Electronic invoice XML file Contains all necessary information such as business name, tax code, product/service list, total value and VAT, considered the standard format for transmitting electronic invoice data to the General Department of Taxation.

In this article by Bizzi, let's learn more about how to read and effectively use XML file electronic invoices.

What is an XML file Electronic Invoice?

An electronic invoice XML file is a file containing invoice data in XML (Extensible Markup Language) format.

The main purpose of XML file electronic invoice is Transmit and exchange invoice information transparently and synchronously between systems and information technology applications. More specifically:

- Proof of legal transaction: When requested by tax authorities, auditors, or inspectors, you need to provide XML files to prove the validity of invoices.

- Storage by law: Enterprises must keep XML files for the entire period of accounting document storage (usually at least 10 years).

- Search & verify: You can use XML files to check digital signatures, look up information directly on the General Department of Taxation portal, and ensure the invoice is genuine and not edited.

- Sharing data between systems: Accounting software, ERP, or enterprise management systems often import invoice data from XML for automatic accounting, avoiding manual entry.

- Convert to print/PDF: When you need to print documents or send them to partners, you open the XML file and export it to PDF to display the familiar invoice format.

Features of XML file electronic invoice

- Clear data structure: Data is organized and described through XML tags, increasing transparency and ease of management.

- Communicate and share easily: As an open standard, it can be read and processed by many different applications and systems.

- Safety and security: Security measures such as encryption and digital signatures can be applied to ensure the integrity and confidentiality of information.

- Easy storage and retrieval: XML invoice data is stored and managed, making it convenient to search and retrieve when needed.

Legal value of electronic invoice XML file

- Electronic invoice XML file available legal value before being amended, represents the legality of all invoice data, is the basis for issuing invoices and data reconciliation.

- Legitimate electronic invoices need to be stored in both forms simultaneously. PDF and XML, with matching content and correct format as prescribed in Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

How to download electronic invoice XML file

Currently there are 4 most popular methods applied in download electronic invoice XML file, here are detailed instructions:

Download electronic invoice XML file from the General Department of Taxation Portal (hoadondientu.gdt.gov.vn)

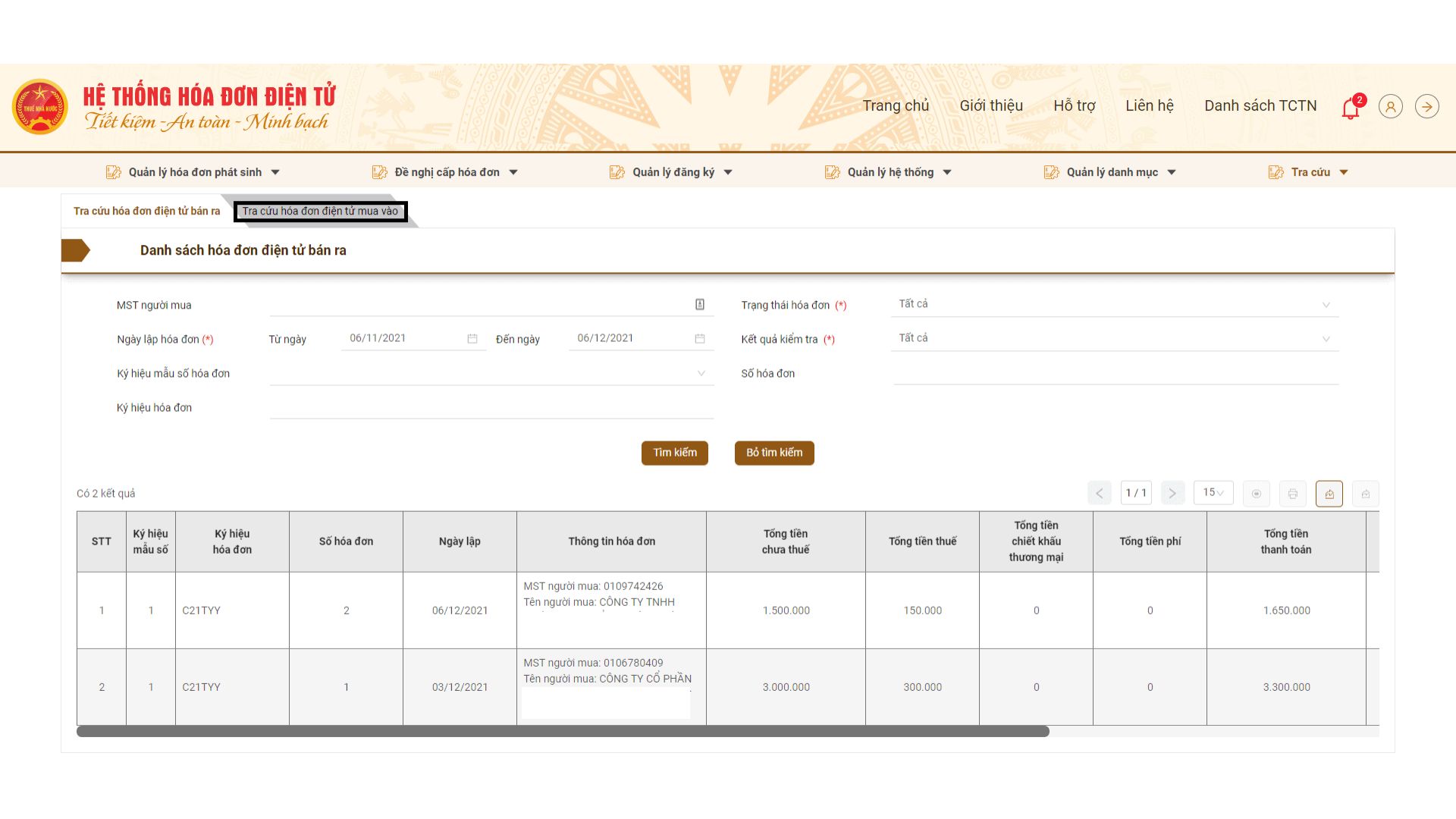

- Step 1: Visit the official website: hoadondientu.gdt.gov.vn.

- Step 2: Log in with your business's e-Tax account.

- Step 3: Navigate to “Search” and select “Search Bill”.

- Step 4: Enter complete lookup information: Seller tax code, Invoice symbol, Invoice number, and other required information.

- Step 5: Click “Search”. The system will display the corresponding invoice results.

- Step 6: Select the invoice you want to download and click the “Download” button.

- Step 7: Choose download format (choose to download XML file and can download additional PDF to view).

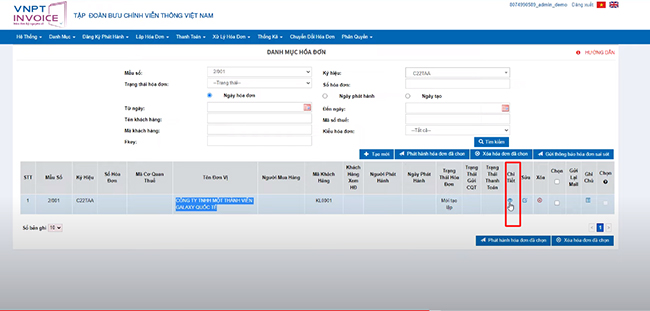

Download electronic invoice XML file from supplier system (MISA, Viettel, VNPT, BKAV...)

- Step 1: Open the invoice release notification email from the seller and click on the provided lookup link.

- Step 2: Enter the “Invoice Lookup Code” (this code is usually sent in an email or printed on the PDF version of the invoice).

- Step 3: After entering the code, the system will display the invoice details. You just need to choose the option to download XML and PDF formats.

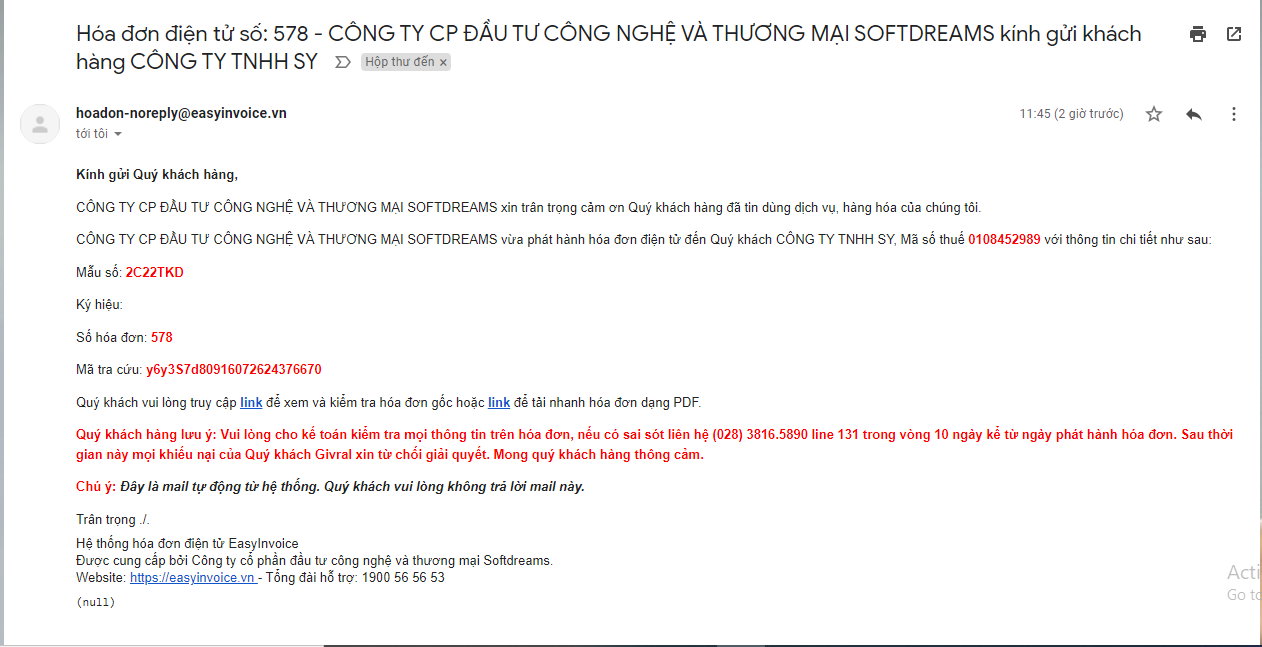

Download electronic invoice XML file from transaction Email

- Format: The seller attaches the invoice file (usually in both .XML and .PDF formats) in the transaction confirmation email.

- Steps to follow:

- Open transaction email: Go to your email account and look for the email containing the electronic invoice from the seller.

- Download XML file: Find and download the XML formatted e-invoice file attached to the email to your computer

- Security Note: Always double-check the sender's email address to avoid fraudulent emails that pose financial risks to your business.

Download electronic invoice XML file from Seller's own Website/Search Portal

- Format: The seller provides a portal on their website.

- Steps to follow:

- Visit the website to look up the seller's electronic invoice: Find and go to the invoice lookup website of the electronic invoice service provider (electronic invoice software) that the seller uses.

- Find the lookup item: On that website, go to “Check bill” or “look up electronic invoice“.

- WOMENEnter search information: Seller's tax code, invoice lookup code. Enter captcha code if required by the system.

- Search: Click the “Search” or “Look up bill” button for the system to display bill information.

- Download invoice: Click the “Download XML” (or “Download”) button to download the XML file to your computer.

How to read electronic invoice XML file

In general, with the above forms of downloading electronic invoices in XML files, you can choose to view them in PDF format. If you still want to download electronic invoices in XML files for future storage, you need to encode the file using invoice reading software. Below is a summary of some of the most common forms:

Open directly with browser

Right click on the file, select “Open with” and select a browser (e.g. Internet Explorer, Microsoft Edge). However, this method usually only displays the data as code.

Use software to read XML file invoices

- iTaxViewer (of the General Department of Taxation)

- Free download at https://hoadondientu.gdt.gov.vn

- Open software → Select function Read XML invoice → Upload file → the system displays the invoice in standard form (clear as PDF).

- Invoice provider software (VNPT, MISA, Meinvoice, BKAV…)

- Log in to your account → Use the function XML Lookup / Read → Select file to view.

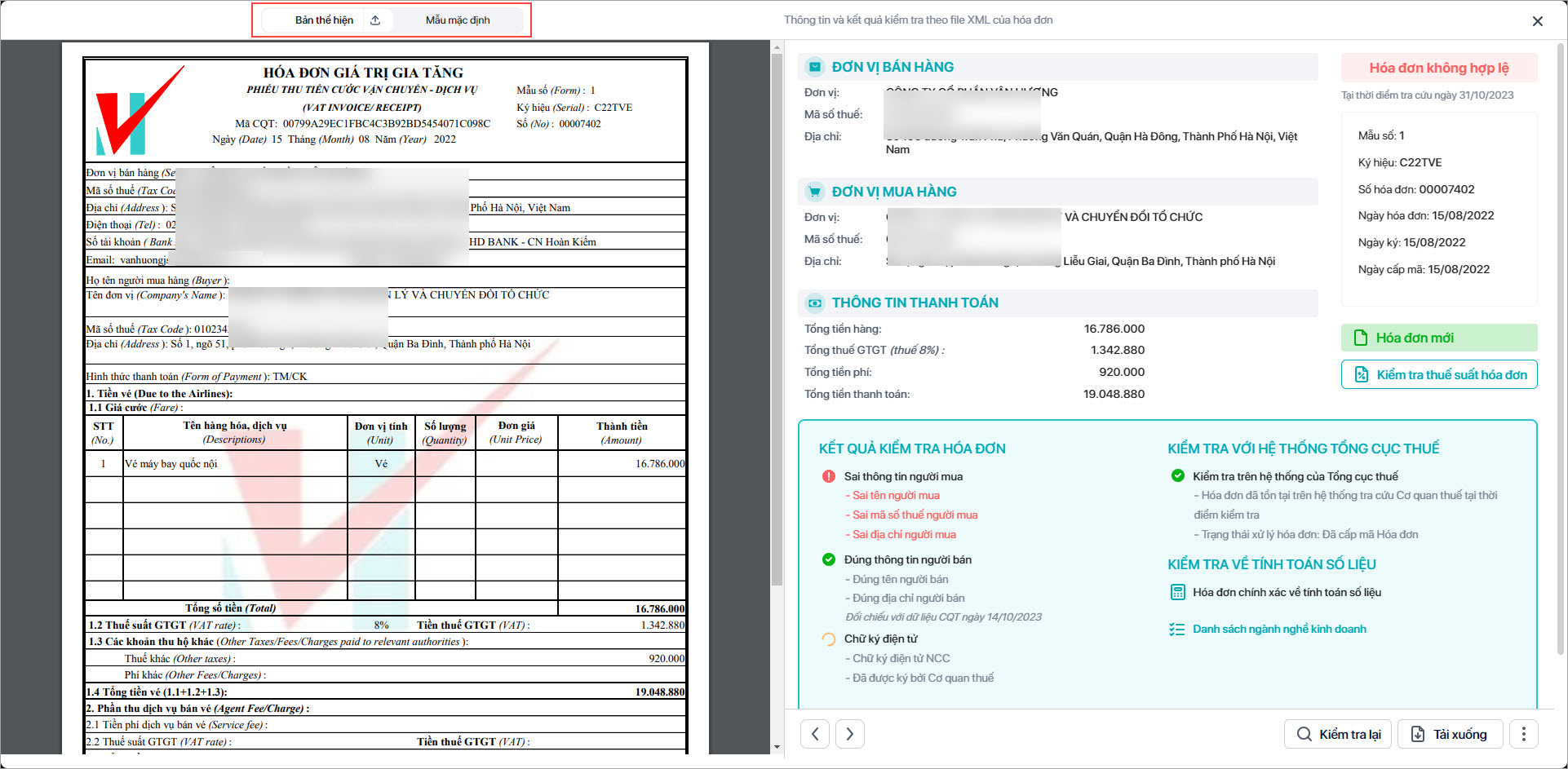

- Look up on the General Department of Taxation website:

-

- Visit website: http://tracuu.ehoadon.vn (or http://hoadondientu.gdt.gov.vn).

- Look for the “Search by XML file” option or upload a file.

- Select “Choose file”, then find and upload your invoice XML file.

- The system will read and display the invoice information.

Instructions for checking the validity of Electronic Invoice XML file

This is an important step to ensure that the invoice you receive is real - valid - accepted by the Tax Authority.

- Check XML format and structure: Ensure proper structure, complete XML tags, no tag ending errors or missing required attributes, and UTF-8 encoding.

- Check the validity of the digital signature: Use specialized software (Bizzi). If valid, the software will display the status “valid“. If modified, the digital signature will be lost or an error will be reported.

- Check the lookup code on the website of the General Department of Taxation: Access https://hoadondientu.gdt.gov.vn, enter the seller's tax code and invoice lookup code to verify the information.

- Check invoice content: Compare the information in the XML file with the actual transaction to ensure there are no errors.

- Check file integrity: Ensure that the file has not been modified after signing. A corrupted or modified file may invalidate the digital signature.

Regulations and Methods of Storing Electronic Invoices XML files

Understanding the regulations and how to store XML files is extremely important, as this is the original document required by the tax authorities.

Legal regulations on storage

According to Accounting Law 2015, Decree 123/2020/ND-CP and guidance of the General Department of Taxation:

- Electronic invoices must be stored as XML native data. (according to tax authority standards).

- Storage time: minimum 10 years (like other accounting documents).

- Ensuring integrity & accessibility:

- Do not change the contents of the XML file.

- Must be able to be consulted, printed or presented upon request by a government agency.

- Save the entire presentation (PDF): for easy viewing/printing when needed, but the legal value is still in XML.

If the enterprise does not store or loses the XML file → when the tax authority requests to present it, it will be considered as no valid documents (may be subject to administrative penalties and fees).

Methods of storing electronic invoices XML files securely:

- Store classified by invoice type:

- Purchase invoice: Save in a separate folder with the supplier name or tax code, along with the transaction date/month. It is recommended to save both the XML file and the PDF version.

- Sales invoice: Extract XML files from the software, store by month/quarter/year with clear file names. Absolutely no editing XML file content after signing.

- Centralized storage on digital platform: Use electronic invoice software with centralized storage and lookup functions. Set up a cloud or internal storage system with access permissions and periodic backups.

- Comply with storage deadlines and formats: Ensure the ability to look up and retrieve data when requested and save it in the correct format of the original, digitally signed XML file.

Automate the entire XML file electronic invoice management process with Bizzi

Application Bizzi help businesses fully automated The process of storing, searching, checking and accounting from XML files, reducing the risk of loss, saving time and costs, and ensuring compliance with tax regulations. Why do we say so? Let's look at the table of criteria below to see the difference between traditional management methods and when applying Bizzi:

| Criteria | Electronic invoice XML file (traditional) | Bizzi Automation Solutions |

| Nature | A data file, is simply a container for billing information. | An intelligent system for processing and managing invoice files. |

| Main role | Provide raw data, requiring manual or semi-automatic processing. | Automate the entire process, from data intake to storage and integration. |

| Receive invoice | The accountant or employee has to download each XML file from email or website. | Bizzi Bot automatically scans and downloads XML files from various sources. |

| Checking for validity | Do it manually by opening the file, checking the digital signature via software, and comparing it on the website of the General Department of Taxation. | Automatically check the format, structure, and validity of digital signatures in XML files upon receipt. |

| Data reconciliation | The accountant has to manually compare each information in the XML file with the PO and GR. | Automatically compare information in XML files with PO and GR in real time, detect discrepancies. |

| Data processing & entry | Accountants must manually enter information from XML files into the accounting or ERP system. | Automatically extract data from XML files and sync directly to accounting or ERP software. |

| Storage | Manually stored on computers, hard drives, or email. Easily lost, difficult to retrieve, and not secure. | Automatically stored on a secure cloud platform, in compliance with legal regulations. Data is scientifically arranged, easy to search and retrieve. |

| Create output invoice | Use separate software to create and export XML format invoices. | Automatically generate output invoices according to tax authority XML standards, support batch invoice generation. |

In short, electronic invoice products B-invoice Bizzi's has many advantages, bringing outstanding advantages to businesses when making the most of the features:

- Automation & Standardization: XML is processed by Bizzi system according to tax standards from the beginning — reducing manual entry errors and incorrect information.

- Quick search & lookup: The original XML is stored in an organized manner, Bizzi allows quick searching with conditions (invoice number, date, seller, etc.), saving time compared to searching through scattered files.

- Data security: High security storage standards and digital signatures, QR codes, and anti-counterfeiting — giving businesses peace of mind and reducing the risk of invoice rejection.

- Reduced storage & operating costs: no need to print, no need to store paper invoices, reduce costs of paper, ink, transportation, and storage.

- Scalability & Integration: When the business gets bigger and needs to integrate with ERP, management software, sales, Bizzi supports that very well — helping XML invoices become part of a large system, not just a single one.

Conclude

Above is all the information related to electronic invoices XML files. Storing electronic invoices XML files is especially important because when tax authorities, auditors, or inspectors request, you need to provide XML files to prove the validity of the invoice. Therefore, most businesses choose to manage and store electronic invoices through technology solutions.

With B-invoice, businesses can process and reconcile 10 times more invoices than they currently do, while still reducing up to 95% of time and human resources. Now, the accounting department will be assured of the accuracy and transparency when managing invoices, minimizing tax risks. For more specific advice, register to schedule an appointment here: https://bizzi.vn/dat-lich-demo/