In today's business environment, finding the right sources of capital to support finance is very important for businesses. To optimize operational efficiency and sustainable development, businesses need to understand the forms of business loans, from which to choose the most suitable method.

This article will summarize and analyze the most popular forms of business loans in 2024, including unsecured loans, mortgage loans, loans from investment funds, banks, bond issuance and other forms to support businesses to achieve financial goals in a sustainable way.

Index

Toggle1. What is the form of business loan?

Business loans are methods of raising finance to support the production, business or investment development activities of the company. These forms of business loans help companies to be more flexible in expanding their scale and developing new projects without having to use all their own capital.

Depending on the needs and financial capacity, you can choose the appropriate form of business loan such as unsecured loan, mortgage loan, loan from investment funds, or issue bonds to raise capital from investors.

2. Unsecured loans for businesses

Unsecured loans are a form of loan that does not require collateral, based on the reputation and financial capacity of the business. This is a popular form with many advantages, suitable for businesses that want to borrow capital quickly without having to mortgage assets.

Characteristics of business credit loans

Unsecured loans are a form of loan that does not require collateral, based on the creditworthiness and financial capacity of the business. This form is often applied to small and medium-sized enterprises that have urgent capital needs or want to invest in expanding their scale but do not have collateral.

Benefits of unsecured loans

Businesses can access capital quickly and flexibly without having to mortgage assets. This makes it easy for businesses to implement short-term business plans or solve temporary financial problems without taking on much asset risk.

Conditions for business credit loans

To get a credit loan, a business needs to have a clear, transparent financial profile and demonstrate its ability to pay. Banks often require businesses to provide financial statements, balance sheets and cash flow information to assess their ability to repay.

Things to note when choosing unsecured loans

Unsecured loans usually have higher interest rates than secured loans due to the higher risk to the lender. Businesses should consider their ability to repay and choose an appropriate interest rate, while paying attention to the terms and costs of the loan agreement.

3. Business mortgage loans

Mortgage loans require businesses to use fixed assets as collateral, helping to minimize risks for the lending institution and providing interest rate advantages for the business.

What is a mortgage?

A mortgage loan is a form of business loan in which the business owner must use valuable assets such as real estate, machinery, and means of transport as collateral for the loan. This form is often suitable for businesses that need long-term loans and want a stable interest rate.

Collateral when borrowing business mortgage

Common types of collateral include buildings, land, machinery, equipment, or vehicles. Having collateral allows businesses to enjoy lower interest rates and longer repayment terms.

Benefits and risks of mortgage loans

The main benefit of secured loans is that businesses can access capital at a lower cost than unsecured loans. However, the biggest risk is losing the collateral if the business cannot repay on time, leading to serious impacts on the company's finances and assets.

Conditions required for mortgage loan

To get a mortgage loan, businesses must provide documents proving ownership of the property and other financial records. The bank will conduct an appraisal of the property value before approving the loan, so businesses need to prepare carefully and meet the lender's requirements.

4. Borrowing capital from investment funds and financial institutions

Investment funds and financial institutions often provide capital to support startups or business expansion. This is a form of business loan without collateral, suitable for businesses with potential business ideas.

What is a business support investment fund?

Investment funds are typically financial institutions or investors that have capital available to support the growth of businesses, especially startups or small and medium-sized enterprises. These funds often provide capital at preferential interest rates or flexible loan terms.

How to access capital from investment funds

To access capital from investment funds, businesses need to prepare a detailed and transparent business plan, clearly demonstrating profit potential and sustainable development. Some investment funds require businesses to have unique products/services or have a clear business strategy.

Advantages of borrowing from financial institutions

Investment funds and financial institutions provide loan packages with preferential interest rates and more flexible repayment periods, helping to reduce financial pressure on businesses and create favorable conditions for business development.

Important notes when borrowing capital from investment funds

Enterprises should carefully consider the terms of capital contribution ratio, interest rate and benefits of investment funds to ensure rights and maintain stability in business operations.

5. Borrowing capital from commercial banks

Commercial banks offer a variety of loan packages to suit different business needs. This is the most traditional and popular form of business lending.

Business loan packages from banks

Commercial banks offer a variety of loan packages such as short-term, medium-term and long-term loans, suitable for different needs of businesses. Depending on the purpose of capital use, businesses can choose the appropriate loan package to meet financial needs.

Benefits of borrowing from commercial banks

The benefit of borrowing from a commercial bank is that businesses can receive capital with stable interest rates and flexible repayment periods. In addition, banks provide accompanying financial services such as financial management consulting, helping businesses operate more effectively.

Bank loan conditions for businesses

To borrow from a bank, a business must have transparent financial records, clear financial statements and documents on assets and revenue. The bank will assess the risk and ability to repay before approving the loan.

Bank loan process and procedures

The loan process at the bank includes steps such as submitting loan applications, financial appraisal, signing loan contracts and disbursement. Businesses need to ensure complete legal documents and comply with contract terms for the loan process to go smoothly.

6. Borrow capital from internal credit funds of the enterprise

Internal credit funds are a source of capital funding from the members or shareholders in the enterprise, creating flexibility and no need to rely on outside sources.

What is an internal credit fund?

Internal credit fund is a source of capital that the enterprise itself creates from profits to support the production and business activities of subsidiaries or internal projects. This is a form of borrowing that helps the enterprise be flexible without having to depend on external financial institutions.

Benefits of internal credit fund loans

Without having to pay high interest rates, internal credit funds make it easy for businesses to raise capital when needed. This is especially effective for short-term needs.

Things to note when using internal credit funds

The use of internal credit funds must ensure that the parent company's capital is still sufficient for other activities, avoiding abuse that affects long-term development plans.

In addition, the use of internal credit funds needs to be strictly managed to avoid conflicts of interest and ensure transparency in the use of capital.

7. Form of business borrowing through bond issuance

Issuing corporate bonds is one of the effective forms of business loans to help mobilize capital from individual and institutional investors.

What are corporate bonds?

Corporate bonds are debt securities issued by companies to raise capital from investors. This form allows businesses to access long-term capital without affecting ownership.

Benefits of issuing bonds to borrow capital

Issuing bonds helps businesses access long-term capital at attractive interest rates, while helping to protect the ownership of the business.

Corporate bond issuance process

Enterprises need to build an issuance profile, register with the management agency and issue bonds on the market. This process is often complicated and requires advice from professional financial institutions.

Notes when issuing corporate bonds

Issuing bonds requires businesses to have prestige and stable financial capacity to ensure commitment to pay interest to investors.

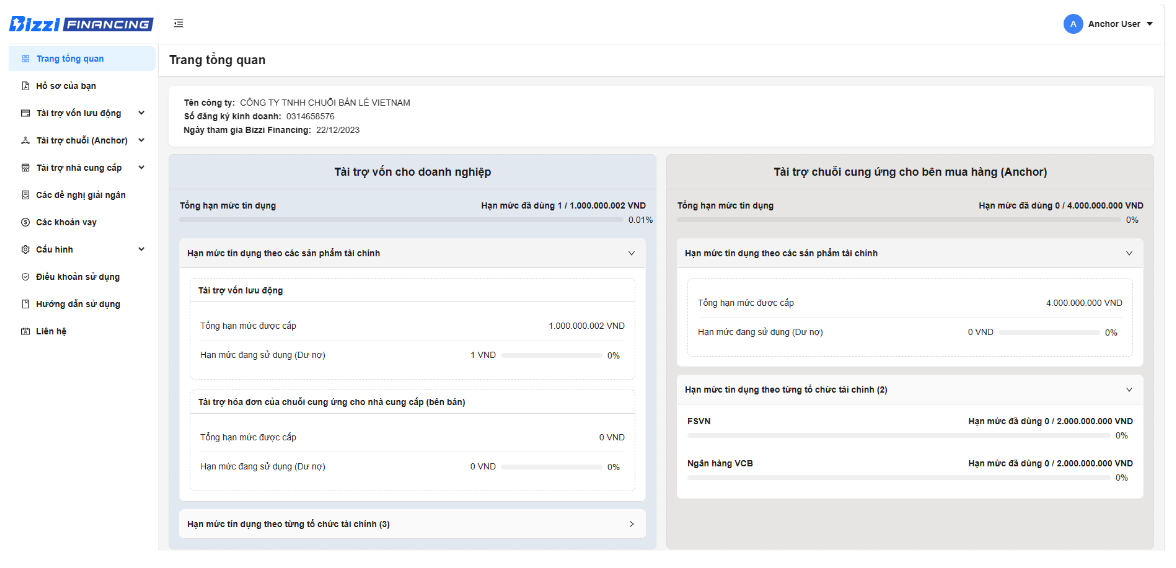

8. Borrowing through Bizzi Financing – Effective form of business loan today

Bizzi Financing is a platform that provides flexible financial solutions for businesses, helping them access capital quickly and conveniently.

What is Bizzi Financing?

Bizzi Financing is an intermediary platform that manages costs, limits and meets capital needs for businesses through a network of leading financial partners, thereby helping businesses access capital quickly without having to go through complicated procedures.

Bizzi connects a variety of capital support products for customers (including: loans, overdrafts, guarantees, Letters of Credit L/C, Corporate Credit Cards) and many types of financial partners to meet different business conditions (No collateral, newly established, not meeting Bank conditions)

What factors does Bizzi Financing use to select businesses for funding support?

Bizzi Financing will not directly appraise and finance businesses. Bizzi's financial partners will conduct appraisals based on various criteria, including but not limited to assessing: business operations, financial capacity, and credit history of the business.

What is Bizzi's financial partner?

Bizzi's financial partners are reputable banks and financial institutions in Vietnam that cooperate with Bizzi to support businesses in accessing financial support packages quickly and conveniently.

Benefits of Bizzi Financing over Traditional Forms of Business Financing

Compared to traditional banks, Bizzi Financing has fast approval times, competitive interest rates and convenient online processes.

- Diverse choices: Connect with a variety of financial partners to FULLY meet your business's additional capital needs.

- Flexible loan conditions: Unlike traditional loans that require businesses to have collateral, Bizzi Financing offers unsecured loan packages based on the creditworthiness and financial capacity of the business. This helps small businesses or startups without large assets to also access capital.

- Fast approval time: With a modern technology platform, Bizzi Financing can approve loans in a short time, helping businesses quickly access capital when needed. This is a big advantage compared to the slow approval processes of traditional banks, which can take from several weeks to several months.

- Transparent process: The entire loan process from application to approval and disbursement is done online and transparently, with clear terms that help businesses easily control their loans without worrying about hidden costs. Businesses can easily manage debts, limits and balances on one platform.

Why do businesses receive capital support through Bizzi Financing instead of working directly with banks?

When using Bizzi Financing, businesses will get:

- Connect with reputable financial partners to proactively choose the right financing program and interest rate

- Submit application online and connect to selected Financial Institution Meet the need for additional capital according to many business situations: no collateral, newly established, not eligible for bank loans

- Enterprises monitor the limit balance at all credit institutions and available balance to balance appropriate capital use.

- In addition, businesses can combine using other Bizzi products to manage costs, debts, and automatically process input invoices to save operating costs.

Steps to connect with Bizzi Financing to borrow capital

- Step 1: Businesses need to register an account on the Bizzi Financing platform and provide basic information about the business, including company name, tax code and contact information. Register information to use Bizzi Financing here: https://finance.bizzi.vn/

- Step 2: Submit your profile and financial documents. After registering an account, businesses need to submit financial documents such as tax reports, financial reports, and balance sheets so that the system can automatically assess their financial situation.

- Step 3: Wait for approval. Businesses will receive notification of approval results via email or on their Bizzi Financing account.

- Step 4: Sign the contract and receive disbursement. Once approved, the business will sign the loan contract and the loan will be disbursed directly to the business's bank account within 1-2 working days.

9. Conclusion

The year 2024 opens up many opportunities for businesses to access diverse and suitable sources of capital. From unsecured loans, mortgage loans, to bond issuance, these forms of business borrowing have their own advantages and disadvantages. Businesses need to carefully consider and choose the most suitable borrowing method for their financial situation and development strategy.

Bizzi Financing is an innovative financing solution, suitable for small and medium-sized enterprises, especially startups that need quick capital and do not want to be bound by many collateral constraints. With a simple, transparent process and fast approval time, Bizzi Financing is gradually becoming an attractive lending option for businesses in 2024, giving them more flexibility in meeting their financial needs and sustainable development.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam