The Government assigned the Ministry of Finance to propose to the National Assembly to continue reducing VAT 2% in the first 6 months of 2024 and submit to the National Assembly Standing Committee for consideration and decision during the period between two National Assembly sessions if the economic situation and business is still difficult.

Proposal to continue reducing VAT 2%

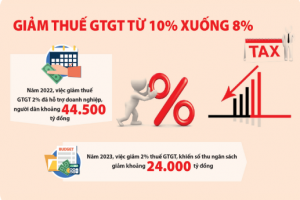

According to Decree No. 44 of the Government, the VAT reduction 2% will end on December 31, 2023.

In the Resolution of the regular Government meeting in September 2023 and the Government's online conference with localities, the Government assigned the Ministry of Finance to continue to effectively implement policies on exemption, reduction, extension of taxes, fees, fees and land rent have been issued. For policies effective at the end of 2023, the Government requires proactive research, review, consideration, and timely proposal and reporting to competent authorities for extension in case of necessity to continue solving problems. difficulties for production, business and people's lives.

“Propose to submit to the National Assembly to continue reducing value added tax 2% in the first 6 months of 2024 and assign the National Assembly Standing Committee to consider and decide between the two National Assembly sessions. If the economic and business situation remains difficult, report to the National Assembly at the nearest session and report to the Prime Minister before October 7, 2023,” the Government requested the Ministry of Finance.

Previously, in mid-June 2023, the Government issued Decree No. 44/2023/ND-CP stipulating the VAT reduction policy according to Resolution No. 101/2023/QH15 dated June 24, 2023 of the Government. Congress.

According to Decree No. 44, from July 1, 2023, value added tax of 2% will be reduced for groups of goods and services currently applying the tax rate of 10%, except for the following groups of goods and services:

- Telecommunications, financial activities, banking, securities, insurance, real estate business, metals and fabricated metal products, mining products (excluding coal mining), coke, oil refined mines, chemical products.

- Goods and services are subject to special consumption tax.

- Information technology according to the law on information technology.

- The reduction of value-added tax for each type of goods and services is applied uniformly at all stages of import, production, processing, and commercial business.

will be valid until December 31, 2023. According to the Ministry of Finance, the reduction in VAT 2% in the last 6 months of the year is expected to reduce state budget revenue equivalent to about 24,000 billion VND.

According to CafeF - General electronic information site

>> See more: Proposal to submit to the National Assembly to continue reducing value added tax 2%

Hope the above information will be helpful to you. Bizzi We hope that accountants in businesses will be provided with full information about the latest regulations from the Government and the Ministry of Finance to help them avoid difficulties during their work.

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam