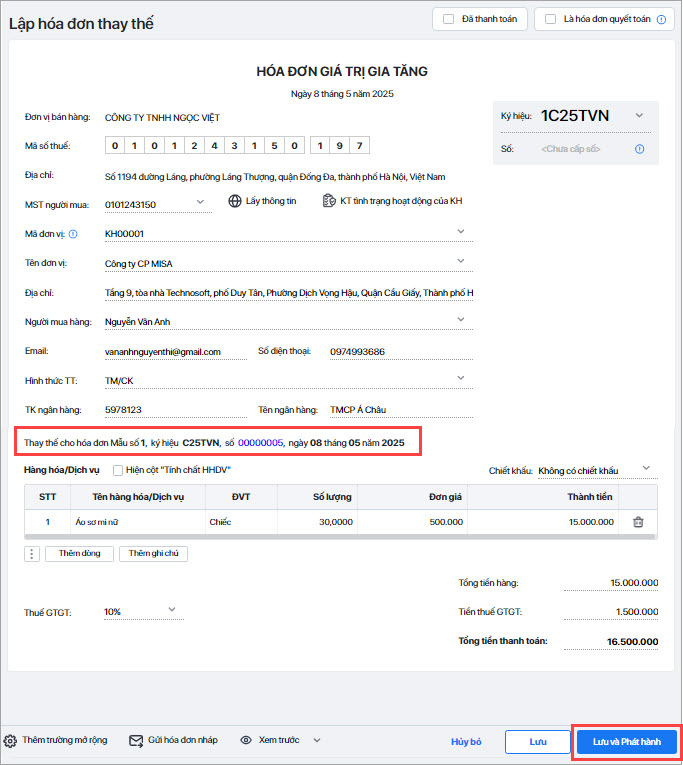

How to handle erroneous invoices that have NOT yet been sent to the buyer (but have already been assigned a tax authority code)?

Below is how to handle erroneous invoices that HAVE NOT YET been sent to the buyer but HAVE ALREADY been assigned a code by the Tax Authority, according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC:

Principle

- Invoices that have been assigned a tax authority code cannot be deleted/cancelled directly.

- Since it hasn't been sent to the buyer yet, there's no need to create a record with the buyer.

The correct way to handle it according to regulations.

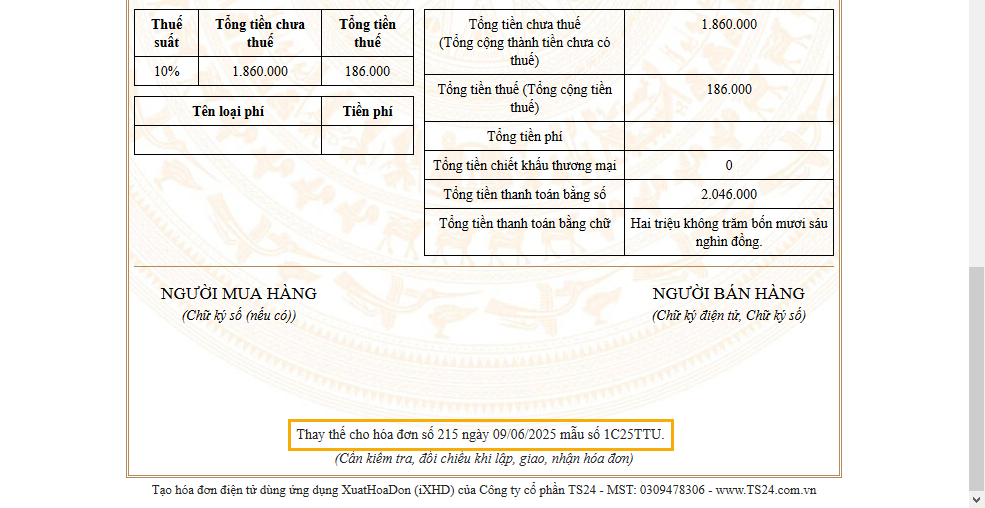

Issue a new invoice to replace the erroneous one.

-

- Create a new electronic invoice (with correct information).

- On the new invoice, clearly state: "This invoice replaces invoice number ..., symbol ..., dated ..."

- Submit the new invoice to the tax authority for code issuance.

- The old (incorrect) invoice is recorded by the system as having been replaced and cannot be used for declaration purposes.

Important Note

- No adjustment invoice will be issued in this case.

- Do not issue incorrect invoices.

- Only declare valid replacement invoices.

- If detected and addressed before the tax filing deadline, there are usually no penalties.

Handling the risk of errors in invoices already sent to buyers.

Below is How to handle the risk of errors in invoices ALREADY sent to the buyer., categorized by each specific case, exactly as Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC:

Only the buyer's name/address is incorrect; the tax identification number, amount, and tax rate are correct.

How to handle it:

- No adjustment invoice issued.

- No replacement invoice will be issued.

- The seller notifies the buyer about the error.

Important Note:

- Both parties can still file taxes as usual based on the invoices already issued.

- This is considered a non-material error in information and does not affect tax obligations.

- No penalties are usually imposed if there is no evidence of fraud.

In this case, only the explanatory document needs to be kept on file; no new invoice transaction will be generated.

Incorrect Tax Identification Number (TIN), amount, tax rate, goods/services

General principle: It is MANDATORY to correct or replace erroneous invoices.

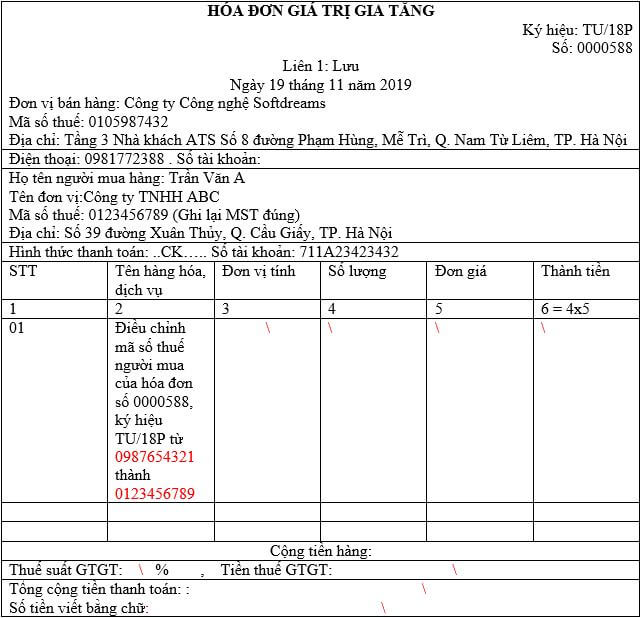

Issue an ADJUSTMENT invoice when:

- Incorrect content (increase/decrease in amount, tax)

- The original transaction remains true to its nature.

- The increase/decrease difference needs to be reflected.

Instructions: "Adjustment for invoice number…, symbol…, date…"

Issue a REPLACEMENT invoice when:

- Many important points are incorrect.

- Incorrect Tax Identification Number (MST), incorrect for all goods/services.

- The invoice needs to be reissued with the correct invoice.

How to write:

"This invoice replaces invoice number…, symbol…, date…"

General notes for both methods:

- Invoices that have already been sent cannot be canceled.

- Both parties declare the information based on the adjustment/replacement invoice.

- A written agreement regarding the discrepancies between the two parties may be necessary (this is recommended for a more thorough record).

In the event that the tax authorities discover a risk of invoice errors,

Mandatory handling method:

- Businesses receive notifications from the tax authorities.

- Issue an adjusted or replacement invoice to correct the error.

- File a supplementary tax return if the errors affect your tax liability.

- Send a valid invoice back to the buyer.

Note the risks:

- If the tax authorities discover the violation before the business handles it itself, there is a higher risk of administrative penalties.

- If the error results in a reduction of tax liability, it may be subject to back taxes, penalties, and late payment fees.

How to properly fill out an adjustment invoice to avoid making the same mistake twice?

Below are instructions on how to properly fill out adjustment invoices, along with a practical checklist to avoid repeating mistakes, in accordance with Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC:

Clearly state the original invoice information.

It is MANDATORY to show the following in full:

- Some bills

- Invoice symbol

- Date of original invoice

Standard recording method: "Adjustment for invoice number ..., symbol ..., date ..." If this information is missing, the adjustment invoice is invalid.

Only record the difference that needs adjustment.

- Do not record the full value of the original invoice.

- Only record the increase (+) or decrease (–) adjustment amount.

For example:

- If the unit price is incorrect and missing 1,000,000 VND, record: Adjustment increased by 1,000,000 VND, corresponding VAT.

- For post-sale discounts, record a negative value (-).

Recording the entire value ⇒ can easily be misinterpreted as creating a new invoice, which is very prone to errors.

Adjust the content to what is permitted.

Adjustment invoices are used for:

- Quantity

- Unit price

- Total amount

- Tax rate / tax amount

Do not use adjustment invoices for the following errors.:

- Incorrect buyer's tax identification number

- Incorrect for all goods/services

- Too many important indicators are incorrect.

These cases should alternative billing.

Filing taxes correctly

Errors in the declaration process are the most frequently repeated mistakes, so it's crucial to understand them:

- Do not resubmit original invoices.

- Declaration Adjustment invoice during the adjustment period

- Buyer and seller declare uniformity

If the adjusted/replacement invoice is still incorrect, can it be adjusted again?

Yes. Adjusted or replacement invoices, if still incorrect, will be processed further, but they must be handled correctly.

The principle in short:

- There is no limit to the number of adjustments/replacements.

- Always refer to the immediately preceding invoice (do not go back to the original invoice).

- Choose the correct method based on the nature of the error.

Quick method:

- The adjustment is still incorrect → make another adjustment, only recording the new difference.

- If the replacement is still incorrect → create another replacement, clearly stating that it is replacing the most recent invoice.

- Errors of a different nature occur → change the format (adjust ↔ replace) accordingly.

Note: Repeated processing can easily attract scrutiny → a checklist is needed before release.

What should businesses be aware of regarding common errors in invoices, tax declarations, and electronic invoice storage?

Here are some brief key points businesses need to know regarding error reporting, tax filing, and electronic invoice archiving:

Notification of invoice error risks

- Only notify the tax authorities when requested. or as required on a case-by-case basis; not every error requires notification.

- With invoice sent to the buyer, so there should be minutes/exchange confirmation to prepare the explanatory document.

- The content of the notification must perfectly matched with an adjustment/replacement invoice.

Tax declaration

- Do not resubmit original invoices. That's wrong.

- Declaration Adjustment/Replacement Invoice in Error handling period.

- Seller and buyer unified declaration To avoid data discrepancies with the tax authorities.

- If the error affects the amount of tax already declared → supplementary declaration In accordance with regulations.

Electronic invoice storage

- Save complete set of documents: Original invoice + adjustment/replacement + minutes/exchange + related documents.

- Ensure data integrity (XML file, digital signature, tax authority code).

- Minimum storage period 10 years as prescribed.

- There is a mechanism Quick lookup and verification when the tax authorities conduct an inspection.

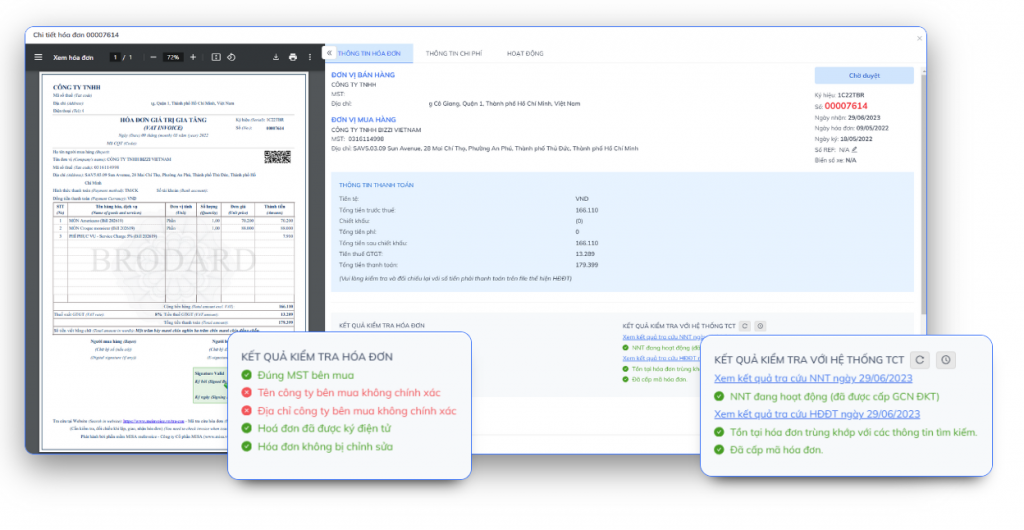

What should businesses check to avoid the risk of errors in input invoices?

Businesses should check invoices as soon as they receive them, not wait until the tax filing period or until the tax authorities have issued a warning.

Check the legal status of the supplier.

- In progress legal activities (No fleeing, no cessation of activity)

- Not on the high-risk list. Announced by the tax authority/police agency

- Registered business activities Fit with goods/services on the invoice

Verify the validity of the invoice.

- Have Tax code, valid digital signature

- Seller/Buyer Information correct and consistent

- Bill set up at the right time according to regulations

Check the transaction details.

- Goods/services did actually occur

- Invoice description In accordance with the contract, quotation, and acceptance report.

- Value, tax rate Reasonable compared to the market.

Check the accompanying documents.

- Contract, appendix

- Handover/Acceptance Report

- Payment documents cashless (with invoices ≥ 20 million VND)

Missing supporting documents = High risk during settlement..

Check for signs of abnormalities.

- Newly established supplier, constantly changing information.

- Issuing invoices for large quantities in a short period of time.

- Unusually low prices, vague payment terms.

How can businesses prevent the risk of internal invoice errors?

Below is Internal invoice error prevention checklist – concise and easy to apply., used for accounting/finance purposes before issuance and declaration:

Before issuing an invoice

- Buyer information: Name, Tax ID, Address correct & consistent

- Goods/services In accordance with the contract, quotation, and acceptance.

- Unit price, quantity, tax rate in accordance with regulations

- Invoice time Correct (delivery/service completion/payment collection)

When creating and issuing invoices

- Full mandatory targets

- Valid digital signature, Have Tax code

- No duplicate numbers, no draft invoices.

- Check System/Format Error

Before sending to the buyer

- Review all important information (MST, money, tax)

- Final comparison with original documents

- Incorrect detection → Deal with it immediately. (If not sent, replace)

When filing taxes

- Do not declare incorrect invoices.

- Declaration on time, not duplicated

- Adjust/Replace → Declare at the time the transaction occurs

- Seller - Buyer unified declaration

Storage & Control

- Save XML + tax authority code + adjustment/replacement invoice

- Save contract, acceptance, payment

- Have error tracking log to avoid repetition

- Periodic reviews (monthly/quarterly)

What technological solutions help detect and prevent invoice errors automatically? Where does Bizzi intervene in this process?

With the ever-increasing volume of invoices and increasingly stringent compliance requirements, controlling invoice errors using Excel or manual verification is no longer sufficient. The risks now stem not only from... data entry error, but also from Supplier risk, operational errors, and timing of processing. – factors that are very difficult to detect if you only look at each invoice individually.

Technology platforms such as Bizzi It's not about replacing accountants, but... Intervening at the very points in the invoice lifecycle where errors are most likely to occur., helping businesses shift from "fixing mistakes after they're done" to Prevent risks from the start..

1. Control invoice errors right from the input stage (Input control)

Upon receiving the input invoice, Bizzi provides the following support:

- Automatically download and read electronic invoices Using RPA + AI to gather data from multiple sources reduces the risk of missing or incorrectly entering data.

- Verify the validity of the invoice.Tax authority code, digital signature, XML format.

- Verify supplierTax identification number, operating status, risk indicators (inactive, absconding, under warning).

This helps businesses. Avoid the risk of receiving illegal invoices from the start., which is the reason why fees are disallowed even when there is a real transaction.

2. Prevent business errors through data verification (Substance check)

One of the most common sources of invoice errors is The invoice does not match the actual transaction.Bizzi helps control this point through:

- Real-time 3-way reconciliation of Invoice – Purchase Order – Retail Price..

- Identifying common discrepancies:

- Incorrect quantity, incorrect unit price.

- The invoice exists, but there is no delivery/acceptance record.

- Invoices were issued at the wrong time compared to the transaction.

- Incorrect quantity, incorrect unit price.

→ This is a control layer that significantly reduces errors. Medium – High Risk, which makes them vulnerable to scrutiny by tax authorities during inspections.

3. Early warning of invoice errors instead of late detection.

Instead of waiting until the filing deadline or when the tax authorities send a notice, Bizzi helps:

- Early warning system for potentially risky invoices., like:

- Duplicate invoices, incorrect arithmetic logic.

- The date was set unusually.

- The supplier has a history of risks.

- Duplicate invoices, incorrect arithmetic logic.

- Flagging risks by invoice and by supplier helps accountants prioritize checking the right areas.

→ Businesses proactively handle the matter before filing the declaration. Reduce the risk of penalties and increase the tax risk score..

4. Standardize tax filing and explanation services.

Invoice errors are not only due to incorrect preparation, but also... Missing documents during inspection.Bizzi support:

- Electronic invoices must be stored for a minimum of 10 years., full:

- Original invoice.

- Adjustment/Replacement Invoice.

- Related documents (PO, GR, payment).

- Original invoice.

- Quickly search by invoice number, date, supplier, or project.

This helps businesses. Reduce the risk of expense disallowance due to insufficient documentation., even though the invoice was processed correctly.

5. Reduce recurring errors by standardizing processes, eliminating reliance on human error.

Through integration with ERP and accounting softwareBizzi helps:

- Synchronize data and minimize manual data entry – a common cause of errors.

- Create an audit trail for the entire invoice lifecycle.

- Help businesses shift from emotional control to data-driven control.

Conclude

Common errors on invoices are a widespread problem but pose significant risks to businesses, ranging from seemingly minor mistakes like incorrect information or timing to serious errors that directly affect tax declarations, deductible expenses, and audit risk. In the context of increasingly stringent electronic invoice management, handling errors manually and passively is no longer suitable.

To mitigate the risk of electronic invoice errors, businesses need to control invoices from the very beginning, standardize the verification, declaration, and storage processes, and shift from late detection to early prevention. This is where automated platforms like Bizzi come into play: automatically uploading and reading invoices, reconciling data, alerting to risks, verifying suppliers, and storing invoices legally for 10 years, while also integrating with accounting and ERP systems to reduce reliance on manual operations.

Effective invoice management is not just about complying with the law, but also a foundation for transparent, secure, and sustainable long-term business operations. Register here to receive personalized advice on solutions tailored specifically for your business: https://bizzi.vn/dang-ky-dung-thu/