In the context of increasingly deep global economic integration, the application of International Accounting Standards (IFRS) is becoming an inevitable trend, reshaping the accounting and financial picture for businesses globally. IFRS is not just a set of standard; it is an accounting language international, help the enterprise and investor communication and comparable financial information efficiently across borders. The core objective of IFRS, issued by IASB (International Accounting Standards Board) belong IFRS Foundation, is to bring about transparent and maximum reliability for the financial report, serve the public interest and capital market.

The conversion from Vietnamese Accounting Standards (VAS) Converting to IFRS is an important process, requiring comprehensive preparation of knowledge, processes, systems and people. In Vietnam, this process has been Roadmap for IFRS adoption in Vietnam clearly, set out both benefit and challenge for the enterprise.

This article, Bizzi will help you better understand international accounting standards IFRS, application roadmap in Vietnam, those benefit and especially those things businesses need to prepare to adapt and transform successfully, towards optimizing accounting processes according to international standard and improve cost management efficiency.

What is the international accounting standard IFRS?

IFRS, abbreviation of International Financial Reporting Standards, is the set of international financial reporting standards Developed and published by IASB. Unlike some traditional accounting systems (such as VAS of Vietnam or US GAAP), IFRS is built in the direction of based on principle (principle-based) instead of rule-based. This requires accountant and the founder financial report must have highly professional to be applied in accordance with the economic substance of the transaction, rather than merely in compliance with the form.

The main objective of IFRS is to create a common, globally consistent accounting language that will help financial report become transparent and comparable high between enterprise in different countries. This is especially important for listed company or have cross-border business and investment activities, creating favorable conditions for attracting investor foreign and access international capital markets.

Currently, IFRS has been widely accepted and applied in 166 countries and territories, with more than 144 countries having made it mandatory. This affirms the position of IFRS as a set of international accounting standards most widely recognized in the world.

Why do businesses need to prepare for IFRS International Accounting Standards?

According to experts, the average business will need 3-5 years to train human resources with enough knowledge to be able to prepare financial statements in accordance with International Financial Reporting Standards (IFRS).

- Global integration and access to capital markets: IFRS is a passport to help enterprise easy integration into the economic community international. Financial report established under IFRS investor and trusted foreign financial institutions, helping enterprise easily raise capital, conduct M&A transactions, or expand operations abroad.

- Enhance transparency and trust: IFRS sets out strict requirements for recognition, measurement, presentation and explanation above financial report. Compliance with IFRS helps financial information become more transparent, trustworthy, thereby enhancing trust from investor, creditors and other stakeholders.

- Improve internal governance quality: The process of conversion and IFRS adoption demand enterprise Review and standardize accounting processes, data collection and processing. This promotes the improvement of knowledge and skills for accounting and finance teams (required). need high professional evaluation), thereby improving financial management and decision making efficiency.

- Enhanced Comparability: Using a common set standard help financial report belong to enterprise comparable directly with competitors on the field international, creating competitive advantage in the market.

- Meet legal requirements: In Vietnam and many other countries, IFRS adoption is becoming mandatory for some groups. enterprise certain (like listed company), proactive preparation helps enterprise comply with regulations and avoid legal risks.

In short, preparing for IFRS is a strategic investment that helps enterprise not only meet compliance requirements but also enhance competitiveness and sustainable development in the market. international.

What do businesses need to prepare to prepare IFRS reports?

To successfully prepare IFRS reports, businesses need to prepare carefully, focusing on 5 key factors:

- Commitment from the Board of Directors: Consistent guidance and support are the cornerstones.

- IFRS-savvy human resources: Train existing staff or hire experienced consultants.

- Appropriate information technology (IT) systems and data: Evaluate, upgrade or replace accounting software; prepare and convert data according to IFRS requirements.

- Detailed conversion plan: Build a clear roadmap, assign responsibilities, timelines and specific budgets.

- Comprehensive impact assessment: Understand the impact of IFRS on financial reporting, performance metrics, internal processes and stakeholders.

Roadmap for IFRS adoption in Vietnam

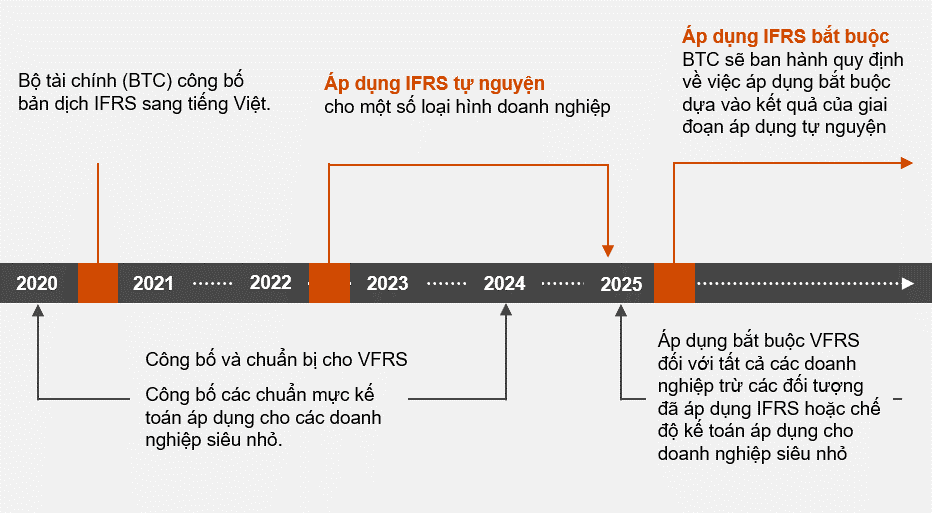

Vietnam is in the process of converging with the international accounting standardsOn March 16, 2020, the Ministry of Finance issued the "Project on applying international financial reporting standards IFRS in Vietnam", outlining a specific roadmap:

- Phase 1 (2020 – 2021): Preparation phase. The Ministry of Finance focuses on building legal frameworks, guidelines, financial mechanisms and training core human resources. Business encouraged to learn and self-assess readiness.

- Phase 2 (2022 – 2025): Voluntary implementation phase. Some enterprise qualified and in need (such as parent companies of large corporations, enterprise FDI 100% foreign capital, listed company) can voluntarily register IFRS adoption give financial report individually and/or consolidated financial statements.

- Phase 3 (From 2025 onwards): Mandatory implementation phase. The enterprise subject to mandatory (mainly large corporations, listed company, commercial banks) will have to IFRS adoption. The enterprise The rest will apply. VAS updated and converged with IFRS (expected to be VFRS - Vietnamese Financial Reporting Standards).

Roadmap for applying ifrs in Vietnam This shows that preparation is no longer optional but an urgent requirement for many. enterprise right now

Challenges and notes when preparing to apply International Accounting Standards IFRS

Progress VAS to IFRS conversion not simple and carry a lot challenge, requires enterprise must prepare carefully:

- High initial switching costs: Job IFRS adoption requires significant investment in staff training, upgrading IT systems (especially accounting and ERP software), and possibly hiring consultants. This is a high initial switching costs but enterprise need to plan and balance with benefit long term

- Regular changes and updates: IFRS is a set of standard live, be alive IASB review and update to suit the development of the business environment. This requires accountant must continuously learn and update knowledge.

- More complex IT system requirements: IFRS requires the collection, processing and explanation much more detailed data than VAS. This raises the question complex IT system requirements More, need to upgrade or change accounting and management software to meet.

- Requires high level of expertise and a change in mindset: Nature based on principle of IFRS requires people to financial reporting not only understand the rules but also apply them highly professional to reflect the true economic nature of the transaction. This requires a change in thinking from following rules to applying principles.

- Difference between accounting and tax: Recognition and measurement under IFRS may differ significantly from tax regulations in Vietnam, leading to differences between accounting figures and tax bases. Business These differences need to be closely managed and deferred tax recorded in accordance with regulations.

- Change the terms of the economic contract: Some standard like IFRS 15 (Revenue) or IFRS 16 (Leases) may require reclassification of transactions or changes in the timing of revenue/expense recognition compared to traditional practices. This may impact financial metrics and require reviewing and even adjusting the terms of contracts with customers and suppliers.

- Estimated impact on financial metrics: Job VAS to IFRS conversion may alter key financial metrics (e.g., asset values, revenues, profits, liquidity ratios). Business It is necessary to analyze and anticipate these impacts in order to have appropriate response plans and communication with stakeholders.

What do businesses need to prepare for successful IFRS conversion?

According to Mr. Trinh Duc Vinh - Deputy Director of the Department of Management and Supervision of Accounting and Auditing, Ministry of Finance, the training of an enterprise's staff to be proficient in International Accounting Standards (IFRS) takes a long time. about 3-5 years. For potential foreign enterprises, this time may be only 3 years, but for Vietnamese enterprises, it is necessary to consider more about the time required.

Benefits of adopting IFRS

Application International Accounting Standards (IFRS) brings many significant benefits to businesses as follows:

- Improve the quality of financial statements: When applying IFRS, the company's financial statements will be improved with a higher level of complete and relevant information than current accounting standards. This helps to increase the transparency and reliability of financial information, thereby building credibility and trustworthiness in the market.

- Advantages in international transactions: Applying IFRS helps businesses to have more advantages in international transactions. It is easy for foreign partners to read and understand information on financial statements of enterprises, helping to create trust and attract cooperation and investment opportunities from international investors.

- Reducing costs for FDI enterprises: FDI enterprises in Vietnam will reduce costs for converting financial statements from VAS to IFRS to merge with overseas parent companies. As IFRS is a globally recognized accounting standard, using the same standard saves time and money in reviewing and processing financial information.

- Improve management and business efficiency: Using IFRS helps businesses improve administrative and business efficiency. This standard provides clear and detailed guidance on financial reporting and asset valuation, helping businesses make accurate and data-driven financial and strategic decisions. reliable.

Things businesses need to consider before deciding to apply IFRS

Before deciding to apply International Accounting Standards (IFRS), businesses need to consider the following issues:

The issue of costs and benefits

The conversion and operation of an accounting and financial reporting system under IFRS requires a significant investment in cost, time and effort. Therefore, businesses need to estimate these costs and compare them with benefits before deciding to apply IFRS.

Material change

Applying IFRS will lead to some material changes in the accounting and financial activities of the enterprise. This includes differences between tax and accounting bases, variations in the terms of economic contracts, and the need to provide complete and detailed information as required by IFRS.

-

Difference between tax base and accounting

When using IFRS, some transactions are accounted for and reflected in the financial statements using different methods than the historical cost method. This leads to the difference between the accounting data and the tax authority's tax base (at cost). This discrepancy can make it difficult to maintain parallel IFRS accounting records and subsidiary accounting books to track the tax base as well as to track deferred taxes incurred as a result of the difference. between tax and accounting.

-

Changing the terms of an economic contract

Applying IFRS may require changing the terms of economic contracts to conform to the requirements of this standard. This requires the accounting department and the legal department to work together to understand the legal rights and obligations of the contract and related regulations in IFRS. From there, correctly and fully determine arising financial rights and obligations to serve as a basis for accounting.

-

Request for complete and detailed information

IFRS requires businesses to provide more complete and detailed information than Vietnamese Accounting Standards. Therefore, the accounting department needs to work closely with other departments in the business to collect all the information required by IFRS. For example, IFRS Standard 15 on Revenue from Contracts with Customers requires that the accounting department be familiar with the terms of the supply of goods and services in the revenue contract. This requires coordination with relevant departments to collect sufficient information for accounting purposes and make necessary amendments to the contract if necessary.

Before deciding to adopt IFRS, an enterprise should perform an overall study and assessment of the changes, estimate the costs and benefits, and be prepared to comply with the requirements and changes. in the application of International Accounting Standards.

Contents that businesses need to gradually prepare

The amount of time and investment required to apply International Accounting Standards (IFRS) varies depending on the size of the business, the economic sector and the stage of development of the business. Ensuring efficiency instead of spreading investment requires considering and ensuring the level of investment (cost, time, human, material) in accordance with the needs and capabilities of each business.

Converting data from Vietnamese Accounting Standards to International Accounting Standards (IFRS) according to IFRS Standard 1 – First time applying IFRS

To convert data from Vietnamese Accounting Standards to International Accounting Standards (IFRS) in accordance with IFRS 1 – The first time applying IFRS, enterprises need to develop a process to comply with the guidelines of this standard. . This is the process that applies to entities preparing financial statements in accordance with International Accounting Standards (IFRS) for the first time. Vietnamese enterprises will use the guidelines in this standard to convert their financial statements for the first time to IFRS according to the plan of the Ministry of Finance.

The data transformation needs to follow a step-by-step process and requires a long enough time to prepare the relevant content. Therefore, businesses should take advantage of experts on International Accounting Standards (IFRS) for advice and support to implement this content in the most accurate and effective way. Hiring an expert helps ensure your business gets it right and productive from the very first step in the transition.

Improve understanding of International Accounting Standards (IFRS) and finance for relevant personnel

In order to improve the understanding of International Accounting Standards (IFRS) and finance for relevant personnel, it is necessary to conduct training not only for the accounting department staff but also for the Board of Directors and the Board of Directors. key management staff. This ensures they have good coordination with the accounting department when required to provide or explain information and data related to IFRS. Businesses need to motivate employees to take courses on International Accounting Standards (IFRS) and how to apply it in practice.

This helps provide them with the knowledge and skills needed to effectively apply IFRS in their day-to-day work. Training ensures that relevant personnel have the same understanding of IFRS, thereby facilitating the application of the standard and ensuring consistency and accuracy in the processing of financial information.

By participating in the training course, employees can master the principles and regulations of IFRS, as well as learn how to apply them to real-life business situations. This will help increase work efficiency, ensure consensus and reliability in financial information, and increase the value of the business in the international market.

Need to reorganize and upgrade the accounting information system

To convert and prepare Financial Statements (Financial Statements) according to International Accounting Standards (IFRS), enterprises need to reorganize and upgrade their accounting information systems. The preparation of financial statements under IFRS has many differences in recognition, measurement, presentation and disclosure compared with current standards. Therefore, enterprises need to review and make changes (if necessary) to the following contents of the accounting information system to ensure the suitability and stability when officially applying IFRS:

- Building a new account system and financial statement preparation process in accordance with International Accounting Standards (IFRS).

- Streamline the process of processing and gathering data from all relevant departments, and clearly define their respective responsibilities for coordinating with the accounting department.

- Reorganize the accounting-finance personnel to ensure that the positions are suitable for the new requirements.

- Upgrade accounting software and Enterprise Resource Planning (ERP) to comply with the higher requirements of International Accounting Standards (IFRS).

- Upgrading the database for the measurement and valuation of items on the financial statements according to the guidance of the International Accounting Standards (IFRS).

However, to implement the above changes, businesses need to prioritize and optimize resources, not spending more than necessary. Therefore, businesses should have support and advice from experts on International Accounting Standards (IFRS) to ensure the effectiveness and success of the transformation process.

Adjust the terms of economic contracts with partners

To adapt to International Accounting Standards (IFRS), businesses need to adjust the terms in economic contracts with partners. IFRS has strict requirements for determining liability for delivery of goods or completion of services. Therefore, enterprises need to review contracts with suppliers and customers and compare them with the contract-related requirements of IFRS to make appropriate adjustments. This should be consulted by IFRS experts and attorneys to ensure accuracy and relevance from the outset.

Anticipate negative impacts (if any) on financial indicators

Before converting financial statements to International Accounting Standards (IFRS), enterprises need to anticipate the negative effects (if any) on financial ratios and plan appropriate responses to cope with the situation. this situation. Eg:

- Assets that are impaired due to revaluation at fair value: Because IFRS has stricter requirements on asset revaluation, businesses need to anticipate the possibility of asset devaluation. To respond appropriately, businesses can consider adjusting investment strategies, managing assets more effectively, and ensuring they have enough reserves to restore asset value if necessary.

- Non-guaranteed payout metrics: When converting to IFRS, some cash flows in financial report can change, affecting the business's ability to pay. Therefore, businesses need to carefully develop financial plans, ensuring that they have enough working capital and cash flow to meet future payment needs.

- Declining revenue when recognized under the new accounting policy: The revenue recognition guidelines in IFRS may differ from previous ones. Businesses need to come up with a plan to increase sales, look for new opportunities to increase revenue, and adjust business strategy to respond flexibly to this change.

Bizzi accompanies businesses on the journey of applying IFRS

Job Applying International Accounting Standards IFRS not only stops at changing accounting methods but also is an opportunity to enterprise Standardize the entire financial accounting process, aiming for transparent, effective and international standard.

Bizzi understands these challenge, especially with regard to data processing, process optimization and complex IT system requirements When VAS to IFRS conversion. Solution cost management and automate Bizzi's billing and payment processing processes are designed to help enterprise:

- Standardize the process: Apply professional invoice processing and payment request procedures international standard, support the systematic collection and organization of data, meeting requirements transparent and explanation of IFRS.

- Improve efficiency and save time: Financial accounting automation, reduce errors, help accountant have more time to focus on demanding tasks highly professional according to IFRS.

- Flexible integration: Ability to integrate with existing accounting and ERP software helps enterprise easy upgrade information technology system without changing the entire infrastructure.

- Manage conversion costs effectively: Reduce process and data burden, contribute to control high initial switching costs.

By optimizing core processes, Bizzi helps enterprise create a solid foundation of data and processes, which is an important premise for Applying International Accounting Standards IFRS success, improvement benefit and competitiveness in the market international.

International Accounting Standards IFRS is an irreversible trend, bringing benefit big for enterprise in the context of integration. The process VAS to IFRS conversion requires careful preparation, facing many challenge, especially in terms of people, processes and systems. However, with a application roadmap clearly in Vietnam and support from modern technology solutions such as Bizzi, enterprise It is possible to make the conversion efficiently, international standard, optimize processes, improve transparent and assert the position on international capital markets.

Follow Bizzi to update more useful information about financial management, accounting and supporting technology solutions. enterprise on the journey of development.

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam

See more: