In the context of strong digital transformation, registering for e-invoices has become a mandatory requirement for all businesses in Vietnam. According to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, businesses need to comply with specific conditions and procedures to legally and effectively deploy e-invoices. This article will provide detailed instructions on the conditions, requirements and procedures for registering to use e-invoices, helping business owners and accountants grasp the necessary information to comply with legal regulations.

1. General introduction to Electronic Invoice (E-Invoice) and Registration Requirements

In the context of strong digital transformation, the application of electronic invoices is not only a trend but also a mandatory legal requirement for businesses. Below is basic information about electronic invoices and instructions for registration and use in accordance with legal regulations.

1.1 What is an electronic invoice?

Electronic invoice (E-invoice) is a type of invoice presented in the form of electronic data, created and sent electronically by organizations or individuals selling goods or providing services in accordance with tax and accounting laws. This is a complete alternative to paper invoices, helping to simplify procedures, save costs and improve management efficiency.

- Electronic invoices may or may not have a tax authority code.

- Coded invoice: Coded by the tax authority before sending to the buyer. The code includes a unique transaction number and a string of characters encoding seller information.

- Invoice without code: Created by the sales organization and sent to the buyer without needing a code from the tax authority.

- Including cases where invoices are generated from cash registers with data connection to tax authorities.

1.2 Mandatory nature of electronic invoice registration

According to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, registration for the use of electronic invoices is a mandatory procedure for all qualified enterprises, economic organizations and business households.

- Enterprises must complete the electronic invoice registration procedure with the tax authority before issuing and using electronic invoices.

- From July 1, 2022, the application of electronic invoices will be mandatory nationwide.

- There is no longer a requirement to make a release notice as before, businesses only need to register to use with the tax authority via the electronic system.

- After being approved by the tax authority, businesses are allowed to issue and use legal electronic invoices.

Understanding the regulations and properly implementing the procedures for registering electronic invoices will help businesses avoid legal risks and operate the invoice system more transparently and effectively.

2. Subjects required to register for using electronic invoices

According to current regulations, all organizations and individuals selling goods and providing services in Vietnam are required to register for electronic invoices. This is to ensure compliance with tax authorities' regulations and facilitate the management and storage of electronic documents.

Below is a list of specific objects to be implemented. Procedures for registering to use electronic invoices:

- Enterprises established under Vietnamese law, including limited liability companies, joint stock companies, and private enterprises.

- Branches and representative offices of foreign enterprises operating in Vietnam.

- Public service units that generate sales of goods or provision of services.

- Business households and individuals with legal business registration.

- Cooperatives, cooperatives and cooperative unions.

- Organizations that are not businesses but have business activities (for example, non-governmental organizations with commercial and service activities).

In addition, special attention should be paid to newly established businesses during the period from 09/17/2021 to 06/30/2022 but does not meet the information technology infrastructure requirements. This case will be apply specific guidance from tax authorities, depending on the actual conditions in each locality.

Identifying the right audience and following the correct registration process is an important first step in the process of implementing e-invoices. If your business is unsure about the profile, process or platform to use, Bizzi provides solutions. Instructions for registering to use electronic invoices from A to Z, ensuring compliance with regulations, saving time and costs for accounting.

3. Conditions and Requirements to prepare before registration

Before registering for electronic invoices, businesses need to ensure that they fully meet the conditions and prepare the necessary elements for the implementation process to go smoothly and in accordance with legal regulations. Below are instructions for registering for electronic invoices with important requirements:

- Register valid digital signature software: Enterprises need to have a legal digital signature, still valid at the time of registration and use of electronic invoices. This is a mandatory condition to digitally sign invoices when issued.

- Have stable equipment and connection: Computers, internet access devices and network connections must ensure sufficient speed and stability to perform the procedures of declaring, issuing and storing electronic invoices continuously and without interruption.

- Guaranteed 10-year invoice storage: According to the provisions of the Accounting Law, enterprises must store electronic invoices for 10 years. They can choose to build their own storage system or cooperate with a reputable electronic invoice provider with a data storage infrastructure that meets security standards and is fully certified.

- Prepare staff and train to use software: The person in charge needs to be instructed on how to use the electronic invoice software properly. Choosing a software provider with 24/7 technical support will help businesses easily handle arising situations.

- Connect sales and accounting software (if required by Tax Authority): Many Tax Authorities require that the sales system be integrated with accounting software to ensure that electronic invoice data is automatically transferred and synchronized when invoicing. Especially for newly established businesses, it is advisable to consult the Tax Authority in charge for appropriate preparation.

- Full legal documents: Enterprises need to prepare business registration certificate, establishment decision, tax code and related documents if submitting electronic invoice registration application directly.

4. Documents required to register for using electronic invoices

To complete the procedure Register for electronic invoices In accordance with regulations, businesses need to prepare complete documents in one of two forms: submit paper copies directly or submit electronic copies through the system. Below are Instructions for registering to use electronic invoices Details for each submission method.

4.1 Paper application (Method 1):

- Electronic invoice template: Create a template on the initialization software, select “View template”, then “Sign electronically” and “Print on paper”. Some tax offices may require an additional invoice to be converted to a paper document – similar operations: “Convert paper invoice” → “Sign electronically” → “Print”.

- Decision to apply electronic invoices: Prepare according to standard form, print on paper, sign and stamp the company.

- Notice of electronic invoice issuance: On the software interface, select "Notification of electronic invoice issuance", print, sign and stamp. (Note: From 2022, according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, enterprises are no longer required to send a notice of invoice issuance to the tax authority, except in special cases requested by the tax department.)

4.2 Documents submitted electronically (Method 2 - popular according to Decree 123):

- Application form for using electronic invoices: Use form No. 01/DKTĐ-HĐĐT Appendix IA issued with Decree 123. The file is exported in XML format from the invoice software.

- Electronic invoice template: On the software interface, click “View sample”, “Sign electronically”, then export to an unaccented Word file (.doc).

- Decision to apply electronic invoices: You can submit a scan or Word file (.doc).

- (Additional note: Depending on the declaration system, it may be required to combine all documents such as Decision, Release Notice (if any), invoice form into the same Word file.)

- Register to use USB Token digital signature: Digital signature device is a mandatory condition for businesses to be able to sign and submit valid documents via electronic system.

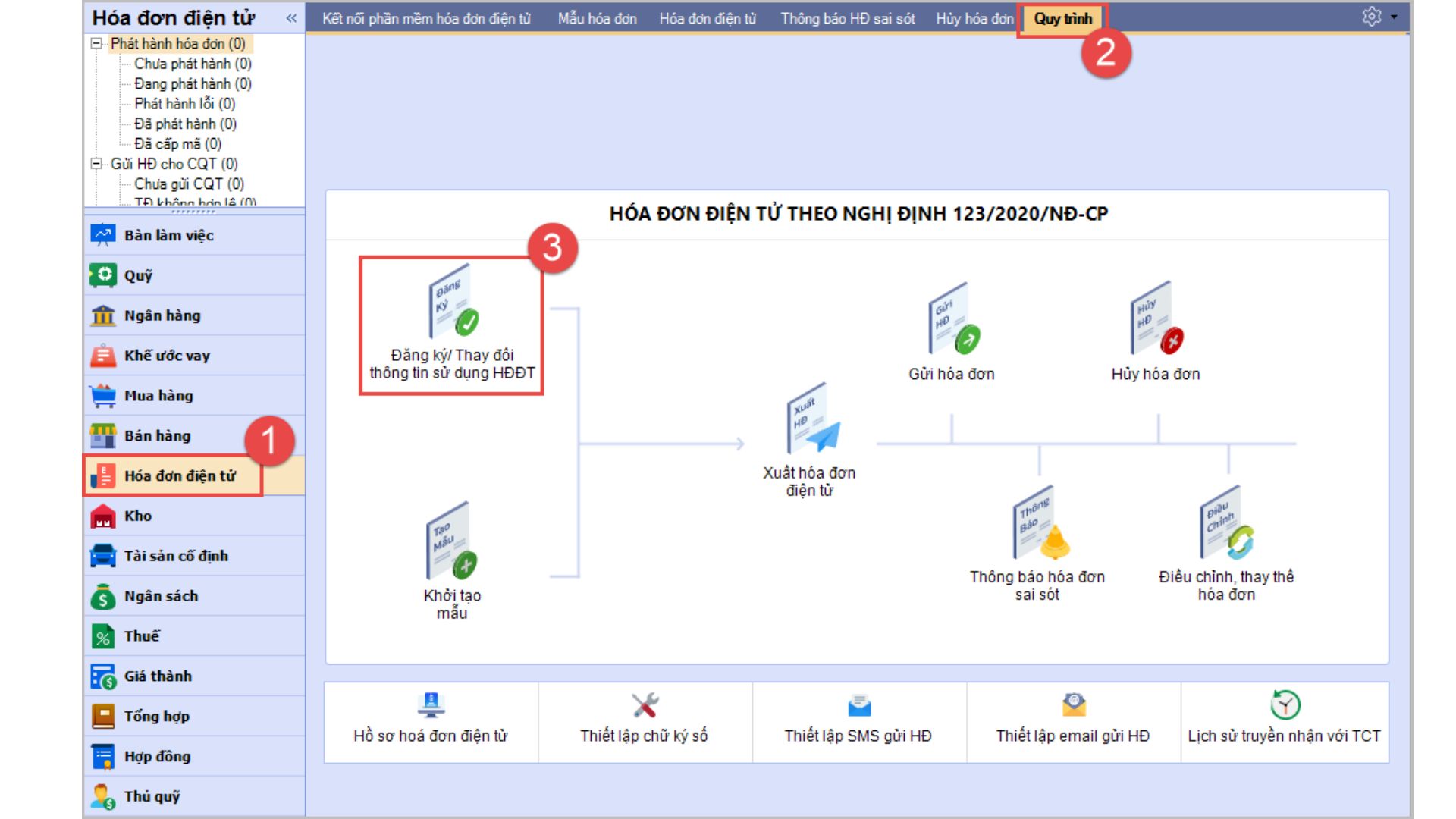

5. Procedure for registering to use electronic invoices according to Decree 123 (Electronic submission)

To officially use electronic invoices (E-invoices) according to the provisions of Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, enterprises need to follow the correct registration process with the tax authorities. Below are Instructions for registering to use electronic invoices details, helping business owners and accountants easily implement standards, limit errors:

- Step 1: Select an electronic invoice service provider (TVAN): Businesses that are not exempted from tax service fees need to choose an electronic invoice provider. Prioritize reputable units with quick support and transparent costs like Bizzi to ensure compliance with regulations and save implementation time.

- Step 2: Prepare application for using electronic invoices

Including the Registration Form for using electronic invoices (Form 01/DKTĐ-HDĐT), Decision on applying electronic invoices and Sample invoice expected to be issued. - Step 3: Submit electronic documents via the Electronic Tax system

Business access thuedientu.gdt.gov.vn To apply:- First time declaration registration: Go to tab Tax Return → select Register the declaration → scroll down and select "Notice of issuance of electronic invoices", "Decision to apply electronic invoices" → click Continue and Accept.

- Submit official declaration: Back to tab Tax Return → select Submit XML declaration → upload file Form 01/DKTĐ-HĐĐT (format .xml) → sign electronically with USB Token → click Submit the form → receive successful submission notification.

- Step 4: Attach appendix (Decision on application and Invoice form)

Access the item Lookup → select Declaration → look up the submitted file → select the attachment icon → upload the Decision to apply electronic invoices and the Invoice form → sign and resubmit. - Step 5: Wait for response from tax authorities

Within 01 working day, the tax authority will respond via registered email:- Accept: Enterprises can start issuing electronic invoices according to regulations.

- Not accepted: The enterprise adjusts the profile as required and resubmits it as per the above steps.

Understand electronic invoice registration process not only helps businesses comply with the law, but also optimizes the invoice management process, saving time and costs. If you are looking for a quick and effective solution to deploy electronic invoices, please contact Bizzi for detailed advice and support.

6. Steps after being accepted by the Tax Authority

After completing the process Register for electronic invoices and receive the acceptance notice from the Tax Authority, the enterprise needs to fully implement the following steps to ensure compliance with legal regulations and avoid tax risks:

- Stop using electronic invoices that have been announced to be issued according to the old regulations: Enterprises must stop using all invoices in the old form, including electronic invoices and paper invoices previously announced for issuance.

- Destroy unused paper invoices (if any): Paper invoices that have been announced for issuance but have not been used must be destroyed in accordance with the procedures in Article 27 of Decree 123/2020/ND-CP. Enterprises must make an inventory record, a destruction record, and decide to establish a destruction council.

- Prepare a report on the settlement of invoice usage (form BC26/AC): This report needs to be sent electronically to the tax authorities, to confirm the number of invoices used, unused or destroyed.

- Store invoice cancellation records at the enterprise: The records including inventory records, destruction records, decision to establish a destruction council and destruction notice (form TB03/AC) must be fully archived to serve future inspection and examination work.

- Start using the new e-invoicing software: Once receiving the acceptance notice from the tax authority, the enterprise can officially use the software to create and issue electronic invoices whenever there is a transaction of goods and services.

- No need to notify the issuance of new invoices: According to Decree 123, businesses no longer have to notify tax authorities about invoice issuance, quantity and duration of invoice use as before.

Understanding the instructions for registering to use electronic invoices and the steps after being accepted will help businesses convert smoothly, save time and minimize legal risks during the process of implementing electronic invoices.

7. Check application status after submission

Below are the steps to check the status after submitting an application for electronic invoice registration for businesses:

Step 1: Log in to the Electronic Tax system

- Visit website: https://thuedientu.gdt.gov.vn

- Select the appropriate subsystem:

- Business: Log in with tax code and password or digital signature.

- Individual: Log in with tax code and password.

Step 2: Look up submitted declaration

- After logging in, select the item “Tax declaration” on the menu bar.

- Select “Lookup” to check the submitted returns.

- Select the type of declaration you want to view (for example: VAT, PIT, CIT,...) and the period you want to look up.

- Press the button “Lookup” to display a list of filed returns.

Step 3: Check the notice from the tax authority

- In the section “Lookup”, select “Notice of tax authority” to view notifications related to submitted applications.

- Check to see if you have received any acceptance or response from the tax authorities.

Step 4: Look up electronic invoice

- After 2 days from the date of submission of the application without receiving any response from the tax authority, the enterprise should check the status of the electronic invoice:

- Visit page: https://hoadondientu.gdt.gov.vn

- Enter the required information such as tax code, invoice type, invoice symbol, invoice number, total tax, total payment amount and captcha code.

- Press "Search" to check invoice status.

- If the system displays the status “Invoice code issued”, meaning the invoice has been accepted.

- If you do not see the invoice information, please check the information entered or contact the tax authority for confirmation.

Step 5: Contact the tax authorities

If after performing the above steps, you still do not receive a response or cannot determine the status of the application, the enterprise should proactively contact the tax authority directly for support and confirmation of the application status.

8. Frequently asked questions about electronic invoice registration

8.1 Do the date of creation and the date of signing of the electronic invoice have to be the same?

Yes, the date of electronic invoice creation is determined by the time the seller digitally signs or electronically signs the invoice.

8.2 Is the buyer required to sign the electronic invoice?

Not required for the buyer, the electronic signature criteria are only required for the seller. Only in cases where the buyer has a prior digital signature agreement with the seller is it required to sign.

8.3 Does the seller have to store electronic invoices?

Yes, sellers (and intermediary organizations providing e-invoice solutions if invoices are generated from their systems) must store e-invoices for the period prescribed by the Accounting Law (currently 10 years). Data must be backed up to a storage device or backed up online for protection.

8.4 When is it mandatory to convert invoices to Decree 123 & Circular 78?

All businesses must complete the conversion before July 1, 2022. The 6 pilot provinces and cities must complete it before April 1, 2022.

8.5 If my business does not convert to electronic invoices according to Circular 78/2021/TT-BTC, will it be fined?

As of now, there is no provision regarding penalties for this case mentioned in the source.

8.6 If our business converts invoices to Circular 78, do we need to cancel paper invoices and electronic invoices according to Circular 32?

Yes, after converting and having the tax authority accept the registration declaration for use according to Circular 78, the enterprise must stop issuing old invoices, cancel paper invoices and electronic invoices according to the old Circular before using invoices according to Circular 78 and make a final report on the use of invoices BC26/AC.

8.7 How to send data to tax authorities when using invoices with codes according to Circular 78/2021/TT-BTC?

By default, invoice data is transmitted to tax at the time of invoice issuance.

Conclude

Registering and using electronic invoices not only complies with legal regulations but also brings many benefits to businesses, such as cost savings, improved management efficiency and transparency in transactions. To ensure a smooth transition, businesses need to fully prepare the necessary conditions and properly follow the registration process according to the instructions of the tax authorities. Support from modern technology solutions, such as Bizzi's electronic invoice software, will help businesses deploy quickly and effectively.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/

Related Posts: