Analyze with Bizzi EPM Case Study Sactona in Japan – successful EPM users. How they overcame the limitations of Excel, standardized planning processes, and made faster decisions with unified data.

Panasonic EPM Case Study: Eva-Net Global — Reduce Forecasting Time & Standardize Reporting

The Panasonic case shows that digital transformation in finance does not necessarily start with expensive software, but from standardization, flexibility, and prioritizing user experience. Vietnamese businesses can absolutely learn from this model to Shorten forecasting times, speed up response times, and make decisions based on real data.

Background before implementation

- Panasonic previously had a management accounting system used in the consolidated accounting system, but when updating the budget/revenue and expenditure changes continuously, it had to wait until half a day to update.

- When there is an organizational change, the system must stop working for at least 1 month to reflect these changes.

- Management methods vary between units, and some work still has to be done outside the system to ensure consistency.

- Reporting to headquarters and to subsidiaries takes place twice, through multiple layers of organization, resulting in large delays.

Key Results & Benefits

- The time taken to perform monthly forecast work has been reduced from 7 days down to 5.5 days After closing. With the time saved, staff can spend more time on analyze data and create explanations instead of just doing the paperwork

- Organizational changes – which previously took nearly a month to reflect – now only need modify master data is fine

- The standardization of meeting materials produced by member companies has progressed to a point where reduce templates to ¼ compared to before

- The “Eva-Net” system with Sactona helps Panasonic “capture management information on a globally consolidated basis” and “respond flexibly to changes in the business environment”

Lessons for Vietnamese businesses

- Reduce processing times not just with “new technology”, but with process standardization: Panasonic does not replace the entire financial system but standardizes the planning - reporting - forecasting on the same platform. Therefore, before investing in technology, Vietnamese businesses need to review internal processes, eliminate duplication and unify reporting formats (templates, targets, terms). This helps the EPM or BI system when deployed to truly save time.

- Flexibility in organizational change is vital: It took Panasonic 1 month to update the structural changes, but after having Sactona, it only needed to edit the master data. Fast-growing Vietnamese businesses (retail chains, FMCG, logistics...) should prioritize flexible systems that allow self-configuration, without depending too much on IT or software suppliers.

- Standardizing data across departments is the foundation of digital transformation: Panasonic reduced the number of report templates to only ¼ compared to before, creating a unified data language across the group. Vietnamese businesses often encounter "data silos" (one file per department, one format).

Fujifilm EPM Case Study: From 2-Day PSI Collection to Instant Fusion Thanks to Sactona

As it ramps up global production of its X-series mirrorless cameras, Fujifilm faces the challenge of forecasting ever-changing demand. Gathering data from multiple markets takes days, making the supply chain slow to react to market fluctuations.

Background

- Fujifilm's Imaging Solutions division, which produces the X-series mirrorless cameras with hundreds of SKUs, has to manage global demand.

- They need to move from monthly to weekly forecasting, but collecting PSI (orders + inventory + demand) from international offices takes 2 days just for general information.

- Distributed Excel aggregation of multiple components is a bottleneck in the supply chain (SCM).

Results & Benefits

- The time to collect and consolidate PSI data from countries is reduced from ~2 days to “instant”. Thanks to that, SCM can react faster to demand fluctuations, deciding to increase/decrease production at any time.

- Friendly forecasting interface (Excel-based) makes it easy for international offices to adopt.

Lessons for Vietnamese businesses

- When managing multinational/multi-SKU supply chains and demand, a forecasting system is needed. shorten data collection cycle to speed up the reaction.

- Using a familiar interface (like Excel) helps users accept the system faster.

- Aim for weekly or faster moving forecasts rather than just monthly reporting – especially in fast moving industries like FMCG, cosmetics.

Case Study EPM: Monex Group & Sactona

As one of Japan’s leading fintech companies, Monex needed to optimize its budgeting and forecasting processes in a fast-moving environment. Previously, they spent a lot of time on manual tasks and cross-checking data.

Background

- Monex Group needed to improve its budget management and forecasting productivity as it operated in a rapidly changing financial environment.

- The previous system was too complex, making it difficult to analyze non-financial data along with cost details.

- Need a more flexible and intuitive budgeting/forecasting system for top users.

Results & Benefits

- The Sactona system eliminates repetitive tasks, reduces manual work and simplifies budget forms.

- Improve budget accuracy, eliminate double-checking.

- Finance staff shift focus from data collection to analysis & strategy.

Lessons for Vietnamese businesses

- When the business environment is highly volatile (such as finance, fintech, e-commerce), the budget system needs to be flexible & easy to use to quickly "run" scenarios.

- Simplifying the form and eliminating redundancy saves time and the risk of error.

- Finance is not just about numbers but needs to be transformed into an “advisor” to support business – the system must support this.

LIXIL EPM Case Study: Global FP&A Implementation in 2 Months — Lessons in Speed & Scale

LIXIL – Japan’s leading manufacturer of bathroom fixtures and building materials – is going through a period of intense M&A. They need a unified global financial system, yet flexible enough to adapt to constant organizational change.

Background

- LIXIL is in a period of strong globalization, many M&A, need a global management system.

- Previously, data collection and synthesis were done using Excel, which was very time consuming. Many changes were required (e.g. IFRS, new indicators).

- Requires rapid deployment (in just a few months) to accommodate organizational changes.

Results & Benefits

- Only 2 months from project inception to LIXIL's global FP&A system being operational.

- Lightweight, flexible system that allows internal units to operate autonomously and respond quickly to organizational changes.

- Reduces the burden on user input, making data entry and reporting easier.

Lessons for Vietnamese businesses

- When there are multiple international subsidiaries or branches, choose a deployment solution fast and light will help reduce implementation risk.

- Flexibility in configuration to respond to organizational changes, metrics, and reporting is critical.

- User-friendly interface – no long training required – helps speed adoption.

EPM Kaneka Case Study: Multi-Entity Consolidation, Automated Foreign Currency Processing, and Internal Transaction Elimination

Kaneka is a diversified chemical conglomerate with dozens of business divisions. Previously, each division prepared its own forecasts using Excel, which made consolidation and elimination of internal transactions time-consuming.

Background

- Kaneka applies a performance management cycle (monthly consolidated performance forecast for the next 3 months). Business divisions also use separate Excel, which is a huge burden.

- The system does not yet support: foreign currency conversion, multi-step allocation, internal transaction elimination, consolidation by business organization/group.

Results & Benefits

- Deploy Sactona with the above features: foreign currency conversion, allocation, internal transaction elimination, faster consolidation.

- Improve forecasting accuracy & speed across the company. Standardize accounting management activities of business units.

Lessons for Vietnamese businesses

- In multi-industry, multi-unit enterprises with complex requirements (foreign currency, allocation, consolidation), a suitable infrastructure system is needed from the beginning.

- Standardizing the way data is recorded, allocated, and consolidated is important for accurate and fast data reflection.

- Choosing a system that is easy to operate and supports non-IT people in adjusting configurations will help businesses be more proactive when making changes.

EPM Sigmaxyz Case Study: Comprehensive FP&A Implementation in 3 Months – Proof of EPM Speed & Efficiency

SIGMAXYZ is Japan's leading strategy & technology consulting company, supporting businesses in implementing comprehensive digital transformation (DX) - from process redesign to new service development.

Background

- Many clients like H2O Retailing need to build digital platforms to develop new business models.

- The challenge is to test quickly while ensuring commercial viability.

Results & Benefits

- Successfully deployed new digital services, reaching 55,000 users after 10 months, exceeding the initial target.

- Full support from consulting, design to operation helps businesses deploy quickly and stably.

Lessons for Vietnamese businesses

- Digital transformation is not just about implementing technology but about redesigning processes and customer experiences.

- Need a partner with both business and technology mindset to lead the project.

- Start small with a pilot but measure effectiveness to scale quickly

Factors for success in EPM case study

Successful EPM businesses do not come from technology alone, but from a combination of 4 strategic elements: data – people – process – measurement. Vietnamese businesses that want to achieve similar results need to consider EPM as a management transformation project, not just a “financial software implementation”.

Data Governance

- Standardizing financial and operational data is a key foundation for businesses to effectively transition to an EPM system.

- Companies like Panasonic and LIXIL have succeeded by establishing standardized data sets, communicating between departments, reducing manual errors and increasing reporting reliability.

- Lesson for Vietnamese businesses: It is necessary to set the goal of data unification from the beginning, avoiding the situation of "disjointed data" that makes EPM a separate tool instead of an integrated one.

Change Management

- The change is not only in technology, but also in thinking and decision-making habits.

- Fujifilm and Monex are prime examples of how they provide ongoing training to their finance staff, helping them transition from manual Excel processing to strategic analysis.

- Lesson: Vietnamese businesses need to have clear internal communication about the benefits of EPM, have a training and support roadmap throughout, and avoid the "fear of innovation" mentality.

KPI and performance measurement mechanism

- EPM is only effective when KPIs are tied to specific business goals.

- Kaneka and Sigmaxyz has implemented a real-time data-driven KPI system, allowing departmental performance appraisal right in the planning cycle.

- Lesson: Don't apply KPIs in a spread-out manner; Identify core metrics (e.g., forecast accuracy, reporting time, budget variance) to measure EPM effectiveness.

Flexible & efficient Forecast process

- Before EPM, most corporations took weeks to complete forecasts; after implementation, this time was reduced to days thanks to automation and data modeling.

- Monex and Panasonic made great strides by standardizing scenario planning models, helping management make quick decisions when the market fluctuates.

- Lesson: Vietnamese businesses should shift from static to dynamic forecasting, leveraging EPM to simulate various financial scenarios, especially in a rapidly changing environment.

The decisive roles that help businesses use EPM successfully

From EPM case studies of businesses successfully using EPM, it can be seen that EPM, CFO, FP&A, CEO and PMO are key roles in EPM implementation, ensuring the connection between strategy - data - people.

CFO – The “strategic sponsor” of the project

CFOs must have a deep understanding of the FP&A process, have a digital mindset, and be willing to redesign the process instead of just “digitizing old tools”.

- Be the sponsor and decision maker that guides the project.

- Ensure EPM aligns with overall financial strategy: budget management, performance, profitability.

- Communicate clearly about business goals and quantifiable benefits (reduce forecast time, increase data accuracy, shorten closing time…).

- Act as a liaison between leadership and implementation team, ensuring commitment and resources.

FP&A Team – The people who “operate and optimize” the system

FP&A teams need to be trained in-depth on EPM tools and data-driven thinking, avoiding just stopping at “input data”.

- Is the key user of the EPM system.

- Define financial model logic, reporting templates, forecasting processes.

- Convert from manual Excel to automated forecasting models, increasing speed and accuracy.

- Coordinate with IT and PMO to ensure actual – budget – forecast data are connected and continuously updated.

CEO – The person who “orients and leads change”

CEOs need to link EPM with the goal of digital transformation and sustainable growth, not just a math problem EPM cost control.

- Ensure EPM is not seen as a finance department project, but as an enterprise-wide governance platform.

- Create positive pressure on departments to comply with new processes, unify data recording and reporting.

- As a “cultural change sponsor” – without the CEO’s support, the project is likely to fall into a half-hearted state.

PMO – The person who “controls and connects” the entire project

PMO must have dual knowledge (finance + project management), be able to make quick decisions and resolve conflicts between parties.

- Coordination point between groups (Finance – IT – Vendor).

- Track timeline, resources, scope, and quality of implementation.

- Ensure the right person – right job – right schedule.

- Act as a bridge to help transition from deployment to stabilization.

Frequently asked questions about successful EPM case studies (EPM Success Story)

Below is a summary of common questions about EPM case studies, ROI and actual implementation time with Sactona EPM in Vietnam.

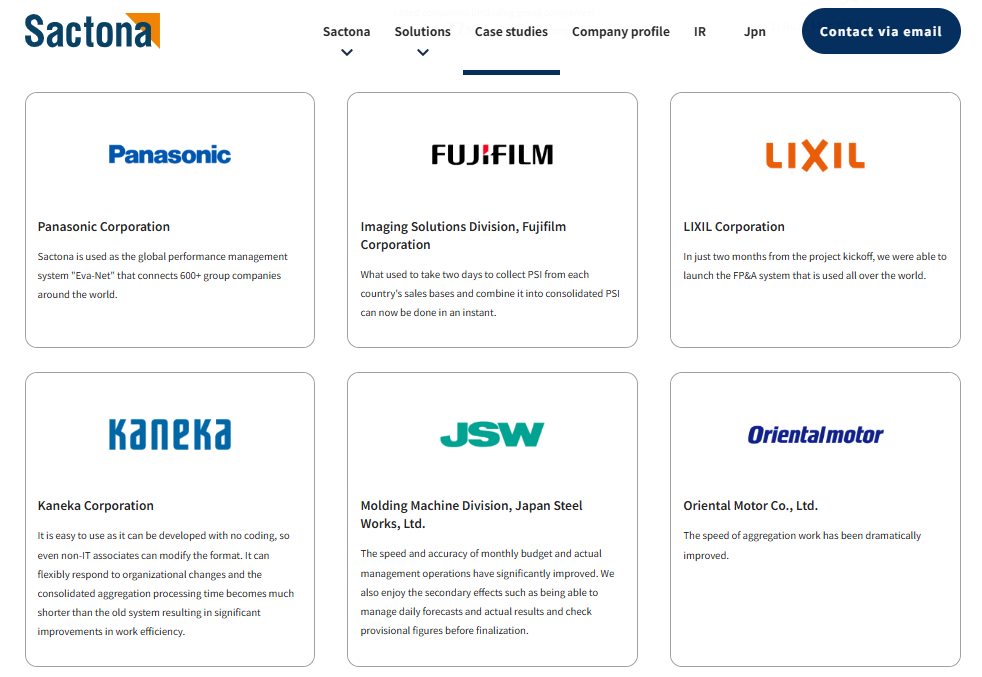

1. Which businesses have successfully implemented EPM (especially Sactona)?

Many Japanese corporations such as Panasonic, Fujifilm, LIXIL, Monex, Kaneka and Sigmaxyz have applied Sactona - a specialized EPM solution for the Finance department.

Overall results:

- Reduce forecasting time by 40–60% and standardize reporting processes.

- Successfully transitioned from manual Excel to a digital platform, allowing CFOs to focus on strategic analysis rather than data aggregation.

2. What is the average ROI of EPM projects?

Benefits of EPM for businesses ROI aspect according to statistics from real case studies:

- Average ROI is 120–180% in 12–18 months.

- By reducing financial operating costs, shortening planning cycles, and speeding up decision making, EPM brings long-term value in terms of transparency and more accurate forecasting in addition to quantitative benefits.

3. How will Sactona help Vietnamese CFOs make decisions quickly?

Sactona is designed to:

- Automatically connect actual data – plan – forecast,

- Provides real-time visual dashboards,

- Allows CFOs to simulate what-if scenarios and immediately assess the impact on profits, costs, or budgets.

From days of analysis to just hours – CFOs can react quickly to market fluctuations or executive requests.

4. What is the average implementation time?

With Sactona's flexible deployment model:

- Small and medium enterprises: about 2–3 months,

- Large corporations (multiple business units): 4–6 months.

Thanks to the Excel-like interface and built-in financial module, user onboarding time is 30–40% faster than traditional EPM software.

5. How does EPM help align strategy and action plans?

EPM is more than just a budgeting tool – it's a bridge between strategic goals and concrete actions:

- Translate strategic goals (e.g., increase profits by 15%) into detailed financial plans for each department.

- Continuously monitor actual performance vs. plan, helping management make early adjustments when there are discrepancies.

- Create a “Performance Loop”: strategy → action → measure → adjust → new strategy.

Through analyzing EPM case studies of businesses that successfully used EPM, it can be seen that EPM is not only for multinational corporations - but can also be effectively applied in Vietnamese businesses if implemented appropriately.

Conclude

The successful EPM case study (EPM Success Story) has proven that EPM is a lever to help CFOs and CEOs move from reactive management to proactive management, standardizing the planning - forecasting - reporting process. With Sactona, Vietnamese enterprises can achieve the same level of flexibility, transparency and accurate forecasting as international corporations.

Bizzi Vietnam is the exclusive distribution partner of Sactona Japan, providing a new generation EPM solution - easy to use, quick to deploy, and maintaining the familiar experience on Excel. In other words, the Sactona solution meets modern financial management standards while still being suitable for the operational characteristics of Vietnamese businesses.

👉 Sign up here to discover Sactona EPM – the solution to enhance data management, financial planning and forecasting – faster, more accurate and more efficient for your business!