In the process of issuing and using electronic invoices, errors are inevitable. When errors are detected, the preparation electronic invoice adjustment minutes is an important step to ensure the accuracy and legality of accounting documents. This article will provide a detailed guide on cases where adjustment minutes are required, common minutes templates, the preparation process, and answers to frequently asked questions related to electronic invoice adjustment minutes.

Cases and sample minutes of electronic invoice adjustment

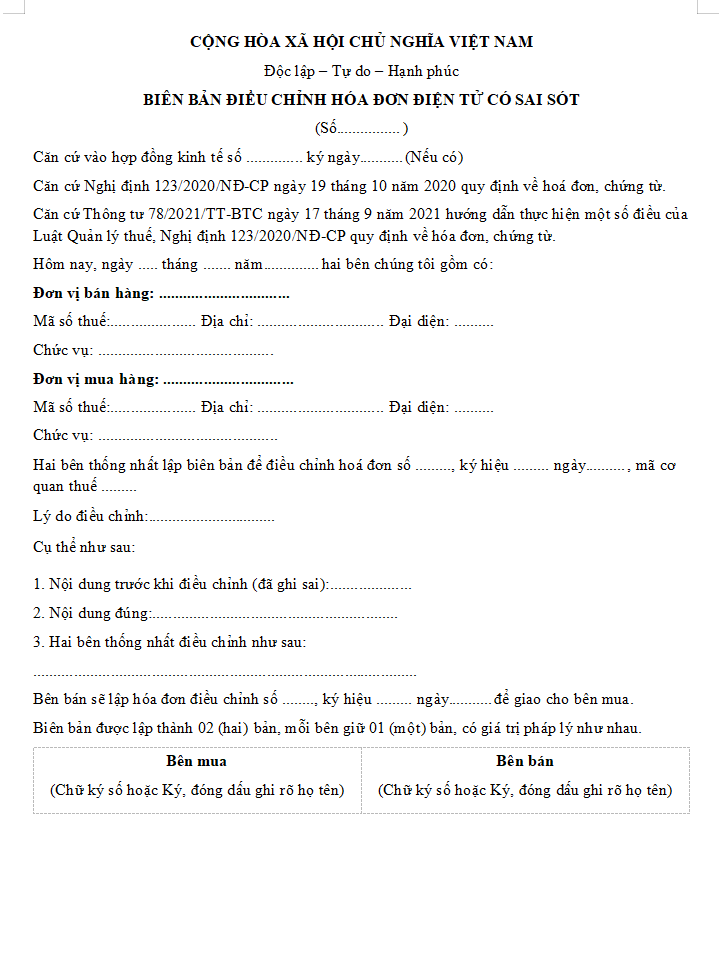

Minutes of electronic invoice adjustment is made when errors in information on issued invoices are discovered. Below are common cases and corresponding adjustment minutes:

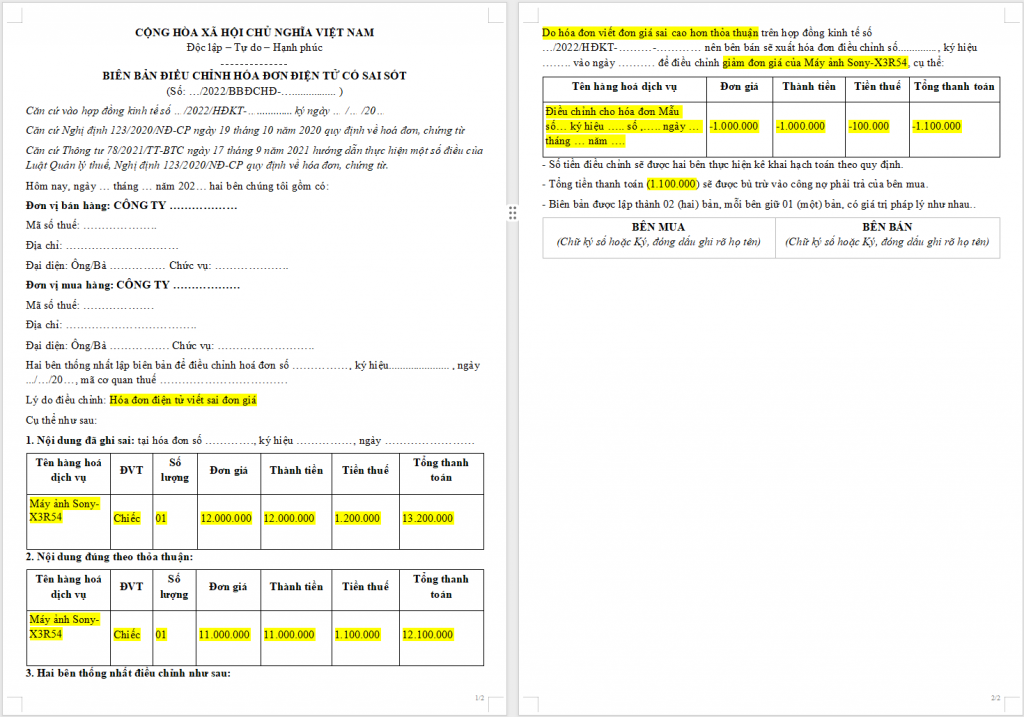

Sample of adjustment report due to incorrect unit price

An electronic invoice has been created and sent to the buyer, but an error was found in the unit price column of one or more items/services. This error leads to incorrect calculation of the total amount of each item and the total payment amount of the invoice.

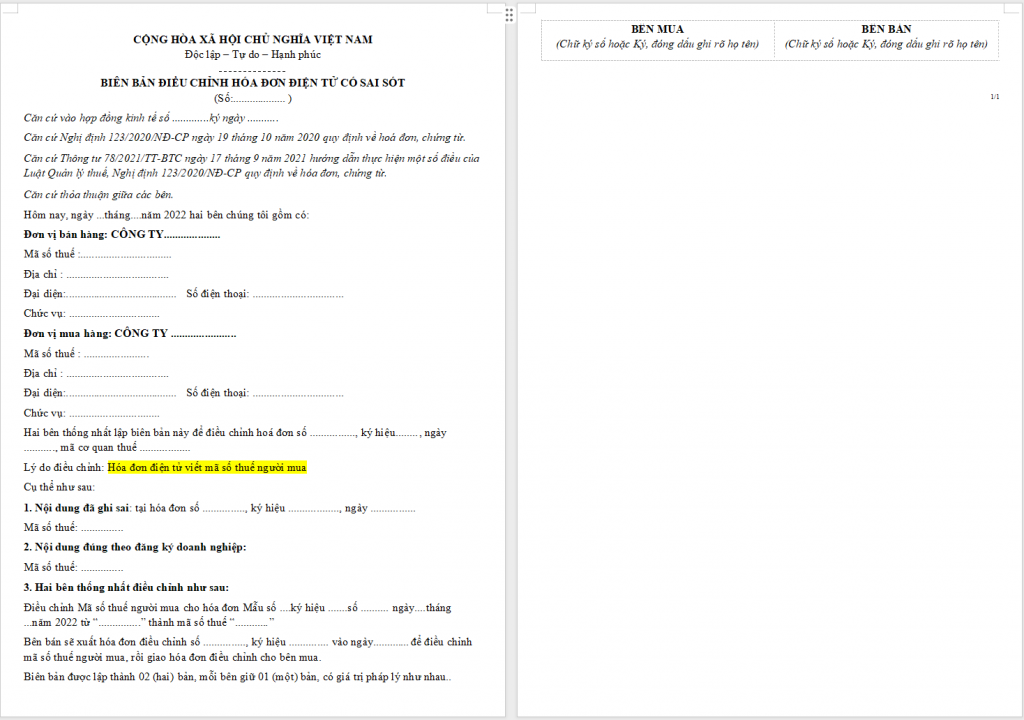

Sample of adjustment report due to incorrect tax code

The electronic invoice has been created and sent to the buyer, but an error was found in the tax code of the buyer or seller. This is a serious error, affecting the legality of the invoice and tax declaration.

Sample invoice adjustment form with incorrect company name

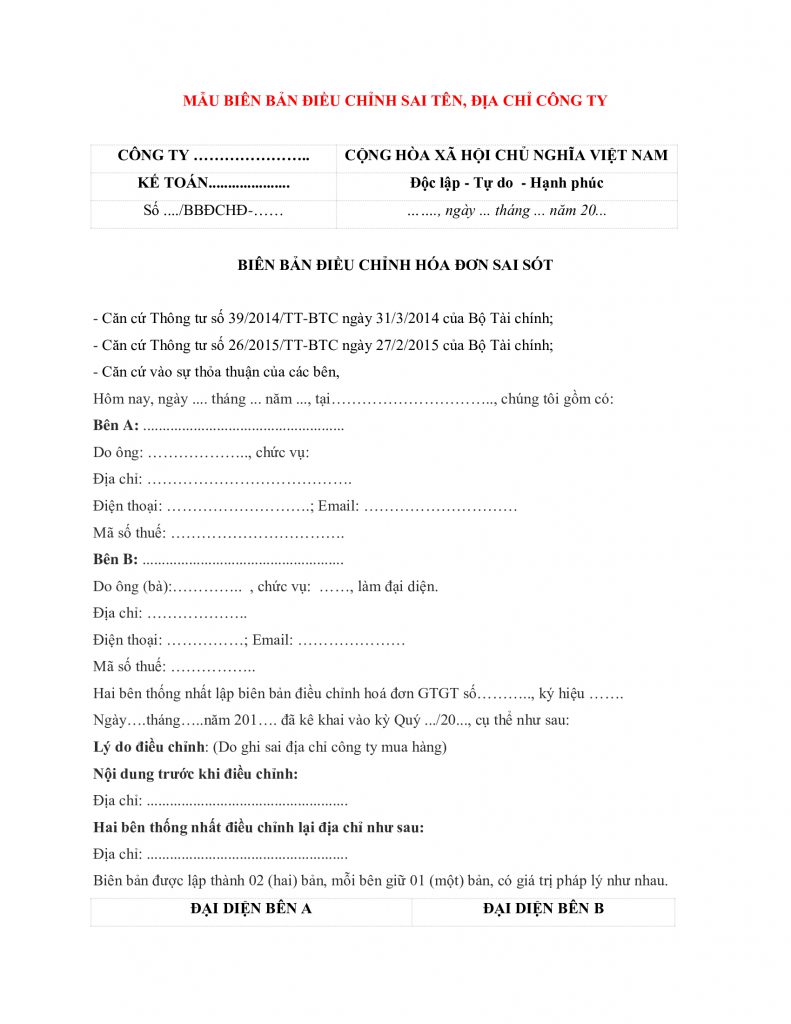

An electronic invoice has been created and sent to the buyer, but an error is found in the buyer or seller's company name. An incorrect company name can cause difficulties in identifying the transaction subject and related procedures.

Sample invoice adjustment form for incorrect address

An electronic invoice has been created and sent to the buyer, but an error has been found in the buyer or seller's address. An incorrect address can affect communication and other legal issues.

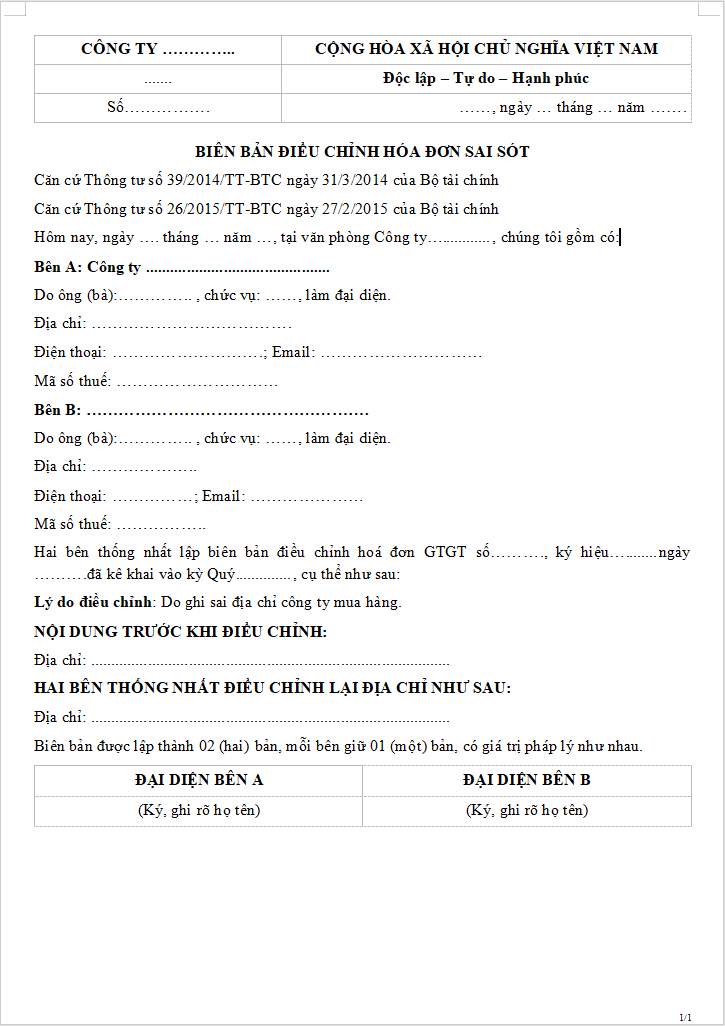

General adjustment form for other cases

In addition to the specific cases listed above, you can use the general adjustment form below for other errors that do not fall into the above cases. Just adjust the “Incorrect content” and “Adjusted content” to suit

Procedure for making electronic invoice adjustment minutes

Establishment process electronic invoice adjustment minutes depends on whether the erroneous invoice has been sent to the buyer, and the type of invoice (regular electronic invoice or old-style invoice during the transition period).

Case 1: Incorrect invoice sent to buyer

When detecting errors in the electronic invoice sent to the buyer (with or without a tax authority code), the seller and buyer need to coordinate to make a correction. electronic invoice adjustment minutes. The implementation process is as follows:

- Error Detection: The seller or buyer discovers errors in the information on the invoice.

- Notice and agreement: The party discovering the error shall notify the other party of the error and propose a correction plan. The two parties shall agree to draw up a correction record.

- Make a record of adjustment: Seller established electronic invoice adjustment minutes, which clearly states the original invoice information that is incorrect, the incorrect content and the correct adjustment content. This record must have full signatures and seals (if any) of both the seller and the buyer.

- Create adjusted electronic invoice: Based on the adjustment record, the seller shall issue an adjusted electronic invoice. The adjusted invoice must clearly state the adjustment content (for example: “Adjust unit price on invoice number… symbol… date…”), the number and date of the adjustment record. The adjusted invoice must not contain negative numbers.

- Send adjustment invoice: The seller sends the adjusted electronic invoice to the buyer.

- Storage: Both the seller and the buyer must keep the original (erroneous) invoice, the adjustment report and the adjusted electronic invoice for future tax declaration and audit purposes.

Case 2: The old paper invoice sent to the buyer has an error (during the transition period)

During the transition from paper invoices to electronic invoices, if the paper invoice sent to the buyer contains errors, the handling may differ depending on the specific regulations at that time. However, the general principle is still to make a record of adjustment and can make a replacement invoice or adjust it in the form of a paper invoice (if it is still allowed to be used). After the complete conversion to electronic invoices, invoices with errors will be handled according to the electronic invoice process (TH1).

Instructions for writing invoice adjustment minutes

When setting up electronic invoice adjustment minutes, it is necessary to ensure that the following contents are clearly and accurately presented:

- General information:

- Minutes name: MINUTES OF ELECTRONIC INVOICE ADJUSTMENT.

- Minutes number (managed and numbered by the seller).

- Date of record.

- Information of the parties:

- Seller: Company/business name, tax code, address, representative, position (if any).

- Buyer: Company/individual name, tax code (if any), address, representative, position (if any).

- Original invoice information is incorrect:

- Invoice number.

- Invoice symbol.

- Invoice date.

- Reason for invoice adjustment: Write the reason clearly, concisely and accurately. For example:

- Adjust buyer address from [old address] to [new address].

- Adjust the quantity of item [item name] from [old quantity] to [new quantity].

- Adjust the unit price of [commodity name] from [old unit price] to [new unit price]

- Other agreements (if any): Other agreements between the seller and the buyer regarding invoice adjustments.

- Confirmation of the parties: Signature and seal (if any) of the legal representatives of both the seller and the buyer.

- Number of copies: Clearly state the number of copies of the minutes made (usually 02 copies, each party keeps one copy).

Frequently asked questions

Below are some frequently asked questions regarding electronic invoice adjustment minutes and corresponding answers:

If an invoice adjustment has been made, do I need to send form 04/SS-HĐĐT to the tax authority?

According to current regulations, when an electronic invoice has been sent to the buyer and contains errors, the seller does not need to submit Form 04/SS-HĐĐT to the tax authority to correct the incorrect information (except for errors in tax codes). Instead, it is sufficient to make an adjustment record and an adjustment invoice (if necessary). However, if the error is related to the tax code, the seller must cancel the incorrect invoice and issue a new invoice to replace it.

Is the adjustment record mandatory?

Minutes of electronic invoice adjustment To be obligatory When the electronic invoice sent to the buyer has errors and needs to be adjusted. This record is the legal basis for the seller to issue an adjustment invoice (if necessary) and for both parties to adjust related accounting operations.

When is it necessary to make an adjustment record for an electronic invoice?

Need to set up electronic invoice adjustment minutes when detecting any errors in the information on the invoice sent to the buyer, for example:

- Incorrect name, address, tax identification number of buyer or seller.

- Incorrect unit price, total amount, tax rate, tax amount, total payment.

- Incorrect name of goods, services, quantity, unit of measure.

- Other errors in invoice content.

After making an adjustment report, is it necessary to make an adjustment invoice?

Whether or not an adjustment invoice is required depends on the nature of the error:

- Errors do not change tax liability: For example, the buyer's and seller's names and addresses are incorrect, but the tax code and other information are correct. In this case, only an adjustment report is required without an adjustment invoice.

- Errors that change tax liability: For example, incorrect unit price, quantity, tax rate, tax amount. In this case, after making the adjustment record, the seller must make an electronic invoice adjustment (clearly stating the information to be adjusted, the number and date of the adjustment record). The adjustment invoice cannot have negative numbers.

Can the adjustment minutes be created in Word or PDF files or does it require special software?

Minutes of electronic invoice adjustment can be created using common word processing software such as Word, then can be saved as PDF to ensure consistency and no editing. There is no mandatory requirement to use electronic invoice software to create the adjustment minutes. It is important that the minutes must have full information, signatures and seals (if any) of both parties.

If I make an incorrect invoice but have not sent it to the customer, do I need to make an adjustment report?

If the electronic invoice has been created but not yet sent to the buyer and an error is discovered, the seller does not need to make an adjustment record. Instead, the seller can make Cancel erroneous electronic invoice and issue a new electronic invoice to replace it. Cancellation of invoices must comply with the provisions of law on electronic invoices.

How long does it take to make a correction report from the time an error is discovered?

Current law does not specifically stipulate the time limit for making a record of adjustment from the time of detecting errors. However, the making of the record and making the adjustment should be done promptly to ensure the accuracy of accounting documents and avoid affecting the tax declaration of both parties.

Do the adjustment minutes have to be sent to the tax authorities?

Minutes of electronic invoice adjustment This is not a mandatory document to be sent to the tax authority. However, the seller and buyer need to keep this record together with the original invoice and adjusted invoice (if any) to present when the tax authority requests an inspection.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam