Financing is one of the important factors that help businesses start up and develop sustainably. This is the process by which businesses access the necessary financial resources to maintain operations, expand production and business or overcome difficult periods. With a fundamental role in promoting growth, financing not only provides financial support but also brings opportunities for long-term cooperation and development.

This article will help you understand the concept of capital funding, the popular forms of funding today and how to approach them. Through that, you can choose the most suitable funding option for your business.

Index

TogglePart 1: Understanding Capital Financing

1. What is capital funding?

Financing is the process by which a business mobilizes financial resources from organizations, individuals or investment funds to meet capital needs for business operations, investment and development. This is an important step to help businesses maintain stability and prepare for future expansion opportunities.

Capital financing can be divided according to purpose of use or nature such as:

- Short-term financing: To meet immediate needs such as paying for raw materials, paying employees, or handling daily operating expenses.

- Long-term financing: Used to carry out large projects such as factory construction, equipment purchase, or production expansion.

2. Distinguish between financing and borrowing

To understand better, it is necessary to distinguish between financing and borrowing – two concepts that are often confused.

- Funding:

- Can be in the form of equity or non-refundable investment.

- The sponsor may demand equity in the business in exchange for capital.

- No repayment of principal is required, but the business may require profit sharing or management rights.

- Loan:

- A loan that a business must repay both principal and interest over time.

- Often require collateral and have strict conditions regarding credit history.

3. Why is funding important to businesses?

Financing plays a pivotal role in helping businesses overcome financial challenges and foster growth and development. Some of the key benefits include:

- Expanding operations: To meet market demand, businesses need capital to invest in factories, technology or human resources.

- Improve competitiveness: Businesses need capital to improve products and services or invest in research and development (R&D).

- Effective cash flow management: During difficult business times, financing helps businesses maintain a steady cash flow and ensure continuity of operations.

- Seize business opportunities: Capital financing provides flexibility for businesses to take advantage of investment opportunities or expand markets quickly.

4. The role of funding in the process of starting and developing a business

Capital funding is the foundation that helps businesses develop through each specific stage:

- Startup phase:

- Capital acts as the “first mover,” helping business ideas become reality.

- Usually includes capital from the founder, friends or angel investors.

- Growth phase:

- Businesses need capital to expand production, hire staff, and increase marketing.

- Common forms include bank loans or raising capital from venture capital funds.

- Stable and sustainable phase:

- Long-term financing helps businesses maintain stability, ensure cash flow and reduce the risk of bankruptcy.

Part 2: Common forms of funding

When businesses are looking for financing to sustain and grow, it is essential to understand the different forms of financing available. Below are the common forms, each suited to specific needs and situations.

1. Funding from investors

Angel Investing

Angel investing is a form of financing in which individual investors provide financial resources to start-up businesses or new projects. Often, angel investors provide not only capital but also knowledge, experience, and networks.

Advantage:

- Simple financing procedures, no complicated requirements like bank loans.

- Receive strategic support and advice from investors, helping businesses orient themselves properly in the early stages.

Disadvantages:

- A business may lose some control when investors demand shares or decision-making power.

Venture Capital

Venture capital is a form of funding from professional funds, focusing on businesses with strong growth potential, usually in the growth stage.

Advantage:

- Large investment capital scale, helping businesses expand operations quickly.

- Opportunity for long-term cooperation, accompanying in the growth process.

Disadvantages:

- Require transparency of all business information.

- Businesses must share ownership and may be limited in strategic decisions.

Investment Fund:

Investment funds such as private equity funds or venture capital funds often look for businesses with high profit potential.

Sponsorship criteria:

- Clear and feasible business plan.

- Businesses that have the potential for sustainable growth and long-term profitability.

2. Bank financing

Borrowing capital

Banks provide short-term, medium-term or long-term loan packages to suit the financial needs of businesses.

Advantage:

- Stable interest rates, ensuring reliable financial resources.

- Businesses can use capital flexibly for different purposes.

Disadvantages:

- Collateral requirements are sometimes a barrier to startups.

- The application is complicated and the approval time is long.

Bank overdraft

Overdraft allows a business to spend more than its bank account balance within a certain limit.

Advantage:

- Flexibility in cash flow management, especially when faced with short-term capital shortages.

- Quickly deal with unexpected expenses.

Disadvantages:

- Interest rates are higher than conventional loans.

- Cash flow needs to be carefully controlled to avoid excessive risk.

3. Funding from other financial institutions

Finance company:

Finance companies offer flexible financial products such as asset leasing, trade credit or other financing solutions.

For example:

- Support businesses to buy equipment and machinery with installment packages.

- Provide trade credit for businesses to expand their operations.

Non-governmental organizations:

NGOs often provide grant or concessional capital to small and medium-sized enterprises, especially in the fields of sustainable development or innovation.

Advantage:

- No repayment required (with some financing programs).

- Financial support and free training programs.

Disadvantages:

- The funding process is sometimes lengthy and requires detailed project information.

4. Crowdfunding

Crowdfunding is a form of raising capital from a large number of contributors through online platforms.

4.1. Popular Crowdfunding Models

Donation-based Crowdfunding:

- Contributors do not expect a refund but support the project out of trust or social significance.

- Often applied to non-profit, creative or community projects.

Equity Crowdfunding:

- Contributors receive shares in the business, becoming shareholders.

- Suitable for startups looking to raise capital without debt.

4.2. Advantages and disadvantages

Advantage:

- Businesses can access large amounts of capital without requiring collateral.

- Increase brand awareness through crowdfunding campaigns.

Disadvantages:

- Effective marketing campaigns are needed to attract the attention of the community.

- Risk of not achieving fundraising goal if campaign is not attractive enough.

Choosing the right form of financing depends on your financial needs, business size and stage of development. Understanding each form of financing will help your business maximize growth opportunities and achieve business sustainability.

Part 3: Common challenges in financing

Funding is an important step in helping your business grow, but the process isn't always smooth sailing. Here are some common challenges businesses face when raising capital:

1. Difficulty in convincing investors

When approaching investors, especially angel investors or venture capital funds, businesses face strict requirements for demonstrating capacity.

- Detailed business plan:

Investors often require businesses to present a clear business plan, including growth strategy, market analysis, and revenue projections. - Proof of profitability:

Businesses must provide specific data or previous business performance to demonstrate profitability potential. This is a big challenge for startups without a long operating history. - Compete with other businesses:

Investors often receive many funding offers. Businesses must stand out from the crowd, requiring creativity and high persuasiveness in presenting their ideas.

2. Complicated approval process

Financial institutions, especially banks, often require strict approval processes and long processing times.

- Complex profile:

Businesses need to prepare a variety of documents such as financial statements, collateral, and repayment plans. These requirements can sometimes be a barrier for small or start-up businesses. - Extended processing time:

Even when the application is complete, loan or funding approval can take weeks to months, slowing down a business's project implementation. - Risk of rejection:

If a business fails to fully meet the criteria of a bank or financial institution, it may be denied funding, disrupting its business plans.

3. Risk of losing control

Sharing shares or management rights with investors potentially risks influencing the strategic decisions of the business.

- Share ownership:

To attract investors, businesses often have to agree to give up part of their shares, which can reduce their control over the company. - Conflict in development orientation:

Investors often have a stake in major decisions of the company. If there is a disagreement about goals, there can be conflict between investors and the founding team. - Impact on corporate culture:

When control is shared, investors can impose changes that are inconsistent with the company's culture or core values.

4. Pressure from high expectations

- Revenue target:

Investors or financial institutions often set high expectations for profits or growth rates. Businesses face great pressure to achieve these goals. - Commitment to repay debt:

With bank loans, businesses must adhere to strict repayment schedules. This can affect cash flow, especially during difficult times.

5. Lack of experience in financial management

- Ineffective capital management:

Some startups lack experience in using the funded capital, leading to unreasonable spending. - Unforeseeable risks:

Without a contingency plan, businesses can find themselves short of capital when faced with unexpected fluctuations.

Challenges in financing require businesses to not only carefully prepare documents and plans but also have a reasonable strategy to effectively manage capital resources.

Part 4: Business financing solutions – Bizzi Financing

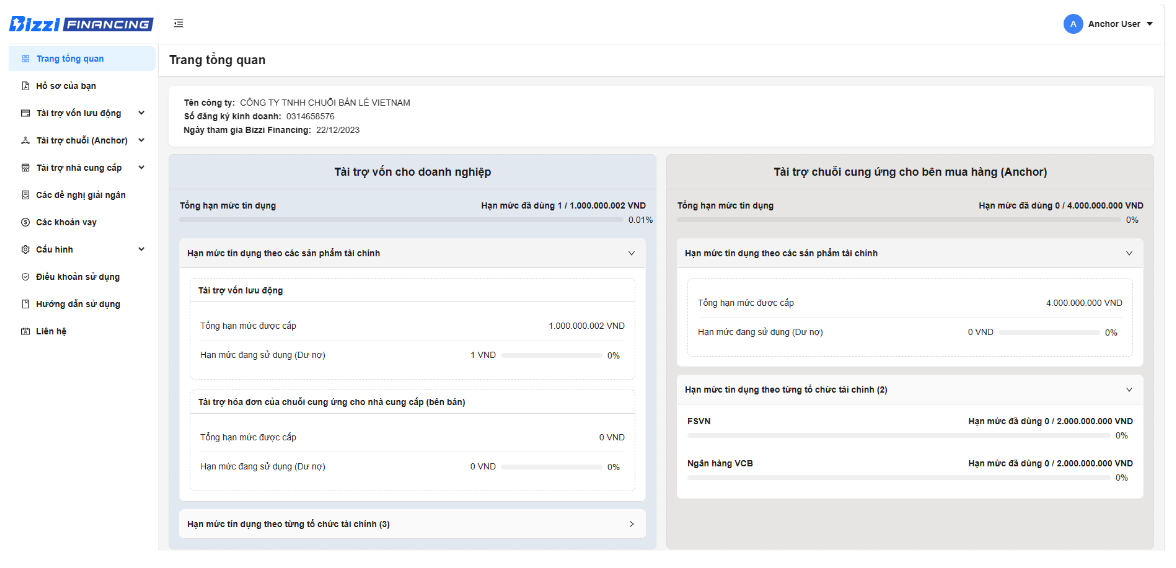

In the context of businesses needing fast and effective funding solutions, Bizzi Financing has emerged as a modern financial platform, helping to connect businesses with investors and financial institutions. This is an ideal choice for businesses looking for flexible support, especially when traditional funding channels such as banks or investment funds have many limitations in procedures and processing time.

What is Bizzi Financing?

Bizzi Financing is a fintech platform that provides optimal capital financing solutions for businesses. The platform's mission is to help businesses easily access capital that suits their needs, whether it is to expand their business, invest in technology, or maintain operations during difficult times.

With modern technology and a team of experienced financial consultants, Bizzi Financing ensures that each business receives the fastest and most comprehensive support.

Bizzi Financing offers many advantages over traditional forms of financing:

- Quick and easy registration process:

Businesses only need to provide basic information and necessary documents, the system will process the application in the shortest time. - Flexible loan conditions:

Suitable for all types of businesses, from startups to small and medium-sized companies, without requiring too much collateral. - Competitive interest rates:

Interest rates at Bizzi Financing are designed to be reasonable and transparent, helping businesses save more costs compared to traditional financial solutions. - Professional support:

Bizzi Financing provides dedicated financial consulting services, helping businesses optimize their access to capital and use capital effectively.

Why choose Bizzi Financing?

Compared to traditional forms of financing, Bizzi Financing is not only faster but also more friendly to businesses of all sizes. In particular, with comprehensive support from financial consulting to completing documents, Bizzi Financing becomes a reliable partner for businesses looking for sustainable development opportunities.

Register for Bizzi Financing information here: https://finance.bizzi.vn/

Conclude

Financing plays an important role in maintaining and developing a business. Understanding the forms of financing and choosing the right solution will help businesses optimize cash flow and achieve business goals. If you are looking for a fast and effective financial support platform, Bizzi Financing is the choice worth considering!

Monitor Bizzi To quickly receive the latest information: