In the context of Vietnamese enterprises increasing digital transformation, the implementation of e-invoices has become a mandatory requirement according to Decree 70/2025 and Circular 32/2022. However, Cost of implementing electronic invoices, include electronic invoice registration fee, is a significant concern for business owners and accountants. This article analyzes in depth the factors that affect costs – from service packages, system integration, to storage requirements, technology – and recommends optimal solution help save money while still ensuring efficiency and legal compliance.

1. Overview of electronic invoices and related regulations

Electronic bill increasingly becoming a mandatory standard for businesses in accounting and financial activities. Understanding the types of bill, legal regulations and implementation requirements help businesses be proactive in cost management, especially the cost of implementing electronic invoices.

1.1. What is an electronic invoice?

An electronic invoice (E-invoice) is a collection of electronic data messages recording information about the sale of goods and provision of services, which is created, created, sent, received and stored electronically. According to Circular 78/2021/TT-BTC, an E-invoice has the same legal value as a paper invoice if it meets the requirements for format, storage, digital signature and connection with the tax authority.

1.2. Common types of electronic invoices

Currently, businesses can apply the following types of electronic invoices:

- Regular electronic invoice: Include VAT invoice (applicable to businesses declaring using the deduction method) and sales invoices (applicable to businesses declaring using the direct method).

- Electronic invoice generated from cash register (E-invoice generated from cash register): Applicable to retail units, direct consumer services such as supermarkets, restaurants, hotels.

- Other electronic documents: Including e-PIT (personal income tax deduction certificate), electronic tickets, electronic receipts, etc. are also considered invoices depending on the purpose of use.

1.3. Regulations on mandatory use of electronic invoices

The use of electronic invoices has been implemented according to a specific roadmap since 2018 and is increasingly expanding the scope of mandate:

- From 01/11/2018: Newly established businesses and businesses that run out of paper invoices are forced to switch to electronic invoices.

- Since 2019: Big cities like Hanoi and Ho Chi Minh City have completed the implementation of e-invoices.

- From 11/01/2020: 100% enterprises, economic organizations, business households/individuals are required to use electronic invoices according to regulations.

- From 01/06/2025: Some industries such as retail, food and beverage, hotels, passenger transport... will Mandatory application of electronic invoices generated from cash registers and directly connected to the tax authority system. Notably, this type of invoice No digital signature required, helping businesses save costs on initial electronic invoice implementation.

In addition, expenses using electronic invoices from cash registers are still considered valid when determining tax obligations if they fully meet the conditions regarding invoices and documents.

2. Elements that make up the cost of implementing electronic invoices

The cost of implementing e-invoices does not only include the initial fee but also has many other components, depending on the needs of the business and the scale of operations. Understanding each factor helps businesses choose the right solution, optimize the budget while still ensuring compliance with legal regulations.

- Initial setup/initiation fee

This is a one-time cost incurred when a business registers to use electronic invoices, including account declaration fees, storage resource allocation fees, and system setup fees. For example, Viettel currently charges an initialization fee of VND500,000/MST for electronic invoices generated from cash registers. Some providers also include a 10-year storage fee in this fee.

- Cost by invoice quantity

Enterprises will choose an electronic invoice package based on their actual usage needs, usually at levels such as 300, 500 or 1,000 invoices. For example, a package of 1,000 invoices from Viettel's cash register costs 506,000 VND including VAT. According to the General Department of Taxation, electronic invoices generated from cash registers have a significantly lower unit price - only a few dozen VND per invoice, while invoices with or without codes usually range from 100-200 VND/invoice.

- Digital signature cost (if any)

For regular electronic invoices, a digital signature is required. However, invoices from cash registers do not require this element. Some units provide a complete solution – for example, Viettel offers 6 months of free HSM digital signature or an additional 12 months if registered in combination with the electronic invoice service.

- Invoice design cost

Many businesses need to personalize invoices with their own brand identity, logo, or layout. Some suppliers support free templates or custom design services. Bizzi is one of the units that allows customers to design their own invoice templates with their own brand.

- Cost of storing invoices

According to the regulations of the Ministry of Finance, e-invoices must be stored for a minimum of 10 years. Storage fees are usually included in the initial setup fee. Providers such as Bizzi, Viettel and EFY Vietnam all have a policy of free storage during the specified period.

- Software integration costs

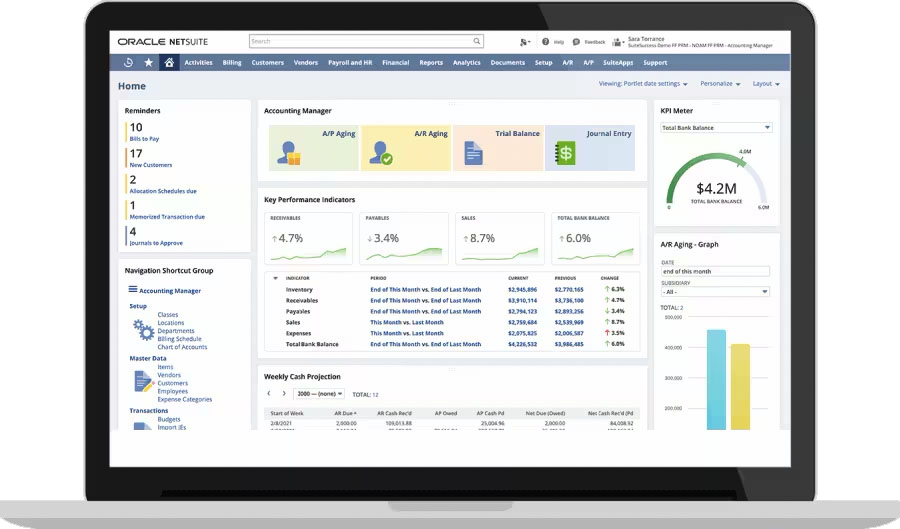

Integrating e-invoicing into your existing accounting, sales or ERP software system increases automation and reduces errors. Most vendors support businesses in integrating their systems without incurring additional costs for purchasing new equipment – all you need to do is install and configure the software.

3. Costs when using Bizzi electronic invoice (B-invoice) note specific costs

Bizzi provides solutions B-invoice electronic invoice With comprehensive features and optimal costs, it helps businesses easily deploy without worrying about financial burdens or technical barriers. The system is designed as an AI assistant to support the finance and accounting department to automate the revenue and expenditure process, increase efficiency and reduce errors.

The cost of implementing electronic invoices at Bizzi is built on the principle of transparency, without additional hidden costs, including:

- Cost of registration to use electronic invoice software: Bizzi does not charge any initial setup fees or complex implementation costs. Businesses simply subscribe to a service package based on their needs – from small businesses to large corporations.

- Cost by number of invoices issued: Flexible service packages according to each invoice quantity level (for example: 500 - 1,000 - 5,000 invoices...), helping businesses easily plan and control their budget.

- Integration costs (if any): In case the business wants to integrate e-invoices into accounting software or ERP system, Bizzi can provide API connection service. Integration fee will be quoted separately depending on the complexity, however, this is a one-time investment, not repeated.

- No additional charge when invoice from cash register: This is a highlight that helps businesses save operating costs. Invoices generated from cash registers are not only valid according to regulations but also no additional costs, different from many other suppliers.

In addition to competitive costs, B-invoice also integrates many value-added features such as:

- Issue invoices in standard formats (XML, PDF) and authenticate directly with the tax authority system.

- Customize invoice templates with your own brand (logo, colors, formats…).

- Generate bulk invoices with just a few clicks.

- Manage invoice status: issued, sent, paid, canceled or adjusted.

- Store invoices properly for a minimum of 10 years.

- Easy to download and print, with built-in valid digital signature.

- Quickly look up invoices by number, issue date, customer or tax code.

In summary, the cost of implementing electronic invoices at Bizzi is designed to suit the needs of each business, helping to optimize the budget, save processing time and increase management efficiency.

To receive an accurate and competitive quote, register for a consultation now at: https://bizzi.vn/dang-ky-dung-thu/

4. Benefits and effectiveness of implementing electronic invoices

Implementing e-invoices is not only a legal compliance requirement but also brings many practical values to businesses. In particular, with solutions from Bizzi, businesses can reduce Cost of implementing electronic invoices, while enhancing management and operational efficiency.

4.1. Save cost and time

Electronic invoices help businesses cut down on a series of fixed and incidental costs such as printing, paperwork, shipping invoices to customers or costs of storing and preserving paper invoices. In addition, invoice processing time is also significantly shortened thanks to the fully automated issuance, sending and storage process. Businesses do not need to invest in additional personnel or manual invoice writing costs, thereby optimizing overall operating costs.

4.2. Strengthen revenue management and transparency

The electronic invoice system helps tax authorities easily track and control business revenue in real time. For businesses, this creates a transparent business environment, enhances brand reputation and prevents risks related to errors or fraud in revenue declaration.

4.3. Compliance with legal regulations

Using electronic invoices ensures that businesses always comply with current regulations such as:

- Decree 123/2020/ND-CP about invoices, documents

- Circular 78/2021/TT-BTC Guide to implementing electronic invoices.

- Decree 70/2025/ND-CP and Circular 32/2025/TT-BTC Update details on the use of electronic invoices according to the new roadmap.

Full compliance helps businesses avoid tax penalties and creates a solid legal foundation for business operations.

4.4. Improve the efficiency of accounting and business administration

Electronic invoices allow for the automation of the process of recording, storing and reconciling documents, thereby minimizing errors and manual work. Accountants can easily create reports on invoice usage, summarize revenue, track input and output invoices and report by tax rate. In particular, Bizzi provides AI assistant and comprehensive cost control system, supporting optimal revenue and expenditure processes and transparent and accurate financial management.

4.5. Reduce the risk of lost or misplaced invoices

All electronic invoices are stored on a digital platform with high security encryption, ensuring safety and preventing loss compared to traditional paper invoices. Users can retrieve invoices at any time with just a few simple steps, effectively supporting reconciliation, auditing and explanation when necessary.

5. Advice when choosing an electronic invoice provider

Choosing the right e-invoice provider not only helps businesses comply with legal regulations but also optimizes accounting processes and saves costs in the long term. Here are some important tips to help businesses make the right decision:

5.1. Assessing business needs

Before choosing a supplier, businesses need to clearly identify their needs to avoid waste or shortage:

- Number of invoices to be issued monthly/yearly to choose the right service package.

- Business type: retail, trade, manufacturing or services – each sector has its own requirements for invoice issuance process.

- Software integration requirements: If the business is using accounting software or ERP, it should prioritize solutions that can connect to API to synchronize data, avoiding manual data entry that causes errors.

5.2. Compare features and costs of providers

To optimize the cost of implementing electronic invoices, businesses should create a comparison table between suppliers on the following factors:

- Initial electronic invoice registration fee: Some units offer free installation, while others charge a setup fee or initial consultation fee.

- Packages by invoice quantity: flexible according to needs (eg 500, 1,000 or 5,000 invoices/year).

- Digital signature and storage costs: Many suppliers integrate or separate digital signatures, so check clearly about invoice storage policy according to regulations (minimum 10 years).

- Additional Features: manage input invoices, automatically look up invoices, summary reports, batch invoice issuance, customize templates according to brand...

5.3. Prioritize suppliers with experience, reputation and good support

Choosing a unit with extensive experience will help businesses feel secure about legal and technological:

- Supplier Priority Certified to connect to the General Department of Taxation system and implementation experience for many industries.

- Make sure to have Professional technical support team, ready to support 24/7, quickly handle problems arising during the invoice issuance process.

- Have good security system, ensuring data security and compliance with international security standards.

5.4. Take advantage of promotions and trials

Some e-invoicing providers like Bizzi now offer free trial package and Special offer for early registrationBusinesses should take advantage of this opportunity to:

- Experience the real features before making a final decision.

- Assess the level of compliance with internal procedures.

- Optimize initial deployment costs, especially for new businesses or businesses undergoing digital transformation.

In short, to optimize Cost of implementing electronic invoices, businesses need to carefully consider their usage needs, system features and support capabilities from the supplier. A right choice will bring long-term operational efficiency, reduce risks and improve internal financial and accounting capacity.