In an increasingly competitive business environment, the need to access capital to expand production and enhance business operations has become one of the top priorities of businesses. Borrowing capital not only helps businesses maintain financial stability but also provides the necessary resources to expand and achieve long-term goals.

However, to be able to borrow capital successfully, businesses need to clearly understand the conditions, procedures and necessary documents. This article will provide a comprehensive view of the conditions for borrowing capital for businesses, thereby helping businesses to be more confident when accessing funding sources from financial institutions.

Index

ToggleWhat is a business loan?

Business loans are a form in which business organizations can access financial resources from banks or credit institutions to serve various purposes in production and business activities. To meet the increasingly diverse needs of businesses, banks and credit institutions have developed many loan products suitable for each type and size of business.

These loans can be used for a variety of purposes, including:

- Invest in expanding production scale: Increase production capacity, purchase more modern machinery and equipment.

- Working capital support: Ensure stable cash flow to pay suppliers, employee salaries, operating costs.

- New Project Development: Implement potential business projects, expand markets and develop new products.

For each type of business and loan purpose, credit institutions will offer suitable loan packages, with flexible interest rates and terms to help businesses optimize financial costs.

Business loan conditions

To be able to borrow capital successfully during the year, businesses need to meet a number of specific conditions from financial institutions. These conditions often include requirements on credit history, financial capacity and feasibility of capital use plans.

Each credit institution will have its own conditions for business loans, but in general, financial stability and development potential are still the main evaluation criteria.

Businesses that can borrow capital

Not all businesses are eligible for business loans from credit institutions. Typically, credit institutions will consider the profiles of businesses with a stable operating history, clear profits, and growth potential. Specifically, businesses in the manufacturing, service, and trade sectors can all borrow capital, as long as they meet the requirements of the credit institution.

Businesses that may be eligible for business loans:

- Registered businesses: Businesses operating in all fields, from manufacturing, trade to services, can access loans.

- Businesses with legitimate capital needs: Loans must be used for legitimate business purposes, not contrary to the provisions of law.

Specific requirements for businesses

To access capital, businesses need to ensure a number of important conditions:

- Good credit history: The credit institution will review the business's credit profile, ensuring there are no bad debts or uncollectible debts.

- Stable revenue: Credit institutions often require businesses to demonstrate stable revenue, the ability to generate profits and maintain operations.

- The business representative who borrows money must have full civil capacity and civil law.

- Have collateral: For large loans, banks often require businesses to mortgage assets such as real estate, machinery, equipment, etc.

- Clear business plan: A detailed and feasible business plan helps credit institutions assess the risk level and the ability to repay the business.

- The purpose of borrowing capital must be legitimate and transparent, such as expanding the business market, purchasing raw materials, expanding production, etc.

- The business investment project of the enterprise is feasible and practical with a debt repayment plan.

Factors to ensure when borrowing capital

When borrowing capital, businesses need to pay attention to the following factors:

- Debt repayment ability: Need to calculate carefully to ensure that loans can be repaid on time, avoiding falling into bad debt.

- Interest rates and fees: Interest rates may vary depending on the credit institution and loan term. Businesses should compare interest rates between providers to choose the optimal fee.

- Collateral (if required): Many loans require collateral, which can be fixed assets of the business or the individual who owns the business.

- Read the contract carefully: Before signing a contract, businesses should carefully read the terms and conditions to avoid unnecessary risks.

Documents needed to prepare when borrowing business capital

Preparing complete and accurate documents is an important step for businesses to access capital easily. Documents often include legal documents, financial reports, and related documents for credit institutions to evaluate the financial situation and solvency of the business. Completing documents helps speed up the approval and disbursement process.

Necessary legal documents

To complete the loan process, businesses need to prepare important legal documents:

- Legal documents: Business license, Company establishment license, Company charter, Tax registration certificate, Appointment decision (if any), ID card/Citizen ID card or household registration book of the borrower's representative.

- Documents confirming mortgaged assets: If there are mortgaged assets, the business needs to prepare documents certifying ownership or documents verifying the value of the assets.

Financial statements and related documents

Credit institutions often request financial reports to evaluate the financial capacity and business performance of enterprises:

- Business financial reports: Financial reports (within the last 2 years), Labor contracts, Purchase-sale contracts, etc.

- Business performance report: Provides information on revenue, profit, operating costs.

- Balance sheet: Helps credit institutions see the overall financial situation of the business.

- Proof of purpose of borrowing from the bank: Production and business plan with potential to repay the bank, Debt repayment plan,...

- Cash flow: Shows cash inflows and outflows, the liquidity of the business.

Internal corporate procedures to be completed

In addition to preparing legal documents, businesses need to complete internal procedures to ensure consistency and transparency when borrowing capital:

- Register for loan information: Submit loan application online or directly at a credit institution branch.

- Internal financial control: Ensure that the company's finances are strictly managed and can meet the inspection requirements of credit institutions.

Latest business loan procedures

Business loan procedures have many innovations to create more favorable conditions for businesses to access capital. Financial institutions today also have improvements in the process to shorten processing time, meeting businesses' timely loan needs. Understanding each step in the process will help businesses prepare better and increase the rate of successful loan approval.

Loan application process

The business loan application process usually includes basic steps such as application submission, financial assessment and loan approval. The business needs to submit an application including necessary documents for the credit institution to review. After the application is submitted, the credit institution will conduct an assessment and make a decision to approve the loan based on the financial situation and reputation of the business.

The business loan process may include the following steps:

- Register for loan consultation: Register for business loan consultation through the lending organization's links

- Get advice from a loan support unit: A consultant will contact you to guide you through the loan application process, answer questions and provide information about loan products.

- Prepare loan documents: Businesses prepare loan documents according to the consultant's instructions. Clear and accurate documents will help businesses speed up the loan application approval process.

- File appraisal: The credit institution will check the file to assess the risk level and the business's ability to repay the loan.

- Approval and contract signing: After successful appraisal, the enterprise and credit institution will sign the loan contract.

- Disbursement: The loan amount will be disbursed into the business's bank account as agreed.

Approval and disbursement time

Approval times typically range from 7 to 14 business days, depending on the credit institution's internal processes and requirements.

Nowadays, many organizations have improved the process to reduce the approval time, even having fast loan packages with disbursement time within 24 hours. However, for large loans or requiring a lot of collateral, this time may be longer to ensure the safety of both parties.

Once approved, the loan will be disbursed in the agreed form, helping businesses quickly access capital.

Points to note when completing business loan procedures

Businesses need to pay attention to a number of important factors when completing the business loan procedure, including ensuring complete documentation, carefully checking the terms of the loan agreement, and ensuring the repayment plan is suitable for financial capacity. This helps businesses avoid unwanted financial risks during the repayment process.

Businesses need to pay attention:

- Review the loan agreement carefully: Make sure the terms of interest rates, repayment terms, and other obligations are clearly understood.

- Meet repayment deadlines: To avoid penalties or damage to your credit history, businesses need to proactively plan their repayments.

- Regularly contact the credit institution: If there are difficulties in the debt repayment process, the business should discuss immediately to find appropriate support solutions.

- Loan insurance: You should consult your bank about purchasing loan insurance to minimize risks.

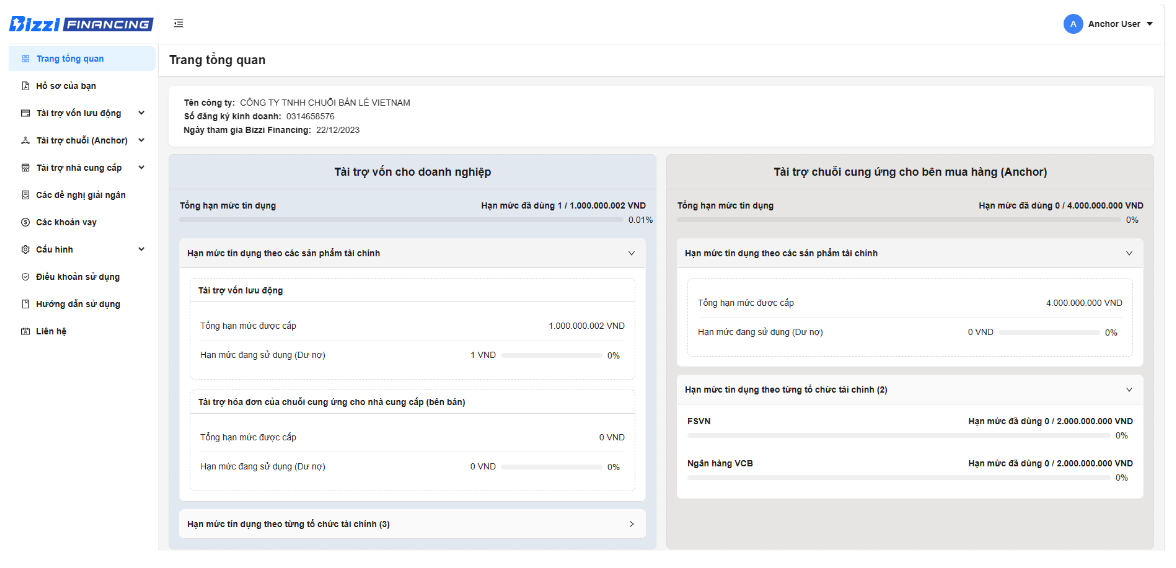

Business financing connection solution with Bizzi Financing

Bizzi Financing is a modern financial solution, providing many flexible loan options for businesses. With an advanced technology platform, Bizzi helps connect businesses with reputable financial institutions, thereby easily accessing loan packages suitable for business needs. Support from Bizzi helps businesses optimize the loan process, saving time and costs.

What is Bizzi Financing?

Bizzi Financing is a digital financial platform that provides a variety of capital financing solutions for businesses, from short-term loans to medium and long-term loans without having to go through complicated procedures. This is a platform that connects businesses in need of capital and investors. This platform helps businesses access capital faster and more conveniently than borrowing from banks.

Designed to optimize the financing process, Bizzi Financing is the top choice for small and medium-sized businesses.

Benefits of Bizzi Financing in Capital Financing

With Bizzi Financing, businesses can experience a simple, transparent and efficient lending process. Key benefits include saving time with an online process, reducing complex documentation requirements, and accessing a wide range of loan packages at preferential interest rates. In addition, Bizzi also provides consulting support to help businesses choose the most suitable financial solutions.

- Access to diverse sources of capital: Bizzi Financing connects businesses with a variety of investors, giving businesses more options.

- Simple and fast procedures: The application and approval process on the Bizzi Financing platform is often faster than at traditional banks.

- Competitive interest rates: Bizzi Financing offers reasonable interest rates, helping businesses optimize their borrowing costs.

- Professional financial consulting: Bizzi's experienced consulting team supports businesses in choosing suitable financial products.

- Transparency and confidentiality: All business information is kept absolutely confidential.

The process of connecting with Bizzi Financing is quick and convenient

The process of connecting with Bizzi Financing is simple and convenient. Businesses just need to register online and provide the necessary information, then the Bizzi platform will evaluate and connect with suitable credit institutions.

This process helps to reduce cumbersome procedures and save time for businesses, ensuring that businesses can access capital in the shortest time.

- Register an account on Bizzi Financing: Businesses can easily create an account online.

- Apply for a loan online: Loan applications are submitted online, saving time.

- Get free consulting support: Bizzi will contact you to provide dedicated support, helping businesses quickly complete loan procedures.

In short

Business loans are an important financial tool to help businesses grow. However, to successfully borrow capital, businesses need to prepare complete documents, choose a reputable bank or funding platform, and consider carefully before signing the contract.

Bizzi Financing is an optimal solution for businesses looking for capital. With a simple, fast and transparent process, Bizzi Financing helps businesses access capital easily and effectively.

Sign up for a consultation today to receive the best support! Registration link: https://finance.bizzi.vn/

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam