During the operation process, the occurrence of bad debts is an inevitable problem for many businesses. If there is no timely and effective solution, these debts can seriously affect the cash flow, business performance and even the existence of the business. So what is how to handle bad debt both comply with the law and ensure the rights of businesses? The following article is from Bizzi will provide specific processing steps, from debt review, negotiation, to appropriate legal and accounting solutions.

1. What is bad debt?

Bad debts (also known as bad debt) are receivables from customers that a business has difficulty collecting, with a very low probability of collecting in full or on time. This is an inevitable part of business operations, especially if the business does not have an effective debt management process. According to accounting standards, bad debts are often recorded as a type of expense and need to be appropriately provisioned to ensure the integrity of financial statements. Understanding the causes and impacts of bad debts is the first step in how to handle bad debt effective.

1.1 Common causes of bad debt

Bad debts not only come from objective factors but can also come from errors in internal management processes. Below are common reasons why businesses have difficulty in debt collection:

- Customer is insolvent: Due to bankruptcy, prolonged losses, or serious decline in income, making it impossible to fulfill financial obligations on time.

- Unclear contracts: Terms are not strict, lack legal binding, leading to difficulty in claiming or disputes.

- No customer credit assessment: Lack of information about payment history and financial situation causes businesses to accept too much risk.

- Poor debt management process: Lack of monitoring tools, periodic reminders or unsystematic debt collection process.

- Market fluctuations and force majeure factors: Economic crisis, epidemics, natural disasters can cause customers to fall into financial crisis.

- Fraud or intentional delay: Some subjects take advantage of trust to avoid debt repayment obligations, intentionally prolonging the time of capital appropriation.

1.2 Impact of bad debt on businesses

Bad debt not only affects cash flow but also negatively impacts all aspects of a business's operations and long-term development strategies:

- Cash flow interruption: Tworking capital shortage to maintain operations, pay operating costs, pay salaries, import goods, etc.

- Limited ability to reinvest: Unable to scale, improve products or upgrade technology.

- Increased legal processing costs: Including attorney fees, court costs, negotiation costs or debt collection litigation.

- Loss of reputation in the market: Partners, investors and customers may be apprehensive, demanding stricter terms.

- Impact on business credit score: Difficulty in borrowing from banks or being charged high interest rates.

- Negative impact on human resources: Unstable financial situation causes psychological insecurity and reduces work performance.

Bad debt is an inevitable problem, but it can be managed and limited if businesses apply the right measures. how to handle bad debt such as building a professional collection process, controlling credit risk, and regularly assessing the quality of receivables. In the next section, we will explore in detail the bad debt handling methods that businesses can apply.

2. Popular methods of handling bad debt

Businesses need to carefully consider the pros and cons as well as the complexities of implementing each debt settlement option.

2.1. Provision for bad debt

To minimize risks and financial losses, setting aside a bad debt provision is one of the most effective and proactive ways to handle bad debt that businesses should apply. This not only helps to accurately reflect the financial situation but also complies with current legal regulations. Here are some points to note:

- Definition: Setting up a provision for bad debts is when a business proactively records an expense to reserve for possible losses from receivables that are unlikely to be recovered.

- Conditions for setting up provisions (according to Circular 200/2014/TT-BTC, Circular 228/2009/TT-BTC and Circular 48/2019/TT-BTC):

- There is evidence to prove that the debt is bad such as: the debtor is missing, bankrupt, prosecuted or dead.

- Debt that is overdue for payment under a contract, loan agreement or debt commitment.

- Have full original documents and debt reconciliation confirmation from debtors.

- Provisioning method:

- Businesses must determine the age of debt and the potential loss for each debt.

- Specific deduction level:

- Overdue from 6 months to < 1 year: 30%.

- From 1 to < 2 years: 50%.

- From 2 to < 3 years: 70%.

- From 3 years and up: 100%.

- For debts that have not yet matured but the debtor has fallen into a serious situation (bankruptcy, missing, etc.): provision is made according to the expected loss level.

- Retail and telecommunications businesses: have separate instructions for debts overdue for 3 months or more.

- Accounting:

- When setting up: Debit account 642 - Business management expenses; Credit account 2293 - Provision for doubtful debts.

- When reversing (debt is recovered or no longer needs provision): Debit account 2293; Credit account 642.

- Note to perform:

- The provision must be accompanied by a detailed list of debts and related evidence.

- Businesses need to regularly update and re-evaluate debts to adjust appropriate provisions.

Making provisions is not only the first step in handling bad debts, but also helps businesses proactively protect their finances, improve reporting transparency and ensure compliance with Vietnamese accounting standards.

2.2. Handling bad debts through professional debt collection services

One of the effective and time-saving ways to handle bad debts for businesses is to use a professional debt collection service. This is a legal solution, chosen by many companies when they have difficulty in recovering outstanding debts from customers or partners who are slow to pay. Below are common forms and important factors to consider when choosing a debt collection partner:

- Common forms of operation: Including debt collection consulting (guiding businesses on how to approach and handle debt), debt collection by phone (professional debt reminder calls) and debt collection detective services (tracking down evading subjects). Depending on the severity and value of the debt, businesses can choose the appropriate form to increase the ability to recover capital.

- Ensuring legality and reputation: Professional debt collection companies must be licensed, comply with the law and have a clear customer information confidentiality policy. Using a reputable unit helps ensure that the debt collection process does not affect the reputation or partnership of the business.

- Specialization in each debt area: Each debt collection agency usually has its own strengths, such as handling bank debt, business-to-business (B2B) debt, or debt from small businesses. Businesses need to choose the right agency with experience with the corresponding debtor group to achieve optimal efficiency.

- Ability to monitor and negotiate: Bad debtors often deliberately avoid contact. Therefore, service providers need to have skills in monitoring, understanding behavior and negotiating skills to force the subjects to cooperate without causing legal conflicts.

- Costs and contingencies: Businesses need to carefully consider the amount of debt they want to collect and the cost of their services. Debt collection agencies typically charge a flat fee or a percentage of the amount collected. The actual amount received will certainly be less than the original value of the debt, so careful calculations are needed to achieve financial efficiency.

Using professional debt collection services is one of the strategic ways to handle bad debts and control risks. With support from reputable partners, businesses can improve cash flow, reduce financial pressure while still protecting their brand image in the market.

2.3. Initiating a lawsuit

When all measures of reminder, negotiation or bargaining fail to bring results and the debtor is not willing to cooperate, the enterprise should consider the last option: filing a lawsuit to recover bad debts. This is a necessary step to protect legal rights and minimize financial losses.

- Statute of limitations: According to the provisions of the Commercial Law, the statute of limitations for filing a lawsuit to request the court to resolve disputes related to bad debts arising from contracts is 2 years from the date the legitimate rights and interests of the enterprise are violated. Missing this time limit causes many enterprises to lose the right to file a lawsuit, especially when they still hope for negotiation.

- Common harmful psychology: Many businesses tend to delay filing lawsuits with the mentality of “let’s wait a little longer” or “while there’s still life, there’s still hope”. However, prolonging the time will increase legal risks and affect the ability to recover debts.

- How to reset the statute of limitations: In some cases, a business may still be able to re-establish a new statute of limitations, if there is evidence that the debtor has acknowledged the obligation. Actions that may help re-establish the statute of limitations include:

- The debtor acknowledges part or all of the obligation to pay the debt.

The debtor has partially performed an obligation (such as paying part of the debt). - The two parties agreed to reconcile, with a record of confirmation.

- The debtor acknowledges part or all of the obligation to pay the debt.

- Documents as evidence: Enterprises should keep legally valid documents such as debt reconciliation records, payment agreements, debt confirmations, etc. to prove the establishment of obligations and serve the lawsuit process later.

2.4. Write off bad debts

Writing off bad debts is one of the important steps in the process of handling irrecoverable debts to ensure financial transparency and compliance with accounting regulations. Doing it correctly not only helps businesses minimize losses but also avoid audit and tax risks. Below are detailed instructions on how to handle bad debts in accordance with legal regulations:

- Correctly identify bad debt objects: Including debts that are overdue or not yet due but fall into the following cases: the debtor enterprise has dissolved or gone bankrupt; the debtor individual has died, gone missing, is being prosecuted or has lost civil capacity; debts that have been provisioned for 100% but have been over 3 years (or 1 year for telecommunications and retail debts) and are still not recoverable.

- Prepare complete supporting documents: Enterprises need to keep documents such as economic contracts, debt reconciliation documents, debt collection documents with delivery confirmation, bankruptcy decisions of the Court, death certificates or related legal documents depending on whether the debtor is an organization or an individual.

- Authority to decide on debt cancellation: Bad debts can only be handled with a valid decision from the Board of Directors, Board of Members, Chairman of the Company, General Director or other authorized representative. The decision must be based on the minutes of the Handling Council and have full supporting documents.

- How to handle finances when clearing debt: Enterprises use the provision for bad debts to compensate for losses, the difference is accounted for in the enterprise management costs. Debts that have been written off must continue to be monitored in the financial statements for at least 10 years and recovery measures must continue to be implemented if possible.

- Accounting for debt cancellation transactions: Based on the debt cancellation decision, the accountant records Debit Account 229 (established provision), Debit Account 642 (management expenses), or the accounts of organizations/individuals that must compensate. Credit Accounts 131, 138, 128, 244 corresponding to the canceled debt. In case the enterprise recovers the canceled debt, record the income in Account 711 - "Other income" after deducting related expenses.

2.5. Debt sale

In case the debt cannot be recovered, the enterprise can consider selling these debts to bad debt purchasing companies.

This is a solution to help reduce the financial burden, although it may mean accepting the sale of debt at a price lower than its actual value.

Accounting for sale of overdue receivables:

- Case of overdue receivables without provision: Debit accounts 111, 112 (according to agreed selling price); Debit account 642 - Business management expenses (loss from debt sale); Credit accounts 131, 138, 128, 244….

- In case of overdue receivables, provisions have been made but the provision is not enough to cover the loss when selling the debt.: Debit accounts 111, 112 (according to agreed selling price); Debit account 229 - Provision for asset loss (2293) (amount of provision made); Debit account 642 - Business management expenses (amount of loss from debt sale); Credit accounts 131, 138, 128, 244….

3. Avoid bad debt from the start

Preventing bad debt from the start is one of the most effective strategies for dealing with bad debt for businesses. When accounts receivable are tightly controlled in advance, businesses can minimize the risk of losing cash flow and maintain stable business operations. Below are proactive measures to help prevent bad debt effectively:

- Thoroughly assess customers before trading: Businesses should check the financial situation, credit history and reputation of their partners through financial reports, assessments from banks or credit data providers.

- Build a clear and complete contract: The contract should specify payment terms, late payment penalties, sanctions and forms of security such as deposits, bank guarantees or credit insurance.

- Establish internal credit policy: Businesses need to clearly define credit limits, maximum payment terms and debt approval processes for each type of customer based on risk level.

- Require deposit or prepayment for new customers or customers with poor payment history: This helps to minimize cash flow pressure and the risk of bad debt.

- Regular debt monitoring and timely reminders: Use accounting or debt management software to update payment status in real time, and send debt reminders according to the correct procedure for timely processing.

- Classify debtors to have separate management plans: Customers with a history of late payments should be monitored more closely, while reputable customers may be offered more flexible credit policies.

- Build long-term and trusting relationships with customers: When there is a good relationship foundation, businesses can easily negotiate extensions or find solutions to handle debt before having to resort to legal measures.

- Periodic assessment of debt management effectiveness:Reviewing overdue debts, monitoring cash flow and updating credit policies will help businesses adjust their strategies to suit the actual situation.

- Apply for credit insurance or bank guarantee: This is a tool to help businesses protect their finances in case customers become insolvent.

- Integrate debt control into the sales process: Sales staff need to be trained to understand credit regulations and coordinate with the accounting department to limit the risk of bad debt arising from the sales stage.

Proactively preventing bad debts not only helps businesses protect cash flow but also contributes to enhancing reputation, increasing financial management efficiency and reducing pressure in handling future debts. This is the first but decisive step in effectively and sustainably handling bad debts for all businesses.

4. Applying technology in managing and handling bad debts: Bizzi solution

The Bizzi platform provides an AI assistant for the finance and accounting department in automating the revenue and expenditure process and is a multi-featured integrated platform that helps businesses streamline and automate the cost management, debt collection and B2B payment processes.

4.1 Bizzi's Accounts Receivable Management (ARM):

As an AI assistant for the finance and accounting department, Bizzi provide comprehensive solutions to automate debt management process and business revenue and expenditure. With more than 30 smart features, the platform supports businesses:

- Automatic debt reminder: Set up email or message sending scenarios for each target and time, minimizing overdue debts.

- Debt control effective: Track receivables and payables, analyze key metrics such as DSO, debt aging reports.

- Track details of each customer and supplier: Automatically record new debts, track payment progress, and easily reconcile when needed.

- Debt due warning: The system sends early warnings about accounts that are about to become due or are at risk of being overdue, helping businesses handle them promptly.

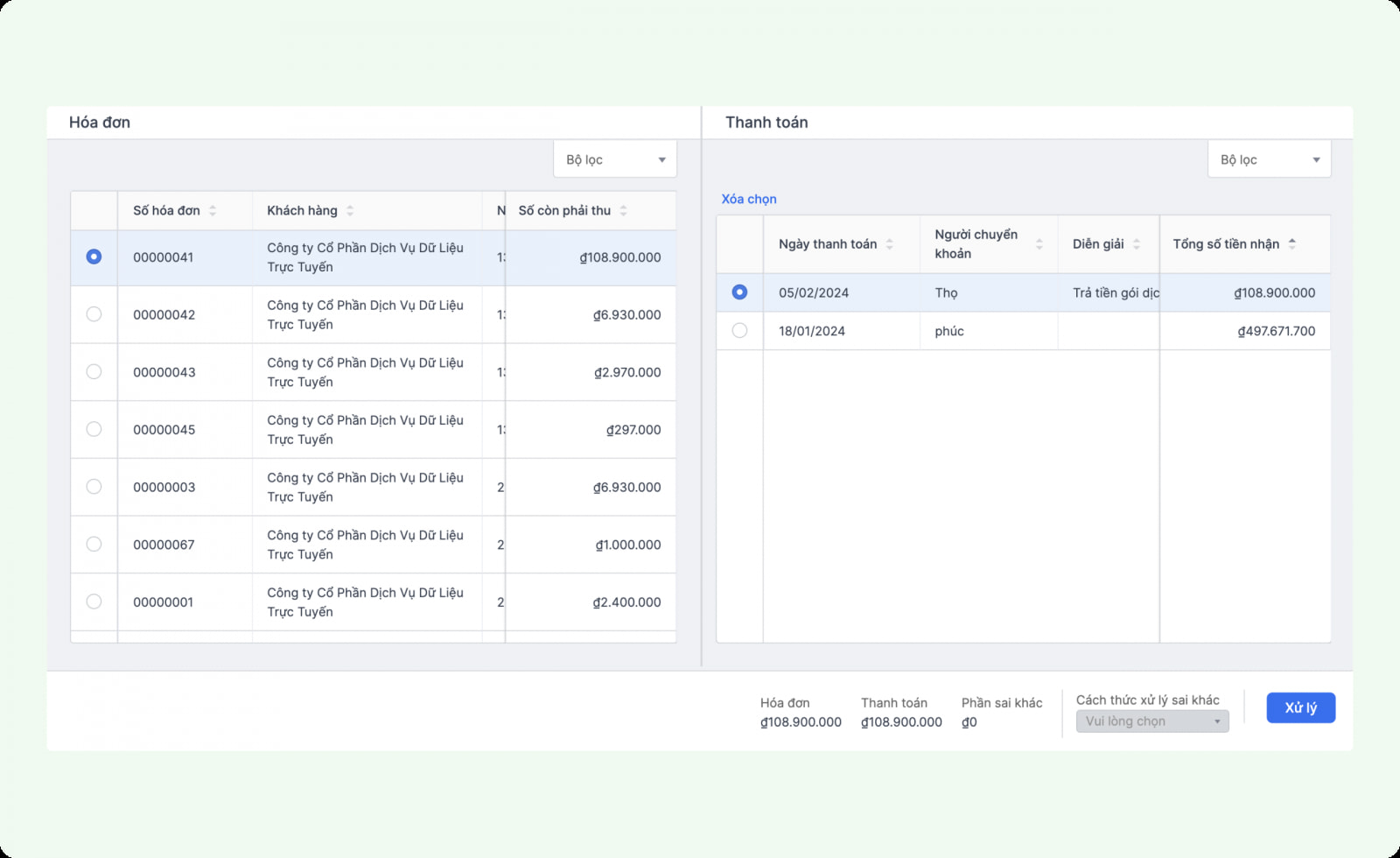

- Quick debt reconciliation: Compare and confirm debt balances between businesses and partners accurately and transparently.

- Flexible debt reporting: Create customized reports by period, by subject or debt type, serving financial management and control.

In addition, Bizzi also supports many other tasks such as processing input invoices using IPA + 3way matching technology, managing electronic invoices (B-invoice), helping businesses optimize the entire accounting - financial process.

4.2 Other Bizzi features that support related financial management

To solve complex financial problems such as bad debt handling, businesses need a comprehensive support platform in cash flow management, cost control and ensuring transparency in invoice reconciliation. Bizzi provides a powerful toolkit with many features directly related to debt control, helping accountants and business owners proactively prevent and handle bad debt effectively:

- Processing, reconciling and managing input invoices (IPA + 3Way): The system automatically checks invoices against purchase orders (POs) and warehouse receipts (GRs), detects unusual discrepancies, verifies valid suppliers, and alerts to risky invoices – all to prevent errors and fraud at an early stage, thereby minimizing the risk of bad debts.

- Business expense management (Bizzi Expense): Helps businesses set budgets for each department or project, track costs in real time, and control expenses through an automated approval system. As a result, invalid or over-budget payments are strictly controlled, contributing to minimizing debt arising from unplanned expenses.

- Electronic bill (B-invoice): Create, export and store electronic invoices in accordance with legal standards; easily look up, track transaction history and quickly compare with accounting or ERP systems. Transparency and automation in invoices help limit disputes, shorten debt collection time and reduce overdue debt rates.

Overall, Bizzi not only supports businesses in debt settlement but also proactively helps prevent bad debts from the early stages by strictly controlling expenses, legalizing transactions and increasing financial transparency. This is a comprehensive solution to help businesses build a sustainable financial management foundation.

5. Legal responsibility when handling bad debt

Failure to collect receivables not only directly affects cash flow and business results but also entails serious legal liability for individuals and related departments. To properly handle bad debts and avoid legal risks, businesses need to pay attention to the following:

- Issue regulations on receivables management: Enterprises need to develop and implement regulations on receivables management, which clearly define the responsibilities of each department and individual related to monitoring, classifying, urging and collecting debts.

- Open a debt tracking and classification book: Debts need to be monitored in detail for each customer or debtor, and regularly classified by term (not yet due, due, overdue, difficult to collect, irrecoverable) to promptly take appropriate measures.

- Manager Responsibilities: The Board of Members, Chairman of the Board of Members/Company, Director/General Director must be responsible for handling bad debts and irrecoverable debts. In case of failure to handle them promptly, they may be subject to disciplinary action depending on the level of impact on the company's finances.

- Consequences of slow or no processing: If the business owner has to be reminded in writing multiple times, or the slow handling negatively affects the company's finances, the individuals involved may be subject to disciplinary action. More seriously, if the loss of capital to the business is caused, the responsible person must also compensate with personal assets and be held legally responsible.

- Debt settlement records storage: All debt settlement steps must be fully documented for auditing, inspection and to ensure transparency in financial operations.

Understanding legal responsibilities is an indispensable step in handling bad debts effectively and legally. Businesses need to build clear processes, assign specific responsibilities, and ensure full compliance with current legal regulations.

Conclude

Managing and handling bad debt is not only a financial problem but also a vital factor in the business's operating strategy. Proper application how to handle bad debt will help businesses proactively control risks, improve cash flow and maintain relationships with partners. Don't let bad debts become a burden - proactively build a professional debt collection process and apply technology to optimize efficiency. If you need a smart debt management support solution, Bizzi Always ready to accompany businesses.

To improve the efficiency of invoice management as well as automate the financial and accounting processes of the business. Register to experience Bizzi's comprehensive solution suite today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/