Electronic invoices have become an inevitable trend in the digital transformation era. However, in many specific cases, businesses still need to convert electronic invoices to paper documents to serve internal processes and legal requirements.

This article by Bizzi will give detailed instructions. how to print electronic invoice in accordance with the provisions of Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, and at the same time provide important notes to ensure the validity of documents, the foundation for cost management efficient and transparent

General introduction to electronic invoices and printing needs

Electronic invoice (E-invoice) is a type of invoice that is created, created, sent, received, stored and managed entirely by electronic means according to the provisions of Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

With outstanding advantages, electronic invoices have completely replaced traditional paper invoices, contributing significantly to cost reduction for businesses:

- Convenient, safe and cost-effective in printing, shipping and storage.

- Minimize the risk of counterfeiting, fire, damage or loss, avoiding unnecessary financial losses.

- Easily integrate with accounting software, ERP to invoice processing automation, reduce errors and optimize business operating costs.

See more articles about Top 13 new points of Decree 70/2025/ND-CP on electronic invoices here

Why do you need to know how to print electronic invoices?

Electronic invoices only need to be printed in special cases for the purpose of storing accounting documents, presenting them to tax authorities during inspections, or to prove the origin of goods in circulation.

Printing electronic invoices to paper documents (converted electronic invoices) is an important link in ensuring information flow and controlling expenses:

- Presentation to authorities: Serve the inspection and examination work of the Tax Authority, ensure transparency and avoid the risk of being fined, affecting compliance costs.

- Proof of origin of goods: Accompanying goods while in transit, helping to minimize the risk of supply chain disruption and related costs.

- Storing accounting documents: According to the provisions of the Accounting Law, enterprises can choose to print the converted copy to store with other sets of paper documents, ensuring the integrity of cost records when settling. To ensure compliance, enterprises need to clearly understand How to store electronic invoices both the original (XML file) and the converted version.

- Complete internal payment records: Some Supplier Payment Process According to internal spending policy, paper documents are still required with the payment request file. This ensures close reconciliation before disbursement, which is an important step in controlling cash outflow.

- For investigation purposes: Provide to competent authorities in economic cases.

- Respond to customer requests: The buyer may need a paper copy for processing purposes. input invoice processing and their internal storage.

Detailed instructions on how to print electronic invoices from Bizzi software

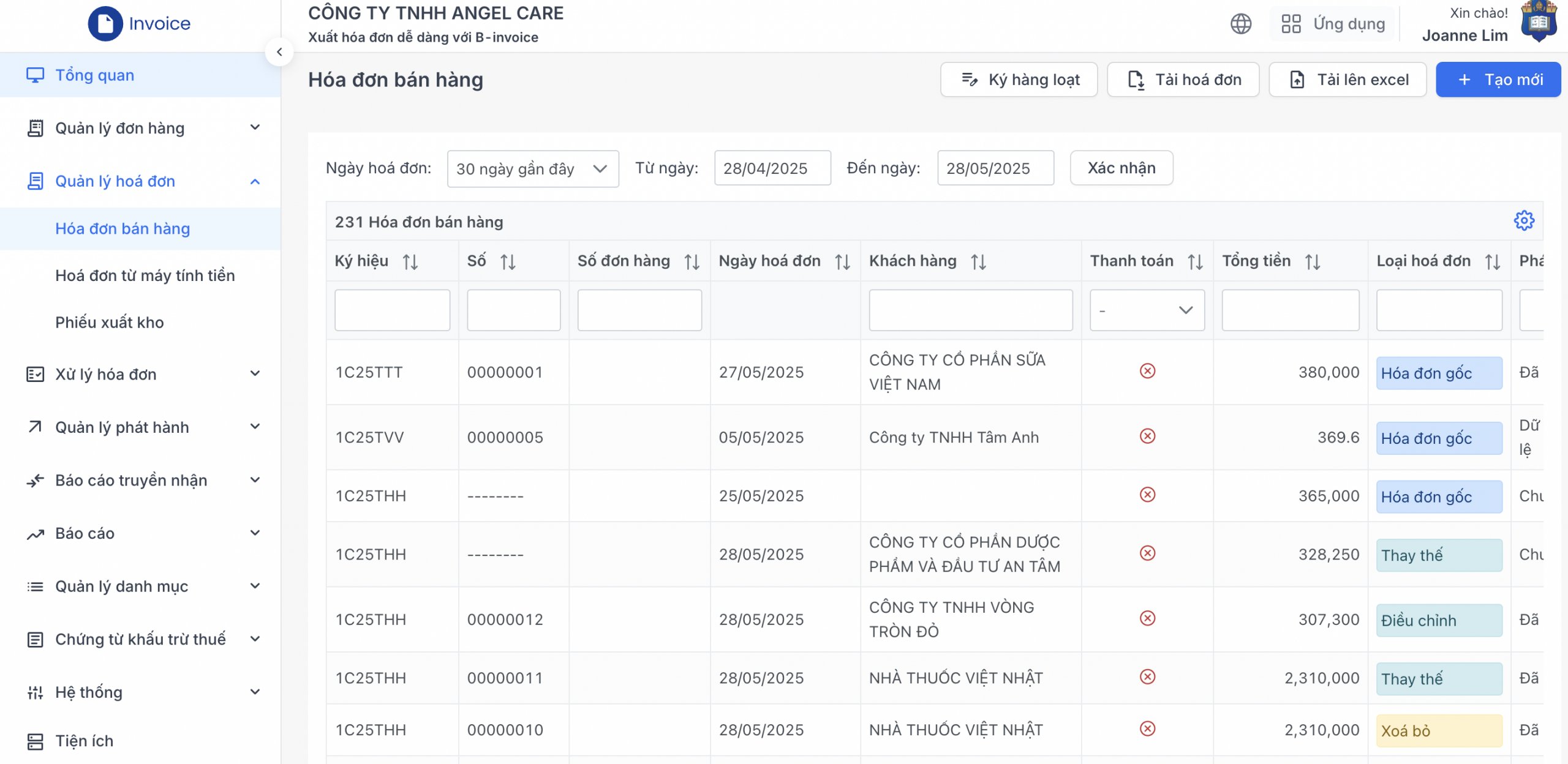

Process and how to print electronic invoice Converting to paper documents is usually done directly on the e-invoice software that the business is using. Below are 2 simple steps on Bizzi's system.

- Step 1: Select the invoice to print

In Bizzi's "Invoice Management" interface, you find and select the electronic invoice to print from the list of issued invoices.

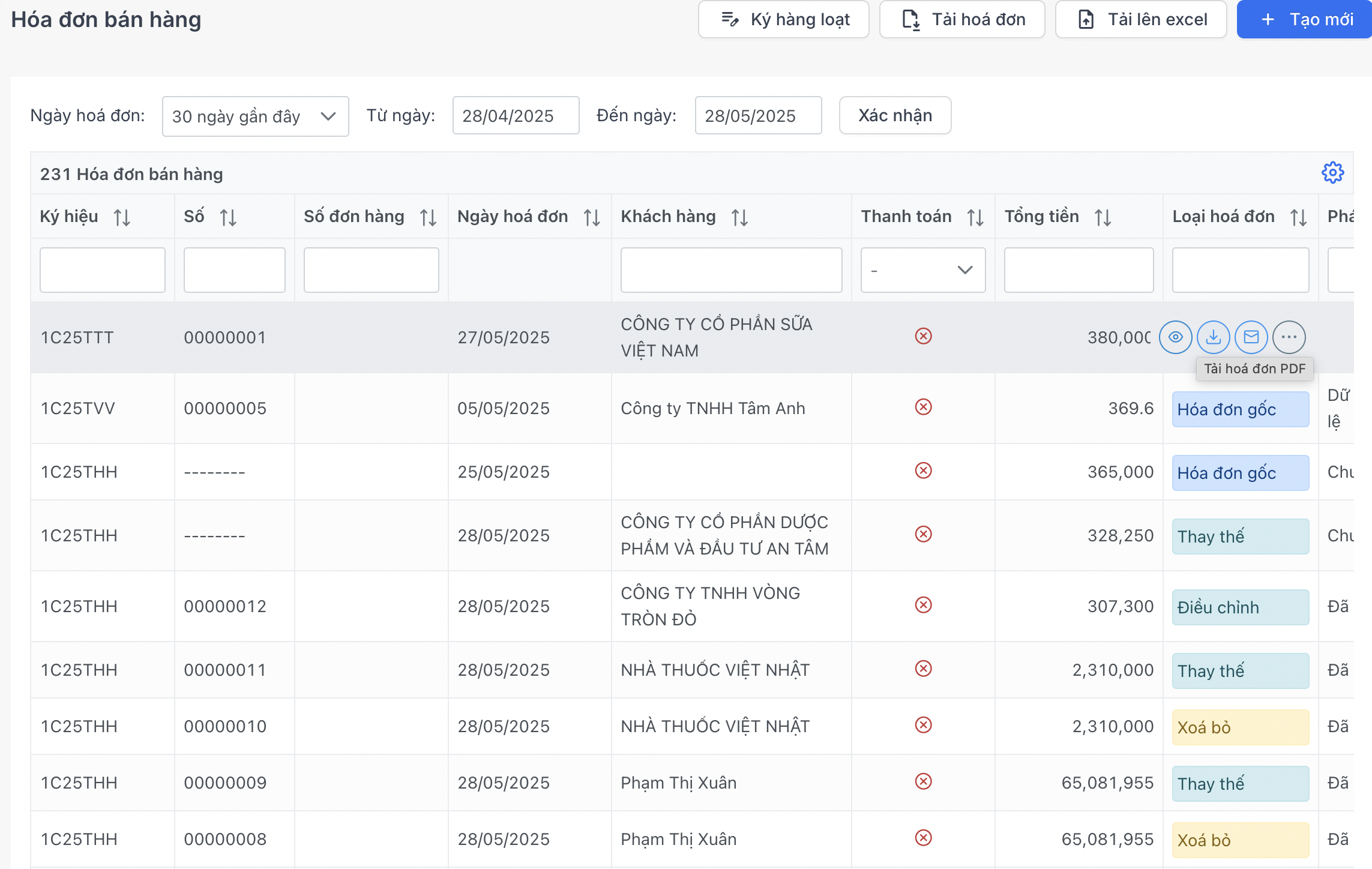

- Step 2: Download and print invoice

– To download the original XML file (which has the highest legal value), click on the Down arrow icon to save it to your computer.

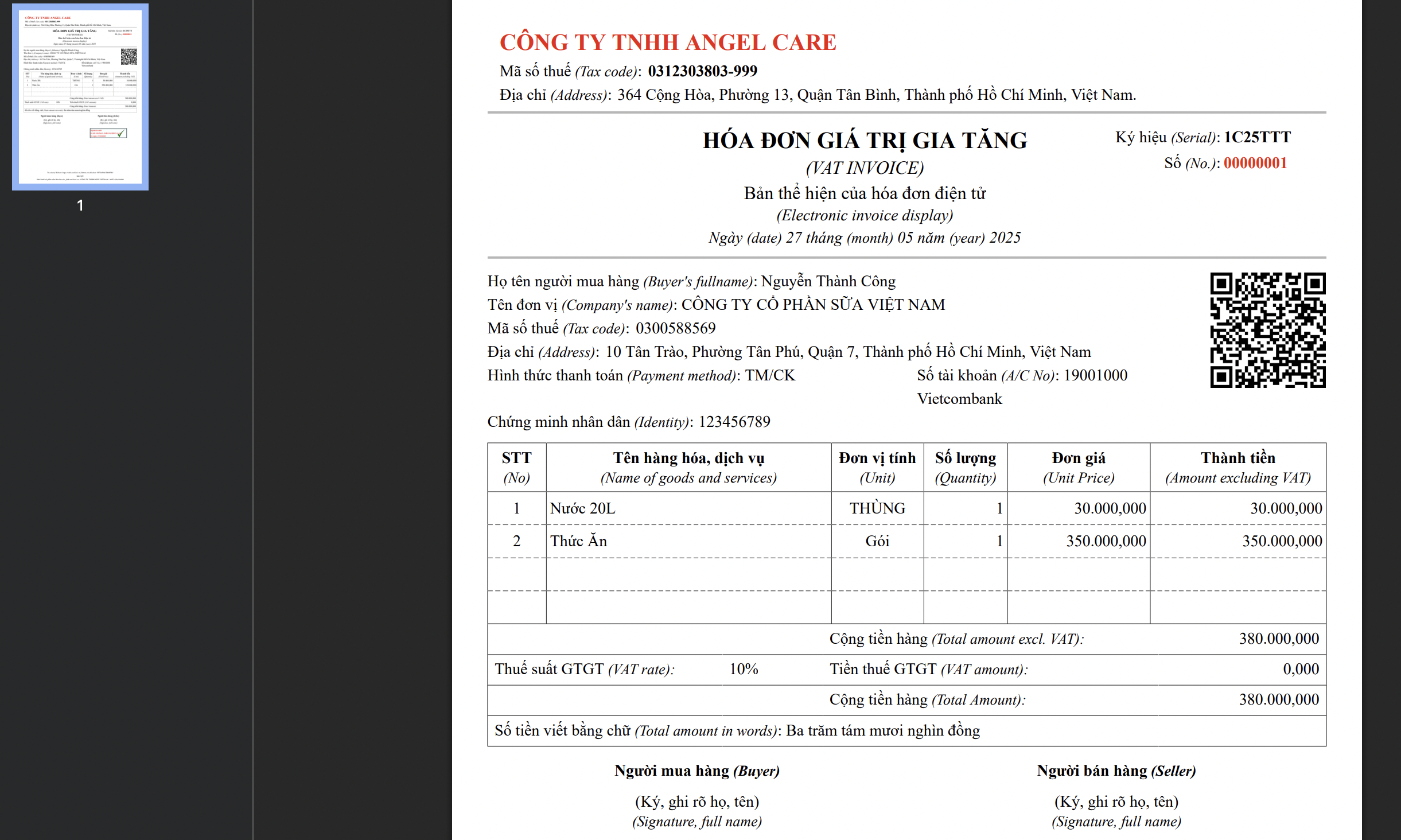

– To perform how to print electronic invoice PDF, you click on the eye icon to preview. The invoice will open in a new tab. Here, you can select Download (to save the PDF file) or click on the printer icon to print directly.

Distinguishing types of electronic invoice prints

To use it properly, ensure compliance and avoid costly errors, businesses need to clearly distinguish between the types of printed copies of electronic invoices:

| Print Type | Purpose | Legal value | Identification features |

| Rendering (Reference Print) | Used to view, compare internal information, clip payment records, and send to partners for checking. | No legal value for transactions, tax declaration. For reference only. | Print directly from PDF/XML files.There is no line “CONVERSION INVOICE…”.No seller signature and stamp required. |

| Converted electronic invoice | Use for:

|

Legally valid if converted in accordance with Circular 78/2021/TT-BTC. | Required:

|

| Print from POS software | Print at retail outlets, supermarkets, restaurants to deliver to customers at checkout. | Usually the expression, no legal value for accounting purposes unless the POS system is integrated and directly generates electronic invoices with tax authority codes. | Usually in the form of a small bill, containing only basic information about the transaction. Need to be compared with the original electronic invoice (sent via email/SMS) for accounting. |

Instead of manual operations, Bizzi software automatically creates valid conversions, attaches digital signatures and confirmation lines according to Circular 78, helping businesses save time and ensure compliance. [Try it for free now].

Legal value of electronic invoices when printed on paper

The legal value of an electronic invoice printout depends entirely on whether it is a “representative copy” or a “transformed electronic invoice.” Understanding this helps businesses avoid legal risks that can lead to financial penalties.

- Original electronic invoice (XML file): This is the version with the highest legal value, used as the basis for declaring, accounting for taxes and recording valid expenses.

- Converted electronic invoice: It is only legally valid when converted in accordance with the conditions specified in Article 7 of Decree 123/2020/ND-CP. It is valid to prove the transaction but cannot replace the original invoice for tax declaration.

- Presentation (printable PDF): No legal value, only for reference and information reading.

Do I need a red stamp to print an electronic invoice?

Yes, the converted electronic invoice must have the signature of the legal representative and the seal of the seller (the party issuing the invoice).

This is one of the prerequisites to ensure the legality of paper documents according to the regulations of the General Department of Taxation, clearly stated in Circular 78 and Decree 123. If these two elements are missing, the printed copy will not be valid for submission, which may lead to the corresponding costs not being accepted when settling taxes.

How many times can an electronic invoice be printed and converted?

According to the provisions of Clause 2, Article 10 of Decree 123/2020/ND-CP, the conversion of electronic invoices to paper documents can only be done once.

Limiting the number of conversions ensures the integrity and uniqueness of documents, avoids the risks of using one invoice for many different fraudulent purposes, and helps to make financial and cost management transparent.

Important legal notes when printing electronic invoices (According to Circular 78)

Compliance with legal regulations is not only an obligation, but also a way for businesses to protect themselves from unnecessary fines, an important factor in controlling costs. Businesses should remember the following core regulations:

- Full content: The conversion must fully and accurately reflect the content of the original electronic invoice.

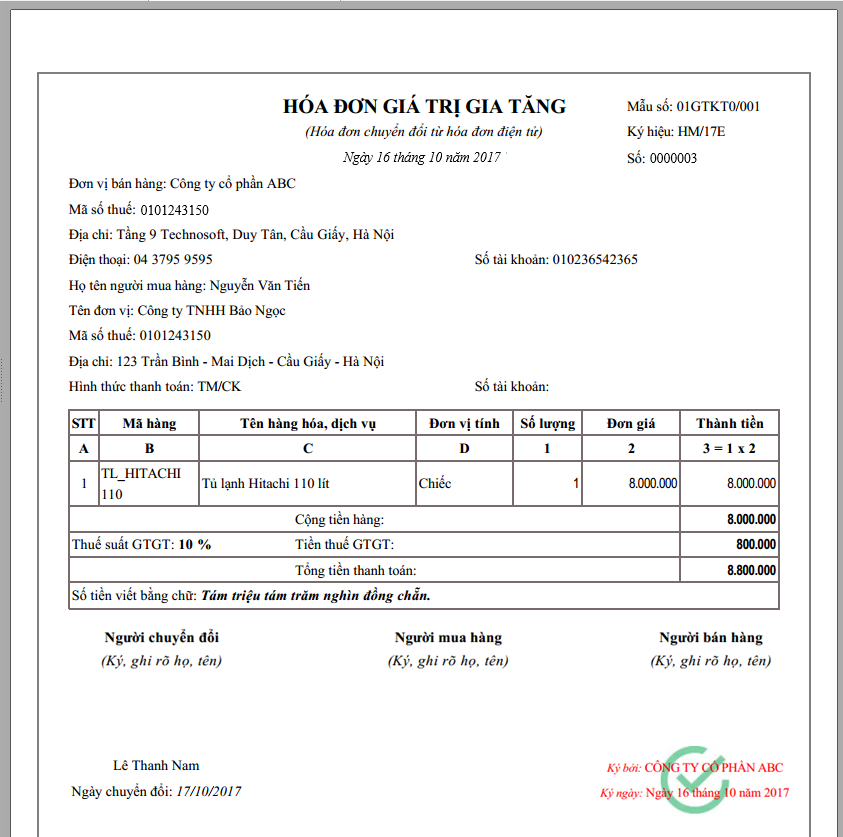

- Required symbols: There must be the words "INVOICE CONVERTED FROM ELECTRONIC INVOICE" to distinguish.

- Converter information: Full name, signature of the person performing the conversion and time of conversion are required.

- Verification from seller: The conversion must have the signature and full name of the legal representative, along with the seller's seal.

- Compliance with current regulations: All operations must comply with Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC. Older documents have expired. In case of detecting errors on issued invoices, businesses need to take Correct Invoice with Incorrect Content Follow the correct procedure before printing the conversion.

- Parallel storage: Enterprises must store both the original electronic invoice (XML file) and the converted version (if any) for the period prescribed by law.

See more about the latest electronic invoice cancellation form 2025 here

Conclude

Although electronic invoices are an irreversible trend, the need and how to print electronic invoice Paper documents still exist and play an important role in specific management activities. Mastering the process and strictly complying with legal regulations are key factors to help businesses ensure the validity of documents, avoid risks and optimize operations.

Automation platforms like Bizzi.vn not only help businesses issue invoices, but also provide a comprehensive solution for input invoice processing and cost managementBy automating manual tasks such as checking, reconciling, and even printing correct conversions when needed, Bizzi helps accounting departments save time, reduce errors, and ensure compliance, thereby optimizing financial performance for the business.