A systematic approach to cost management means that businesses proactively adjust their budgets to protect the elements that create core value.

As CFOs, we not only “manage the books” but also coordinate the financial strategy of the entire enterprise – especially in times of economic instability and rising inflation like today. So the question is: How to reduce expenses while maintaining growth momentum?

Proper cost optimization is the way to protect growth momentum

According to a Gartner survey in March 2025 with more than 500 business leaders, up to 49% said their budgets and spending would be cut in the second quarter. And this number was given before new US tariff policy raising concerns about rising inflation and slowing growth. But the point is: Cutting spending does not mean sacrificing growth.

In today's uncertain economic climate and ever-increasing pressure on margins, business leaders need a clear process for reducing costs without compromising core values or growth drivers.

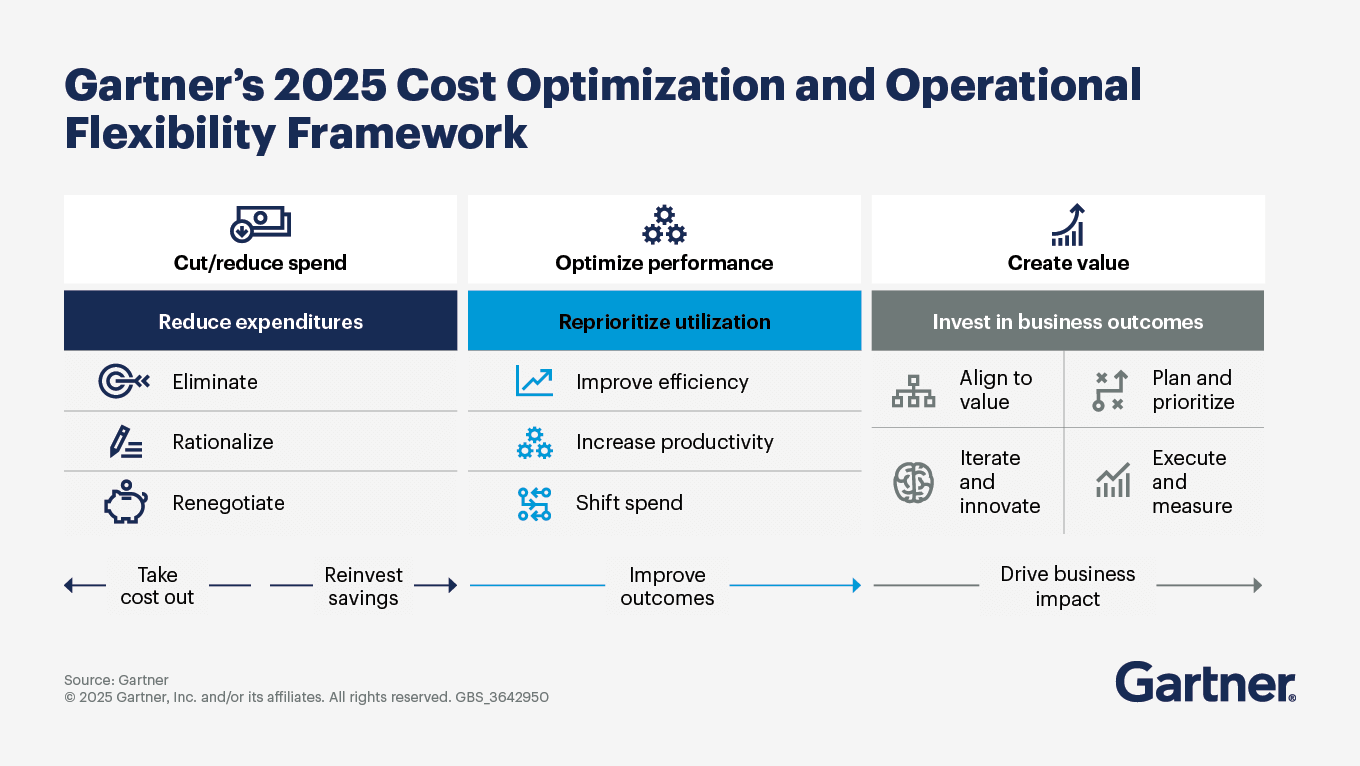

Gartner recommends that businesses apply the “structured cost optimization” method – to ensure that every dollar spent creates value, without causing loss of competitiveness or long-term growth momentum. Each spending decision should be viewed as a strategic action: reduce costs, optimize performance and still maintain investment for future growth.

Proper cost optimization is not about cutting corners, but about creating long-term competitive advantage.

One of the biggest misconceptions in business is to equate cost optimization with “reducing investment”, “cutting budgets”, “freezing recruitment”… In fact, Gartner points out that “efficient growth companies” have a very different mindset:

- They view spending on core competencies as an investment to create advantage – not a cost to reduce.

- They have strict cost discipline, yet invest flexibly in innovation and digitalization.

They apply cost optimization thinking in every decision – not waiting until “difficult” to cut corners.

It is this disciplined, forward-looking mindset that helps them thrive in a volatile environment and build lasting resilience. Gartner’s cost optimization methodology synthesizes and systematizes these behaviors into a process that any leader can apply.

CFOs are often the ones driving cost optimization programs… but in reality, Every leader in the business can use this method. to make informed spending decisions for your department – and create a clear basis when presenting budget plans to your CFO.

As CFOs, they need to proactively send a clear message: Optimization is about reallocating to grow – not suffocating to survive.

Note: While cost optimization should be viewed as a routine activity, it can be adjusted to respond to short-term pressures. In this way, even “emergency” actions become part of a systematic plan – not an emotional reaction – helps protect long-term goals.

Gartner's Cost Optimization Decision Framework: 6 Strategic Criteria

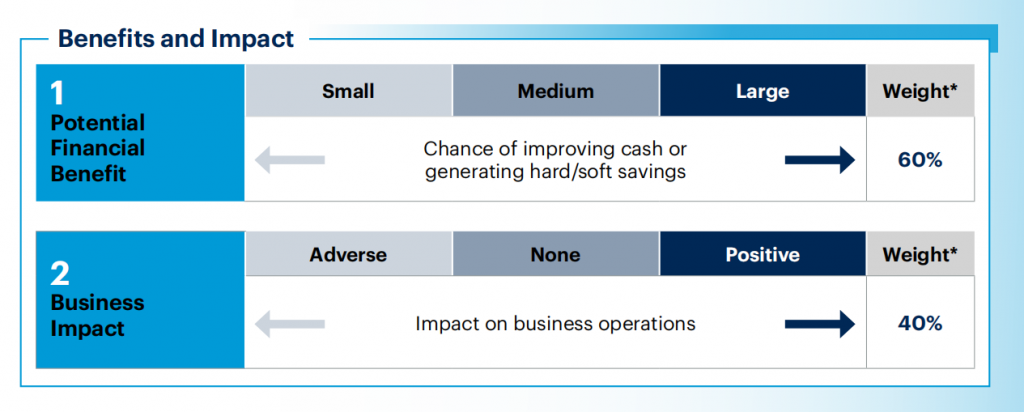

To help CFOs and senior leaders make the right decisions, Gartner recommends a framework for evaluating cost optimization initiatives based on six key factors, divided into two groups:

Benefits and Impact Group:

- Potential Financial Benefit – weighted at 60%

- Business Impact – weighted at 40%

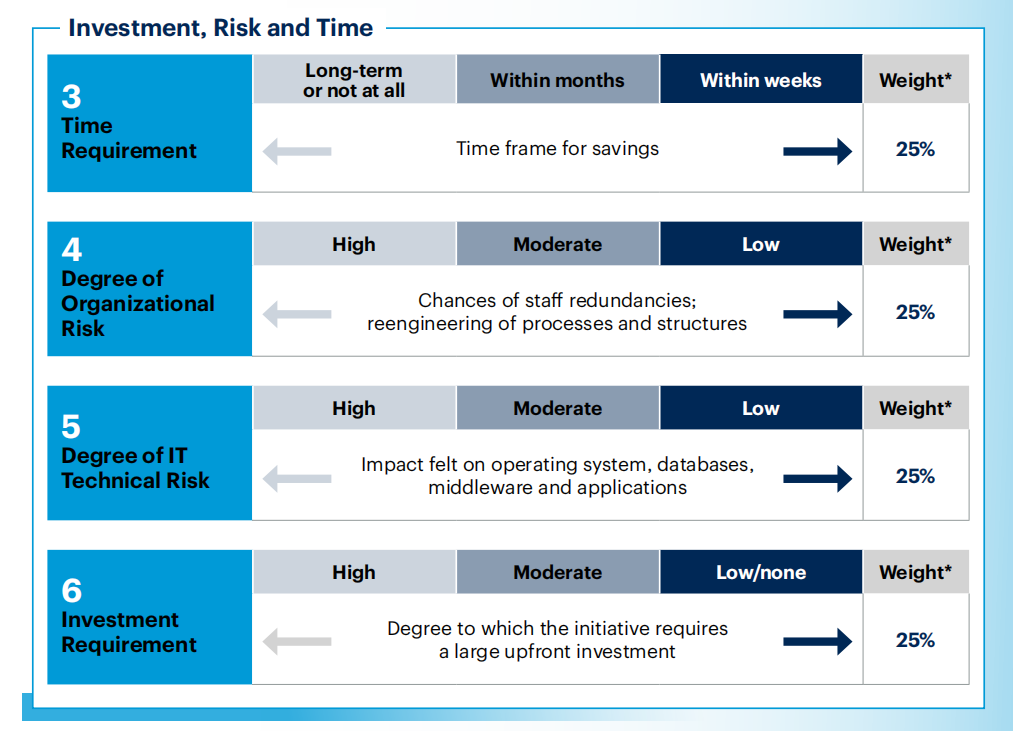

Risk, Time & Investment Group:

- Time Requirement

- Organizational Risk – affects structure, personnel, culture

- IT Technical Risk

- Investment Requirement

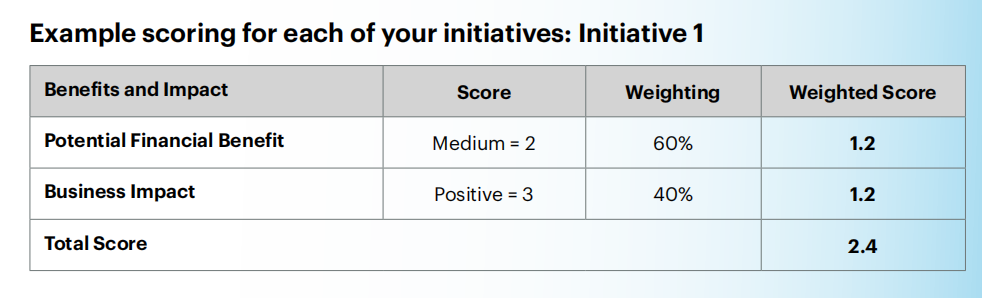

For each initiative, the CFO can score each criterion (on a scale of 1–3) and then multiply by the weight, thereby building a priority matrix: choosing “high impact – low risk – short time” initiatives to implement first.

Plus point: This framework not only helps the Finance department – but also serves as a budget coordination tool with other departments, creating consensus and transparency in spending decisions.

Gartner's Cost Optimization Decision Framework provides leaders with a strategic, systematic approach to reducing spending and costs while maximizing business value.

3 pillars of cost optimization in 2025

According to Gartner, 2025 is the time when businesses need to optimize costs not only to “survive”, but to “restructure operational capacity for the future”. The three main goals are:

- Systematically reduce unnecessary costs

- Optimize business-wide operational performance

- Reinvest in future sources of value

With price fluctuations and margin pressure, businesses need to manage these strategies more aggressively and systematically than ever before.

Here are some dos and don'ts for each goal – from a CFO perspective:

Dos and Don'ts of Cutting Spending

✅ Should:

- Proactively propose cost optimization plans with CEO and department leaders.

- Project future operating models – then adjust your spending structure accordingly.

- Focus on AI applications that create immediate value, avoiding cases where it is difficult to demonstrate effectiveness in the short term.

- Strategic cuts – for example, reduce marketing spend on weak channels, but increase investment in high-growth channels.

- Get ideas from frontline operations – but with clear criteria.

- Re-evaluate job openings, hiring people who fit current and future strategic priorities.

- Free up underperforming staff and invest more resources in high-impact performers.

- Negotiate with suppliers and evaluate the role of outsourcing services.

❌ Should not:

- Cut across the board, regardless of the importance of each activity.

- Retain positions or projects that no longer fit into long-term strategy

- Spreading investments in activities that do not provide competitive advantage

Dos and Don'ts of Performance Optimization

✅ Should:

- Build a multi-year optimization roadmap with periodic evaluation milestones.

- Identify the “core costs” to protect – e.g. core technology, customer service.

Cut out “sacrosanct” expenses that no longer create value. - Create a culture of “cost thinking” from top to bottom.

- Leverage automation (RPA), business process management (BPM), cloud computing, and artificial intelligence (AI) to transform operational processes.

❌ Should not:

- Applying technology in a scattered manner without a ROI measurement model.

- Retaining outdated processes because of “fear of change”.

Dos and Don'ts of Investing for the Future

✅ Should:

- Maintain investment in AI, digital technology and innovation – but focus on applications that can create short – medium – long term value.

- Retain talent, retrain them to adapt to new roles (especially in an AI-driven environment).

- Communicate clearly with investors and shareholders about counter-cyclical investment logic.

- Build flexible organizational capacity to adapt to rapid change.

❌ Should not:

- Stop investing in AI and automation just because of short-term inefficiencies.

- Ignore the “organizational readiness for change” factor in restructuring.

- It is necessary to clearly explain to investors the reasons and expectations when investing in technology, emphasizing long-term growth.

See more: Top 33 effective cost cutting strategies in business

Technology application – a strategic step to realize cost optimization

Cost optimization cannot stop at the strategic planning level – it needs to be realized through specific operating systems. That is why the application of technology, especially automation (RPA), data recognition (OCR), artificial intelligence (AI) and cloud management platforms, is becoming an indispensable part of modern financial strategies.

Many businesses have found that cost-cutting efforts are often unsustainable without ongoing monitoring and measurement. When expense management relies on manual processing, distributed spreadsheets, or disjointed approval processes, the risk of loss, overspending, or incorrect approvals is high – even with the best intentions.

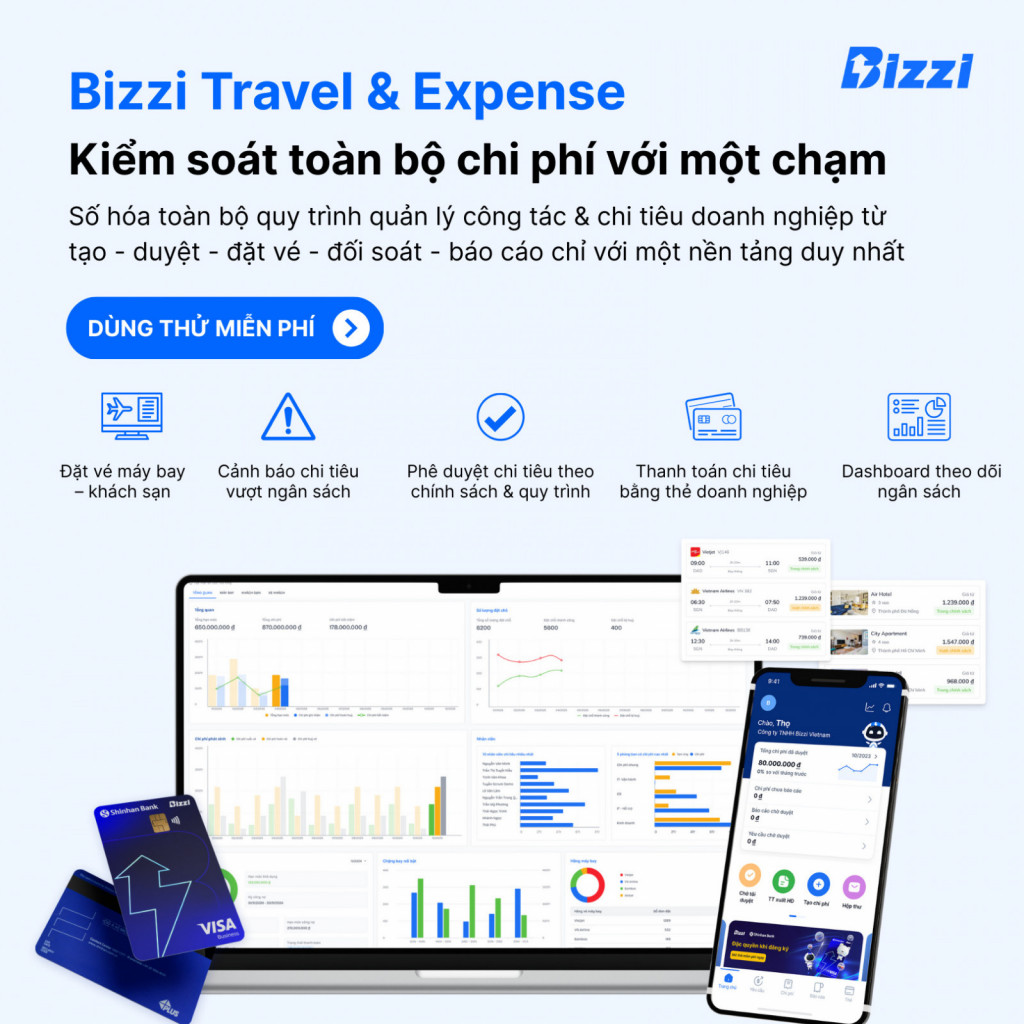

One of the solutions that many CFOs are interested in is implementing a real-time operating cost management platform. In Vietnam, Bizzi Travel & Expense is a typical example. This is a solution that helps businesses standardize the expense management process – from receiving invoices, approving expenses to reconciling and reporting – in a fully automated and integrated way.

It is worth noting that this system is not just a control tool, but also a platform for CFOs to:

- Transparency of all costs from input to output

- Shorten document processing time and minimize human errors

- Real-time spending analysis for timely decision making

- Set flexible budget ceilings by department or project

- Increase finance team efficiency by eliminating manual operations

Digitizing the cost control process frees CFOs from relying on delayed reports or inconsistent data. Instead, CFOs can proactively assess the effectiveness of each expense, recommending cuts or reinvestments based on standardized data.

>> Sign up for a free trial of all features in the Bizzi Travel & Expense expense management solution: https://signup.bizzi.vn/bizzi-travel-expense?utm_source=newsletter

Cost optimization, after all, is not a single action. It is a system that includes the right strategy, the right methodology, and the right tools. Implementing platforms like Bizzi Travel & Expense is one of the concrete steps that can help turn optimization theory into control practice – and create long-term efficiency for the organization.

The New Role of the CFO in the Digital Financial Ecosystem

Cost optimization Today it cannot be the sole responsibility of the Finance department – it requires multi-dimensional coordination.

With the help of technology, the role of the CFO is clearly shifting – from being a financial supervisor to being an architect of a more efficient, transparent and flexible financial ecosystem. While the CFO used to focus on risk control and compliance, today the responsibilities also include:

- Leading the digital transformation of finance – choosing the right technology, setting up real-time financial performance metrics

- Partner with CEOs and operations leaders to make data-driven decisions

- Reengineering financial processes to support new business models – especially when businesses need to adapt quickly to market fluctuations

- Promote a culture of responsible finance – where every spending decision is linked to strategic goals

In an uncertain economic environment, CFOs hold the “leverage” for businesses to not only survive – but also grow sustainably. Investing in platforms like Bizzi Travel & Expense is no longer an individual choice for the finance department, but part of an overall strategy for businesses to upgrade their financial operations – both at the strategic and execution levels.

Cost optimization is never just about “cutting the budget.” It is a continuous process that includes assessing what activities create value, building operating systems that support smart financial decision-making, and most importantly – building an organization that is frugal yet ready to invest for growth.

Gartner’s cost optimization decision framework—with its six evaluation factors and initiative prioritization model—is a solid tool for CFOs. But for the approach to translate into action, businesses need a unified data platform, transparent processes, and real-time cost control.

Bizzi Vietnam will continue to accompany CFOs and finance teams on the journey of optimizing, automating and digitally transforming corporate finance.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam