In 2025, regulations on cash payment invoices under VND 20 million will continue to have a major impact on the recording and processing of financial transactions of enterprises. This article will help you understand the requirements for invoices, as well as how to properly handle cash payment transactions under VND 20 million to ensure compliance with legal regulations.

1. Current regulations on invoices above/below 20 million and payment methods (before July 1, 2025)

Before July 1, 2025, regulations on the use of invoices with a value of VND 20 million or more and the corresponding payment methods are still being applied according to current legal documents. Enterprises need to understand clearly to ensure tax benefits and avoid risks when settling.

- Invoices for purchasing goods and services with a value of VND 20 million or more (including VAT) must be paid through non-cash methods (bank transfer, payment order, bank payment, etc.) to be eligible for input VAT deduction according to Circular 219/2013/TT-BTC and Circular 26/2015/TT-BTC.

- For input costs with invoices over 20 million paid in cash, enterprises will not be allowed to include those costs in reasonable costs when determining corporate income tax. This is stipulated in Point C, Article 4 of Circular 96/2015/TT-BTC.

- Job Pay bills over 20 million in cash Not only does it lose the right to deduct taxes, it also causes businesses to exclude expenses when calculating corporate income tax, directly affecting after-tax profits.

- Some businesses seek to split bill under 20 million to be able to pay in cash. However, if the tax authority detects signs of splitting transactions to avoid regulations, the business may be subject to tax arrears and administrative penalties.

- Valid cases for Invoice under 20 million paid in cash can still be deducted from tax and included in expenses if the payment and documentation conditions are met as prescribed.

These regulations are intended to control cash flow, prevent tax fraud and increase transparency in corporate financial operations.

2. Consequences of paying bills over 20 million in cash

When a business pays an invoice over VND20 million in cash, it may encounter undesirable consequences, affecting tax obligations and business operations. Below are the impacts on both the buyer and the seller:

2.1 For the buyer

When paying invoices over VND20 million in cash, the purchasing business will face a number of important legal and tax consequences. Although this form of payment may be convenient in some cases, it has many potential risks and tax disadvantages, which can increase costs for the business.

- Input VAT not deductible: Businesses will not be allowed to deduct input VAT when paying invoices over VND20 million in cash. This may increase tax costs, affecting business profits.

- Non-deductible expenses when calculating corporate income tax: Cash payments over 20 million are not included in valid expenses when calculating corporate income tax (CIT), resulting in businesses having to pay higher CIT, thereby increasing taxable income and tax payable.

2.2 For the seller:

For the seller, cash payment for invoices over 20 million VND not only affects the accounting process but also poses legal risks that can affect the business operations of the enterprise.

- Risks related to payment methods: Although there are no direct penalties for sellers accepting cash, invoicing in the wrong form of payment can pose a significant risk. If a seller fails to comply with the payment method requirements, tax authorities may request evidence to prove the validity of the transaction. This can lead to complex and lengthy tax audits, increasing the cost and time of the business.

- Difficulty in proving the validity of the transaction: Sellers may have difficulty proving legitimate payment transactions to tax authorities. Without valid documentation or inaccurate information on invoices, businesses may face legal issues such as tax arrears, fines or requests to pay additional taxes, seriously affecting the business's reputation and finances.

Therefore, businesses need to pay attention to payment and invoice regulations to avoid unnecessary consequences when handling cash payment invoices over 20 million.

3. How to handle when paying a bill over 20 million in cash

When paying invoices worth over 20 million in cash, businesses need to pay special attention to regulations to handle them properly and avoid tax and financial management risks. Below are handling options in different situations:

3.1 In case the invoice has been created but tax has not been declared:

When an invoice has been created but not yet declared for tax, adjustments need to be made correctly to avoid future tax issues. Businesses can apply the following solutions:

- Cancel invoice (needs consent of both parties): In this case, cancelling the issued invoice is a necessary step. This requires the consent of both the seller and the buyer. Refer to the instructions How to cancel electronic invoice most detailed from Bizzi

- Create a new invoice with the correct payment method: After canceling the old invoice, the business needs to re-issue a new invoice, which accurately reflects the payment method, especially when there is a cash payment exceeding the prescribed level.

3.2 In case the invoice has been created and tax has been declared:

Once an invoice has been declared for tax, any adjustments to the information must be made through legal adjustment records. This helps ensure transparency and tax compliance.

- Make a record of invoice adjustment clearly stating the error in payment method (with signatures of both parties): When detecting errors in payment methods, businesses need to make a record of invoice adjustment. This record needs to be signed by both the seller and the buyer to ensure legality.

- Seller issues adjustment invoice: The seller is responsible for creating an adjustment invoice and updating payment method information to match the actual transaction.

3.3 Other treatment options (according to current regulations):

In addition to the above options, businesses can also apply other solutions to handle cash payments of over 20 million. However, these options need to follow the correct procedures to ensure the validity of the transaction.

- Go to the bank together for the buyer to transfer money, the seller to return cash/check: One reasonable option is for both the buyer and seller to go to the bank to make the transfer, and the seller returns the cash or check. However, it should be noted that without an actual transaction, this can be legally risky.

- The buyer receives the cash back and makes the transfer: If the buyer receives cash and then makes a bank transfer, the business needs to ensure that all transactions are valid and fully documented.

Note: In all cases, it is necessary to ensure that the purchase and sale transaction is genuine and has full legal documents. Compliance with payment and accounting regulations is necessary for businesses to avoid risks and ensure transparency.

4. Exceptions that do not require cashless payments

The following are exceptions where non-cash payments are not mandatory but cash payments can still be made as required by law. These cases relate to specific expenses or purchases in certain industries.

- Expenditures for defense and security: These expenditures related to national security will not be bound by the cashless payment regulations.

- HIV/AIDS prevention expenses at the workplace: Expenses related to disease prevention are also an exception allowing cash payments.

- Expenses of a direct welfare nature for employees (within prescribed limits and with invoices and documents): When a business pays benefits directly to employees, if there are complete invoices and valid documents, payment can be made in cash.

- Purchase of agricultural, forestry and aquatic products directly sold by producers and fishermen: When businesses purchase agricultural, forestry and fishery products directly from producers and fishermen without going through intermediaries, payment in cash is reasonable and acceptable.

- Buy handmade products from non-commercial artisan producers who sell directly: Purchases of handicraft products from producers who are not direct business entities can also be paid in cash.

- Purchase of soil, rock, sand, gravel directly exploited by households and individuals for sale: Transactions related to soil, rock, sand, and gravel exploited and sold by individuals and households can be paid in cash.

- Buy scrap from direct collectors: When purchasing scrap from a direct collector, cash payment is accepted in these cases.

- Purchase of assets and services from non-business households and individuals for direct sale: Transactions for the purchase of assets or services by individuals or households that are not directly engaged in business are also allowed to be paid in cash.

- Purchase of goods and services from individuals and business households (except for the above cases) with revenue below the VAT tax threshold (VND 100 million/year): This case allows cash payment when the business household's revenue is below the VAT threshold.

5. The problem of splitting bills to pay in cash

Splitting invoices for cash payments is an important issue for businesses, especially when it comes to tax deductions and deductible expenses. Current regulations are as follows:

- Bills under 20 million VND paid in cash: According to regulations, if the total invoice value on the same day for a buyer (same tax code) is less than 20 million VND, businesses can pay in cash without violating the law.

- Bill over 20 million cash payment: In case of issuing invoices with a total value of over 20 million VND, payment must be made through non-cash methods (bank transfer, credit card, etc.). Cash payment in this case will not be accepted and the business will not be able to deduct taxes or calculate deductible expenses.

- Split bills under 20 million: Businesses should not intentionally split invoices to circumvent the law, for example, splitting invoices under 20 million VND to pay in cash. This is a violation of regulations and can result in fines for issuing invoices at the wrong time, causing risks to the business.

Note that compliance with these regulations not only helps businesses avoid legal errors, but also ensures legality in managing costs and taxes.

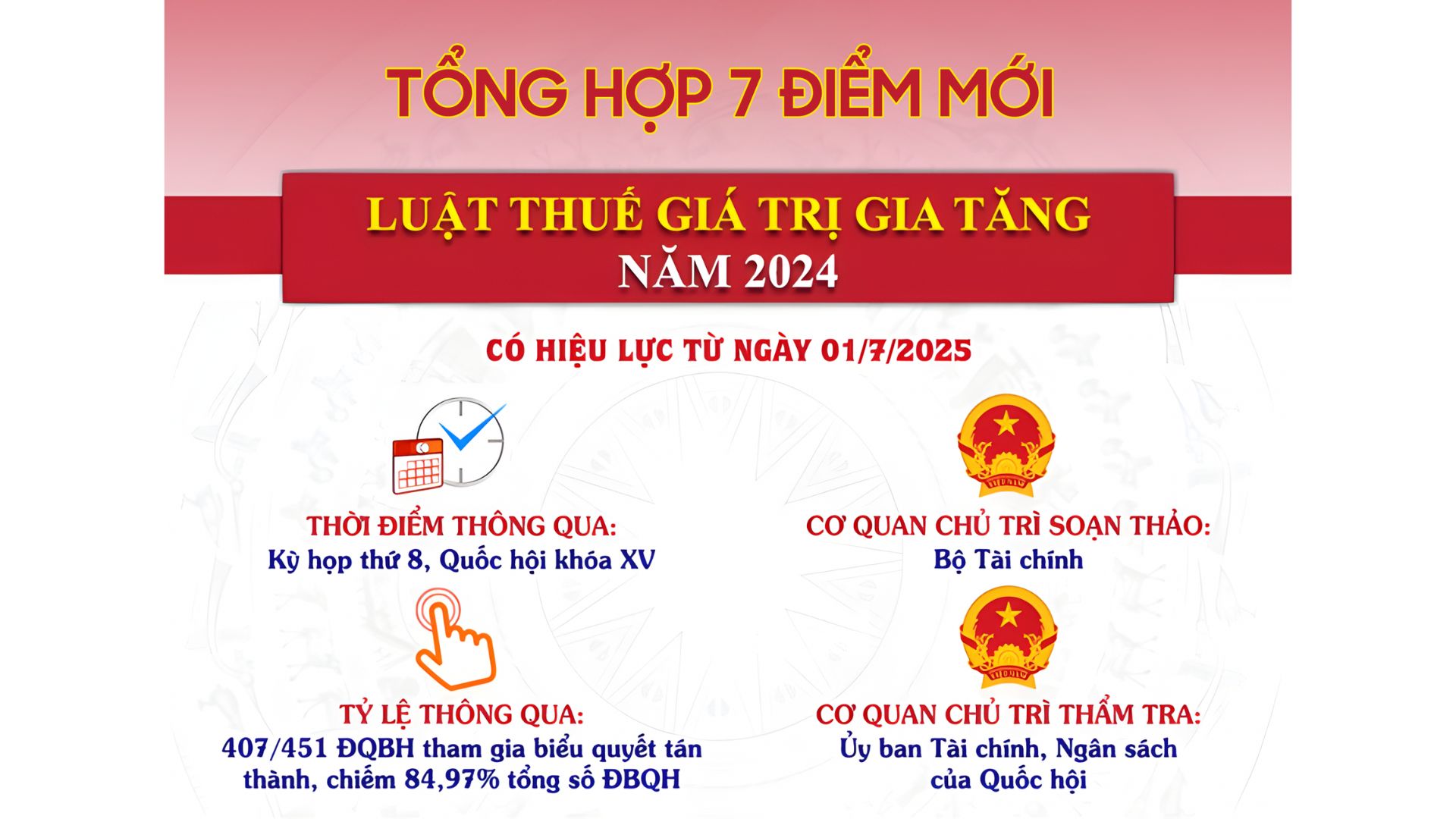

6. Changes in regulations from July 1, 2025 according to the VAT Law 2024

Legal basis: Law on Value Added Tax 2024 (effective from July 1, 2025).

On July 1, 2025, the Value Added Tax Law 2024 will officially take effect, bringing a number of important changes to payment and invoice regulations. Here are the changes to note:

- New rules: All transactions for the purchase and sale of goods and services (except for some special cases) will require non-cash payment documents to be deducted for input VAT.

- No more 20 million threshold: This regulation no longer limits cash payments to invoices over VND20 million. Instead, all transactions must use non-cash payments to be deductible for VAT.

- Target: This regulation aims to enhance transparency in financial activities and efficiency of tax management.

- Note: Special cases will be regulated separately by the Government, helping to ensure flexibility in specific situations.

Recommendation: Businesses need to prepare for this change by adjusting their payment processes, ensuring all transactions use cashless payment methods. Updating accounting systems and training employees will help businesses better comply with the new regulations from July 1, 2025.

7. The importance of cashless payments for cost management and tax compliance

Cashless payments are an important part of managing costs and ensuring tax compliance, especially for invoices valued below and above VND20 million. Making payments via bank transfer, bank card or electronic payment methods brings many benefits to businesses, including:

- Ensure valid input VAT deduction, reduce tax costs: Non-cash payments help businesses have clear and valid documents to deduct input VAT. This not only helps reduce tax costs but also avoids the risk of not being accepted for deduction when the tax authority inspects.

- Ensure expenses are deductible when calculating corporate income tax, reducing taxable income: For valid expenses, non-cash payments will help businesses demonstrate the reasonableness of expenses, thereby reducing taxable income when calculating corporate income tax (CIT).

- Avoid risks and fines from tax authorities: If a business pays in cash for invoices over VND20 million, it will run the risk of not being recognized as a reasonable expense when the tax authority inspects. This can lead to fines or requests to pay back taxes. Furthermore, “splitting invoices under VND20 million” to avoid non-cash payments can be detected and handled by the tax authority, causing serious damage to the business.

To ensure compliance and optimize tax benefits, businesses need to pay attention to making payments via non-cash methods, especially for large-value invoices.

8. Applying technology in invoice management and regulatory compliance

In the digital age, the application of electronic invoice management software has become an important factor to help businesses improve the efficiency of financial management and comply with legal regulations. Bizzi is one of the electronic invoice software Advanced, providing electronic invoice management solutions, supporting businesses in managing invoices intelligently and accurately.

Bizzi's notable features include:

- Connect electronic invoices: Bizzi helps businesses connect directly to the electronic invoice system, automatically store and manage issued invoices, helping to save time and minimize errors.

- Manage invoice status: Bizzi provides the ability to track the status of invoices, from issuance to payment, helping businesses easily control and manage related expenses.

- Detailed financial reports: The software provides transparent and detailed financial reports, helping businesses grasp their financial situation clearly and accurately.

- Ensure regulatory compliance: Bizzi always updates the latest regulations on electronic invoices and supports businesses in complying with legal requirements such as regulations on "invoices under 20 million paid in cash" and "invoices over 20 million paid in cash", helping to minimize the risk of violation.

Starting July 1, 2025, businesses will be able to integrate Corporate credit card solutions same application Bizzi Expense, providing the ability to make non-cash payments easily and transparently. This helps businesses not only comply with regulations but also increase the ability to control costs effectively and clearly.

With the above features, Bizzi is the perfect solution to help businesses not only manage electronic invoices but also ensure compliance with all regulations related to payment and cost management.

Conclude

Compliance with regulations on payment methods for invoices over 20 million VND is very important for all businesses. Cash payment for invoices over 20 million VND will encounter unexpected legal and tax risks. Along with that, changes in payment regulations will become increasingly strict, businesses need to understand and comply with the regulations to avoid being fined.

Businesses may face legal issues such as tax arrears, administrative fines, and difficulties in proving the validity of financial transactions. Furthermore, paying in cash will not help businesses have enough valid documents to compare when the tax authority inspects.

In short, with increasingly strict regulations, splitting invoices under 20 million to pay in cash is not a sustainable solution. Businesses should prioritize non-cash payment methods to manage costs more effectively, while avoiding legal issues related to taxes.

Reference: