In business and financial transactions, debt is one of the most important concepts.Debt confirmation minutes is an official document created to compare, unify and record the debt balance between the parties involved. This is an important legal basis to clearly define payment responsibilities and avoid future disputes.

In this article, let's learn in detail about the requirements and rules for creating a debt confirmation minutes template, and quickly update the latest 2025 minutes templates.

What is a debt confirmation form? Why use a debt confirmation form?

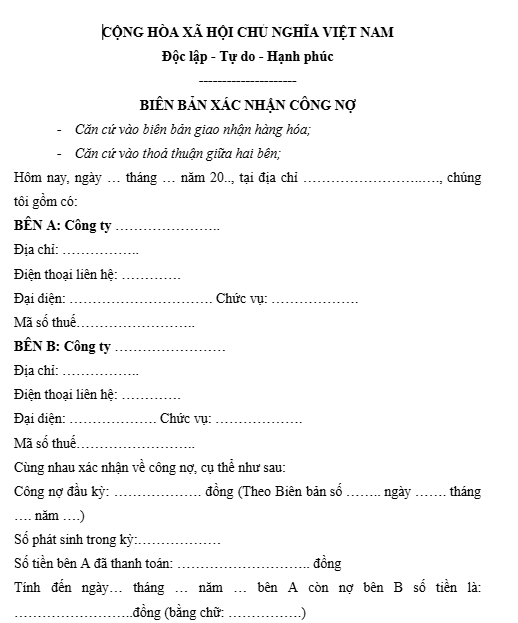

A debt confirmation report is a document made between two parties (buyer and seller, or borrower and lender...) to confirm the amount of debt (or obligation to pay for goods and services) remaining at a certain point in time. Depending on the needs and habits, businesses can use a debt confirmation report template in word file or an excel debt confirmation report template.

Minutes usually include the following contents:

- Legal information of both parties (business name, tax code, representative...)

- Amount of debt payable or receivable

- Time of debt confirmation

- Commitment of the parties on payment obligations

- Signature and confirmation stamp of both parties

The debt confirmation minutes are a legally valid document.

The role of debt confirmation form

Using a debt confirmation document is important in business operations:

- Verify the accuracy of accounting records: Ensure that the debt figures on both parties' accounting systems match. Avoid errors and confusion due to accounting or transactions that have not been updated.

- Legal basis when disputes arise: If there is a dispute over the amount owed, the minutes are legal evidence proving the obligation to pay.

- Serving audit and tax settlement work: Audit and tax agencies often require businesses to provide debt confirmation records when checking the transparency and reasonableness of costs and revenues.

- Helps track, remind and manage debt effectively: It is the basis for the debtor to proactively urge, collect or pay on time.

Download common debt confirmation form

Below are some sample debt confirmation minutes word files that businesses can refer to:

- Sample debt confirmation minutes for businesses Form No. 1. Download now here

- Sample debt confirmation minutes for businesses Form No. 2. Download now here

- Sample debt confirmation form for individuals. Download now here.

When to confirm and make a debt confirmation record

Confirming debts and making a debt confirmation record is usually done periodically or when there is a special request to ensure transparent accounting data, avoiding risks in payment or disputes. Below are common and appropriate times to conduct debt confirmation:

| Time | Characteristic | For example |

| End of accounting period (month, quarter, year) | This is the most common time to confirm debt.

The purpose is to check and compare the accounting books of both parties to close the books, prepare financial statements or settle taxes. |

Before December 31st of each year, businesses often send a letter/debt confirmation to partners to compare the ending balance. |

| When there is a large or long-term debt | For large debts or debts that have been outstanding for many periods, businesses should proactively confirm to avoid the risk of losing control or disputes later. | For example: A debt overdue for more than 3 months needs to be confirmed in writing, with a commitment to a new payment term. |

| At the request of the auditor or tax authority | When independent auditors or tax authorities conduct inspections, they may require businesses to present debt confirmation records with customers and suppliers to clarify figures on financial statements. | |

| When detecting debt discrepancies between the two parties | If there is a difference in the debt balance between the two parties during the reconciliation process, it is necessary to make a record to confirm the correct number to promptly adjust the books. | |

| When changing the contract, terminating cooperation or dissolving the enterprise | Before the two parties stop cooperating, transfer, merge or dissolve, it is necessary to confirm the debt for final settlement. |

Steps to confirm debt

Below are the steps to confirm debts between businesses and partners (suppliers, customers, lenders, etc.), to ensure data matches and avoid accounting and legal risks:

- Step 1: Check and summarize debt data from the accounting system and contact and compare documents with relevant parties. Determine information related to debt (amount, date, form of payment).

- Step 2: Compare collected data with accounting data, identify and resolve discrepancies. Prepare debt confirmation minutes, ensuring information is accurate and complete.

- Step 3: Make a formal debt confirmation record to record the results. The parties confirm the information in the record and sign the confirmation.

- Step 4: Send minutes to relevant parties for review and signature, ensuring agreement. File minutes in accounting records and track confirmed debts.

- Step 5: Report debt situation to management.

- Step 6: Use the minutes to resolve disputes if any.

What content should be included in the debt confirmation form?

A debt confirmation form must be presented clearly and completely to ensure legal value and facilitate comparison and auditing. Below are the required contents in a debt confirmation form:

| Item | Detailed content |

| Introduction | National emblem, motto.

Document name: Debt confirmation minutes. Basis for making minutes (for example: goods delivery minutes, agreement between two parties, etc.). Place of record. Date of record. |

| Content section | Information of related parties (Party A and Party B): Name of unit/individual, Tax code/ID card/CCCD/Passport, address, phone number, representative, position.

Contract code (if any). Confirm debt amount:

Reason for debt. Payment due date. Payment method. Other contents in specific cases. Commitments of the parties (e.g. commitment to pay on time, creating conditions for the debtor to pay). Other agreements (e.g. late interest, penalties for breach of contract). |

| The end | Number of copies of the minutes made (usually 02 copies, each party keeps 01).

Confirm the value of the minutes. Signatures and full names of the parties involved. Seal (for businesses). |

Important notes when making a debt confirmation record

When making a debt confirmation record, businesses need to pay attention to the following points to ensure: accuracy and legality of the text:

- The debt record is an important basis for agreeing on debt, interest rates... and Not is part of a loan document or economic contract appendix.

- Fill in complete and detailed information of the parties (name, address, tax code, ID card/CCCD) to ensure legal value.

- Before making the minutes, the parties need to agree on the payment period, late interest, and how to handle late payment, instead of just confirming the debt amount.

- Individual signature or fingerprint; business representative signs and fully stamps.

- Use clear, precise, easy-to-understand language to avoid confusion and disputes later.

- Ensure transparency by establishing proper procedures and having signatures of confirmation from all parties.

- Keep complete and accurate records for use when needed (especially in the event of a dispute).

How to effectively manage debt in business?

The debt confirmation minutes will help ensure the accuracy and transparency of financial data, protect business interests and maintain good relationships with stakeholders. To improve management efficiency, businesses can consider using additional software or financial solutions.

Using financial management solutions - accounting and invoices such as electronic invoice software helps to control input/output invoices easily, supports checking and warning of invoice risks. These software can summarize receivable/payable debts, automatically offset/offset debts, summarize debts by due date, allow quick viewing of debt status and details of each document, as well as remind and send periodic debt reconciliation emails.

In the market today, Bizzi is one of the leading financial invoice processing automation platforms, helping businesses speed up accounting - optimize debt management. Bizzi provides debt control tools, including tracking important indicators (such as Days Sales Outstanding - DSO, debt aging reports) to help manage debt closely.

Synchronize input and output invoices

- Bizzi automatically reads, checks and stores electronic invoices from suppliers or sales software.

- This helps ensure that input data always matches actual debt generation.

- Minimize errors, avoid mis-entering, missing invoices and accurately reflect debts.

Automatic real-time debt reconciliation

- Bizzi's feature allows for transaction - invoice - payment reconciliation, helping accountants track detailed debts for each supplier and customer.

- Reduce manual reconciliation time, easily export data to create confirmation minutes.

Reminders and warnings of due debts

- Bizzi can integrate or synchronize with ERP/Accounting software to send warnings of upcoming or overdue debts.

- Help the finance department proactively collect or pay debts on time → avoid penalty interest and loss of reputation.

Create automatic debt confirmation minutes

- Based on synchronized data, accountants can quickly extract sample debt confirmation minutes from the system (pre-filled with transaction information, amount, partner, etc.).

- Save time, avoid errors in the copying and comparison process.

Fast storage, search and retrieval

- Bizzi supports standardized electronic document storage, easy to search by supplier name, invoice code, document date.

- Easily retrieve debt confirmation records for auditing and tax settlement.

Conclude

Tight debt management is a way to help businesses minimize financial risks. Note that when creating a debt confirmation form in a word file or an excel debt confirmation form, it is necessary to have legal representatives of both parties sign and stamp. The content of the debt confirmation form must clearly show the debt amount, the time of debt closing, and the remaining payment period.

Bizzi is an automated debt management platform for businesses, providing automated debt management solutions with smart reminder processes. If your business wants to automate payment processes, shorten debt collection time and optimize cash flow, sign up for a Bizzi product trial today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/