The Quarterly Invoice Usage Report Form is an important document for organizations that purchase invoices from the Tax Authority, change their operating status or relocate. The following article by Bizzi will provide complete information about the characteristics as well as instructions for submitting the correct invoice usage report form.

What is the invoice usage report form?

The invoice usage status report form is a report form that businesses periodically prepare and send to the tax authority. The purpose of the invoice usage status report form is to count the number of invoices that have: Use – Delete – Lose – Destroy. Simultaneously, This is also the basis for tax authorities to monitor the issuance and use of invoices in accordance with regulations.

Who must submit the invoice usage report form and vice versa?

According to Article 29 of Decree 123/2020/ND-CP and related guiding documents, the subjects required to submit Invoice Usage Report (BCTHSDHĐ) include:

Businesses and individuals buy invoices from tax authorities

- Including: economic organizations, business households, business individuals.

- Responsible for preparing and submitting reports with a list of invoices used during the period.

Business changes operating status

- In case of: Division, separation, merger, dissolution, bankruptcy or transfer of ownership

- Reports must be submitted at the same time as tax settlement documents.

Business moves to another district/county

- Report submitted to the tax authority of the place of departure.

Other special cases

- For example, problems with electronic invoices with codes, temporarily use printed invoices from tax authorities.

In contrast to the subjects required to submit invoice usage status reports, the following subjects will not need to do so:

- Enterprises using electronic invoices according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC: No need to submit as data is synchronized with tax authorities.

- Enterprises do not use invoices during the period: If the previous period's invoice has been used up, there is no purchase or use during the period → no need to report.

- Business not yet operating or not yet issuing invoices: If you have not registered for printing/self-printing or have not announced the release, you do not need to submit a report.

Latest invoice usage report form

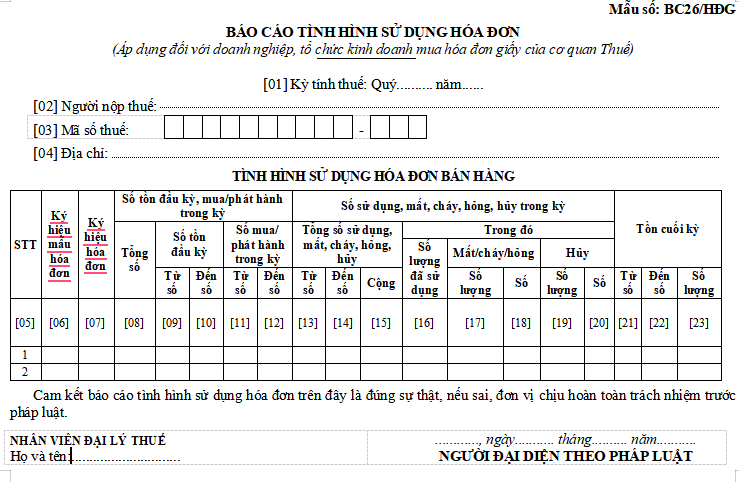

Enterprises using paper invoices purchased from the Tax Authority shall report on invoice usage according to Form No. BC26/HDG according to Decree 123/2020/ND-CP. To download the report form, click on the link below to download and edit.

This invoice usage status report template has the following characteristics:

- Applicable to organizations purchasing invoices from tax authorities.

- Located in Appendix IA issued with Decree 123.

Appendix IA – Form No. BC26_HĐG

- Free Download here

Deadline for submitting invoice usage report form

The deadline for submitting the Invoice Usage Report (BCTHSDHĐ) is clearly stated in Article 29 of Decree 123/2020/ND-CP as follows:

- Quarterly submission:

Deadline is the last day of the first month of the following quarter: Quarter I – April 30; Quarter II → deadline July 30; Quarter III – October 30; Quarter IV – January 30 of the following year

- Submit on event basis

-

- Division, separation, merger, dissolution, bankruptcy, ownership transfer: submit with tax settlement dossier.

- Change of business location to another location: submit at the place of departure.

- Use temporary paper invoices (due to system code issue problem): submit no later than 2 working days from the time of notification to the tax authority

- In case of not using invoice during the period

Still have to make a report with usage quantity = 0, no need for detailed list.

Instructions for submitting invoice usage status report form

Below are detailed instructions on how to submit the invoice usage report form (BC26/AC) via the HTKK software and the General Department of Taxation's electronic information portal (eTax):

Submit Report via HTKK software

Step 1: Prepare the report

- Open HTKK software latest version

- Go to menu “Invoice” → “Invoice usage report (BC26/AC)”.

- Select reporting period (quarterly) and type of invoice use.

- Fill in all columns: denominator, symbol, from number - to number, quantity used, delete, cancel,...

Step 2: Sign and Render XML

- Once completed, double check the content then press “XML Rendering” to save the report file.

- Plug USB Token (digital signature) and render digitally signed XML file.

Submit Report via Electronic Tax Portal (eTax)

- Access: https://thuedientu.gdt.gov.vn

Step 1: Log in to the system

- Select Business, log in with Tax code and password.

- Plug Digital signature USB.

Step 2: Submit the declaration

- Go to section “Filing Tax” → “Submit XML Return”.

- Select declaration BC26/AC → Select the XML file just exported from HTKK.

- Sign and submit the declaration.

Step 3: Check status

- Enter “Search profile” → check if the report status has been accepted.

- If the status “Submitted to CQT” or “Approved”, meaning done.

What is the penalty for late submission of invoice usage report?

Late submission of invoice usage reports (BCTHSDHĐ) will be subject to administrative penalties according to Article 23 of Decree 125/2020/ND-CP (amended and supplemented by Decree 102/2021/ND-CP). Specifically:

Penalties according to Decree 125/2020/ND-CP

- 1–5 days late (with mitigating circumstances): Warning

- 1–10 days late or incorrect declaration: 1–3 million VND

- 11–20 days late: 2–4 million VND

- 21–90 days late: 4–8 million VND

- Over 91 days or no payment: 5–15 million VND

Special Note:

- Small businesses and individuals may be treated more leniently depending on the case.

- The penalty applies to each reporting period. If the enterprise is late for many quarters, the penalty will be cumulative.

- Failure to submit reports is considered an act of evading the obligation to declare invoices, affecting the credibility of the business in the eyes of tax authorities.

Measures to overcome the situation of late submission of invoice usage report form:

- Use invoice management software with deadline reminder (like Bizzi B-Invoice, MISA, VNPT Invoice...).

Generate automatic reports according to BC26/AC template in correct XML/Word/Excel format. - File at least 2–3 days before the deadline to avoid tax system overload.

Verify the list of invoices issued – canceled – adjusted during the reporting period.

B-Invoice is the foundation Electronic invoice Developed by Bizzi, applying advanced technology to help businesses manage invoices easily. accurate – legal – cost-effective. B-Invoice electronic invoice includes:

Regular electronic invoice

- Fully comply with the regulations of Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

- Support for creating, issuing and storing electronic invoices in XML/PDF format, valid digital signature according to tax authority standards.

- Manage invoice status: issued – adjusted – replaced – cancelled.

Electronic invoice from cash register (POS)

- Direct integration with popular POS machines on the market.

- Support for issuing invoices at the point of sale immediately after the transaction, saving time and ensuring legal compliance.

E-ticket

- Manage ticket sales and electronic invoicing for event tickets, transportation, entertainment… quickly – accurately – easily controlled.

In short, the invoice usage status report form is an internal management tool that helps accountants and finance know the number of invoices used, remaining, canceled or incorrect. This is considered important data to compare with: Sales and revenue accounting books; Value Added Tax (VAT) declaration; Data on the electronic invoice system (if any).

To improve the efficiency of invoice management as well as automate the financial and accounting processes of the business. Register to experience Bizzi's comprehensive solution suite today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/