In the context of businesses increasingly transforming digitally, choosing a flexible, highly integrated and scalable financial ERP system becomes a key factor to help businesses maintain a competitive advantage. Microsoft Dynamics 365 Finance is one of the ERP solutions Top rated in comprehensive financial management – accounting and process automation.

Explore with Bizzi 5 Dynamics 365 Finance features Featured in this article!

Dynamics 365 Finance – Elevating financial management in the digital age

Dynamics 365 Finance Not only is it an accounting support tool, but it is also a strategic financial management platform. Thanks to its real-time data connectivity and comprehensive process integration, this solution helps businesses improve operational efficiency, control risks, and make more accurate decisions. Effective exploitation Dynamics 365 Finance features will play an important role in long-term growth strategy.

What is Dynamics 365 Finance?

A comprehensive financial management solution developed by Microsoft, helping businesses automate, modernize and unify financial operations globally. This platform deeply integrates the functions of enterprise resource planning (ERP) and customer relationship management (CRM) systems, featuring many outstanding features. Dynamics 365 Finance features suitable for medium and large sized businesses.

The Role of Automation in Modern Financial Management

In an era of fierce competition, businesses are forced to digitally transform and automate all financial processes. Automation helps:

- Save processing time

- Minimize human errors

- Free up resources for strategic activities

- Enhance transparency and compliance

Therefore, effective exploitation Dynamics 365 Finance features will bring a distinct advantage to the corporate finance department.

Learn about the 5 feature groups Dynamics 365 Finance

Microsoft Dynamics 365 Finance provides a comprehensive ecosystem of features, supporting businesses to effectively control finance and accounting, plan budgets, manage cash flow and optimize decision-making processes. Below are 5 typical feature groups that are highly appreciated by businesses.

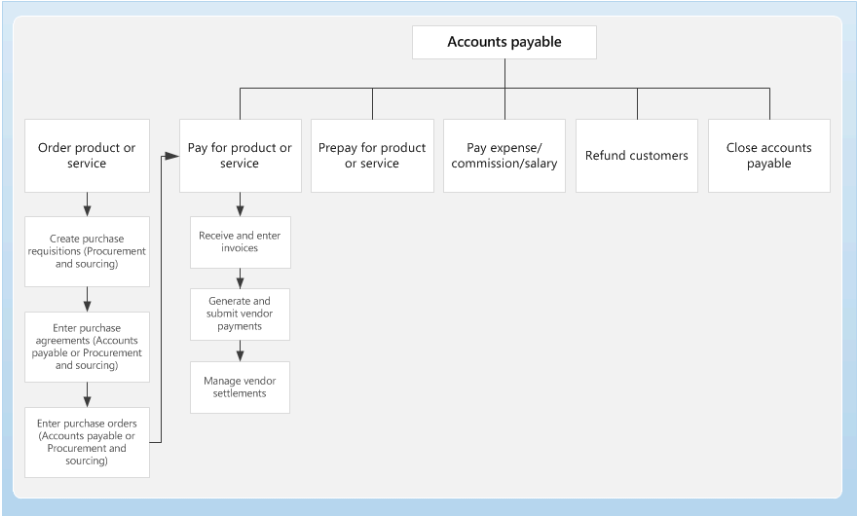

Accounts Payable Feature Group – Automate your payment process

One of the most prominent Dynamics 365 Finance features is the automation of the disbursement process and the processing of incoming invoices.

Automate input invoice processing

Dynamics 365 Finance uses AI to capture, scan, and record data from supplier invoices, eliminating the manual entry process that is prone to errors and time-consuming. This not only increases efficiency but also helps businesses meet audit requirements and make transactions transparent.

Automatic reconciliation of invoices, purchase orders and receipts (3-Way Matching)

The system automatically compares detailed information between invoices, purchase orders (POs) and warehouse receipts (GRNs) in real time. This feature helps to quickly detect discrepancies in quantity and unit price, ensuring accuracy before payment.

Flexible invoice approval process

Enables setting up automated invoice approval flows based on business-defined rules (e.g., by amount, department, vendor), helping to speed up processing and ensure internal policy compliance.

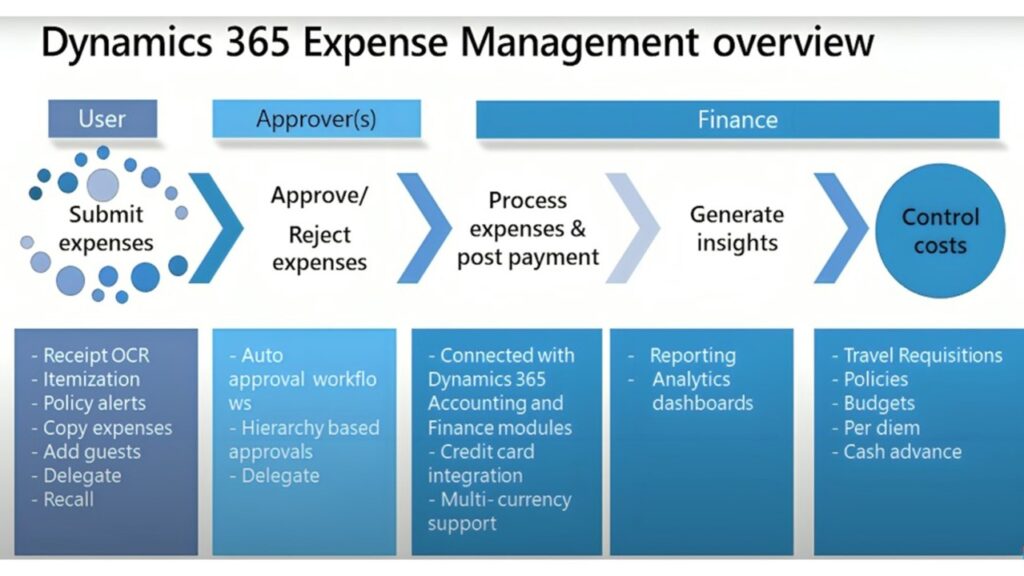

Enterprise Budgeting and Expense Management Feature Group

Controlling budgets and spending is a top priority for CFOs. Dynamics 365 Finance provides powerful tools for financial planning and real-time spending tracking.

Set and control budgets in real time

Provides tools to plan, allocate and track budgets for each department, project or cost center. The system provides instant alerts when spending is at risk of exceeding the threshold, helping managers closely control the financial situation.

Manage expenses and travel expenses effectively

Allows employees to easily create expense requests and report business expenses (airfare, hotels, travel). Businesses can set policies and spending limits to automate checks and approvals, ensuring compliance.

Smart spending analysis and reporting

Provides intuitive reports and dashboards, allowing for spending analysis across multiple dimensions (employees, projects, expense types). This gives businesses insight into expenses, allowing them to make cost optimization decisions.

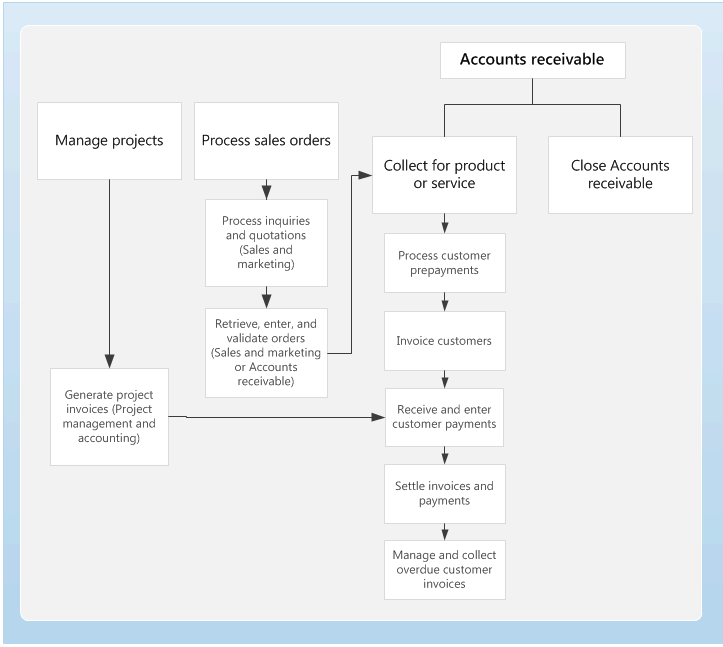

Accounts Receivable Feature Group – Accelerate Cash Flow

Optimizing cash flow is vital for every business. Dynamics 365 Finance helps businesses shorten collection cycles and manage credit more effectively.

Automate debt collection processes

Support setting up automatic debt reminder processes via email or other channels based on the age of the invoice. This helps reduce manual work, improve debt collection efficiency and shorten the receivable turnover (DSO).

Credit management and customer debt tracking

Provides tools to track and manage each customer's receivables. The system allows setting and monitoring credit limits, and issues warnings when there are signs of risk, helping to minimize bad debt.

Effective debt reconciliation and reporting

Automate debt reconciliation with customers, provide detailed reports on debt status, debt aging reports, helping businesses clearly understand the health of cash flow from sales activities.

General Ledger, Invoices and Financial Reporting Feature Group

Bookkeeping is a core function that every financial system needs. With Dynamics 365 Finance, businesses can synchronize and process thousands of transactions every day accurately, transparently and in accordance with international accounting standards.

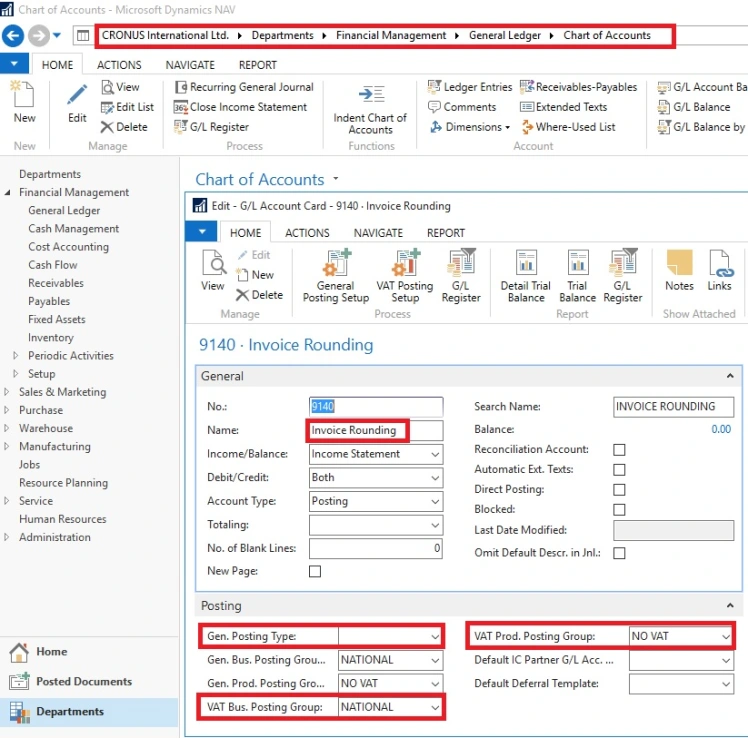

Flexible General Ledger Management

As the core of the financial system, it allows management of all accounting transactions, supports multiple currencies, multiple legal entities and complies with different accounting standards.

Issuance and management of electronic invoices

Support for creating, issuing and storing electronic invoices in accordance with tax authority regulations. Businesses can customize invoice templates and centrally manage invoice status (sent, paid, canceled).

Multidimensional and intelligent financial reporting

Integrates with data analytics and AI tools, enabling real-time generation of intelligent financial reports. Managers can easily review profit and loss statements, balance sheets, and cash flow statements to make informed business decisions.

Extensibility & Integration – Flexible Scalability

Not only providing core functionality, Dynamics 365 Finance is also easily extensible through integration with other software such as CRM, HRM, SCM or third-party applications such as Bizzi, Power BI, Excel...

Integrate with Bizzi – Speed up invoice processing

Bizzi is a financial automation solution that helps businesses read input invoices, compare 3-way (PO – GR – INV) and then push data into Dynamics 365 Finance. With this model, businesses can save up to 80% of invoice processing time and minimize data entry errors.

API Connectivity – Easy Customization

The Dynamics 365 Finance features Designed with high scalability, integrated via API or middleware platform. This helps businesses deploy quickly, without affecting the core system and easily scale according to development needs.

Outstanding benefits when implementing Dynamics 365 Finance

The application of Dynamics 365 Finance features Not only does it improve work performance, it also supports businesses in sustainable digital transformation.

1. Increase efficiency, reduce errors

One of the outstanding benefits that microsoft dynamics 365 finance brings the ability to automate repetitive processes – from accounting, invoice processing to financial reporting. This significantly reduces the administrative burden on the accounting department, limits manual errors and improves the team's productivity. The system helps businesses maintain high accuracy in all financial operations, especially during periods of rapid growth.

2. Improve data-driven decision making

Use Dynamics 365 Finance, businesses can access real-time financial data with high accuracy and consistency across the board. Thanks to the advanced analytics platform, leaders can make quick strategic decisions based on data rather than emotions. This is the core factor that helps businesses respond flexibly to market fluctuations and optimize profits.

3. Ensure compliance and enhance transparency

The ability to systematize the process of controlling expenses and approvals helps businesses ensure compliance with internal policies as well as legal regulations related to finance and accounting. All transactions are recorded transparently and can be traced at any time, helping to increase reliability when working with auditors or authorities.

Conclude

With the power of automation, real-time analytics, and flexible scalability, Dynamics 365 Finance not only an accounting and financial tool, but also a strategic foundation to help businesses develop steadily in the digital age. Fully exploiting the Dynamics 365 Finance features will help CFOs, chief accountants and SME business owners optimize processes, control risks and accelerate long-term growth.

Are you considering implementing Dynamics 365 Finance or want to learn more about financial automation solutions for your business? Contact a Bizzi expert for advice on the most suitable integration model for your business.