Microsoft Dynamics 365 Finance is increasingly becoming one of the solutions. ERP software The most popular finance solution among medium and large enterprises. With the ability to automate financial processes, integrate AI and deep data, Dynamics 365 Finance not only helps businesses manage their finances effectively but also helps them make faster and more accurate decisions in a volatile business environment.

So What is Microsoft Dynamics 365 Finance?, what are its outstanding functions, how is it applied and is it suitable for Vietnamese SMEs? Let's find out the details in the article below.

What is Microsoft Dynamics 365 Finance?

Microsoft Dynamics 365 Finance is a module of the Microsoft Dynamics 365 application suite – an ecosystem ERP + Comprehensive CRM developed by Microsoft. This module specializes in supporting financial management, accounting, budget, tax, cash flow... helping businesses optimize financial resources, increase transparency and operational efficiency.

Dynamics 365 Finance Definition

Dynamics 365 Finance is developed from the famous Dynamics AX software, now upgraded and completely converted to the platform. Microsoft Azure cloud, deeply integrated with Microsoft 365 (Office), Power BI and many other modern tools.

In other words, this is Comprehensive financial ERP solution For businesses in need:

- Automate accounting and financial processes

- Cash flow optimization

- Increase financial analysis and forecasting capabilities

- Easy to expand, integrate technology

Dynamics 365 Finance's place in the Dynamics 365 ecosystem

Microsoft Dynamics 365 is a suite of solutions that combines ERP (enterprise resource management) and CRM (customer relationship management) in the same platform. Each module in this ecosystem serves a different business:

- Dynamics 365 Finance: Financial management - accounting

- Supply Chain Management: Supply chain, inventory, logistics

- Sales: Sales management, pipeline, CRM

- Project Operations: Project management, resources

- Human Resources: Human resource management, timekeeping, salary and bonus...

In there, Finance plays the role of “backbone” – helping businesses control and analyze financial data from all departments, supporting strategic decision making.

What are the key benefits of Microsoft Dynamics 365 Finance?

To understand better What is Microsoft Dynamics 365 Finance?, need to look at the value it brings. Owning Microsoft Dynamics 365 Finance, businesses do not just stop at bookkeeping or reporting, but can also:

1. Automate financial processes

- General accounting, detailed accounting

- Close books and settle accounts faster

- Manage debt, tax, and invoices

2. AI Integration – Smart Analysis

- Copilot AI budgeting support, cash flow forecasting

- Automatically detect financial risks

- Real-time data analysis

3. Connect to the Microsoft ecosystem

- Easy deployment with Office 365, Outlook, Excel

- Integrate Power BI for data visualization

- Connect to Teams for reporting – fast approval

4. Flexible scaling

- The SaaS model helps businesses expand or contract easily

- Support multiple countries, multiple currencies, multiple languages

What are the key functions of Microsoft Dynamics 365 Finance?

Microsoft Dynamics 365 Finance offers a powerful suite of features to manage all financial operations in your business:

1. General accounting & closing

- Manage ledgers, fixed assets, multi-currency transactions

- Automatic book closing, standardizing monthly financial processes

2. Financial planning & analysis

- Budgeting, revenue and expenditure forecasting, financial planning based on scenarios

- Dynamic analytics dashboard

- Copilot AI support analysis and propose plan adjustments

3. Cash flow management (Cash Management)

- Track and predict cash flow

- Manage credit limits, optimize payments

- Increase real-time cash flow control

4. Tax Management

- Automatically apply tax regulations by territory

- Support for electronic tax declaration and tax refund

- Suitable for multinational enterprises

5. Quote-to-Cash

- Order processing, invoicing, debt recording

- Track transaction lifecycle from quote to collection

6. Automatically match journal entries & accounts

- Automatically reconcile documents, bank accounts, card transactions

- Minimize manual errors when closing books

How to use Dynamics 365 Finance software

To get the most out of Dynamics 365 Finance, businesses need to understand the basic implementation and operational steps. Here is a roadmap for using the software in each key phase:

1. Initial setup

Before using, businesses need to configure the entire system to suit the current financial system:

- Set up a chart of accounts (Chart of Accounts): Build an accounting system according to VAS or IFRS standards.

- Configure business units, territories, and currencies: Suitable for domestic or cross-border operations.

- Setting up tax policies: Automatically apply VAT, corporate income tax, import-export tax by territory.

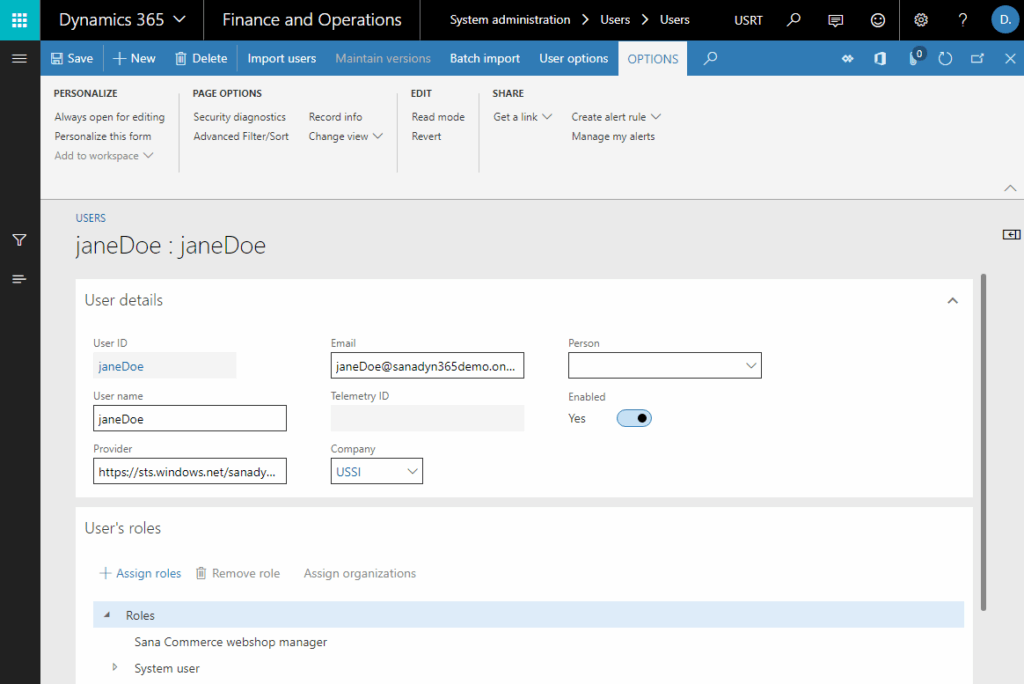

- User authorization: Assign access rights according to roles (accountants, CFOs, internal auditors…), ensuring data security.

This is the foundational phase, requiring close coordination between the finance department and the ERP implementation partner.

2. Data entry & financial transaction processing

Dynamics 365 Finance enables businesses to record and process daily financial transactions quickly and accurately:

- Purchase and sales invoices: Enter input (AP) and output (AR) invoices, linked to orders and warehouse receipts/deliveries.

- Payment & Collection: Record supplier payments, collect customer payments, manage debt.

- Foreign exchange transactions: Automatically convert exchange rates, handle exchange rate differences at the end of the period.

- Fixed assets: Manage the entire asset life cycle, depreciation, liquidation, and asset revaluation.

Thanks to its automation capabilities, the software minimizes manual operations, increasing accuracy and transparency for the accounting system.

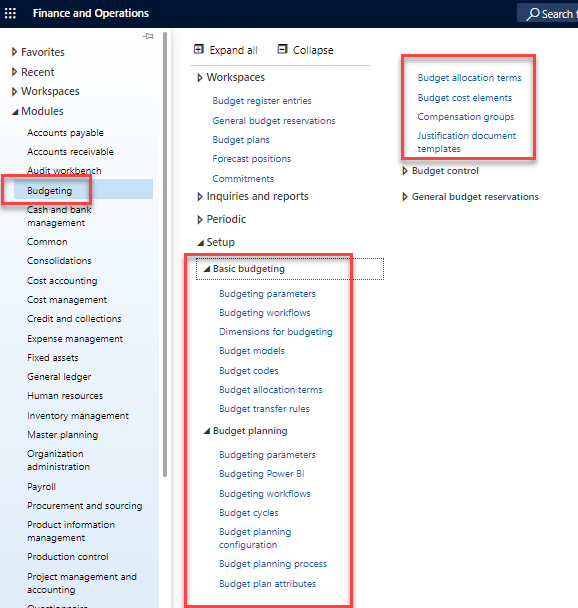

3. Budget management & financial forecasting

One of the strengths of Dynamics 365 Finance is its financial planning features:

- Create a budget: Build budgets by department, product, project...

- Set up forecast scenarios: Forecast of revenue and expenditure, operating costs, cash flow.

- Track budget vs actual: Detect errors for timely adjustment.

- Copilot supports analysis: AI integration suggests appropriate adjustments based on historical data.

This feature is especially useful for CFOs and chief accountants who need to prepare periodic reports for the board of directors or shareholders.

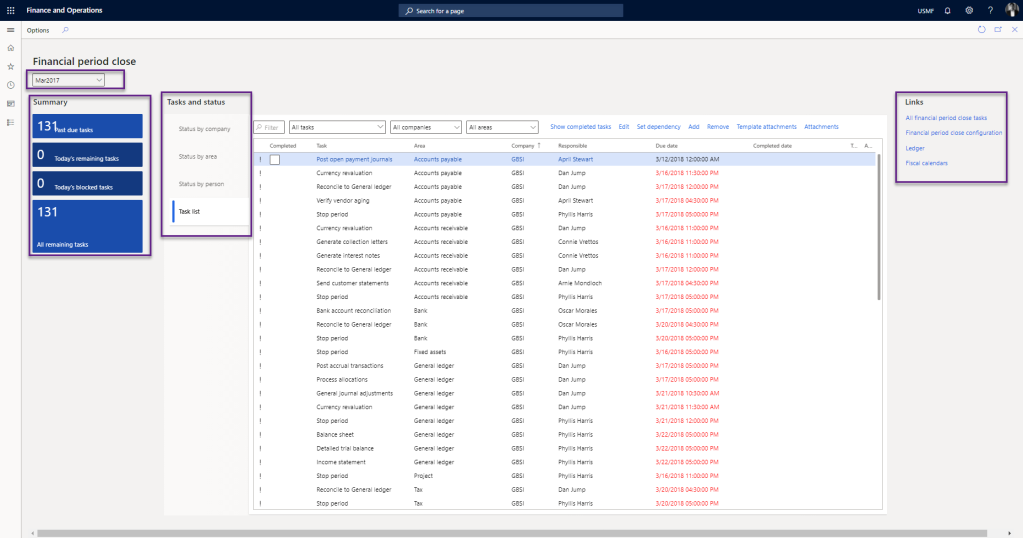

4. Close accounting books & summarize financial data

At the end of each accounting period (month, quarter, year), businesses can close their books quickly thanks to the automatic process:

- Accounting period declaration: Define closing time suitable for business activities.

- Automatic book matching & reconciliation: Compare the ledger with documents, banks, invoices...

- Data synthesis: The system automatically summarizes data, calculates profits, costs, and gains and losses.

- Export financial reports: According to Vietnamese accounting standards (VAS) or international (IFRS).

The closing process is faster, reduces errors and saves significant resources compared to traditional methods.

5. In-depth financial data reporting & analysis

Dynamics 365 Finance supports a variety of advanced reporting and analytics tools:

- Reporting Workspace: Provide real-time reporting space for each role (CFO, CEO, accountant…).

- Personalized Dashboard: Each user can design the report interface according to their own needs.

- Power BI Integration: Easily connect financial data to Power BI for multidimensional visualization and analysis.

- Flexible report export: Data can be exported to Excel, PDF or shared via email, Microsoft Teams.

From tracking project costs to analyzing cash flow trends, it can all be done with just a few taps.

Challenges in implementing Dynamics 365 Finance

Although Microsoft Dynamics 365 Finance is a powerful financial ERP solution with many superior features, the actual implementation and operation process can still encounter some challenges, especially for businesses that have never used an enterprise-level ERP system.

1. Change Management

One of the biggest barriers to implementing Dynamics 365 Finance is the people and process factor:

- Changing operational thinking: From manual working to systematizing and standardizing processes according to ERP.

- User Training: Financial and accounting staff need to be trained extensively to understand how to use the software effectively.

- Adjust internal processes: Must review, standardize and restructure accounting, payment and budget processes to match system logic.

Without careful preparation, implementation can easily fall behind schedule, cause user backlash, and impact short-term financial operations.

2. Relatively high investment costs

The cost of implementing Dynamics 365 Finance can be a barrier for small and medium-sized businesses:

- License fee: From about 210 – 300 USD/user/month, depending on the role and usage features.

- Initial implementation costs: Including business analysis, system configuration, training, testing, data conversion...

- Maintenance and upgrade costs:Regular budget required for stable operation, version updates and security.

Businesses need to carefully calculate their deployment budget, especially when expanding their user base over time.

3. Requires high technical skills when customizing

Dynamics 365 Finance is highly customizable, but effective implementation requires a dedicated technical team:

- Programming language: The software is built on .NET platform, requires C#, X++ skills to perform customization.

- Understanding corporate finance processes: The IT team or implementation partner needs to clearly understand financial and accounting operations to design a system that is suitable for reality.

- Optimize performance: If customized incorrectly, it can cause system conflicts, reduce performance, and pose security risks.

For businesses without an internal IT department, finding and partnering with reputable ERP implementation partner is the key factor.

4. Long implementation time

Depending on the size of your business and the level of customization, implementing Dynamics 365 Finance can take from 3–9 months, even longer if:

- Complex financial operations, linking many different systems

- No clear internal process in place beforehand

- Lack of project management personnel from the business side

This requires businesses to have ERP implementation management board competent, able to coordinate with consultants and control progress effectively.

5. Integration with other systems requires careful preparation

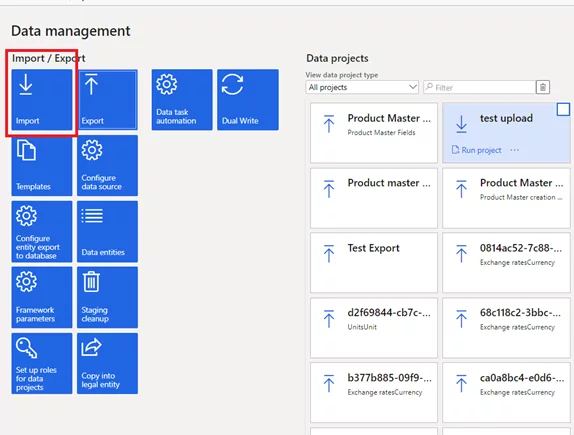

Many businesses use standalone accounting, sales, inventory management, or CRM software. When switching to Dynamics 365 Finance, data integration is no small challenge:

- Need to clarify APIs and data standards

- Data migration

- Thorough testing to ensure correct synchronization

6. Not suitable for micro-enterprises or does not have a clear process

Dynamics 365 Finance is an enterprise-oriented solution medium to large, or fast-growing SMEs. If the business:

- Small in scale

- The accounting process is still fragmented.

- No dedicated IT or financial manager

… it may be difficult to implement and maintain this system effectively.

Bizzi – Financial Automation Solution Dynamics 365 Finance integration

After understanding clearly What is Microsoft Dynamics 365 Finance?, many businesses continue to look for scalable solutions to increase data processing efficiency. Among them, Bizzi is a prominent choice.

It can be said that, besides the powerful features that Dynamics 365 Finance bring, businesses can speed up operations and reduce pressure on the accounting department through Bizzi ERP automation solution – platform designed to seamlessly integrate with major ERP systems like Dynamics 365.

What is Bizzi?

Bizzi is a platform automatic processing of input invoices help businesses:

- Read and classify electronic invoices (e-invoices)

- Automatically compare information between invoice - purchase order (PO) - warehouse receipt (GR)

- Check validity & compliance with tax regulations

- Send standardized data into ERP systems like Dynamics 365 Finance

Bizzi acts as “digital financial assistant”, stand in front of the ERP system to refine the data before recording.

How to integrate Bizzi with Dynamics 365 Finance

Bizzi supports flexible integration through multiple methods:

- Direct Connect API: Real-time synchronization with Dynamics 365 Finance

- Intermediate data files (Excel/XML/CSV): Automatically push into the system periodically

- Middleware: For businesses with many other systems that need to be connected simultaneously

Lightweight deployment model, no interference with core ERP system, helping businesses save time and integration costs.

Case Study: N KID Group deploys Dynamics 365 Finance integrated with Bizzi

To clarify the concept What is Microsoft Dynamics 365 Finance?, let's look at the real case of N KID Group - the business behind the famous children's playground chain tiNiWorld.

N KID Group – the business that owns the tiNiWorld playground system and distributes thousands of children's toys – once faced a huge volume of input invoices, up to thousands per month. With a team of nearly 30 accountants, manually processing the entire process from receiving invoices, comparing PO-GR-INV to accounting and storage took a lot of time for the business, was prone to errors and made it difficult to ensure compliance with electronic invoices.

In order to improve financial operations efficiency and comprehensive digital transformation, N KID Group has chosen to deploy Microsoft Dynamics 365 Finance & Operations – modern ERP solution from Microsoft – combined with the platform Bizzi to automate accounts payable. Bizzi acts as a “smart finance assistant”, receiving invoices from suppliers, reading and extracting data using AI, automatically matching with POs and warehouse receipts (GRs), and then transferring valid data into Dynamics 365 Finance for accounting.

Thanks to flexible integration via API, Bizzi connects smoothly with Microsoft's ERP system, helping N KID Group reduce up to 80% invoice processing time, improving data accuracy and transparency of the payment process. In particular, the Bizzi interface is simple and easy to use, helping the accounting team not to have to remember complex T-codes in ERP but still effectively control the entire cash flow and invoices.

Combining Dynamics 365 Finance with Bizzi not only shortens the financial processing cycle but also creates a solid foundation for N KID Group to expand without having to increase accounting staff accordingly – a solid step forward in the business digitalization strategy.

Conclude

Through the above article, Bizzi hopes you have clearly understood what Microsoft Dynamics 365 Finance is. In short, Microsoft Dynamics 365 Finance is a powerful financial ERP solution, helping medium and large enterprises optimize all financial and accounting management activities.

With deep integration, process automation, advanced data analytics, and flexible deployment on the cloud, Dynamics 365 Finance offers a distinct advantage in improving operational efficiency. However, businesses also need to consider some challenges such as implementation costs, staff training needs, and the level of customization suitable for each operating model.

If you are looking for a solution to automate your financial and accounting processes, save time on data entry, improve data accuracy and optimize overall system performance, learn about Bizzi ERP - a financial automation platform that can flexibly integrate with Dynamics 365 Finance to take digital transformation in corporate finance to the next level.