From July 1, 2025, Decree No. 181/2025/ND-CP issued by the Government officially took effect, bringing many important new points in guiding the implementation of the Law on Value Added Tax (VAT). This document is expected to standardize the tax deduction process, increase transparency in payment and facilitate tax management.

I. Overview of Decree 181/2025/ND-CP

- Text type: Decree

- Number: 181/2025/ND-CP

- Date of issue: 2025

- Issuing agency: Government

- Effective Date: 01/07/2025

- Content: Detailed regulations for the implementation of a number of articles of the Law on Value Added Tax

The Decree consists of 4 chapters and 40 articles, applicable to:

- Taxpayers according to Article 3 of the Decree

- Tax Administration

- Other organizations and individuals related to VAT payment and management activities

=> Download Decree 181/2025/ND-CP here

II. Notable new points in Decree 181/2025/ND-CP

1. Purchases of 5 million or more must be paid without cash.

Article 26. Non-cash payment documents:

“Business establishments must have non-cash payment documents for purchased goods and services (including imported goods) of VND 5 million or more, including value added tax. Of which:

Non-cash payment documents are documents proving non-cash payments according to the provisions of Decree No. 52/2024/ND-CP dated May 15, 2024 of the Government on non-cash payments, except for documents in which the buyer deposits cash into the seller's account."

Thus, all transactions from 5 million VND or more must have non-cash payment documents to be deducted from VAT, including transactions within the day with a total of many invoices under 5 million.

2. Special cases accepted for VAT deduction

Pursuant to the provisions of Point b, Clause 2, Article 14 of the Law on Value Added Tax 2024, the conditions for deducting input VAT are as follows:

b) Have non-cash payment documents for purchased goods and services, except for some special cases as prescribed by the Government.

According to Clause 2 of Decree 181/2025/ND-CP, the special cases specified in Point b, Clause 2, Article 14 of the 2025 VAT Law include:

- In case of goods and services purchased by the method of payment offsetting between the value of purchased goods and services and the value of sold goods and services, or borrowing goods (specifically stipulated in the contract), there must be:

- Data reconciliation report

- Confirmation between two parties on the clearing between purchased goods and services and sold goods and services, and borrowing of goods.

- In case of debt offset through a third party, there must be a debt offset record of the three parties as the basis for tax deduction.

- In case of goods and services purchased by debt offset method such as borrowing or lending money; offsetting debt through a third party as specifically stipulated in the contract, there must be:

- Loan contract in written form previously established

- Documents for transferring money from the lender's account to the borrower's account for loans in cash, including cases of offsetting the value of purchased goods and services with the amount of money that the seller supports for the buyer, or asks the buyer to pay on behalf of the seller.

- In case the purchased goods and services are paid for by authorization through a third party that makes non-cash payments (including cases where the seller requires the buyer to make non-cash payments to a third party designated by the seller), the payment by authorization or payment to a third party designated by the seller must be specifically stipulated in the contract in written form and the third party must be an organization or individual operating in accordance with the provisions of law.

- In case goods and services are purchased by paying for them with stocks or bonds, and this payment method is specifically stipulated in the contract, there must be a sales contract in the form of a written document made beforehand.

- In case after making the payment methods specified in points a, b, c and d, Clause 2, Article 26 of Decree 181/2025/ND-CP, the remaining value paid in cash is worth VND 5 million or more, tax deduction is only allowed in cases where there is a non-cash payment document.

- In case purchased goods and services are paid for non-cash into a third party's account opened at the State Treasury to enforce the collection of money and assets held by other organizations and individuals (according to the Decision of a competent state agency), the input VAT shall be deducted corresponding to the amount transferred into the third party's account opened at the State Treasury.

- For goods and services purchased on deferred payment or installment payment with a value of VND 5 million or more, business establishments shall base on written contracts for purchasing goods and services, VAT invoices and non-cash payment documents for goods and services purchased on deferred payment or installment payment to deduct input VAT.

- In case there is no non-cash payment document because the payment time according to the contract or contract appendix has not yet arrived, the business establishment is still allowed to deduct input VAT.

- In case at the time of payment according to the contract or contract appendix, the business establishment does not have non-cash payment documents, the business establishment must declare and adjust the deductible input VAT amount for the value of goods and services without non-cash payment documents in the tax period in which the payment obligation arises according to the contract or contract appendix.

- In case the value of imported goods and services each time is less than 5 million VND, goods and services purchased each time according to invoices are less than 5 million VND at prices including VAT, and in case the business establishment imports goods as gifts, presents, samples without payment from organizations and individuals abroad, there is no need for non-cash payment documents for purchased goods and services.

- In case goods and services purchased for production and business activities of goods and services subject to VAT are authorized to be paid by individuals who are employees of a business establishment in a non-cash manner according to the financial regulations or internal regulations of the business establishment, and then the business establishment pays the employee in a non-cash manner, input VAT is deductible.

However, if payment documents are not available by the due date, the amount of tax deducted must be adjusted down.

3. VAT calculation price is regulated more clearly

Article 5 of Decree 181/2025/ND-CP Specifies the method for determining VAT prices for domestic goods, imported goods, goods exempted/reduced from import tax, including additional factors such as:

- Special consumption tax

- Environmental protection tax

- Additional import tax (if any)

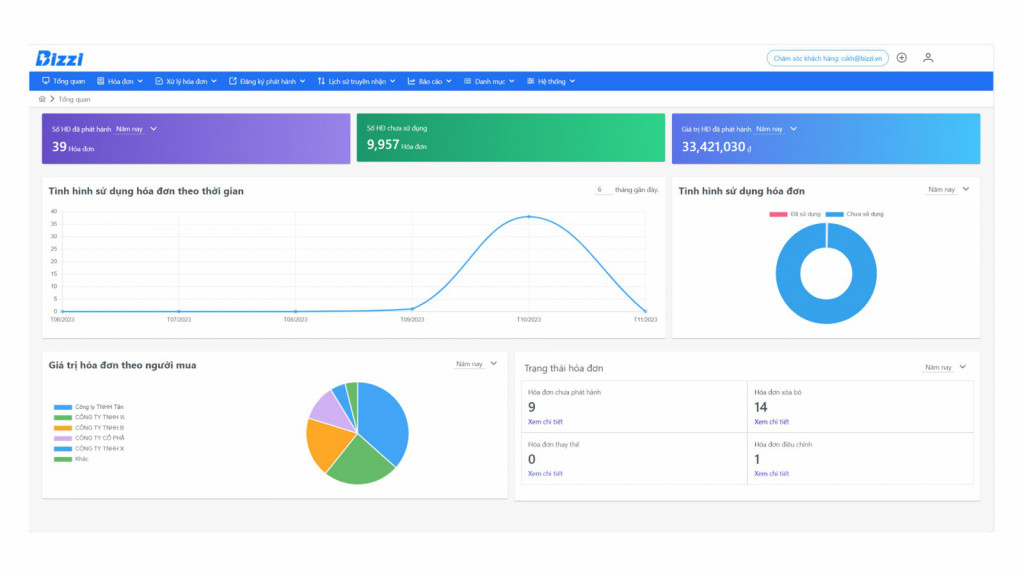

III. Optimize invoice issuance with B-Invoice – Bizzi's electronic invoice solution

Faced with increasingly stringent requirements for documentation and VAT management, businesses need to adopt an electronic invoice system that is both compliant with regulations and easy to integrate and use. That is why B-Invoice – electronic invoice solution of Bizzi – become a reliable choice for modern businesses.

Some outstanding features of B-Invoice:

- Issuing electronic invoices with/without codes from the tax authority: Fully comply with the regulations in Decree 123/2020/ND-CP, Decree 70/2025/ND-CP and the latest Circular 32/2025/TT-BTC.

- Flexible on all devices: Create and issue electronic invoices from your tablet or laptop, anytime, anywhere.

- Automatic integration with accounting, sales, ERP software: Quickly connect to existing systems, saving data entry time and minimizing errors.

- Handle invoice errors right on the platform: Proactively adjust incorrect invoices according to regulations without having to perform many manual steps.

- Track, look up and manage invoices centrally: Helps accountants easily manage and prepare periodic VAT reports.

Sign up for a trial at: https://bizzi.vn/dang-ky-dung-thu

IV. Conclusion

Decree 181/2025/ND-CP not only emphasizes the role of non-cash payment voucher in tax deductions, but also sets clear standards for special cases and VAT calculationTo comply effectively, businesses need to proactively standardize payment processes and apply invoice management technology.

Bizzi's B-Invoice Not only does it help businesses comply with regulations, it is also a tool to improve accounting efficiency, ensure transparency and be ready to face future changes in tax policy.

If you need a download of Decree 181/2025/ND-CP or advice on implementing e-invoice solutions B-Invoice, please contact Bizzi team for specific support.