What is a purchase invoice list?

The list of purchase invoices, also known as the “List of purchase service and goods invoices”, is an important document that helps businesses declare purchased goods and services. The main purpose of this list is to record information related to purchased goods and services during the tax period, and is also an important basis for making tax declarations, helping businesses accurately determine the amount of input value added tax (VAT) to be deducted.

Legal regulations related to purchase invoice list:

- Before 01/01/2015: VAT declaration dossier must be accompanied by a list of invoices for purchased goods and services (PL 01-2/GTGT).

- From 01/01/2015 onwards: According to the amended Tax Law No. 71/2014/QH13 that has come into effect, the regulation that enterprises must submit a List of purchases and sales when preparing VAT declaration dossiers has been abolished.

- Why businesses still make statements: Although it is not required to be submitted to the tax authority, businesses still often create a list (usually using Excel) to facilitate the synthesis of declared data into indicators 23, 24, 25 on the 01/GTGT declaration, as a basis for checking and comparing accounting books, and have documents to explain to the tax authority when requested.

Instructions for creating Purchase Invoice List Form 01-2/GTGT

Below are detailed instructions on how to create a Purchase and Sales Invoice List form - Form 01-2/GTGT, used to declare value added tax (VAT) using the deduction method, before switching to electronic invoices and automatic declaration support software such as eTax or HTKK.

Types of invoices that can and cannot be declared

- Invoices and documents are declared on form 01-2/GTGT:

- VAT invoices eligible for deduction (including omitted invoices from previous declaration periods).

- Documents and receipts for VAT payment of goods during import stage.

- Alternative documents for VAT invoices for foreign investors.

- Input VAT invoice.

- Receipt documents related to tax obligations.

- Invoices not declared on form 01-2/GTGT:

- Sales invoice of the business declaring the invoice directly (not required to declare).

- Invoices are not subject to VAT (no need to declare).

- VAT invoices are not eligible for deduction according to regulations.

- VAT invoice but not eligible for deduction.

Details on how to declare each column and item in the purchase invoice list

Based on Form No. 01-2/GTGT, accountants need to fill in the following information:

|

|

|

|

|

|

Special cases when declaring purchase and sale invoice list form:

- Trade discount invoice, adjustment, return: Make a negative declaration in the 01-2/GTGT form by placing a minus sign (-) before the amount in columns (6), (7), (8) and note “Reduced Adjustment Invoice” in column (9).

- Input invoice is a regular sales invoice: This is an invoice that a business purchases from businesses that declare VAT using the direct method. It is not required to declare this invoice on the VAT declaration. If declared, the total amount on that invoice will be declared in Item 23 - Value of purchased goods and services on VAT Declaration Form No. 01/GTGT.

- Input invoice is an invoice not subject to VAT.: No declaration required.

- Input invoice with reduced VAT 8%: Based on the VAT invoice, the business establishment purchasing goods and services declares input VAT deduction according to the reduced tax amount stated on the VAT invoice. Declare in the VAT reduction Appendix “PL 142/2024/QH15 – 174/2024/QH15” and on the Purchase List (to summarize data on indicators 23, 24, 25 on the 01/GTGT declaration).

- Input invoices have multiple tax rates: The data to be declared is taken from the columns on the invoice: The total amount in the column "Value excluding VAT" is entered into indicator 23; The total amount in the column "VAT amount" is entered into indicators 24 and 25 (if deductible).

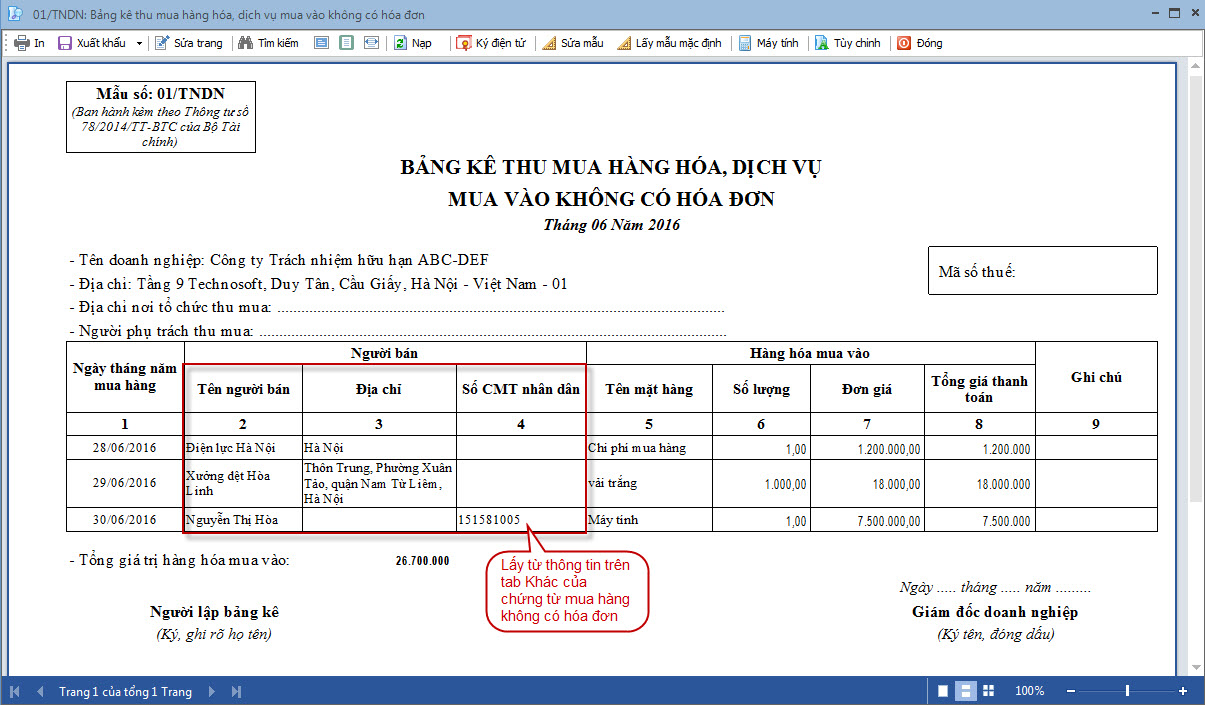

- List of purchased goods and services without invoices (Form 01/TNDN): Currently, this form is specified in Form No. 01/TNDN issued with Circular 78/2014/TT-BTC. Enterprises need to note the actual items purchased from sellers without invoices, make a list in chronological order of purchase, record all indicators and summarize monthly. Purchase documents must clearly state the quantity, value, date of purchase, address, ID number of the seller and signature of both parties.

The role and benefits of the Purchase and Sales Invoice List form

Although the regulation on submitting a list of purchases and sales when preparing VAT declarations has been abolished since 2015, preparing a list still brings many important benefits to businesses:

- Provide data to declare on VAT declaration

The table is a tool to help summarize data to easily fill in indicators 23, 24 and 25 on the 01/GTGT declaration.

- Basis for checking and comparing with accounting books

The schedule provides a document for accountants to systematically check and compare with the figures recorded in the accounting books, ensuring accuracy and consistency.

- Documents to explain to tax authorities when needed

When the tax authority conducts an inspection, the list is an important document for businesses to present and explain the data declared on the VAT declaration.

- Support invoice management and classification

Making a list helps accountants arrange invoices in chronological order and classify them according to their purpose of use (for example: goods and services used for production and business subject to VAT, not subject to VAT), thereby managing invoices more easily and conveniently.

Important invoice template

Download free purchase and sale invoice list template

The purchase invoice list form currently in use is Form No. 01-2/GTGT, issued in the Appendix of Circular No. 119/2014/TT-BTC. Accountants can download this form directly from the Tax Department's website or websites specializing in accounting documents.

Some notes when using the purchase invoice list template:

- Do not submit with the return, but still need to be established in parallel when declaring VAT and storing for tax inspection and examination.

- Can make a list on Excel, or use accounting software (Misa, Fast, ERP...) to automatically export the statement.

- Required Information The form includes: Supplier name, Tax code, Invoice number and date, Excluding tax value, VAT

Free Download here

Purchase invoice list

- The list of purchase invoices is an important document for declaring input goods and services, prepared according to form 01-2/GTGT.

- Download purchase invoice list HERE

Sales invoice list

The sales invoice list is an accounting document summarizing sales and service transactions during the tax period. This document serves as an important legal basis for businesses to perform the following tasks:

- Tax declaration: Perform the obligation to declare output Value Added Tax (VAT) accurately and transparently.

- Financial Management: Synthesize and effectively manage revenue generated during the period.

- Compare and check: Support the process of comparing and checking sales invoices in auditing, tax inspection and internal management.

Download sales invoice form here.

List of purchased goods without invoice

Form No. 01/TNDN is a list form used for cases of purchasing goods and services without invoices, issued with Circular 78/2014/TT-BTC.

Applying technology in managing purchase invoices

To improve efficiency and accuracy in accounting work, especially in processing input invoices and creating purchase and sale invoice lists, many businesses have applied accounting software and automation solutions.

B-invoice: Automation solution for input invoices

Bizzi offers a Comprehensive cost control system and act as a AI assistant for finance and accounting department in automating revenue and expenditure process. The platform integrates more than 30 features to help businesses streamline and automate their cost management, debt collection, and B2B payment processes.

For processing and managing input invoices, Bizzi stands out with its features Processing, reconciling and managing input invoices (IPA + 3way), include:

- Automatically process input invoices:

- Applying RPA (Robotic Process Automation) and AI technology.

- Automatically download invoices from email, tax software, or vendors.

- Extract invoice data and check for validity criteria according to regulations.

- Reduce manual data entry time & errors.

- Automatic invoice reconciliation – PO – GR:

- Reconcile invoices – purchase orders (PO) – warehouse receipts (GR) in real time.

- Detect price, quantity and item code differences as soon as they arise.

- Avoid incorrect payments and invoices that do not match reality.

- Verify valid supplier:

- Check the Tax Code (MST) and operating status of the supplier right on the General Department of Taxation system.

- Reduce the risk of receiving invoices from inactive or invalid businesses.

- Automatically record and store input invoices:

- Store invoices according to regulations for at least 10 years (Accounting data storage standards).

- Quickly search for invoices by date, tax code, invoice number, supplier name...

- Risky Invoice Warning: Detect invoices from suppliers that show signs of risk.

- API Integration with ERP & Accounting Systems: Easily integrated with systems such as SAP, Oracle, Misa, Fast, Bravo…

- Input invoice data is automatically entered: Accounting ledger, VAT Statement, Internal report.

In addition, Bizzi also has other solutions such as Business Expense Management (Bizzi Expense) and Electronic invoice (B-invoice), also contributes to the financial management and invoices efficiently.

Important notes when creating a Purchase and Sales Invoice List form

Creating a purchase and sale invoice list directly affects tax declaration and accounting, therefore, accountants need to pay special attention to the following issues to ensure accuracy and compliance with regulations:

- Ensure complete and accurate declaration of information

All information on the invoice must be declared fully and accurately on the statement.

- Arrange invoices in chronological order and classify them properly

Arranging invoices in chronological order will make it easier to track and check. At the same time, it is necessary to classify invoices according to their purpose of use (for example: goods and services used for production and business subject to VAT, goods and services used for production and business not subject to VAT).

- Double check before submitting/storing

Always review and check the information on the statement carefully before submitting or storing it internally to avoid errors.

- Store original invoices carefully

In addition to making a list, accountants need to carefully store original purchase invoices for checking and comparison when necessary.

Conclude

In short, the Purchase Invoice List plays a key role in the accounting and tax work of enterprises; gathering all input VAT invoices that are eligible for deduction according to legal regulations. To manage intelligently and automate the process, improve the efficiency of the accounting team, enterprises should experience Bizzi's B-invoice solution today. Saving time and optimizing resources is the secret to doubling the business cash flow!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/