IFRS standards IFRS 16 can "transform" EBITDA and liabilities on financial statements, but it is errors in lease terms, discount rates (IBR), component splitting, or remeasurement that actually inflate costs. These errors not only lead to incorrect interest and depreciation calculations but also result in under-disclosure, delayed closing, and increased audit effort. This article helps CFOs pinpoint errors along the data chain: Contract → Invoice → Payment → Close, differentiate between hard cost and soft cost impacts, and build a control playbook to avoid costly but preventable IFRS 16 errors.

3 common mistakes businesses make when implementing IFRS 16

Errors in applying IFRS 16 often don't stem from a "misunderstanding of the standard," but rather from a correct understanding followed by unstructured implementation. Logically, these errors fall into three main categories throughout the lease lifecycle.

- The first mistake lies in the lease contract identification phase, where businesses misidentify the lease definition, overlook embedded leases, or confuse asset leases with service leases.

- The second error arises in the initial measurement, directly related to the lease term, discount rate, and lease payments, which distorts the present value of the lease obligation and the amortization costs.

- The third mistake lies in the post-recognition update phase, where businesses fail to remeasure or improperly handle changes to contract terms, metrics, scope, or value, leading to data distortions that persist over multiple periods.

For CFOs, classifying these three types of errors isn't just academic; it's the foundation for assigning responsibility to the right departments, designing consistent policies, and deciding where to invest in controls. If errors aren't detected early, they accumulate over periods, increasing audit effort, creating covenant risks, and forcing businesses to reactively correct mistakes. The key point to remember is that IFRS 16 errors often originate from input data, not from end-of-period entries.

Once the "mistake" has been identified, the first point to address is lease identification, where Vietnamese businesses make the most mistakes.

How does confusing lease and service lead to a violation of IFRS 16?

The confusion between lease and service is the root cause of the entire IFRS 16 model that follows it becoming meaningless. When a contract contains a identifiable asset and control, but is treated as a service, the business omits both the ROU asset and the lease liability. Conversely, when a service is recorded as a lease, the lease obligation and costs are unnecessarily inflated.

The core issue lies in the failure to correctly identify embedded leases within "service-based" contracts. A lease agreement for office space, warehouse management, fleet operations, or IT infrastructure can potentially contain a lease if the asset is clearly defined and the business has control over its use. When the scope of the contract is misdefined from the outset, all subsequent calculations regarding lease term, discount rate, or lease payments become inaccurate.

The biggest risk of this error is not just inaccurate data, but the omission of lease population, leading to compliance violations and serious problems when auditors require verification of "population completeness." Therefore, CFOs need to establish rules for reviewing contracts at the Legal and Procurement levels, clearly defining checklists for identifying embedded leases by expense group and industry.

After identifying the correct lease agreement, the next most likely source of cost overruns lies in the lease term, which directly determines the size of the debt and the overall cost.

Lease terms are often misjudged due to a lack of "reasonably certain" content.

Discrepancies in lease terms often stem not from a lack of knowledge of the formula, but from inconsistent assessments of the concept of "reasonably certain." IFRS 16 requires the lease term to include an irrevocable period plus the right to extend or terminate if the business has sufficient economic grounds to believe it will exercise or not exercise that right.

In practice, many businesses default to ignoring lease extensions to "reduce debt," or conversely, add up all lease extensions without operational evidence. Both approaches lead to incorrect present value of lease payments, resulting in incorrect interest and depreciation costs over multiple periods. More dangerously, if operating conditions change and the lease term is not reassessed, the error will silently persist until the audit period.

For CFOs, lease terms are the biggest driver of PV and allocation costs, so designing an evidence pack for reasonably certain assessments is essential. This evidence not only serves the audit but also helps internal understanding and consistency in decision-making. When lease terms are handled correctly, the risk of cost overruns often shifts to the discount rate, specifically the International Rent Break (IBR).

How does an incorrect discount rate (IBR) increase costs?

The discount rate is not just a technical number, but a management decision that directly impacts costs over time. When the current value of the lease liability (IBR) is inconsistent across contracts, units, or reporting periods, the present value of the lease liability becomes fragmented, making it difficult to explain the fluctuating interest costs.

Many businesses choose IBR based on intuition, or adjust IBR to achieve short-term presentation goals without clear governance. This not only increases the risk of restatement but also increases audit effort because auditors have to trace back each rate assumption. For CFOs, the issue is not "what is the right IBR," but whether there is a clear rate policy based on currency, tenor, collateral, and portfolio.

Once discount rates are under control, another often overlooked source of error is lease payments and non-lease components, where costs can easily be quietly inflated.

Do not separate non-lease components as PV and expense incorrectly.

By failing to separate lease components from non-lease components, businesses inadvertently include service costs in lease payments, increasing the PV (Performance Value) of lease liabilities and inflating lease costs. This not only distorts financial reporting but also prevents CFOs from analyzing net lease costs versus service operating costs.

The core issue here is the lack of a clear policy on whether or not to separate materiality. IFRS 16 allows for this choice, but requires consistency and a basis. When the policy is unclear, each contract is treated differently, creating significant discrepancies in cost management.

Even when the initial measurements are correct, the most costly errors in practice often lie in the failure to update remeasurements and modifications.

Ignoring remeasurement and modification leads to prolonged errors over several periods.

After the commencement date, IFRS 16 does not end. Any changes to lease payments, indexes, lease terms, or contract scope can trigger remeasurement or lease modification. When a business lacks a workflow to detect these triggers, errors can spread across multiple periods and only become apparent when an audit requires roll-forward explanations.

The risks here aren't just about inaccurate figures, but also about delayed closing, having to redo historical data, and significantly increasing audit costs. For CFOs, the solution isn't about "memorizing the standards," but about designing a "change-to-reassessment" process with clear owner communication.

In reality, remeasurement and lease modification are not ignored because the accountant "doesn't know IFRS 16," but because... The company lacks a mechanism for detecting triggers from operational data..

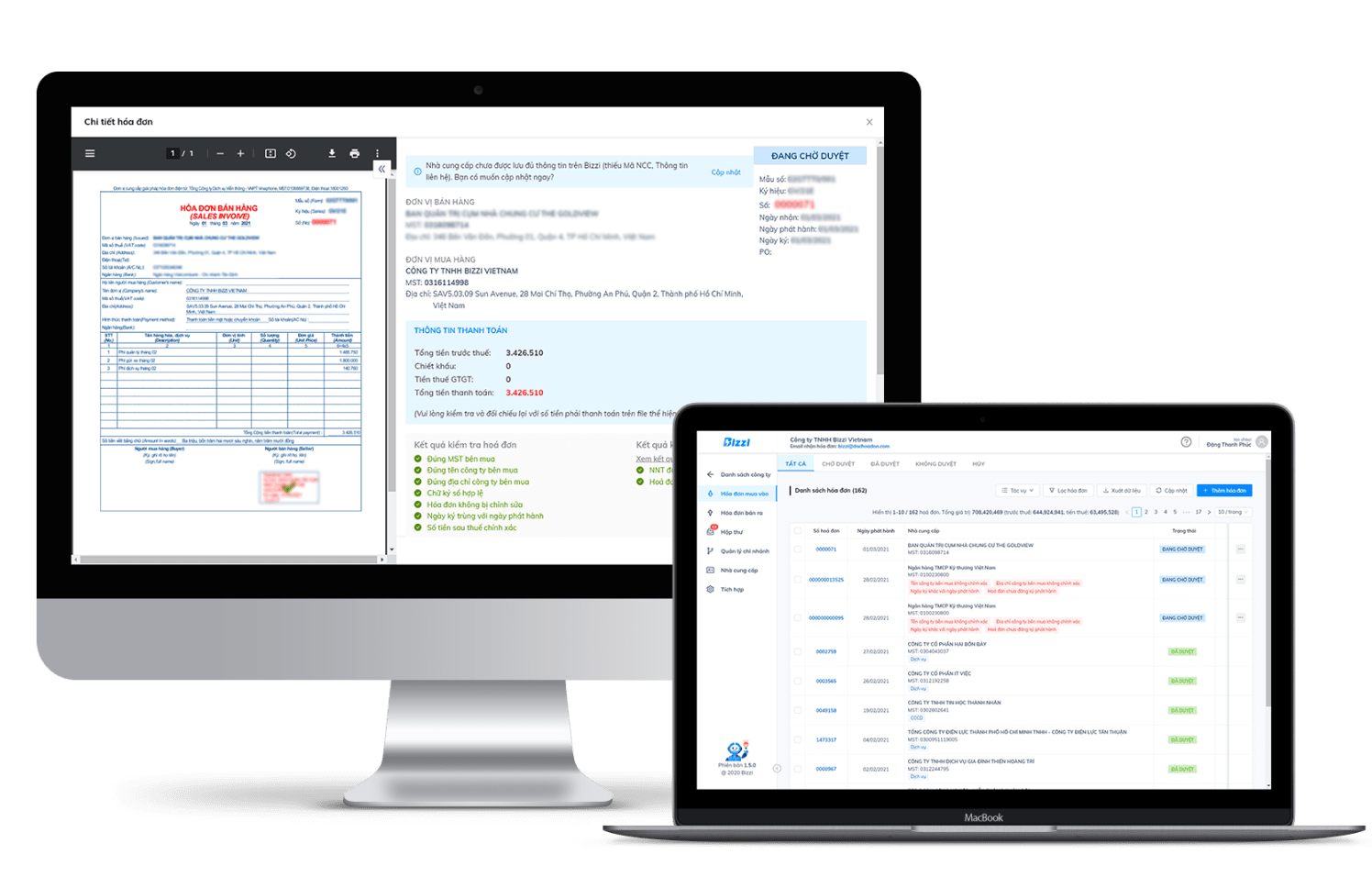

Bizzi assists CFOs at this crucial bottleneck by controlling the flow of expense data:

- Step 1: Bizzi detects change signals from real-world data.

When rental invoices experience fluctuations in price, payment periods, index-based surcharges (CPI, exchange rates), or adjustments outside the standard schedule, Bizzi records the variance immediately at the invoice & approval stage — where the actual changes occur. - Step 2: Attach the operational trigger to the reassessment responsibility.

Change information is linked to the contract/supplier/cost period and forwarded to the correct owner (Finance/Accounting) for assessment on whether to trigger remeasurement or lease modification under IFRS 16, instead of being "lost" in manual processing. - Step 3: Create an audit trail for the "remeasure or not" decision.

Bizzi tracks input data, approvals, and related evidence, helping CFOs demonstrate that the business has processes in place to detect and handle change, even in cases where a decision is not to remeasure.

Bizzi's role here This is not IFRS 16., which is Make sure no triggers are missed.This prevents errors from persisting over multiple periods—the biggest source of operating costs for IFRS 16.

Once core vulnerabilities have been identified, the crucial management question is which vulnerabilities actually increase costs and in what way.

Which two groups of costs are affected by IFRS 16 errors?

From a CFO's perspective, costs resulting from IFRS 16 errors should be divided into two groups. Hard costs are mismeasured expenses such as interest and depreciation due to incorrect lease terms, IBRs, or lease payments, directly impacting profitability and covenants. Soft costs are operating expenses arising from fragmented data and manual processes, leading to slow closing, frequent rework, and increased audit effort.

If a business only amends accounting entries without correcting the input data, soft costs will continue to repeat each period. This is where Bizzi can intervene appropriately by controlling expense data from the outset. When the invoice approval and reconciliation flow is standardized, and vendor data, contracts, expense periods, and payment proofs are fully recorded in the audit trail, CFOs will significantly reduce rework during close and audit, while also gaining a clear view of cost variance by unit and supplier.

While hard costs are often highlighted by CFOs because they are immediately reflected in reports, Soft costs are the real "erosive" factor in the long run. when implementing IFRS 16.

- Step 1: Bizzi controls the soft cost point – input cost data.

Bizzi establishes a workflow for approving and reconciling expense documents (rent invoices, surcharges, adjustments) according to policy, helping to prevent data errors right before they enter the accounting system or IFRS 16 model.

- Step 2: Data standardization & audit trail

Each invoice is tagged with vendor, reference contract, cost center, expense period, and proof of approval, creating a clear data lineage for audits and root cause analysis. incidental expenses.

- Step 3: The CFO can see soft costs using operational indicators.

Instead of simply seeing "auditing as time-consuming," CFOs can measure close cycle time, rework rate, and variance per supplier/unit—the basis for deciding whether to invest in control or automation.

Bizzi helps Transform intangible soft costs into management data., thereby sustainably reducing IFRS 16 costs.

To quickly detect errors in practice, IFRS 16 errors should be viewed in terms of the data series rather than the standard itself.

Which data area do businesses most often use to make mistakes in complying with IFRS 16?

In implementing IFRS 16, Vietnamese businesses often make mistakes in data rather than theory. A lack of contract discovery leads to missed lease portfolios. Incorrect mapping between contracts and invoices results in skewed input data. A lack of proof of payment and debt reconciliation makes roll-forward unreliable. When data lacks clear lineage, errors are repeated and audit costs increase rapidly.

The core issue is the lack of a "single source of truth" for lease portfolios and rental costs. This is why CFOs need to view IFRS 16 as a data and operational problem, not just an accounting one.

The error in IFRS 16 usually lies not in the formula, but in... Data lineage disruption from contract to cash flow..

- Step 1: Bizzi receives and verifies invoice data according to policy.

Bizzi Bot receives invoices, checks for duplicates, incorrect periods, incorrect suppliers, and compares them with the approved contract/PO information. - Step 2: Attach metadata directly at the source.

Contract reference, cost center, expense period, and approval status are integrated directly into the workflow, instead of being manually added at the close. - Step 3: The CFO has a "single source of truth" for the hiring costs.

Clean and lineage expenditure data helps reduce GL-subledger bias, minimize missing disclosures, and limit the need for multiple backtracking audits.

Bizzi plays a role Operational data control layerThis helps ensure that IFRS 16 is not incorrect from the root word.

Lack of contract discovery leads to missed lease portfolios.

When contracts are fragmented among legal, procurement, and operational departments, a lack of contract discovery can lead to missed contracts or addendums. While this error may not immediately be apparent in the P&L, it becomes a critical risk when auditors require verification of population completeness. Therefore, establishing a contract repository, tagging, and version control system is essential.

Invoice discrepancies lead to a surge in "soft costs".

Even with a complete contract, mismatched lease invoices remain the biggest source of soft costs. Incorrect periods, unusual surcharges, or adjustments without evidence force accountants to handle exceptions manually and easily introduce incorrect data into the IFRS 16 model. This is where Bizzi plays its role by automatically checking invoices, establishing policy-based approval workflows, and storing complete audit trails, helping CFOs reduce rework and the risk of data errors.

Lack of debt control makes reconciliation with IFRS 16 difficult.

If accounts payable and payments are not standardized, reconciling lease liabilities with cash flow becomes complicated. Discrepancies between the general ledger, subledger, and bank lead to prolonged closures and numerous questions from the audit. When accounts payable data, payment evidence, and aging data are centrally managed, the CFO can rely on the figures to make decisions.

How do IFRS 16 errors affect CFO KPIs?

Misinterpreting IFRS 16 can create KPI illusions. EBITDA may increase while cash remains unchanged, debt may artificially increase or decrease, and covenants may be misinterpreted. CFOs need to clearly separate accounting impacts from cash flow impacts, building a KPI bridge to communicate effectively with banks and management. When expenditure data is standardized, KPI variance has a clear cause instead of being due to data errors.

One of the biggest challenges for a CFO is KPIs are fluctuating, but it's unclear whether this is due to benchmarking or incorrect data..

- Step 1: Bizzi standardizes expenditure data as input for KPIs.

When rental costs and surcharges are properly categorized at the approval stage, KPI variability no longer stems from data errors. - Step 2: Keep an audit trail for unusual fluctuations.

Each expense change has a rationale, an approver, and supporting documentation, helping the CFO explain variance to the bank or the board of directors. - Step 3: The CFO distinguishes between "accounting illusions" and real operational issues.

Bizzi didn't make EBITDA "look better," but it helped the CFO. We believe that KPI changes are due to business factors, not a failure of IFRS 16..

How does IFRS 16 Control Matrix help prevent costly errors?

IFRS 16's Control Matrix transforms standard knowledge into an operational control system. When risks, control points, owner, and evidence are linked, businesses reduce errors before they escalate to closing and audit. Bizzi supports this by providing workflows for approval, evidence storage, and audit trail management, helping CFOs reduce audit costs and recurring errors.

Control Matrix is only effective when Includes proof of operation.It's not just a document on paper.

- Step 1: Bizzi implements control using workflow.

Control points (expenditure approval, invoice reconciliation, evidence verification) are implemented within the system instead of relying on email or Excel. - Step 2: Automatically create the evidence pack

Bizzi stores the entire approval history, documents, and reconciliation logs, directly supporting audits and internal reviews. - Step 3: CFO reduces audit and periodic rework costs.

When evidence is readily available, audits ask fewer questions, close faster, and the Control Matrix truly becomes a cost-reduction tool.

Early warning checklist to help detect IFRS 16 errors.

An early warning checklist allows for the detection of errors before the audit period, ranging from roll-forward discrepancies, IBR dispersion, unsubstantiated lease term fluctuations, to mismatched invoices and missing disclosures. When warning thresholds and owners are clearly defined, the cost of early detection is always lower than the cost of late correction. Bizzi makes this checklist feasible by automatically flagging anomalies at the source.

A checklist is only valid when activated by real data, not through a manual end-of-period review.

- Step 1: Bizzi Bot detects anomalies as soon as they occur.

Invoices that are duplicates, from the wrong period, missing required fields, or have incorrect supplier information will be automatically flagged. - Step 2: Push the alert to the correct owner.

The warning doesn't stop at simply "knowing it's wrong," but is linked to the person responsible for handling it according to the IFRS 16 checklist. - Step 3: The CFO reduces errors at the source, not at the end of the period.

Checklists become a daily operational tool, helping to reduce rework, avoid restatement, and shorten the close cycle.

Frequently Asked Questions about Common Mistakes When Applying IFRS 16

Below is a detailed explanation of the relevant issues to help businesses avoid costly mistakes in IFRS 16.

Does a violation of IFRS 16 actually increase costs, or does it just change the presentation?

The short answer is: have bothHowever, CFOs need to make a very clear distinction. What are the differences between "presentation" errors and errors that create actual costs?.

- Some errors only affect the presentation, for example:

- Incorrect classification of the line presented in the explanation.

- The mapping between lease expense and depreciation/interest is not accurate.

These errors mainly cause audit comment, with minimal impact on P&L.

- However, the errors are related to:

- Incorrect lease term

- Wrong discount rate (IBR or implicit rate)

- Skip remeasurement or lease modification

This will do Differences in depreciation and interest expense over multiple periods., that is actual cost increaseThis includes not only the paperwork but also operational efforts (rework, audit adjustment, restoration).

Bizzi helps reduce real costs by Control input data (invoice – payment – contract)This helps to limit systemic IFRS 16 errors right from the source.

When is lease liability remeasured under IFRS 16?

According to IFRS 16, a business must remeasure lease liability when:

- Lease payments change (due to CPI, exchange rates, index-linked payments)

- There is a reassessment lease term.

- Lease modification is not considered a separate lease agreement.

The real problem doesn't lie in the standards, but rather in this:

Businesses often fail to detect the "trigger" at the right time..

Without a tracking workflow:

- Rent changes are hidden in the invoice.

- The contract adjustments were not promptly addressed by Finance.

Remeasurement was missed and inaccurate for an extended period.

Should I always use IBR for all lease agreements?

No. IFRS 16 clearly states:

- If interest rate implicit in the lease determined → prioritize use

- Use only Incremental Borrowing Rate (IBR) when implicit rate not readily determinable

Common mistakes include:

- Use a "company-standard" IBR for all contracts.

- No stratification by maturity, asset type, or market conditions.

This does:

- Lease liability is either inflated or reduced.

- Miscalculated interest expenses directly impact financial KPIs.

Bizzi did not identify IBR, but helped Standardize lease contract data.This creates a consistent data base so that Finance can apply discount rates logically and have evidence to support its claims when auditors inquire.

Why is Excel prone to causing errors in IFRS 16 when leasing a large portfolio?

Excel isn't "wrong," but Not designed for large-scale IFRS 16 administration.:

- Formula errors are common when copying multiple periods.

- There is no clear version control.

- It is impossible to trace who changed the data, when, or why.

As the number of contracts increases:

- Small mistakes become systemic errors.

- Audit and rework costs have increased sharply.

Bizzi helps Ensure the stability of input data before importing it into Excel or the IFRS 16 system.This reduces the risk of errors spreading from the source, instead of letting Excel bear the responsibility of controlling them.

Is it mandatory to separate non-lease components?

In principle, Have - to:

- Calculate PV accurately.

- Allocate costs according to the nature of leasing versus services.

However, from the CFO's perspective:

- Businesses can design policy according to materiality

- As long as consistent, well-founded, and evidence-based.

Common mistakes include:

- Neither separate nor with a clear policy.

- The judgment could not be proven when questioned by the auditor.

Which disclosure errors under IFRS 16 most commonly occur?

The three groups most likely to be deficient:

- Maturity analysis of lease liabilities

- Explaining important judgments (lease term, discount rate)

- Reconciliation logic between opening – movement – closing

This is why auditors often ask persistent questions, even when the data seems correct at first glance.

Will IFRS 16 "beautify" EBITDA? What should CFOs be wary of?

EBITDA may increase, because:

- Rental expense is replaced by depreciation + interest.

But CFOs need to be wary:

- Cash outflow remains unchanged.

- Leverage and covenants could deteriorate.

- Decisions based on "good" EBITDA can lead to strategic misjudgment.

Which errors cause the biggest cost increases in the implementation of IFRS 16?

The reality shows that:

- Remove trigger remeasurement/modification

- Unclear billing and payment data.

These are the two reasons why:

- Slow closing

- Rework increases

- The seafood effort has exploded.

This is actual operating costsAlthough not included in the financial statements, the CFO sensed it very well.

How can we reduce the cost of errors without turning IFRS 16 into a massive IT project?

An effective approach for a CFO is:

- Build Control Matrix IFRS 16 based on risk

- Standardization minimum dataset (contract – invoice – payment)

- Establish input control workflow

- Only automate when the ROI is clear.

Conclusion: Avoiding IFRS 16 errors is not only about compliance, but also about cost control.

Overall, common errors when applying IFRS 16 rarely stem from businesses "not understanding the standard," but mainly from fragmented input data, lack of control, and failure to detect operational changes in a timely manner.

Practical implementation has shown that:

- Which IFRS 16 errors increase costs? It's usually not in the presentation, but in the fact that... wrong lease term, wrong discount rate, ignoring remeasurement and lease modificationThis resulted in depreciation and interest expenses being incorrectly recorded over multiple periods.

- What mistakes do businesses often make when implementing IFRS 16? This involves treating IFRS 16 as a purely accounting problem, while the greatest risk arises from... invoices, payments, lease agreements, and small but recurring changes..

- When these errors persist, How do IFRS 16 errors affect finances? This is reflected not only in the numbers on the financial statements, but also in Increased operating costs, extended closing times, explosive audit efforts, and the risk of losing control of CFO KPIs..

So, How to avoid costly mistakes in IFRS 16 It doesn't necessarily have to start with a complex technology project, but rather requires:

- Clearly identify the cost-related risk points under IFRS 16.

- Standardize rental data and expense streams right from the source.

- Establish a mechanism for early detection of remeasurement and modification triggers.

- There is a clear audit trail to protect the CFO's judgment.

In that painting, Bizzi act as a Data and workflow control layer before ERP and IFRS 16 systems, help businesses:

- Reducing IFRS 16 errors is a systematic approach.

- Prevent costs from silently increasing over multiple periods.

- Transform IFRS 16 from a compliance burden into an integral part of effective cost management.

For CFOs, effective IFRS 16 implementation is not about "doing it right," but about... How to avoid paying the long-term price in terms of cost, time, and financial risk? —and that's the problem Bizzi is helping to solve right from the root.

Register for a one-on-one consultation and experience Bizzi's solutions here: https://bizzi.vn/dang-ky-dung-thu/