A payment request is an internal document created by a department or individual with a need to spend money to request the accounting or finance department to make a payment for a specific expense. This is an important intermediate step in the process of controlling the cash flow of the business.

In this article, Bizzi will introduce detailed information about payment request as well as share the link to download the latest payment request form 2025.

Payment proposal overview

Payment request is a tool to help control costs and ensure the validity of each expense; help accountants track debts, reconcile payments, and store documents. Below are the details of the payment request.

What is a payment proposal?

A debt payment request is an official document sent by the supplier of goods/services (creditor) to the buyer/user of services (debtor) to request payment of the outstanding amount.

A payment request is a document that states:

- Information of the person requesting payment (full name, department)

- Purpose of expenditure: purchase, advance, contract payment, business trip, refund, etc.

- Amount to be paid and method of payment (cash/bank transfer)

- Related documents: invoices, contracts, acceptance reports...

- Date of establishment, signature of confirmation of relevant parties (applicant, department head, accountant, director...)

- The main purpose is to promote payment as agreed in the contract.

Why is it necessary to make a payment request?

Making a payment request is not just a procedure, but a part of a professional financial control process, ensuring the business operates effectively, transparently and sustainably.

Tight financial control

- Payment request is the basis for accounting department to evaluate, avoid spending for wrong purposes, wrong procedures or exceeding budget.

- Ensure spending is planned, transparent and well-documented.

Limit the risk of loss

- Have hierarchical approval signatures → control personal responsibility for each expense.

- Payment request form helps to reduce cases of incorrect payments and internal fraud.

Increase initiative and transparency

- The proposer will have clear responsibility for the expenditure he/she requests.

- Relevant departments (purchasing, accounting, approval) have the basis for fast and accurate processing.

Support auditing and archiving

- Payment request is an important document in payment records when the enterprise is audited or needs internal reconciliation.

- Helps retrieve transaction history, serves accounting, legal or budget management purposes.

Download links for popular payment request templates and their features

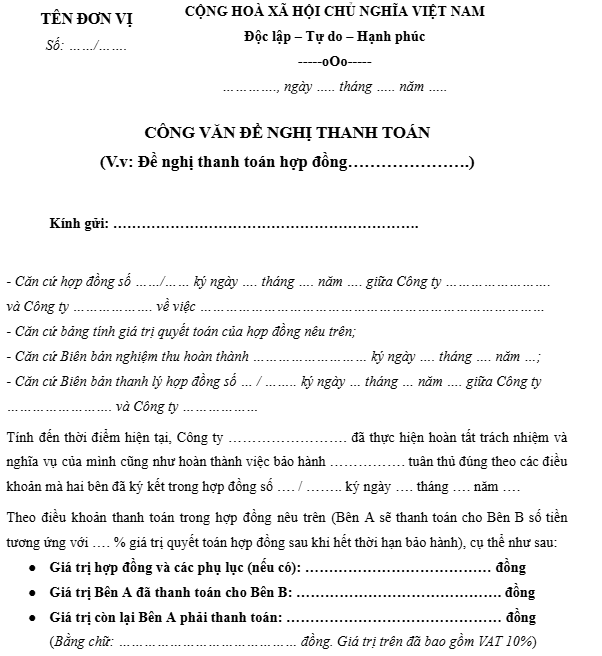

Sample letter requesting payment for construction contract

Required content:

- Confirm that the contractor has completed its contractual obligations and warranties (if any).

- Payment terms in the contract (e.g. payment after warranty period).

- Contract value and appendices.

- Value paid.

- Remaining value proposed to be paid (in numbers and words, including VAT).

- Payment account information of the applicant.

Relevant legal regulations

- Payment for construction contracts must be consistent with the contract type, contract price and signed conditions according to Article 19 of Decree 37/2015/ND-CP.

- The parties shall agree on the number of times, stages, timing, duration, documents and payment conditions.

- Payment term shall not exceed 14 working days from the date the contractor receives complete and valid documents.

>> At the moment Request for payment of construction contract here.

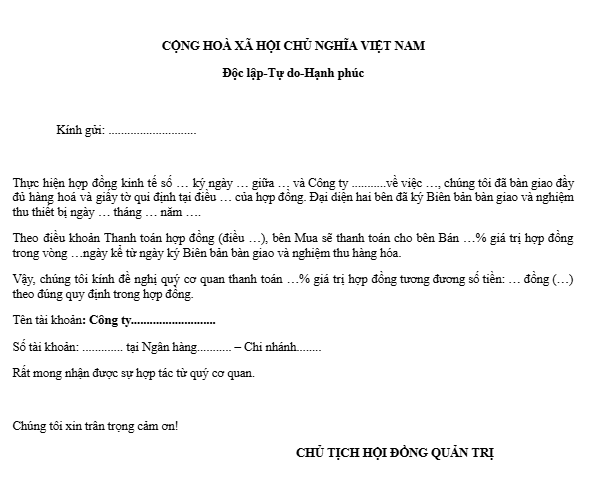

Sample of a regular debt payment request form

Use when you need to remind about payment for purchases of goods or services. Required content:

- Name of unit, business and department requesting payment.

- Information of the person requesting payment (full name, department).

- Payment content (contract information, related invoices).

- Total amount requested for payment (in numbers and words).

- Number of original documents attached (invoices, acceptance reports, etc.).

- Payment account information of the applicant.

>> Download the debt payment suspension request form now here

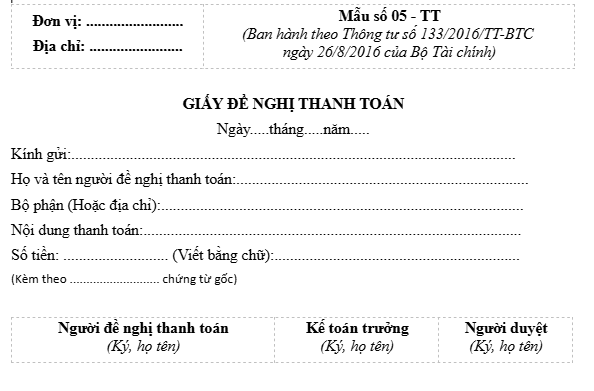

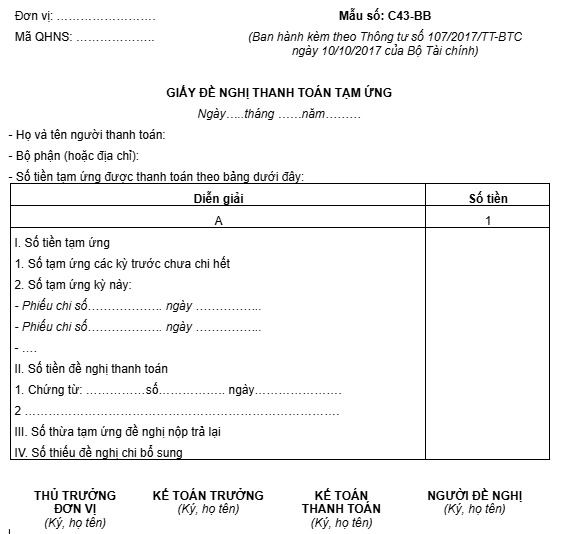

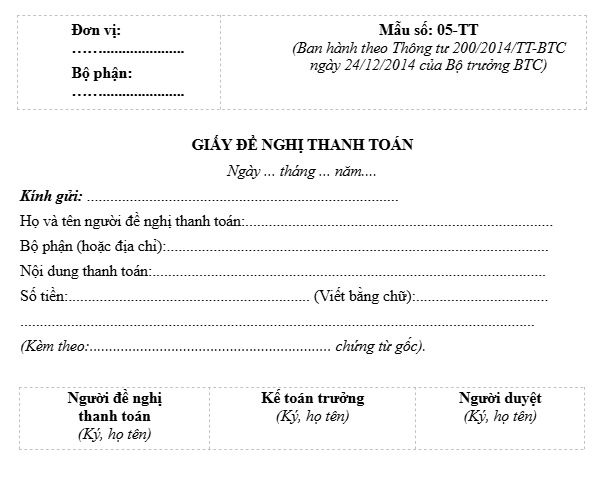

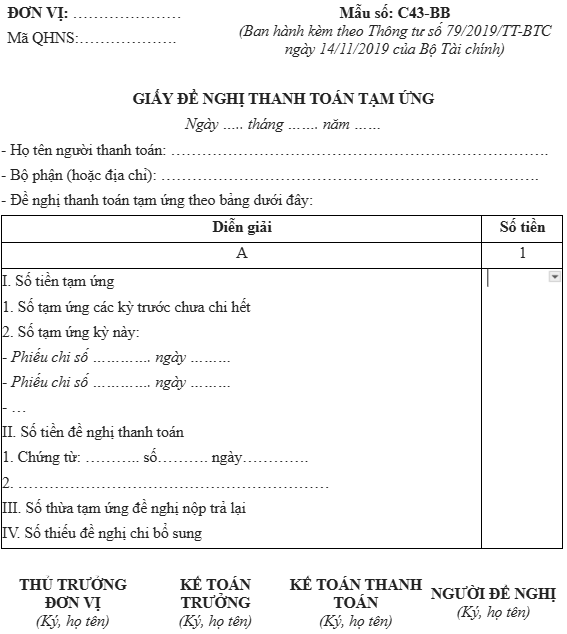

Payment request form according to Circular of Ministry of Finance

The forms are issued according to regulations of the Ministry of Finance, ensuring legality and compliance with accounting standards.

- Payment request form according to Circular 133/2016/TT-BTC: Applicable to small and medium enterprises. Download now here.

- Payment request form according to Circular 107/2017/TT-BTC: Used for administrative and public service units. Download now here.

- Payment request form according to Circular 200/2014/TT-BTC: For all types and sizes of businesses. Download now here.

- Payment request form according to Circular 79/2019/TT-BTC: Applicable to the financial and state budget sectors.Download now here.

Detailed instructions on how to fill in and notes when making a payment request

In the process of making payment requests for individuals, businesses need to pay attention to some important points as below to ensure compliance with the law and the rights of both parties. Specifically as follows:

Requirements on form and language

- Language: Use standard Vietnamese, correct grammar, spelling, and precise word usage.

- Form: Present all necessary content in full compliance with administrative document style.

Information required in payment request

- Name and address of the entity/business requesting payment.

- Details of the person requesting payment (full name, department).

- Clear payment request content: Payment purpose for which item (for example: according to contract number…, invoice number…); Transaction execution time.

- Proposed payment amount: Write clearly in numbers and words, ensuring accuracy.

- List the original or copies of the documents attached.

- Bank account information of the requesting party for the paying party to make the transfer.

Important notes when making a debt payment request

- Make sure to fully mention the contract number and related terms.

- Record the full name and address of both businesses accurately and completely.

- Specify the contract signing time (if any).

- Payment amount must match between numbers and letters, avoid erasure.

- Provide detailed and accurate bank account information.

- Require signatures of the applicant, chief accountant and approver (depending on regulations of each unit).

Use cases and responsibilities for making payment requests

Clearly defining use cases and responsibilities for making Payment Requests helps businesses control costs well, ensure correct procedures - right people - right work, thereby operating more professionally and sustainably.

Cases where payment request form is required

Payment offers are used in many different situations, common ones include:

- Payment to suppliers: After receiving all goods/services and having full documents: contract, invoice, acceptance report,...

- Applicable to: purchasing goods, outsourcing services, agency costs, advertising, logistics, etc.

- Advance payment: Before performing tasks that require advance payment such as: business trips, purchasing small supplies, organizing events, etc. After that, the person making the advance payment must make a refund with original documents.

- Refund (advance payment): After using the advance amount and having invoices and related documents to refund the remaining amount or declare the amount spent.

- Payment of internal expenses: Salary, allowances, personnel support, electricity and water costs, office supplies, internal event costs, etc.

- Periodic or installment payments: Office rent, software, copyright, periodic machine maintenance (monthly/quarterly/yearly).

Who is responsible for preparing the payment request?

Depending on the size of the organization, the responsibility for preparing the Payment Request is often clearly divided as follows:

- The person directly performing the purchasing or spending will prepare the payment request.

- The request will then be forwarded to the Chief Accountant for review and submitted to the Director/General Director (or authorized person) for approval.

Conclude

Applying a standard payment request form helps the payment process run smoothly, transparently and in accordance with regulations. The payment request or payment request letter is the basis to ensure the rights of both the buyer and the seller.

The person in charge should choose the right payment request letter that is appropriate to the type of transaction and legal regulations. Hopefully, through this article of Bizzi, businesses can refer to the provided payment request letter and paper samples to ensure completeness and accuracy.

How does the Bizzi platform help in the “Request for Payment” process?

Traditionally, organizations still use manual methods, and the process of creating payment requests and then approving expenses often takes several days. In such cases, employees have to wait a long time for approval. However, by automating the process, you can significantly reduce the time it takes to approve expenses in your company. Furthermore, you can reduce the workload of the finance department. They do not have to wade through piles of invoices and documents sent by employees.

Choose a software that provides the best user experience for your team and at the same time, gives you great visibility. 3-layer cost management model Bizzi's is a solution that businesses can consider.

Here's how expense approval automation Bizzi Expense can help your organization:

Support in developing spending policies for the organization

- Easily set up expense usage policies for your organization

- Manage billing information for each user: MST, invoice receipt email, address, personal information

- Manage expense categories according to organizational needs

Standardize the automatic cost creation and approval process

- Build an approval process flow for each spending limit, consistent with the nature of the company's costs

- Decentralize approval and management of permission groups according to each department level

- Create and send spending requests according to various categories: travel, business trips, reception, stationery, etc.

- Create and approve payment requests and expenses conveniently anytime, anywhere, instantly via mobile app

- Conveniently attach invoice information and documents to each expense

Manage department and project costs in real time

- Record expenses quickly in real time

- Manage costs by each category/department/project

- Minimize risk and reconcile payments faster

- Allows exporting expense list excel files.

Control costs strictly according to budget

- Set up and divide budgets according to fiscal year and organization/project/department scale

- Proactively control budgets with the ability to set spending limits and assign budgets to each category/department/project

- Automatically warn when spending exceeds the allocated budget

- Easily track remaining budget information and spent expenses

- Dashboard system reports budget compared to reality to help evaluate performance and effective financial operations

- Synchronize with the organization's cost management system and payment request approval process

With just a few simple clicks, with Bizzi Expense all the complex processes of managing, controlling costs and creating a payment offer have become easier thanks to outstanding benefits:

- MANAGE EXPENSES IN ONE PLACE: Automatically remind if you haven't received the bill, no fear of forgetting or missing expenses.

- AUTOMATIC READING OF ELECTRONIC INVOICES: No need for tedious manual data entry, Bizzi Bots automatically checks and verifies the validity of invoices.

- SEND PAYMENT REQUEST WITH JUST ONE TOUCH: Automatically export expense lists and summarize invoices to send to accounting.

To learn more about automating the expense approval process for your company, book a demo with Bizzi today: https://bizzi.vn/dat-lich-demo/