Index

ToggleThe role of the CFO in digital transformation

By Vincent Vu

Companies are concerned about the return (ROI) of digital transformation (DX).

Abbreviation Translation: Private equity partners (PEs) and, in a similar way, boards and shareholders at public companies, are struggling to see return on investment from initiatives Digital conversion (DX) is expensive.

Globally, companies have spent more than $1.2 trillion on digital reinvention over the past few years. The hard truth is that more than 70% of those initiatives failed.

Tackling the next round of DX projects is not the answer: digitization is often essential to a value creation scheme and, for PE holders, to a successful exit and profitable. And the COVID-19 economy has accelerated and amplified demand for it.

For what? Here's an overlooked idea: Switch to the CFO.

Digital initiatives has a virtual festival of stakeholders: chief technology officer, chief information officer, chief digital marketing officer, head of specific business, head of software, staff operations, sales teams, etc. As the “end-to-end” executive, the CFO is often left out. It was a big mistake.

CFOs aren't just key players on digital initiatives; CFOs are key players in digitization – and it's time for companies to recognize that. The CFO is the conductor that allows different digital instruments to play together as an ensemble. In other words, the CFO's central role in DX initiatives is paramount. Here are just 5 reasons why.

1. Successful DX is using data.

The CFO is the champion of all business data – external data, internal data, historical data and employee data. But it's not just enough to have, share and consult data; it must be analyzed, and the DX must then be aligned with it. That's why effective digital transformation requires more than a data dump; it requires an appropriately structured data warehouse to capture the relevant inputs and a business intelligence engine to present them (in context). Enter the CFO. The CFO's office has the best understanding of the key data parameters of the business. Therefore, the best CFO can provide a framework around the data – a framework that is important in driving the DX strategy and completing the DX process.

2. DX increases risk.

Of the many hats a CFO wears, perhaps the corporate risk department is the most important. For PE companies, DX is an important tool for adding value, especially in the post-COVID world. However, company management must use that tool while also keeping an eye on the risks surrounding it in the form of data security, cybersecurity, regulatory compliance, and other areas. No other executive can go the risk-to-reward route, or to be precise, as the head of the finance function.

3. Digitization requires centralization.

The CFO has the best overall view at the corporate level. DX initiatives, by design or by accident, are channeled into many separate business units, resulting in disconnected initiatives.

As custodians and data owners, the CFO is best positioned to understand each individual's digitization efforts and build the necessary bridges to align with a centralized enterprise strategy.

Equally important, she or he is also best positioned to build an external bridge – one that connects the company to the sponsor's digital strategy across the entire large portfolio. than.

4. Conversions have a timeline.

The CFO must ensure that the timeline falls within the retention period. Most DX initiatives – at least the truly transformative ones – are not of the week-long type. They take months and often years.

And then, like every renovation/construction project, they usually take half the time to do so.

It is the “excess” time that the sponsor or owner has not participated in the value creation plan. The role of the CFO is to help calculate a digital ROI strategy, where larger initiatives are broken down into smaller, more manageable, more profitable phases. That ensures the digitization process not only serves the business but also serves the investor's schedule.

5. The path to the transition runs through finance.

The CFO must be its architect and main controller. Indeed, there are few places in the business as ripe for digital transformation as finance, and even fewer business units where the impact of DX will be as large.

As the authorized and functional owner of many of the more ancient, money-critical processes (order to cash, bookkeeping for reporting, procurement for payment), finance must should be at the top of any business transformation audit list.

Of course, financial digitization would be an impossible feat without the guidance and involvement of the CFO. However, the CFO's role in driving digitalization goes beyond its importance to a successful financial transformation.

As one of DX's first functional stakeholders, the CFO will be a key example for peer business unit leaders of the moderator type.

Source: Sanjay Purohit from Accordion,

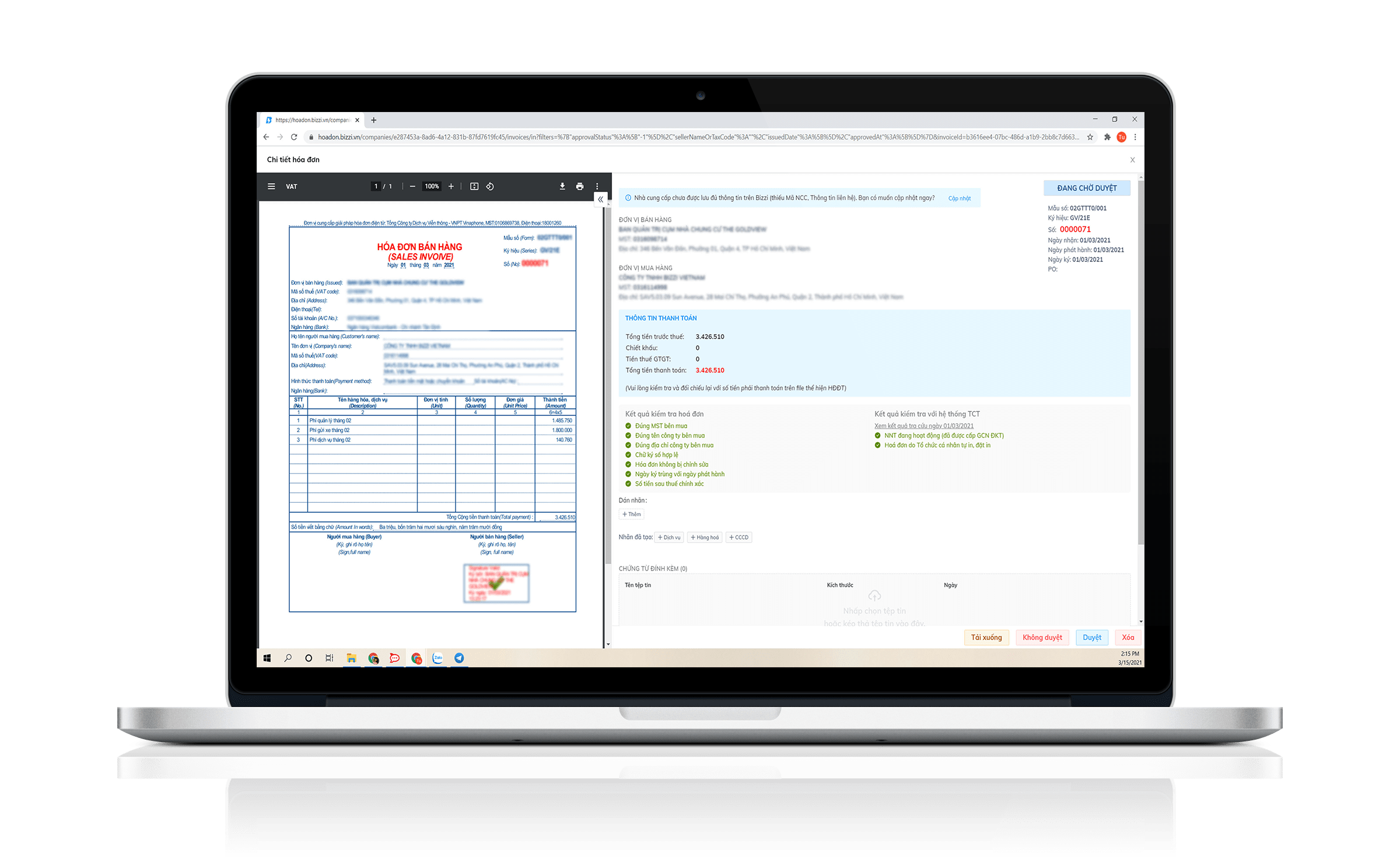

Bizzi - Automated and comprehensive Invoice management technology solution

- Automatically extract, check the validity of Invoices.

- Reduce 80% time to process incoming e-invoices.

- Manage and store invoices efficiently and scientifically.