Complying with the regulations under Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC of the Ministry of Finance, converting electronic invoices to paper invoices is completely legal if. Therefore, mastering the process and principles of converting electronic invoices will help save time as well as ensure the legality of invoices.

Read the article below by Bizzi to better understand how to convert electronic invoices quickly and accurately.

What is a converted electronic invoice?

Is the printing process Electronic invoice on paper for storage purposes, to prove the origin of goods, or to serve internal operations (such as delivering to buyers, accompanying goods during delivery...).

Converting electronic invoices to paper invoices can be used to prove the origin of goods during transportation. At the same time, it also serves the purpose of storing accounting documents in accordance with the law. Therefore, the accounting department in particular and other departments in general need to understand how to convert electronic invoices.

Legal basis and cases requiring conversion to electronic invoices

Below are the legal basis and cases where it is necessary to convert electronic invoices to paper invoices that accountants or businesses need to clearly understand:

Legal basis for converting electronic invoices and electronic documents into paper invoices and documents

- Decree 123/2020/ND-CP issued on October 19, 2020 regulates invoices and documents.

- Circular 78/2021/TT-BTC dated September 17, 2021 guiding the implementation of a number of articles of the Law on Tax Administration dated June 13, 2019 and Decree No. 123/2020/ND-CP.

- Note: Circular No. 32/2011/TT-BTC has expired since November 1, 2020.

When should I convert to electronic invoices?

The conversion of electronic invoices to paper invoices usually occurs when requested by management agencies, to serve tax inspection and audit work, or when customers/partners request it for storage or to serve financial and accounting operations. In addition, conversion may also be necessary when working with units that do not yet use electronic invoices.

| Compulsory conversion | Conversion on demand (not mandatory) |

|

|

Principles and conditions for converting electronic invoices

Below are the principles and conditions for converting electronic invoices to paper invoices clearly stipulated in Circular 78/2021/TT-BTC (Article 10), helping you to do it correctly and avoid legal risks:

Principles when converting electronic invoices to paper invoices

- The content on the converted invoice must be kept intact compared to the original electronic invoice, ensuring correct matching.

- The converted invoice must have a separate symbol for confirmation, specifically the words "INVOICE CONVERTED FROM ELECTRONIC INVOICE" or "DOCUMENT CONVERTED FROM ELECTRONIC DOCUMENT".

- The conversion invoice must have the signature and full name of the person performing the conversion, along with the time of conversion.

- Sellers of goods are only allowed to convert electronic invoices to paper invoices once to prove the origin of goods in circulation.

Conditions for converting electronic invoices

- This function is only available when there is an internet connection.

- The accountant must be authorized to "Convert to paper invoice" on the branch and working book.

- Electronic invoices and electronic documents that need to be converted must be legal invoices and documents.

- Enterprises must meet the conditions prescribed by law and have registered to use electronic invoices according to regulations of the General Department of Taxation.

- Must have an electronic invoice software system with legal certification and meet the technical and security requirements of the tax authority.

- Electronic invoices must be issued via the network system, electronically signed and legally stored for the prescribed period.

- Enterprises must notify tax authorities about the application of electronic invoices and register to use electronic invoices online.

- Enterprises need to comply with regulations related to the issuance, security and storage of electronic invoices to avoid errors or violations of the law.

Instructions for converting electronic invoices to paper invoices

Below is the process of converting electronic invoices to standard paper invoices according to current legal regulations (Circular 78/2021/TT-BTC and Decree 123/2020/ND-CP), applicable to accountants, businesses or individuals who need to print electronic invoices:

Convert each electronic invoice into a paper invoice on B-Invoice electronic invoice software

- Step 1: Log in to the B-Invoice electronic invoice system, go to Bill Management, select the type of invoice to convert Sales invoice/Invoice from cash register

- Step 2: Set up search conditions for electronic invoices that need to be converted to paper invoices

- Step 3: Select bill Released need to convert

- Step 4: On the invoice, select Other, then press Convert to paper invoiceThe program will automatically convert electronic invoices to PDF files.

- Fill in the information The converter by login name, however Accountant can still change if needed.

- Step 5:

- Method 1: Click Convertible printing to print invoice directly now

- Method 2: Click Conversion To download the file in pdf format, open the file on your computer and click print.

Note: The invoice must be signed by the person making the conversion, stating the full name and date of conversion to ensure validity.

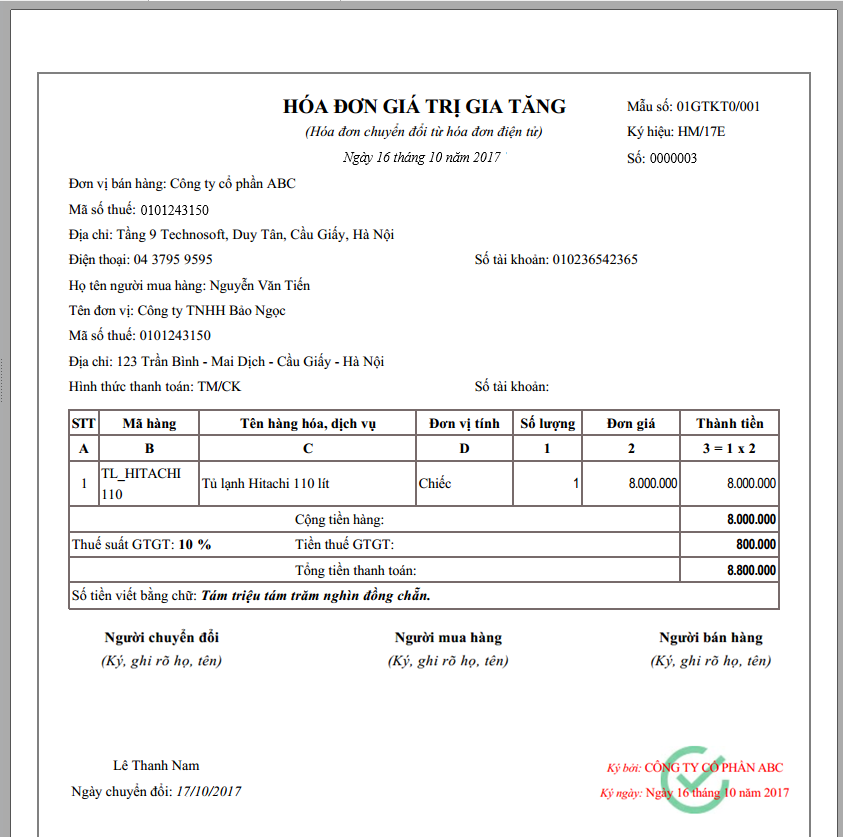

Legality and required content of converted paper invoices

Below is a clear analysis of the legality and mandatory content in converting electronic invoices to paper invoices according to current regulations:

Legal value of paper invoices and convertible paper documents

- Electronic invoices and electronic documents converted into paper invoices and documents are only valid for retention for bookkeeping and monitoring purposes in accordance with the provisions of the law on accounting and the law on electronic transactions.

- The method of converting electronic invoices is not valid for transactions and payments, except in cases where invoices are initiated from cash registers that are connected to electronic data transfer with tax authorities as prescribed.

Content required on paper invoice after conversion

- Sellers need to ensure that the content on the converted paper invoice matches the content on the electronic invoice.

- Basic contents include: Invoice name, invoice symbol, invoice template symbol, invoice number.

- Information of the seller (name, address, tax code) and the buyer (name, address, tax code if any).

- Goods/services details: Name, unit, quantity, unit price, total amount excluding VAT, VAT rate, total VAT amount by tax rate, total VAT amount, total payment amount including VAT.

- Signature of seller, signature of buyer (if any).

- Invoice creation time (calendar day, month, year) and time of digital signature on electronic invoice (if any).

- Tax authority code for electronic invoices with codes.

- Other information such as fees, charges, discounts, promotions (if any).

- The letters, numbers and currency shown on the invoice.

- Sellers can create additional information about logos, sales contracts, shipping orders, customer codes and other information depending on the transaction characteristics.

How is a conversion invoice different from a regular paper invoice?

- Symbol on invoice: If the serial number on a regular paper invoice is VC/15P, then on a converted electronic invoice it is VC/15E.

- Signature on invoice: Paper invoices typically use handwriting, while electronic invoices use digital signatures.

- Invoice copies: A regular paper invoice has copies 2 and 3 and the content on the copies must be identical. An electronic invoice does not have copies.

- Special text: The converted invoice has the text: “INVOICE CONVERTED FROM ELECTRONIC INVOICE”.

- No stamp required: Converting an electronic invoice to a paper invoice does not require the seller's stamp, however the person performing the conversion must sign and clearly state their full name.

Important notes when converting electronic invoices

Below are important notes you need to remember when converting electronic invoices to paper invoices, ensuring compliance with legal regulations and avoiding errors during use:

- Carefully check the invoice content after conversion to ensure it is complete, accurate and matches the original electronic copy.

- Only perform conversion when there is a real business need or as required by law, do not abuse it.

- Ensure compliance with the instructed procedures to avoid causing misunderstandings or affecting business operations, inspections and checks by competent authorities.

- Choose a reputable e-invoice service provider with sufficient capacity and experience to ensure legality and data security.

Solutions to support electronic invoice conversion and effective management

Much electronic invoice software Currently provides support for converting electronic invoices to paper invoices, such as B-invoice

Bizzi's B-invoice Solution is an electronic invoice platform that helps businesses create, export, store and manage invoices according to tax authority standards.

- Feature “Convert to paper invoice” B-invoice allows users to export PDF and print invoices, supporting easy conversion of electronic invoices.

- B-invoice also offers other important features like Create electronic invoices according to prescribed standards (XML/PDF), design Custom invoice templates with your business logo and branding, ability to issue bulk invoices.

- The system also supports tax authority verification code, store invoices according to regulations (minimum 10 years), easily look up invoices, and manage invoice status (issued, sent, paid, canceled or adjusted).

- This solution is also possible API integration with ERP & Accounting systems to synchronize data, making cost and invoice management processes streamlined and automated.

Conclude

Knowing how to convert electronic invoices to paper invoices is not only an accounting skill – but also a tool to protect businesses, ensure smooth operations, comply with the law and maintain prestige in the eyes of customers and partners. B-invoice is an electronic invoice platform developed by Bizzi Vietnam Joint Stock Company, helping businesses:

- Create - issue - store electronic invoices according to the standards of the General Department of Taxation;

- Automatically compare input and output invoices;

- Flexible integration with accounting software, ERP (SAP, MISA, FAST…);

- Enhance the ability to check and prevent invoice counterfeiting, saving time and operating costs.

To fully experience the powerful solution for modern accounting, register for consultation here:

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

Schedule a demo: https://bizzi.vn/dat-lich-demo/