Resource Center – Practical knowledge for businesses & finance teams. Here, you will find everything you need to run your business effectively and control your finances firmly – from in-depth analysis, updated finance and accounting trends, to practical materials such as eBooks, guides, checklists and templates.

October 7, 2025

Discover 5 Dynamics 365 Finance features that help businesses optimize finances

In the context of businesses increasingly rapidly transforming digitally, choosing a flexible, integrated financial ERP system...

October 7, 2025

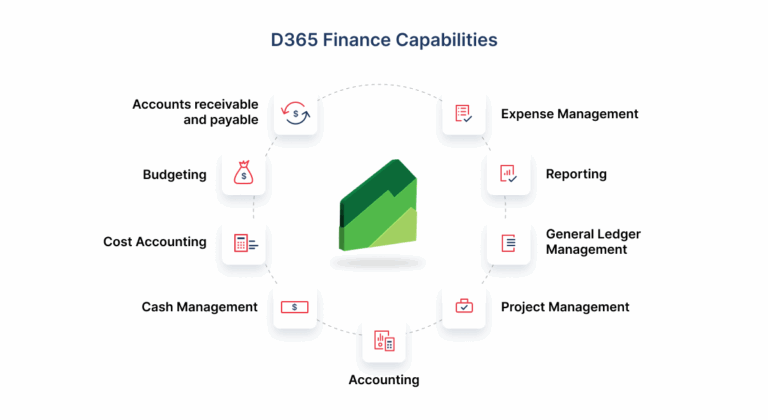

What is Microsoft Dynamics 365 Finance? Overview of modern financial solutions for businesses

Microsoft Dynamics 365 Finance is increasingly becoming one of the most popular financial ERP software solutions in the...

October 7, 2025

What is SAP ERP software? SAP software user guide

In the context of businesses increasingly focusing on comprehensive management and optimizing operational processes, SAP ERP software...