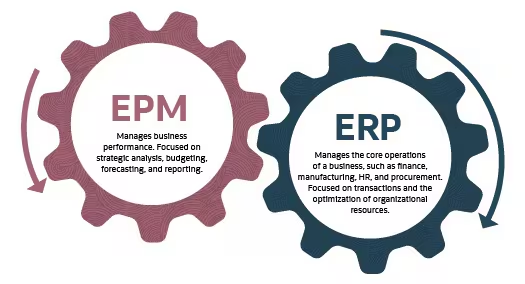

EPM is considered the “Executive Brain” of modern businesses. While ERP only helps manage transactions, EPM helps businesses see the whole picture of performance and forecast the future.

With CFOs facing challenges such as fragmented data, manual planning processes, inaccurate forecasting and slow decision making, the role of EPM is more necessary than ever. EPM – An intelligent platform that transforms the role of finance – from data management to strategic leadership, moving businesses from reactive to proactive forecasting and performance optimization.

Is EPM necessary and why should we use EPM? Let's find the answer with Bizzi in the article below.

What is EPM? And why do businesses need EPM today?

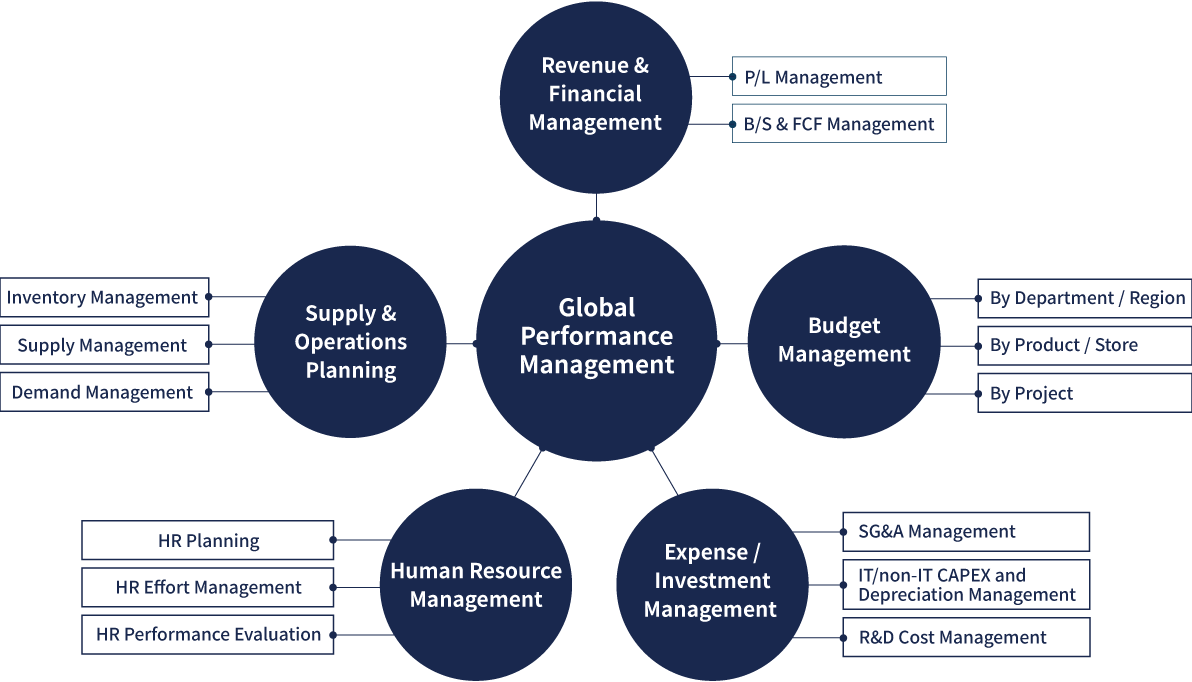

EPM (Enterprise Performance Management) is a business performance management system that helps plan, forecast, analyze and monitor performance based on consolidated data from departments.

Currently, many businesses still make manual plans on Excel, data is scattered across many different systems, leading to a lack of accuracy and difficulty in timely forecasting. EPM was born to overcome those weaknesses — helping businesses automate the planning process, connect and synchronize financial and operational data, thereby improving analysis capacity and making strategic decisions faster and more accurately.

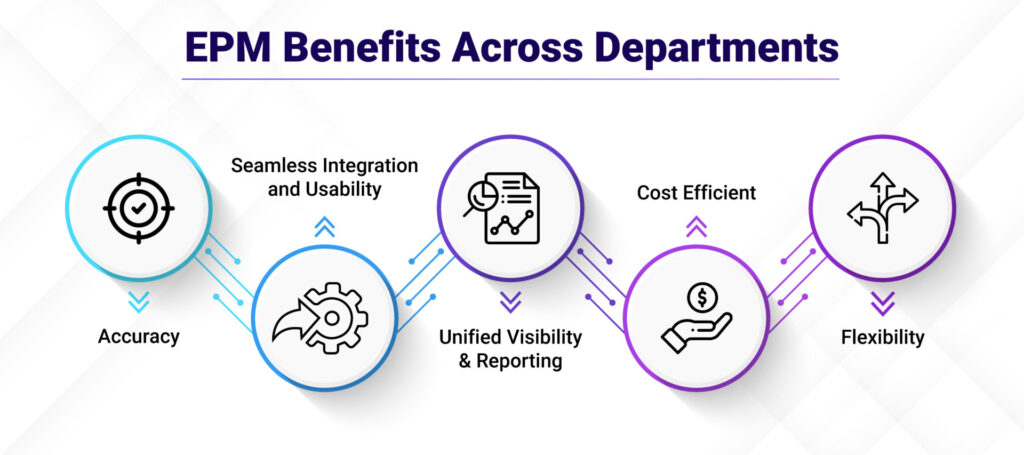

Is EPM necessary? What are the benefits of EPM for businesses?

EPM not only changes the way businesses plan their finances, but also upgrades their entire decision-making and strategic management capabilities, helping businesses operate proactively – forecast accurately – develop sustainably. Let’s analyze the benefits to know why you should use EPM.

Automate and standardize financial processes

EPM helps businesses significantly reduce the time it takes to create budgets, reports, and forecasts, by automating and standardizing processes on a unified platform. By eliminating manual operations on Excel, the system minimizes errors, while increasing productivity and efficiency for the finance team.

Improve decision quality

EPM integrates data from multiple departments, providing a complete financial picture for the business. Thanks to multidimensional analysis and scenario planning capabilities, management can make faster and more accurate decisions, based on data instead of emotions.

Optimize cash flow and profits

With EPM, businesses can cash flow planning Proactively forecast capital needs, costs and cash inflows/outflows in detail. This helps reduce the risk of liquidity shortages, while improving profitability and better financial control.

Linking strategic goals to actual operations

EPM helps to transform financial strategies into specific action plans, measured through real-time KPIs. From there, businesses ensure that all departments operate synchronously and towards the common goals of the organization.

In short, the benefits of EPM for businesses go beyond creating a modern management platform, and also help CFOs and leaders “look beyond the numbers” – from tracking the past to forecasting the future. EPM has the ability to free the finance team from manual data entry work, focusing on analysis and strategic planning.

Why use EPM instead of just ERP or Excel?

While ERP and Excel are still familiar tools in financial management, they are not powerful enough to meet the requirements of strategic planning and decision making in the context of fast-growing businesses and increasingly complex data.

To know if EPM is necessary, let's analyze the characteristics of each tool to see the outstanding features and advantages when implementing:

| Criteria

Evaluate |

Excel | ERP (Enterprise Resource Planning) | EPM (Enterprise Performance Management) |

| Main function | Manual storage and calculation | Business management, accounting transactions | Enterprise-wide financial strategy and performance management |

| Data accuracy | Prone to error, difficult to control change | Accurate in trading but lacks strategic synthesis | Real-time, synchronized and transparent data |

| Planning & Forecasting Ability | Manual, lack of flexibility | Data export is possible but does not support advanced forecasting | Support planning, scenario planning, smart forecasting |

| Scope of management | Limited to each file, department | Focus on operations and accounting | Covers the entire organization, linking strategy with actual operations |

| Scalability & Integration | Low, difficult to share | Good at the operational level | High – easy to integrate with ERP, BI, CRM and other analytics tools |

In short, ERP helps businesses manage transactions and daily operations while Excel Useful for small tasks but error prone and difficult to scale. EPM is the “strategic layer” above — helping to analyze, forecast and optimize overall financial performance, providing competitive advantage in modern business management.

Why CFOs and financial managers should choose Sactona – a solution exclusively distributed by Bizzi

CFOs and financial managers are facing many challenges as businesses scale and data becomes increasingly complex:

- Data is scattered across multiple systems, lacking connection between finance – operations – business departments.

- Manual planning and forecasting on Excel makes the process time-consuming, error-prone, and difficult to update in a timely manner.

- Lack of scenario planning and analysis capabilities to respond to market fluctuations.

Difficulty tracking performance and cash flow in real time, leading to slow or inaccurate decision making.

Faced with these limitations, CFOs turned to EPM (Enterprise Performance Management) as a strategic shift. EPM (Enterprise Performance Management) become strategic tools help CFO. Why use EPM?

- Consolidate financial and operational data, creating a “single source of truth” for the entire enterprise.

- Automate planning, forecasting, and reporting, helping to save time and reduce errors.

- Scenario analysis and trend forecasting, supporting faster and more accurate decision making.

- Track KPIs, performance in real time, ensuring the strategy is effectively executed.

- Increase coordination between departments, helping finance become the center of strategic direction, not just a support function.

Sactona – EPM platform from Japan, by Outlook Consulting development and Exclusive distribution by Bizzi Vietnam – become the top choice. This is a comprehensive financial performance management solution, with a friendly interface similar to Excel, easy to use and approach. Sactona provides a solution to automate the entire planning, forecasting and reporting process, helping to consolidate financial data in just a few minutes.

Suitable for Vietnamese businesses

Sactona is the solution EPM data transparency designed specifically for Finance and Accounting Department of Medium and Large Enterprises, focusing on FP&A process optimization, budgeting and forecasting.

Sactona has a friendly, easy-to-use interface for both Bizzi's accounting team and management, helping everyone quickly get acquainted and exploit it effectively without much training time.

Automate forecasting and reporting processes

Sactona consolidates financial data from multiple sources in minutes, eliminating manual aggregation altogether. The dashboards and dynamic reports are customized by role (CFO, CEO, accounting department…), giving each level of management a clear view that is appropriate for their responsibilities.

Accurate forecasting – faster decision making

Thanks to its flexible forecasting model, Sactona allows CFOs to simulate different growth scenarios and proactively develop response strategies. The system also provides early warning of risks and cash flow fluctuations, helping businesses maintain stability and tighter financial control.

Seamless integration with existing ERP and accounting software

Sactona connects directly to existing ERP systems, accounting software or Excel data, making it easy to transition to an EPM system without disrupting business operations. This solution reduces implementation costs while leveraging existing infrastructure to optimize technology investment efficiency.

Conclude

Is EPM necessary? Of course it is. EPM is not just a financial tool, but the “executive brain”. The benefits of EPM for modern businesses include performance management, strategic planning and data-driven decision making. The core values that EPM brings can be summarized in four words: Proactive – Transparent – Accurate – Data-centric.

With the characteristics of Vietnamese enterprises - solutions are needed Flexible deployment, cost-effective and easy to use, Sactona is exclusively distributed by Bizzi in Vietnam. is a worthy choice. With Sactona, businesses not only digitize financial processes but also completely transform the way they manage and make decisions. The solution helps CFOs, CEOs and finance teams consolidate data, forecast intelligently, and operate financial strategies in real time. That's why you should use EPM.

Registration here To experience the solution to see the real dashboard, discover how Sactona – Modern CFO Assistant operates intelligently and optimizes financial performance!