For accountants and business owners, receiving an input electronic invoice always comes with the question: “How do I know if this invoice is valid?” or “How to quickly check an invoice for tax filing?”.

Since Circular 78/2021/TT-BTC requires 100% enterprises to use electronic invoices, looking up and verifying the validity of input invoices has become a mandatory task. Skipping this step can lead to many serious risks. This article will guide you through Bizzi 3 ways to look up electronic invoices from manual to automated, helping you ensure compliance and optimize finances.

Why do we need to look up input electronic invoices?

- Verify the validity of the invoice

Check if the invoice is legal: Determine if the invoice is issued by a legally registered business. Avoid the risk of using fake invoices: If an invalid invoice is used, the business may be subject to tax arrears or penalties according to the law.

- Know your supplier information

Looking up electronic invoices helps businesses clearly understand related information such as: Supplier's operating status, Corporate tax code and business registration, Tax violation history (if any), Invoice authenticity

- Ensure accurate tax filing

If a business does not check its electronic invoices carefully, it may lose its right to deduct VAT. In case of declaring invalid invoices, the business may also be removed from the tax refund list or be fined. That is why businesses need a system declare and reconcile invoices as effective as Bizzi.

- Meet legal and accounting compliance requirements

Avoid fines for violating invoice regulations: According to tax authorities' regulations, businesses must use valid invoices to declare taxes. Meet audit and financial reporting requirements: When auditing or settling taxes, invalid invoices can lead to tax arrears or financial reporting adjustments.

- Reduce financial fraud and budget loss

Based on electronic invoice lookup, businesses can financial transaction management lack of transparency, false declaration of costs, creating fake invoices to withdraw money from businesses. The lookup helps increase transparency, ensuring that all input invoices accurately reflect actual transactions.

- Support cash flow control and effective cost management

By looking up electronic invoices, businesses will be able to sketch out an accurate financial picture, determine actual costs, avoid unreasonable expenses, and thereby make better financial decisions.

3 ways to look up input electronic invoices quickly and accurately

Below are step-by-step instructions for three search methods, tailored to different business needs.

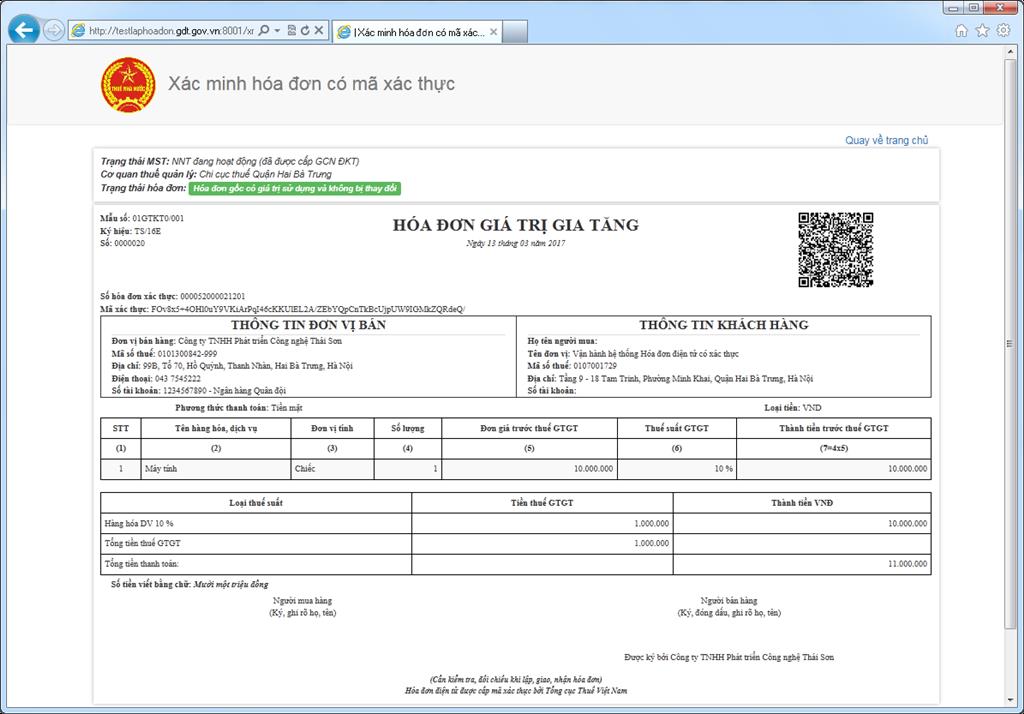

Method 1: Look up valid electronic invoices on the invoice lookup page

Step 1: Access the invoice lookup system

- Open your browser and go to the link:

https://tracuuhoadon.gdt.gov.vn/tc1hd.html - The main interface of the website will display options to look up invoices.

Step 2: Select the type of invoice you want to look up. The system will provide two search methods:

- Look up an invoice (For looking up a specific invoice)

- Look up multiple invoices (For mass lookup of invoices)

Step 3: Enter the invoice information you need to look up

- Seller tax code (enterprise issuing invoice)

- Invoice Type (Select “Value Added Tax Invoice” or other invoice type)

- Invoice symbol (Example: AA/22E)

- Invoice number (Look up electronic invoices by invoice number).

- Captcha (Enter the correct code displayed on the screen).

Step 4: Click “Search” to look up

- After entering all the information, click the "Search" button for the system to process.

- The search results will display the invoice details if valid.

Step 5: Check search results

- If valid invoice, the system will display the tax deductible information.

- Seller name, tax code, address of the business issuing the invoice.

- Invoice issue date.

- Invoice number, invoice symbol.

- Invoice value and tax amount.

- Invoice check status (Valid, canceled, replaced, or invalid).

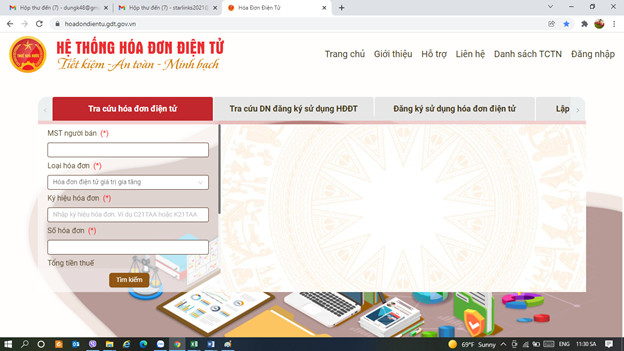

Method 2: How to look up valid e-invoices on the Tax page

General Department of Taxation (GDT) Portal Provides tools to look up electronic invoices issued by businesses, helping to check legality and related information. How to do:

Step 1: Access the General Department of Taxation's electronic invoice lookup portal: https://hoadondientu.gdt.gov.vn/

Step 2: Select "Invoice lookup"

Step 3: Enter the required information

- Seller Tax Identification Number

- Some bills

- Invoice lookup code (if any) for easier invoice verification.

- Invoice issue date

Step 4: Enter the captcha code and click “Search”.

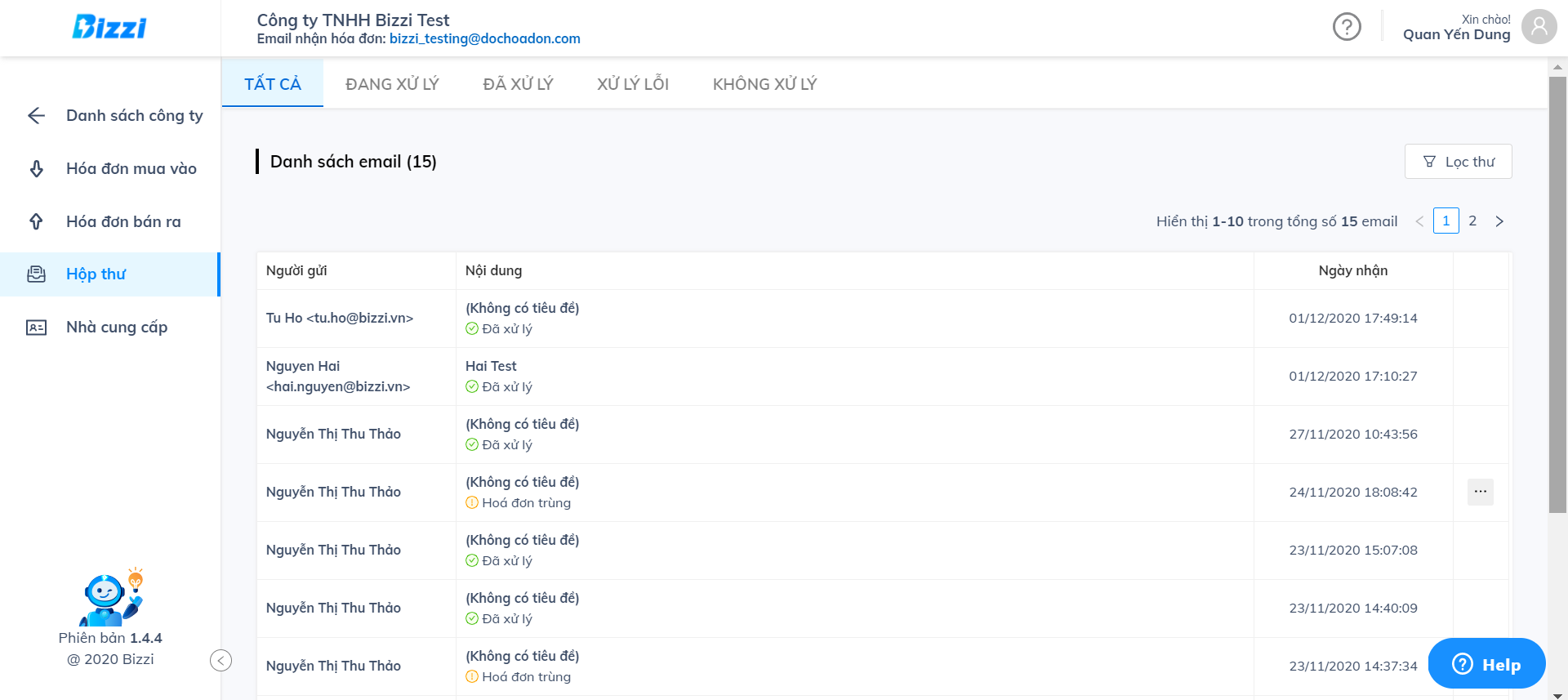

Method 3: Look up electronic invoices on Bizzi

If your business processes dozens, hundreds, or thousands of invoices each month, manually looking up each invoice is not feasible. This is where automated solutions like Bizzi effective, saving up to 80% of time and reducing 90% of errors.

With Bizzi, you can check electronic invoice valid with a file with the extension *.xml of any source providing electronic invoices. The steps to look up electronic invoices on Bizzi's website are specified as follows:

- Step 1: Visit the page and Upload electronic invoice information Bizzi e-invoice system (file with extension *.xml to check the validity of the invoice.

After receiving the invoice information, Bizzi will automatically process it, including reading the invoice, checking the invoice information with the General Department of Taxation, checking the seller information and other related information. The processing time of an electronic invoice will take from 10 to 30 seconds instead of 5 to 10 minutes for manual processing.

After processing Bizzi will notify the user of the invoice status: Processed, Duplicate Invoice, Error Invoice (Unable to download XML invoice, invalid XML file, no lookup information,…)

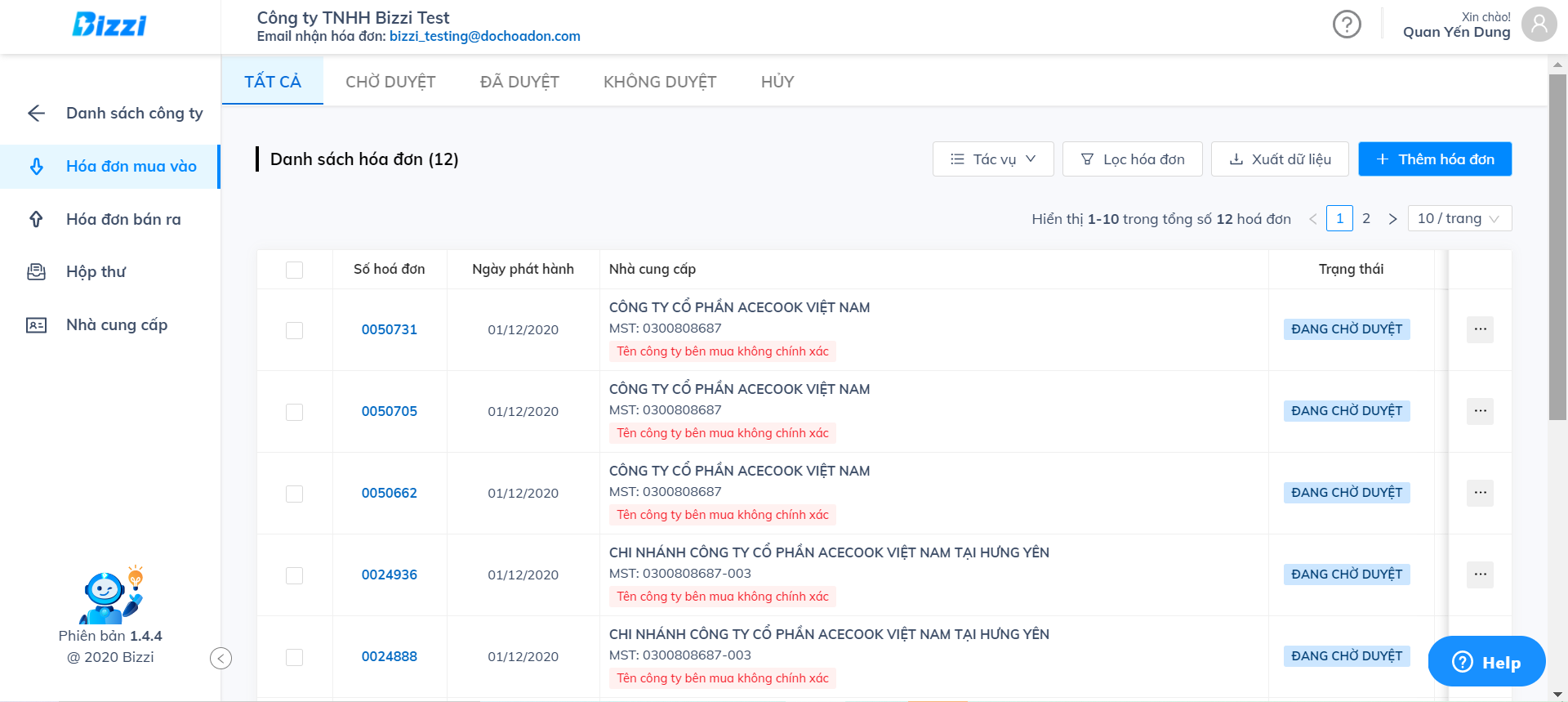

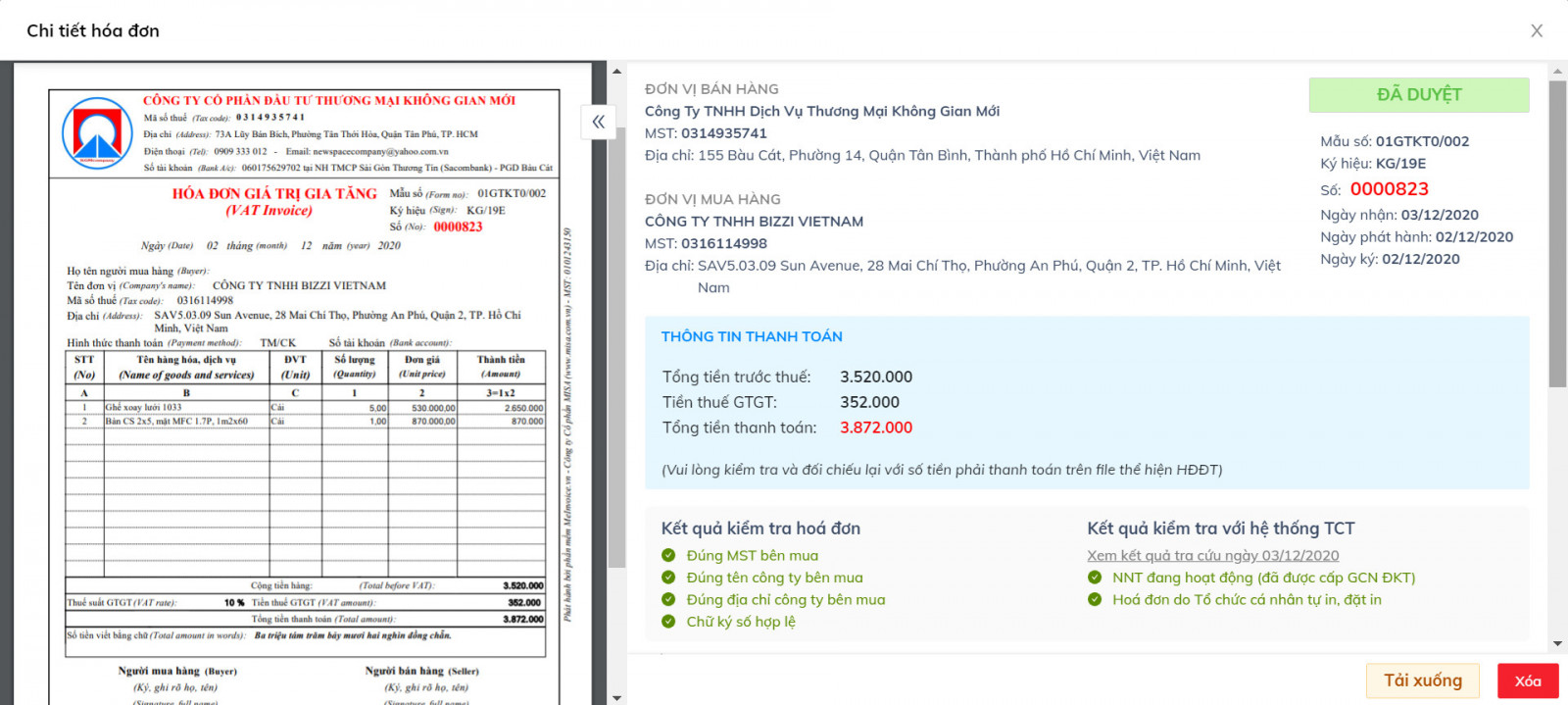

- Step 2: Check invoice information.

Processed invoices will be automatically pushed to the Purchase Invoice menu. Users can view invoice details by clicking on the invoice number.

– Invoice details:

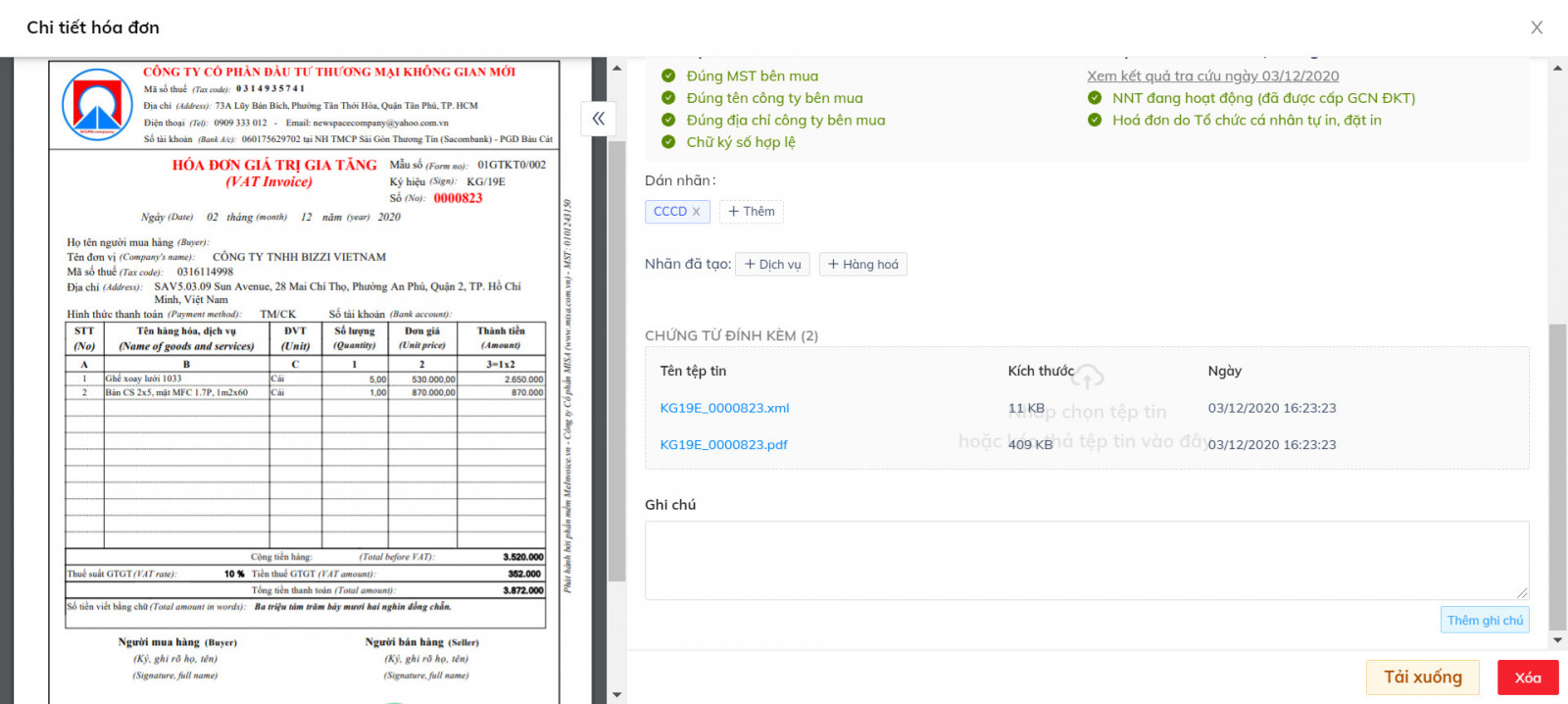

In addition to checking invoice information, users can also label and attach other information such as contracts, documents, notes, etc. to this invoice.

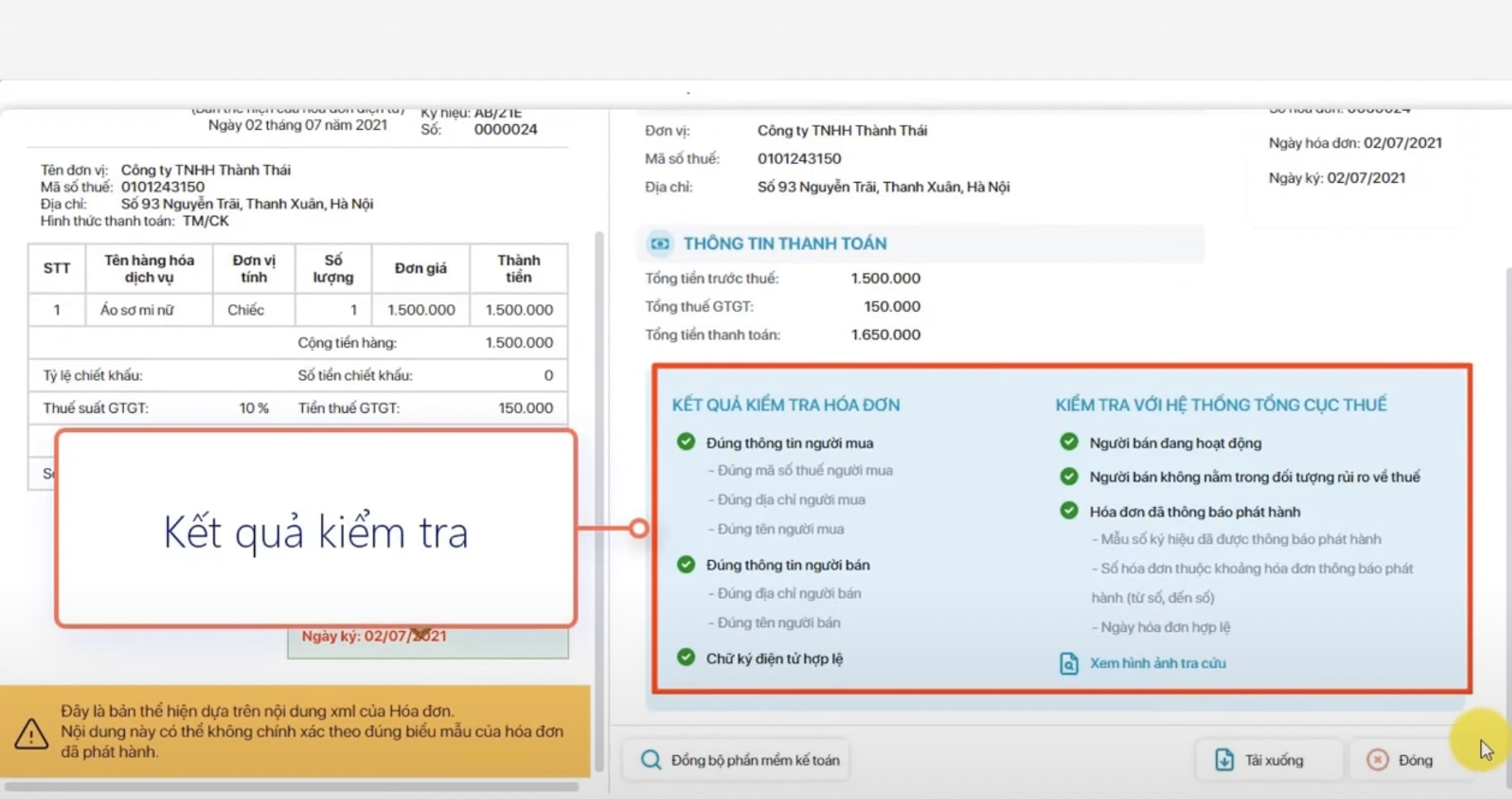

- Step 3: The system returns the invoice check result:

| Invoice check results |

Check with the General Department of Taxation system |

|

|

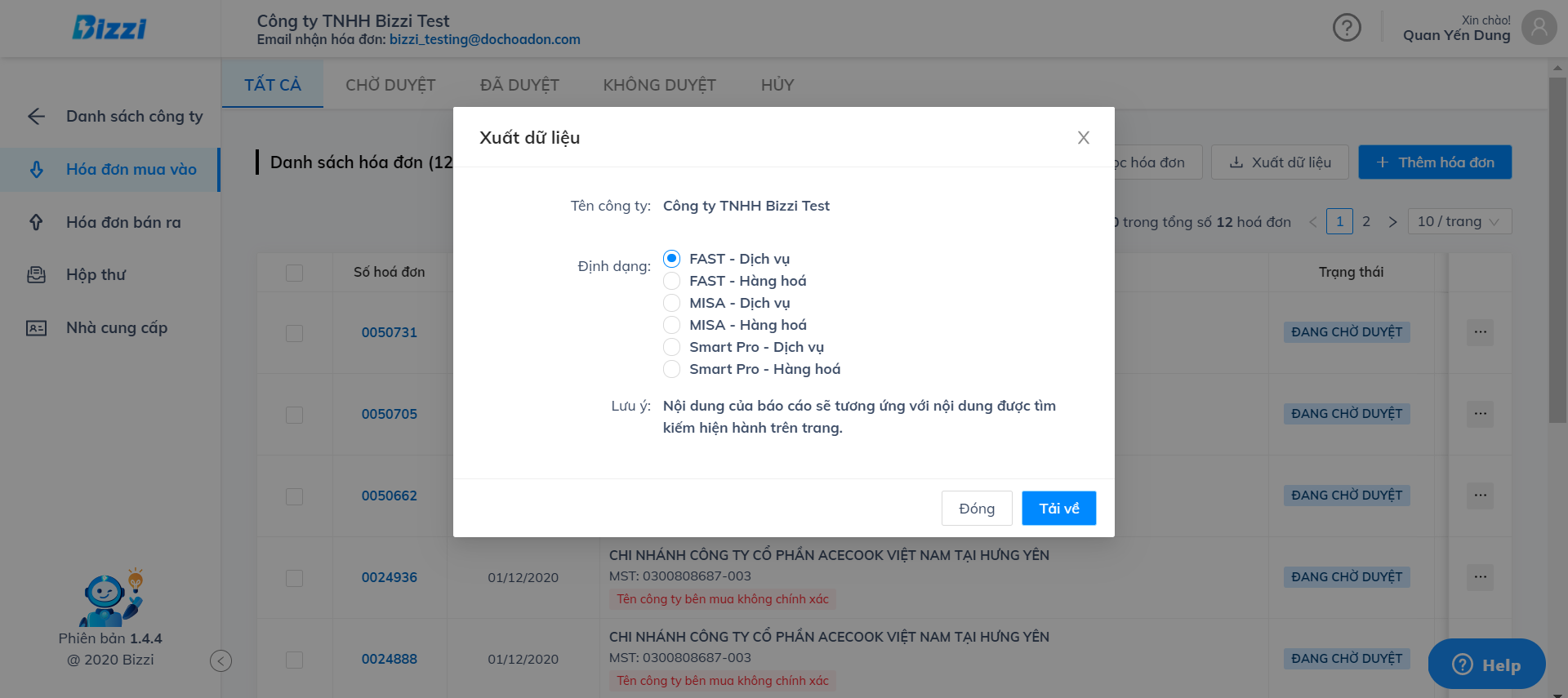

- Step 4: Export data.

Invoice information is rendered in popular formats on the market such as MISA, FAST, SmartPro. To export this data file, click the button in the upper right corner of the screen in the Purchase Invoice Menu, then select the format according to your needs.

Important notes when looking up input electronic invoices

Small errors in the input information can cause the system to not find the invoice. Therefore, make sure you enter the correct tax code, invoice number, invoice symbol and select the correct invoice type (Value Added Tax Invoice, Sales Invoice, etc.) when look up electronic invoice.

- Always make sure the information entered is correct: A single wrong character in the tax code or invoice number will also cause the system to not find any results.

- Invoice not found? Contact seller now: If you are sure you entered the correct information but cannot find the invoice, it may be that the seller has not yet submitted the data to the tax authorities. Ask them to confirm immediately.

- Understand invoice statuses:

- Valid: Can be used for declaration.

- Cancelled: Invoice is no longer valid, cannot be used.

- Replaced/adjusted: Need to find the latest invoice to declare.

- Store search results and invoices: By law, invoices and related evidence must be stored for at least 10 years for future inspection and comparison. Platforms like Bizzi will automatically store them securely for you.

- Make sure the information entered is absolutely correct

Frequently Asked Questions (FAQ)

Question: What to do when detecting that the input invoice is fake or invalid?

Reply: Never use that invoice to file your tax return. Contact your supplier immediately and ask them to reissue a correct invoice. If you suspect fraud, you can report it to the tax authorities to protect yourself.

Question: How long does it take for an invoice to appear on the General Department of Taxation's system?

Reply: Normally, after issuing an invoice, the selling business must submit the data to the tax authority within the day. However, there may be a delay. If after 24 hours you still cannot find it, you need to contact the seller.

Question: Is it safe to use automated software like Bizzi?

Reply: Yes. Solutions like Bizzi are built on a highly secure technology platform, comply with information security standards and ensure that business data is stored and processed privately and securely.

Summary

Look up electronic invoices Input is an important step in business finance and accounting management. Checking invoices not only helps businesses ensure the validity of accounting documents but also supports effective financial management and avoids legal risks related to taxes.

Based on the essential needs of the market, Bizzi has built and developed invoice processing software to support businesses, in which the first step is automatic invoice processing software to replace traditional checking and data entry solutions. Instead of manually looking up paper invoices, using e-invoice helps companies reduce errors and increase efficiency in just 30 seconds with Bizzi.

Bizzi's solution helps businesses automate about 90% of invoice processing from suppliers such as downloading invoices, reading invoices, checking invoice information, helping to reduce 80% of time and save processing fees to about 1 cup of iced tea/invoice.

- Bizzi provides businesses with a free, private email to receive e-invoices

- Bizzi automatically downloads and reads e-invoices

- Online search 24/7

- Automatically calculate the validity and legality of invoices

- Automatically extract data suitable for accounting and ERP software

- Retrieve search and lookup history easily with 10-year storage system

Read more: