ROI is the lifeblood of any automation project. No ROI demonstration = No approval, no matter how good the technology is. Understanding how to calculate ROI (Return on Investment) for an automation project is extremely important. This is the basis to demonstrate financial value, make informed investment decisions, allocate budgets effectively, optimize resources, thereby ensuring the project brings real profits instead of just costs..

Why is ROI a “life or death” issue when implementing automation?

In every automation project (AP/Invoice/ERP/Workflow/AI…), ROI is not a “plus point”, but a condition for survival. Because everyone says it’s more economical – faster – more efficient, but leaders only make decisions when they see the real numbers and a clear payback period.

Why is understanding the nature of automation project ROI calculation key?

ROI in automation projects is important because:

- CFOs don't buy technology – they buy measurable financial value

Without proving ROI with data, automation will be considered a cost, not an investment. No matter how good the technology is, it will fail if it cannot solve the financial problem.

- 70% automation project failed

Not because of poor technology, but because:

- Not defining KPIs before implementation.

- Does not calculate Cost per Invoice, FTE saving, hidden costs.

- No proof of how much money is actually saved.

Result: Projects are stopped midway – or not scaled.

- Leaders need direct answers to three vital questions.

| CFO / CEO Questions | How automation should respond |

| “How many FTEs saved?” | How many hours and how many staff to reduce? |

| “How long does it take to pay back?” | 3 months? 6 months? 12 months? |

| “What is the total cost of ownership?” | Subscription + deployment + operations |

How to distinguish real ROI and virtual ROI

| Virtual ROI | Real ROI |

| “Productivity increased by 300%” | “From 400 → 4,000 invoices/month, reduce 3 FTE (~45–60 million/month)” |

| “Reduce processing costs drastically” | “CPI reduced from 45,000 VND → 12,000 VND/invoice, saving 33,000 VND/invoice” |

| “Shorten processing time” | “Reduce from 10 days → 2 days, reduce penalty fees & take advantage of 2% discount from supplier” |

The Strategic Value of Calculating Automation Project ROI

Real ROI is money, not feelings.

- ROI helps CFOs confidently sign off.

- ROI helps the chief accountant defend the project before the BOD.

- ROI helps SMEs know if automation is worth the money.

Without a clear ROI, the project remains on paper.

What is ROI Automation Index?

ROI measurement real currency value You get what you pay for, not just “feeling faster” or “less people.”

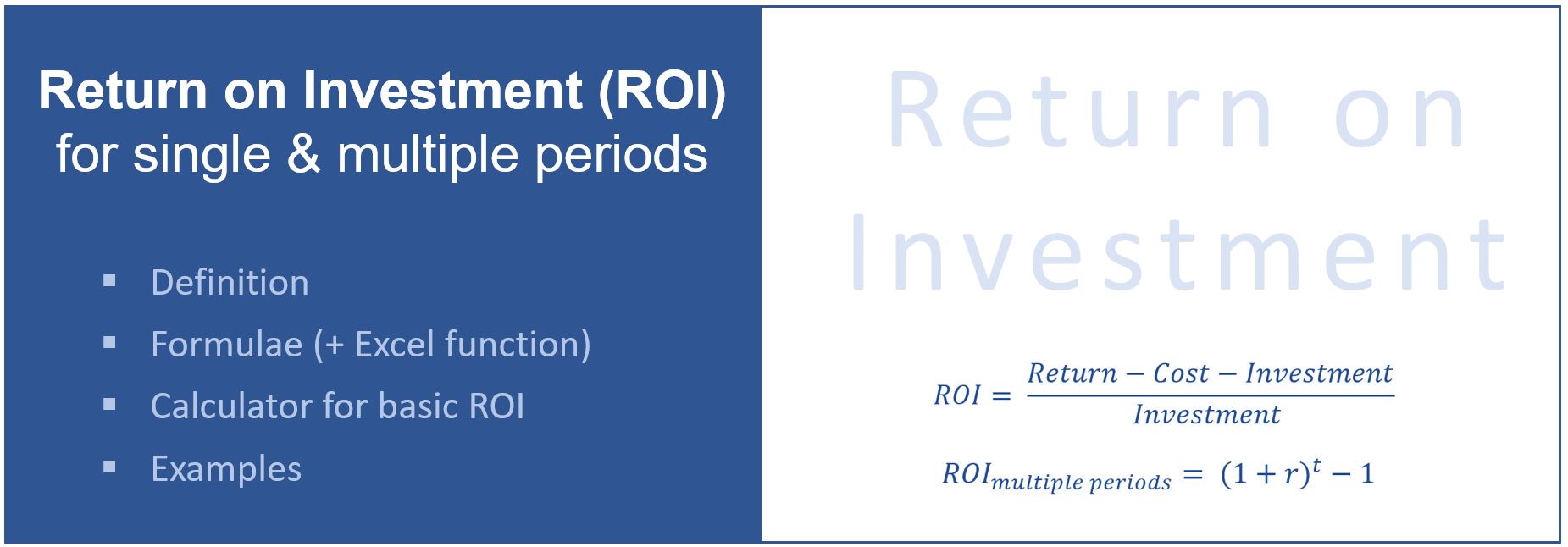

1. Defining ROI in Automation

ROI (Return on Investment) In automation, ROI is a measure of the financial benefits a business receives compared to the total cost invested in the automation solution.

With automation projects (Automation / AP Automation / Invoice Automation / RPA / ERP), the benefits do not stop at saving on personnel costs, but also include:

- Reduce cycle time

- Reduce errors – reduce error correction costs & compliance risks

- Reduce storage & audit costs

- Optimize cash flow, increase the ability to pay on time

- Increase productivity without increasing staff

That is, automation creates direct value + indirect value, all of which must be converted into money.

- Standard FP&A ROI calculation formula

ROI= (Annual Net Benefit/Total Implementation Cost) ×100%

In there:

- Annual net benefit = (FTE Savings + CPI Reduction + Payment Discount Benefits + Risk Reduction + Storage Cost Reduction) − Operating Costs

- Total implementation cost = technology fee + implementation fee + integration fee + training fee

How CFOs look at ROI: ROI must answer: for every $1 the business spends, how much will it earn and in how long?

3. Avoid confusion

ROI Automation = Financial problem, not technology problem.

Without demonstrating ROI in monetary terms, it is difficult to get a project approved.

| Misunderstanding | Understand correctly |

| ROI = saved working time | Time saved must be converted into monetary value. |

| ROI = reduced workload for the accounting department | ROI measures FTE (Full-time Equivalent) savings |

| ROI = feeling more productive | ROI must be proven by data. |

| Technology cost only | Must also consider TCO: total long-term cost of ownership |

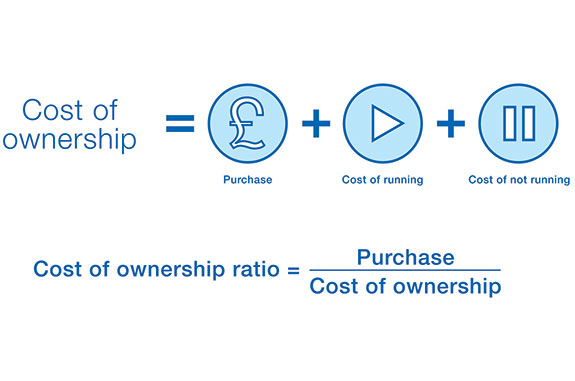

Total cost of an automation project

To evaluate whether an automation project is worth investing in or not, we must calculate TCO – Total Cost of Ownership, not just looking at the license price or initial cost, in addition to calculating ROI of the automation project. Many projects fail because they only calculate tangible costs, ignoring indirect and opportunity costs.

1. Initial investment costs (CAPEX)

These are often easy to calculate and quoted by the vendor, but are just the tip of the iceberg.

| Category | Meaning |

| Software License / First Year Subscription | Initial solution purchase cost |

| Implementation costs | Survey, configuration, onboarding |

| System integration costs (ERP/Accounting/HRM/Banking API) | Data connection and system synchronization |

| OCR / AI / RPA Cost | Data processing automation technology |

2. Operating Expenses (OPEX)

This is a long-term cost that directly impacts TCO in 1–3 years.

| Category | Meaning |

| Cloud & Infrastructure Maintenance Costs | Server, storage, bandwidth |

| Annual support & maintenance fee | Technical support & version upgrades |

| Internal operating costs | Operation and supervision staff |

| Additional fees for increasing users/volume | Scaling up processing |

3. Conversion costs

If this part is underestimated, the project is likely to fall behind schedule or not be accepted by the staff.

| Category | Meaning |

| Training & transfer costs | Train staff & develop new SOPs |

| Rewrite procedures (SOP) | Re-engineering process |

| Downtime costs | Reduce processing speed during the transition period |

4. Opportunity cost

This is the part that many businesses not included in ROI calculation, leading to Virtual ROI.

| Category | Financial impact |

| Loss of early payment discount | Lost 1–2% invoice value |

| Delayed approval results in lost opportunity to negotiate with vendor. | Reduced negotiating benefits |

| Slow cash flow → increased cost of capital | Financial pressure and borrowing costs |

| Slow processing leads to errors ↠ tax penalties / audits | Compliance risk |

5. Total Cost of Ownership – TCO

TCO=CAPEX+OPEX+Change Cost+Opportunity Cost

This is the most important metric for CFOs., because:

- For a look total 1–3 years, not just the initial cost.

- As a basis for comparing different technology solutions.

- Helps decide investment priorities and profitability Payback Period.

Benefits that should be factored into ROI Automation

True ROI does not only take into account the savings in human resources, but also takes into account the full range of financial, operational, strategic and long-term benefits.

1. Direct benefits – Can be converted into money

Here are some benefits that CFOs can measure right away – accounts for 60–70% of ROI value in the first year, often used to calculate initial ROI:

| Category | Meaning | Value conversion |

| Reduce personnel costs (FTE) | Reduce manual labor in processing invoices | FTE reduction × average salary cost |

| Reduce business processing time | Faster approval process, less waiting | Reduce cycle time |

| Reduce errors – reduce compliance costs | Avoid incorrect invoices, tax penalties, late payments | Average Annual Fines & Damages |

| Reduce the cost of processing a single invoice (CPI) | The metric CFOs care about most | For example: from 50,000 VND → 5,000 VND / bill = 90% discount |

2. Indirect benefits – CFOs are extremely interested

Many CFOs consider indirect benefits to be greater than direct benefits. However, they cannot be ignored because of the great impact on governance and risk:

| Category | Impact |

| Increase data quality | Make accurate decisions, avoid accounting errors |

| Speed up decision making | Real-time data → faster month close |

| Reduce the risk of internal fraud | Have clear, transparent approval log |

| Increase confidence with audits & taxes | Limited collection, convenient audit |

3. Strategic benefits – RARE ATTRIBUTE

This factor is very important for fast-growing or multi-branch businesses, making automation a growth lever, not just a cost-saving one:

| Category | Result |

| Increase negotiation capacity with vendors | Data transparency → better negotiations |

| Shorten DSO / improve cash flow | Optimize payments – get early discounts |

| Scale without increasing staff | Double the number of invoices without adding FTEs |

4. Long-term benefits – FP&A Best Practice from FP&A

| Category | Long-term impacts |

| The foundation for building modern FP&A | Enables real-world data-driven planning |

| Rolling Forecast / Real-time dashboard | Make decisions in real time, instead of historical data |

| Standardize digital operating procedures | Ready for ERP / AI / Data lake of the future |

Different types of automation projects and their ROI

AP Automation is always the best starting point to demonstrate real ROI, creating the basis for expanding to full Procure-to-Pay automation. Not all automation projects have the same ROI. CFOs should prioritize projects with immediate measurable financial benefits, then expand to strategic projects.

1. AP Automation – Fastest ROI

This is the type of automation that CFOs choose first because it brings real money the fastest.

- Financial impact: direct – immediately measurable

- Payback period: < 3–6 months

- Key ROI Value:

- Reduce 70–90% invoice processing workload (input & payment)

- Reduce CPI from 50,000 VND → 5,000 VND / bill

- Reduce errors, reduce tax penalties

- Take advantage of early payment discounts → improve cash flow

Suitable for: Businesses with many invoices, many branches, retail, F&B, logistics, manufacturing

2. Workflow Automation

ROI depends on process complexity and current level of process standardization.

- Impact: improved operations, approval transparency

- Payback period: 6–12 months

- ROI comes from:

- Shorten approval cycle time from several days to 1–2 hours

- Reduce coordination costs between departments

- Increase accountability & traceability

- Reduce the risk of internal fraud

3. RPA Automation

- Payback period: 9–18 months

- Key benefits:

- Reduces large manual operations time (data entry, data transfer)

- 24/7 operation, no errors

- Disadvantages that affect ROI:

-

- High cost of maintenance, system updates and changes

- Best ROI when applied to a stable process

ROI is high but prone to decline if the process keeps changing.

4. Procurement Automation

Often deployed after AP automation to optimize end-to-end Procure-to-Pay.

- Payback period: 12–18 months

- ROI comes mainly from:

- Reduce inventory, accurately forecast demand

- Optimize price negotiations with transparent data

- Contract control & cost leakage reduction

5. HR & Payroll Automation

ROI is most evident in accuracy & operational efficiency, not FTE savings.

- Payback period: 6–12 months

- ROI comes from:

- Reduce payroll errors → reduce complaints, increase employee satisfaction

- Reduce 60–80% data entry & synthesis time

- Automate onboarding/offboarding

CFO Standard Automation Project ROI Calculation Process

Correct ROI = convert all benefits into money, including direct + indirect + strategic + opportunity. Not measuring ROI = hard to convince the management, no matter how good the automation is.

Step 1 – Measure baseline before automation

The goal of this step is to determine actual data as a basis for comparison after automation. The more accurate the baseline, the more realistic the ROI.

| Index | Meaning |

| Processing time for 1 transaction / invoice | Current average cycle time |

| Cost per Invoice (CPI) | Average cost to process 1 invoice |

| Number of FTEs involved in the process | Direct/Indirect Human Resources |

| Current error rate | % error, exception needs to be rehandled |

Step 2 – Identify KPIs of the automation project

This is a direct post-implementation performance measurement step.

| KPI | Meaning |

| Automation Rate (%) | % transactions are processed completely automatically |

| % Reduce Exception | Reduce errors and exceptions in the process |

| Throughput / productivity increase (%) | How much does processing volume and staff increase? |

Step 3 – Calculate the annual financial benefit

Basic formula:

Financial Benefits = (Time Saved x Labor Cost) + Indirect Benefits

Indirect benefits may include:

- Reduce tax penalty / compliance risk

- Speed up decision making / improve cash flow

- Increase data transparency, reduce internal fraud

Step 4 – Calculate the sum project costs (TCO)

TCO=CAPEX+OPEX+Conversion cost+Opportunity cost

| Ingredient | Specific examples |

| CAPEX | License, deployment, system integration, OCR/AI |

| OPEX | System maintenance, cloud, support, upgrade |

| Conversion costs | Training, SOP writing, downtime during conversion |

| Opportunity cost | Lost payment discount, longer DSO, lost deal opportunity |

Step 5 – Calculate ROI and Payback Period

Standard ROI formula:

ROI (%)= (Annual Net Benefit/TCO) x 100%

Payback Period:

- Payback period = TCO / Annual Net Benefit

- Normally: 3–12 months, depending on the type of automation and the size of the project.

Standard KPIs to evaluate Automation effectiveness

These KPIs help CFO, Chief Accountant, FP&A Demonstrate ROI and track automation project performance transparently.

1. Cost per Invoice (CPI)

- Define: Average cost to process 1 invoice / transaction.

- Meaning: The most important KPI to demonstrate direct cost savings.

- How to measure: CPI = Total invoice processing cost / Number of invoices to process

2. Cycle Time Reduction (%)

- Define: % reduces processing time from receipt to completion of transaction.

- Meaning: Measure process speed, shorten invoice lifecycle.

- How to measure: Cycle Time Reduction (%)= (Baseline Cycle TimeBaseline Cycle Time – Cycle Time After Automation)/ Baseline Cycle Time ×100%

3. Exception Rate

This KPIs index Reduce errors, increase accuracy to reduce error correction costs and compliance risks. Formula: Exception Rate = (TPercentage of invoices/transactions that need to be reprocessed due to errors or exceptions).

4. Automation Coverage (%)

This is % transactions processed automatically without manual operation. The meaning of this index is to measure the level of technology application and workflow automation efficiency.

5. FTE Reduction / FTE Reallocation

This KPI shows number of people saved or reallocated to high-value work. Human resource ROI is the data that directly demonstrates cost savings.

6. Accuracy Improvement

Definition of Accuracy Improvement is the Correct/Accurate Ratio after automation. The meaning of this KPI is to increase data quality, reduce the risk of tax penalties and internal fraud.

In short, the more specific the KPIs are, the more convincing the ROI will be, making the project more likely to be approved.

What are the risks in calculating ROI of automation projects?

Automation projects fail not always because of technology, but often because ROI is not calculated properly. ROI calculation must be based on real data, baseline measurement, and fully account for direct and indirect costs and benefits. Note that “phantom ROI” must be avoided so that CFO & FP&A can make accurate decisions.

1. Calculate ROI based on intuition, not baseline measurement

- No real data before implementation → ROI is easily illusory.

- For example: “Staff will be reduced by 3 people” but not measuring current workload → wrong forecast.

2. The FTE savings illusion

- FTEs are reported to decrease but in reality workload increases or is just reallocated to other work.

- Consequence: CFO sees low ROI, difficult to convince management.

3. Ignore switching costs (Change Management)

- Includes: training, writing new SOPs, downtime during process transition.

- If ignored, ROI is lost. inflate, leading to disappointment when the project is actually implemented.

4. Poor input data leads to automation giving wrong results

- Automation depends on accurate input data.

- Poor data = incorrect output = low actual ROI.

- For example: OCR misreads invoice information → exception rate increases, CPI does not decrease as expected.

5. ROI expectations are too high

- Set a target of saving 100% FTE or reducing 90% CPI in all processes → difficult to achieve in reality.

- Consequence: Management was disappointed and the project was stopped, even though automation still brought significant benefits.

How does Bizzi solution help increase ROI Automation?

1. The strongest cost per invoice reduction in the market

Bizzi optimizes the entire invoice processing process by:

- Automatically download invoices

- Automatic OCR – AI extraction

- Automatic reconciliation of PO – GR – Invoice

- Automatically check MST, risk invoice

Thanks to that, businesses can reduce sharply CPI from 50,000 VND down to 3,000-5,000 VND/bill, outperforming other solutions on the market. This is a direct and measurable benefit, helping ROI increase sharply from the first year.

2. Real FTE reduction (not “fake savings”)

With Bizzi, a staff can process 300–500 invoices/day, instead of just 30–50 manually. This not only reduces direct labor costs but also frees up human resources to focus on higher-value tasks, ensuring real ROI, avoiding the “FTE illusion” that is common in other automation projects.

3. Reduce tax penalty risk (a big pain point for CFOs)

Bizzi is a financial assistant who helps accountants find out:

- Detecting incorrect invoices at the wrong time

- Duplicate/illegal invoice warning

- Limit the risk of fines of 20-50 million according to Decree 125

This risk management capability not only protects the business legally, but also creates indirect value in ROI, increasing peace of mind for the CFO and management.

4. Feed standard data to FP&A

Bizzi Expense combines IPA to provide data real-time, accurate and complete, helping FP&A calculate accurate ROI, budget, and build reliable forecasts. This data also supports strategic decision-making, from controlling costs to optimizing cash flow, turning automation into comprehensive financial management support tools, not only saving but also creating competitive advantage.

FAQ –The most frequently asked questions by users related to how to calculate ROI of automation projects

Users interested in calculating Return on Investment (ROI) for automation projects often look for answers to the following key questions:

1. How to calculate ROI automation?

ROI is calculated by FP&A standard formula:

ROI (%)= (Annual Net Benefit/Total Cost of Ownership) * 100%

In there:

- Annual net benefit = (Time saved × Labor cost) + Indirect benefits (reduced errors, increased approval speed, improved cash flow)

- TCO = CAPEX + OPEX + Conversion costs + Opportunity costs

For accurate ROI, it must be measured. baseline before automation and fully calculate direct & indirect costs and benefits.

2. How long does it take to payback an automation project?

Pay Back time depends on the project and scale, usually lasting from 3–12 months. In there:

- AP Automation: fastest, usually < 6 months.

- Workflow / RPA / Procurement / HR Automation: 6–18 months, depending on complexity and level of data normalization.

3. Does Automation really help reduce human resources?

Have, but must distinguish:

- Actual FTE savings: Real workload reduction, staff can process more invoices.

- Virtual FTE: In case workload is not reduced but only work is reallocated → ROI is less than expected.

For example, Bizzi allows 1 person to handle 300–500 invoices/day instead of 30–50, is a real FTE reduction.

4. How much ROI should be implemented?

- There is no fixed number, but ROI > 100% in 1–2 years and Payback < 12 months is usually a reasonable benchmark.

- The higher the ROI and the shorter the payback period → the more worth implementing the project.

5. Is AP Automation ROI fast?

- Have, AP Automation is always Automation projects with the fastest ROI.

- Reason:

- Dramatically Reduced Cost per Invoice

- Reduce direct FTE workload

- Take advantage of early payment discounts

- Shorten cycle time and reduce errors

This is considered the reason why many CFOs choose to start with AP Automation to demonstrate ROI from the first year.

Conclude

To understand the nature of how to calculate ROI of automation projects, leaders need to clearly understand the structure of costs - benefits - conversion mechanism to monetary value. For ROI Automation to be truly positive and measurable, businesses need to adhere to the golden rules:

- Standardize the process before automating: Clear, logical, standardized processes help automation run smoothly, reduce exception rates, and avoid wasted costs.

- Measure baseline carefully before implementation: Data on processing time, cost per invoice, FTE, error rate… are the foundation for calculating accurate ROI.

- Full TCO calculation – no hidden costs

- Includes CAPEX, OPEX, conversion costs, opportunity costs.

- ROI is only reliable when it reflects all costs and all benefits.

Choosing the right automation tool – Bizzi – helps achieve the fastest ROI in the AP Automation & Expense Control group. Bizzi is trusted by many Vietnamese businesses thanks to:

- Strongest CPI reduction in the market (from 50,000 VND → 3,000–5,000 VND/bill)

- Real FTE reduction, not “fake savings”

- Reduce tax penalty risk, increase compliance

- Feed standard data to FP&A, serve accurate forecasts and budgets

Bizzi is a reputable choice for AP Automation and Expense Control in Vietnam. Register now to experience specialized solutions for your business: https://bizzi.vn/dat-lich-demo/https://bizzi.vn/