Electronic invoice lookup General Department of Taxation helps check the validity, avoiding the risk of fake invoices. However, you need to note some important points below to ensure the lookup process is accurate and effective.

This article by Bizzi will provide detailed instructions on how to look up electronic invoices from the General Department of Taxation as well as important notes during the implementation process to limit errors.

What types of electronic invoices does the General Department of Taxation have?

Electronic invoice General Department of Taxation Currently, there are many types of invoices such as: value added tax (VAT) invoices, sales invoices, electronic invoices with and without tax authority codes. Each type of invoice is suitable for different tax declaration methods and different users.

About Electronic invoice storage methodEnterprises are required to store in standard format (XML, PDF) in the internal system or on the platform of the electronic invoice service provider, ensuring integrity, security and easy retrieval within the time prescribed by law.

Adhering to the correct invoice type and storage method helps businesses connect effectively with their systems. General Department of Taxation, limit risks in tax inspection and audit.

How to look up electronic invoices of the General Department of Taxation

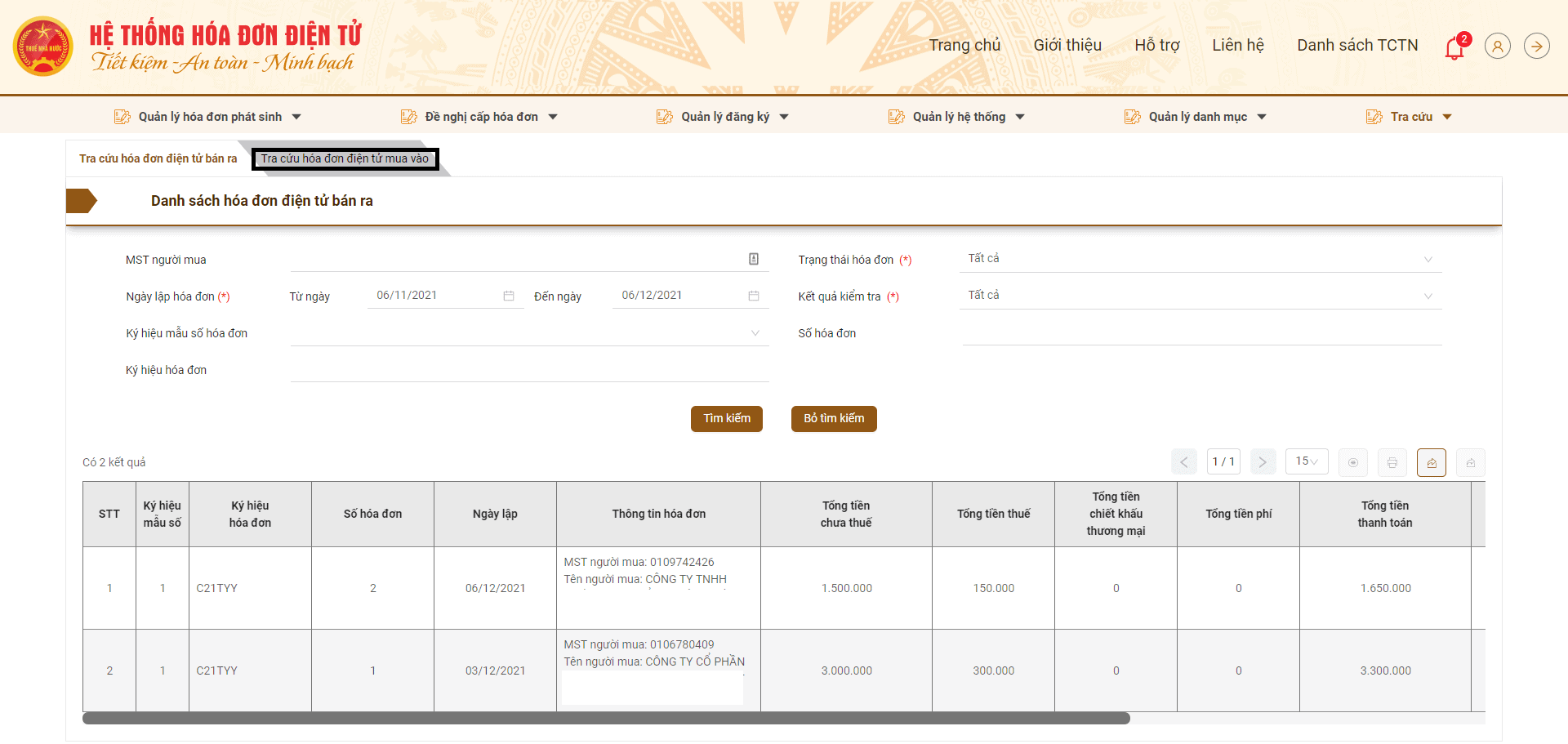

- Method 1: Look up on the General Department of Taxation's electronic invoice system

- Step 1: Access the Electronic Invoice System website at: https://hoadondientu.gdt.gov.vn/.

- Step 2: Fill in all information marked with red (*):

- Seller's Tax Identification Number (MST)

- Invoice type (with code/no code)

- Invoice symbol (note to remove the number character at the beginning of the symbol string, for example: 1C22TYY >> C22TYY)

- Some bills

- Total payment

- Step 3: Enter the captcha code and click “Search”

- Step 4: Check the information results of the electronic invoice you need to look up.

- Valid invoice: Shows “Invoice code issued”

- Invalid invoice: Displays "There is no invoice with information matching the information the organization or individual is searching for"

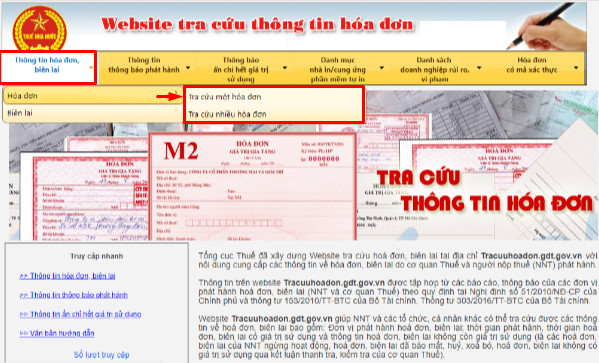

- Method 2: Look up electronic invoices on the General Department of Taxation's information portal

- Step 1: Access the address http://tracuuhoadon.gdt.gov.vn/tc1hd.html

- Step 2: Fill in all information marked with red (*):

- Tax code of HHDV seller

- Denominator

- Invoice symbol

- Some bills

- Step 3: Enter the Verification Code and click “Search”

- Step 4: Check the information results of the electronic invoice you need to look up.

Necessary information when looking up electronic invoices of the General Department of Taxation

After accessing the link to look up the General Department of Taxation's electronic invoice: https://hoadondientu.gdt.gov.vn, businesses need to pay attention to the following information:

- Seller Tax Identification Number

- Denominator

- Invoice symbol

- Some bills

- Captcha/Verification Code

- Total payment

Important notes when looking up electronic invoices of the General Department of Taxation

- Double check the information: Make sure to enter the required information correctly to successfully look up the invoice. (Seller's tax code, Invoice symbol, invoice number, Invoice issuance time must match the information on the electronic invoice).

- For invoice symbols: It is necessary to remove the number characters at the beginning of the string of symbols when entering them into the system.

- Contact support: If you have any difficulty in searching, please contact us directly. General Department of Taxation or electronic invoice software system providers for support.

- Use reputable software: You should use electronic invoice software that has been tested and recommended by tax authorities to ensure validity and safety.

If the bill not appear on the system, may be due to the following reasons:

- The business has not yet submitted data to the tax authorities.

- Invoice is fake or invalid.

- Incorrect information when entering search (need to check again).

- Only invoices in the electronic invoice system have codes. General Department of Taxation can only be searched on this page.

- Invoices without codes or those that are electronic invoices that do not need to be sent to the tax authorities will not appear on the website. authentication system.

If the invoice is not found, contact the issuer for verification.

Some common errors when looking up electronic invoices of the General Department of Taxation

During the process of looking up electronic invoices on the General Department of Taxation, users will sometimes encounter some common error states as follows:

Invoice not found in the system:

- The business has not yet submitted invoice data to the tax authorities.

- Fake or invalid invoice.

- Incorrect information when entering search.

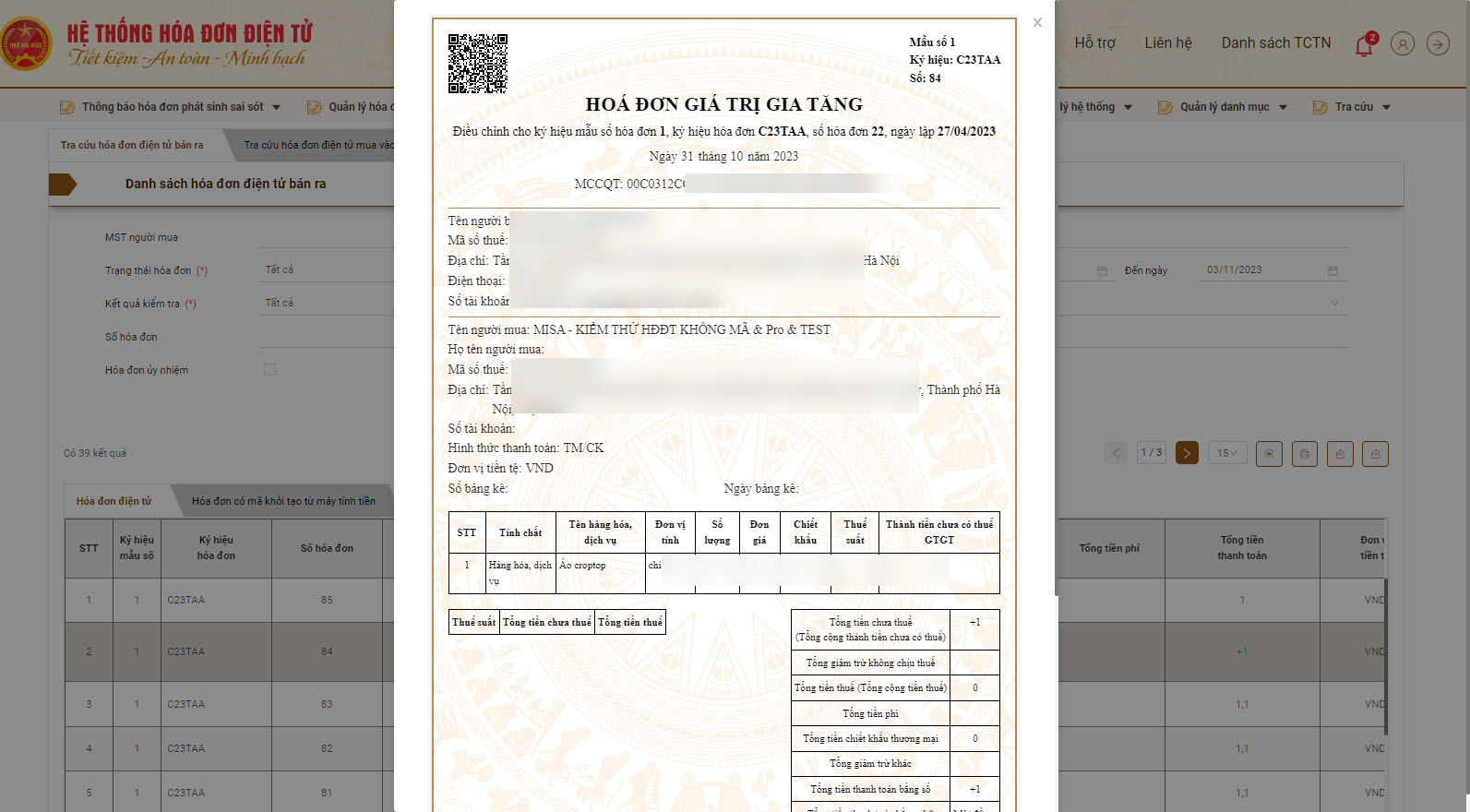

Invoices with status “Cancelled” or “Incorrect information”:

- Because the seller has canceled the invoice and replaced it with a new invoice.

- Please contact the issuer for an accurate invoice.

Cannot access search page:

- Electronic invoice portal of General Department of Taxation may be overloaded, try again later or change browser.

- Check your network connection and make sure you entered the correct address. https://hoadondientu.gdt.gov.vn.

How to register to use the electronic invoice information lookup form of the General Department of Taxation

- Registration form:

- Direct

- Online

- Postal services

- Processing time: 02 working days

- Registration form:

- Case 1: Register by email:

- Form No. 01/CCTT-DK Registering an account to access the Electronic Invoice and Electronic Document Information Portal

- Case 2: Register by texting to your mobile phone number:

- Form No. 01/CCTT-NT: Registration for using text messaging to look up information on electronic invoices and electronic documents

- Case 1: Register by email:

Benefits of using electronic invoices

- Cost savings:

Businesses save a lot of costs compared to using paper invoices in terms of printing costs, ink, shipping costs for invoices to customers, purchasing invoice storage equipment, etc. From there Cut costs of issuing and storing invoices.

- Save time, reduce operations:

With the use of electronic invoices, you only need to enter some basic information of the buyer and press send, then the customer will immediately receive a notification of electronic invoice issuance from your business. In addition, you will also save more time when searching. At the same time, the business will reduce the time to prepare reports on invoice usage, automatic financial management It is not necessary to submit an application for using electronic invoices or to make a report on the use of electronic invoices to the Tax Department.

- Expense management easier:

With electronic invoices, businesses can easily control saved invoices, simplify invoice processing and management, and declare taxes more quickly. Easy to look up and compare invoices from time to time Convenient accounting, bookkeeping, data reconciliation, avoiding loss and simplifying tax settlement.

- Enhanced safety and security:

Electronic invoices cannot be counterfeited, because electronic invoices always have a tax authority authentication code, ensuring safety and security for users and recipients. In addition, when using software to issue electronic invoices, you can still correct the buyer's name, tax code, address, and order in case of mistakes.

- Modernizing tax administration:

Electronic invoice is obligatory according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC; recognized as valid by tax authorities when declaring and settling taxes.

Bizzi's solution for electronic invoice lookup

Bizzi is proud to provide automatic invoice processing software that helps companies reduce errors and increase efficiency because each electronic invoice is processed and data extracted in less than 30 seconds.

Advantages of using Bizzi's input invoice processing and lookup software:

- Full service: Respond to business needs Decree 123/2020/ND-CP, Circular 78/2021/TT-BTC.

- Comprehensive management: Issue, manage, and report invoices anytime, anywhere via any platform.

- Business according to Tax standards: Applying multi-layer security technology ensures absolute safety and prevents invoice counterfeiting.

- Easy to integrate:Multi-platform compatible, easy to integrate with management systems and sales software.

- Rapid deployment and support: Operated and supported by Bizzi Vietnam team

Since its launch, Bizzi has attracted customers from large-scale corporate enterprises in various fields such as: Grab, GS25, Circle K, Tiki, Guardian, Medicare, Pharmacity, to SMEs together with with more than 4,000 vendors using the platform daily. As of 10/2021, the total value of monthly invoices processed through Bizzi platform reaches more than 300 million USD.

In addition, Bizzi provides solutions B-Invoice electronic invoice with many outstanding features:

- Output to various formats: pdf, html, excel: The Bizzi system supports users to automatically fill in invoice information and export it in many formats. Users are flexible and convenient in using and sharing invoice information.

- There is a convenient QR Code for quick checking: Invoice QR Check Code Helps to quickly check information and increases convenience for users, thereby saving search time.

- Easily search and retrieve original invoices on any device through invoice storage method in management systems that incorporate efficient search mechanisms.

- Diverse invoice template warehouse, easy to customize with More than 100+ invoice templates according to the management needs of businesses in all industries with full information according to the regulations of the General Department of Taxation.

- Store invoices safely and securely below Native XML format for 10 years at international standard data storage center.

- Support digital signatures and digital signature methods, Ensure the security, accuracy and reliability of digital signature transactions during invoice processing.

Here is all the information about the search. Electronic invoice General Department of Taxation. Bizzi is proud to be a comprehensive and comprehensive invoice processing software that applies modern technology to bring real value and is recognized not only in Vietnam but also in the international community. Register now to try Bizzi's products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/

See more: