Unplanned expenses are expenses that often arise during the implementation of work, projects or business operations. To manage them well, leaders at all levels need to understand where the unplanned expenses come from and how to manage them effectively.

In this article, Bizzi will provide comprehensive information and perspective regarding the costs incurred.

Definition of incidental costs

Incurred expenses are actual expenses that a business must pay or record during the course of business, production or operation – whether paid or not.

Examples of incidental costs:

- Purchase of raw materials and goods

- Pay employees

- Electricity, water, internet, office rental costs

- Advertising and marketing costs

- Cost of machinery repair and equipment maintenance

- Travel, business, and entertainment expenses

Characteristics of incidental costs:

- Actual occurrence at a given point in time (whether money has been spent or not)

- Is the basis for recording in accounting books, helping to determine business results.

- Can be fixed costs (like office rent) or variable costs (like the cost of purchasing raw materials)

- Must have valid documents such as invoices, contracts, acceptance reports... to be legally recorded.

Impact of incidental costs on the company's financial situation

Unexpected costs are an inevitable part of business operations, but if not effectively controlled, they can negatively impact a company's profits, cash flow, and ability to grow sustainably.

Direct impact on profits

The more expenses arise → profit after tax decreases if revenue does not increase accordingly.

- If costs exceed plan → Business may lose money

- If cost control is good → Maintain or increase stable profits

Impact on Cash Flow

Incurred costs, whether paid or not, impact:

- Cash outflow: when making immediate payment

- Expected cash flow: when expenses are incurred but not yet paid (must be paid in the future)

If not managed well, businesses can easily fall into the following situation:

- Cash flow shortage

- Inability to pay wages, taxes, debts

Impact on cost structure and operating efficiency

The costs incurred reflect:

- Where do businesses spend the most (marketing, production, human resources...)?

- High or low cost/revenue ratio → affects operating efficiency

Impact on financial statements and financial ratios

Incurred costs are a factor that affects many key indicators, like:

| Index | How affected |

| Gross profit margin | Input costs increase → Margin decreases |

| Net profit | Operating costs increase → Net profit decreases |

| ROA / ROE | Costs increase → Return on assets / capital decreases |

| Cost/Revenue Ratio | Increase if not well controlled |

Pressure on management and investment decisions

- Drain the budget

- Impact on expansion plans, new investments

- Leading to the postponement or cancellation of important campaigns

The role of accounting in identifying and tracking costs incurred

The accounting department is the center of the entire financial management system of the enterprise. Accounting not only records but also participates in the process of control, analysis and reporting - helping the enterprise make accurate and timely decisions.

Record expenses at the right time, in the right type, and according to regulations

- Determine which costs are eligible and allowable for recognition.

- Classify costs by purpose: selling costs, administrative costs, financial costs, production costs, etc.

- Record in accounting books right time accrual accounting

Check documents and ensure the legality of expenses

- Check invoices, contracts, payment requests, acceptance reports, etc.

- Ensure full procedures, signatures, and seals as prescribed

- Reject invalid or suspected fraudulent payments

Analyze and track cost variances

- Compare actual costs with budget

- Analysis of increase and decrease fluctuations by period and by department

- Issue warnings if costs exceed thresholds or show unusual upward trends

Coordinate with departments to control costs

- Purchasing: check input costs, unit prices, contracts

- Human resources: salary, bonus, social insurance costs

- Business: marketing costs, commissions

- Production: material and processing costs

Prepare cost reports for management and strategy purposes

- Monthly, quarterly, yearly cost reports

- Actual vs Plan Comparison Report

- Cost reporting by product, project, department

- Cost/revenue ratio, average cost, etc.

Support for auditing, settlement and tax management

- Systematic recording and storage for internal and independent audit purposes

- Corporate income tax settlement: ensuring expenses are deducted properly

- Limit the risk of being inspected by tax authorities

The Importance of Managing Incurred Costs to Increase Profitability

Effective cost management is key to increasing profits and ensuring sustainable growth for businesses, large or small. Here is a detailed analysis of why cost management is so important:

Reduce waste – optimize resource efficiency

- Identify and eliminate non-value-added expenses

- Optimize the use of raw materials, human resources and assets

- Accurately evaluate the investment efficiency of each activity

Support more accurate strategic decision making

- Know which departments to increase or decrease budget for

- Adjust product prices to ensure profit margins

- Decide whether to expand, shrink, or discontinue a project/product line

Improve cash flow and solvency

- Proactively forecast cash outflows

- Avoid the situation of "no cash on payment due date"

- Maintain credibility with suppliers, partners, employees

Increase competitiveness and market positioning

- Keep prices competitive while ensuring profits

- Increase budget for marketing, research new products

- Invest in quality and after-sales service without worrying about "overspending"

Contribute to ensuring sustainable development

- Less affected by market fluctuations

- Adaptable to changes in supply chain, raw material prices, taxes and fees

- Having a stable financial background → favorable for calling for investment and borrowing capital for expansion

How to record costs effectively

Record incurred costs is the accounting or financial management process of recording actual expenses that have occurred during the operation of a business, whether or not the expenses have been paid. This is an important step to accurately reflect the financial situation and operating performance of the business.

Here are ways to record expenses:

Recorded at the right time

- Apply the accrual accounting principle: costs are recorded when incurred, not when paid.

- For example, a service invoice for March, even if paid in April, must still be recorded in March.

Clear cost classification

| Cost Type | Typical example |

| Production cost | Raw materials, labor, machine wear and tear |

| Cost of sales | Advertising, commissions, shipping |

| Business management costs | Office supplies, office staff salaries |

| Financial costs | Bank interest, exchange rate difference |

Proper classification helps businesses easily track, analyze and evaluate the effectiveness of each department.

Attach costs to each department, project, product

- Set up separate cost codes for each unit or project.

- Helps to retrieve costs by item → evaluate specific performance.

How to manage incidental costs effectively

Effectively managing incidental expenses is an important part of ensuring that your business or personal finances stay within budget. Here are some ways to manage incidental expenses:

Build a budget and spending limit

- Budget expenses by month/quarter/year.

- Set spending limits for each department and project.

- Require explanation when exceeding budget.

Accounting software applications and cost management tools

- Automate the recording

- Track cost fluctuations in real time

- Export analysis reports easily

- Save time – reduce errors – make faster decisions.

Compare actual costs and budget periodically

- Compare actual costs with planned costs

- Detecting threshold rate, reasons for abnormal occurrence

- Make timely adjustments to operations or expenditures.

Cost-effectiveness assessment

- Which costs generate clear revenue/value?

- What expenses can be cut – reduced – replaced?

- ROIC (Return on Invested Capital) or cost/benefit analysis

Establish internal cost control processes

- Purchase Request Approval – Multi-Level Payment

- Apply 3-step process: propose → review → implement

- Integrate accounting, internal control and operations management

How does the Bizzi platform support “Business Cost Management”?

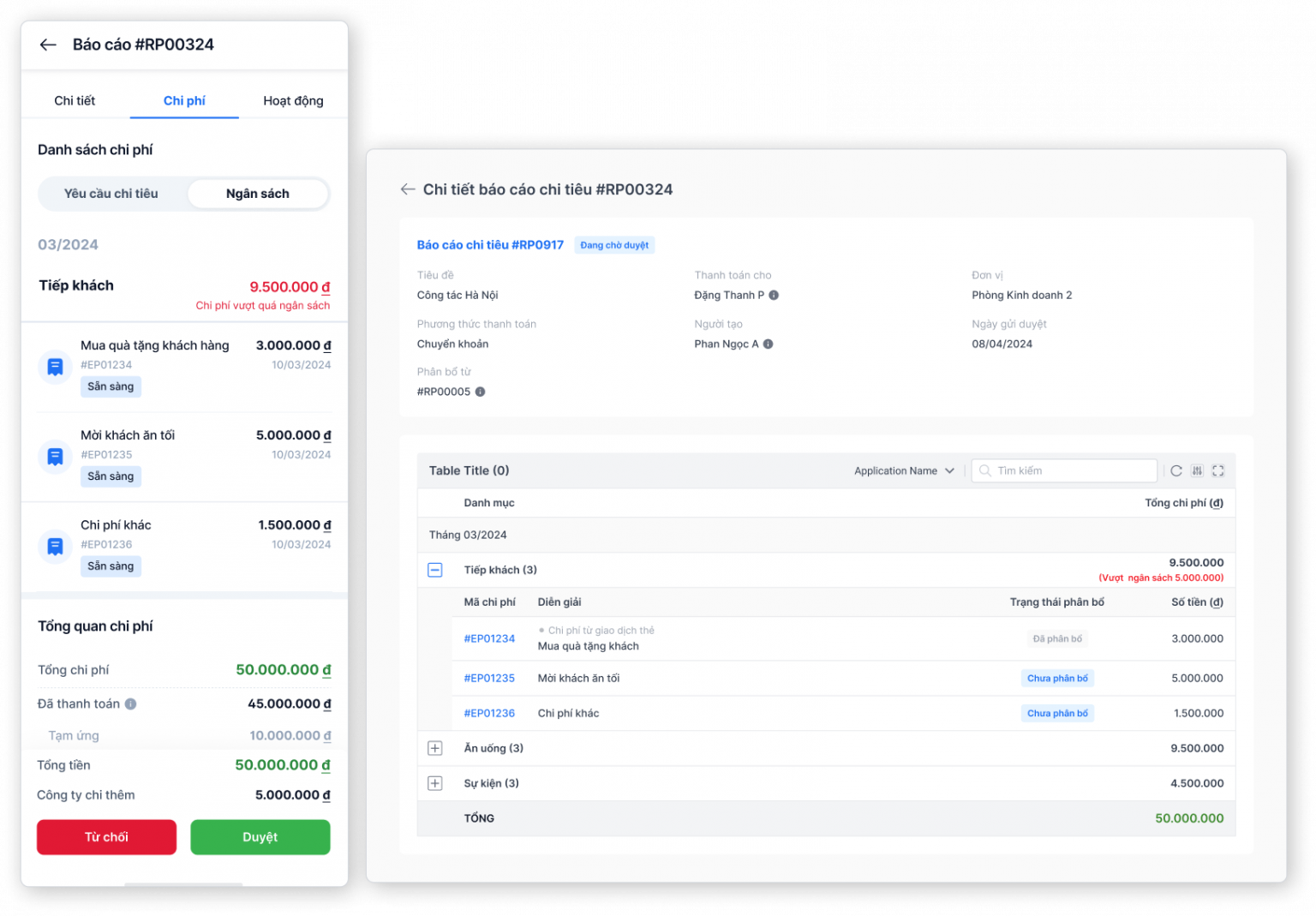

Bizzi Expense is a comprehensive expense management software that helps businesses automate financial processes, minimize risks and optimize work performance. With outstanding features, Bizzi Expense helps businesses set up and control budgets more easily than traditional tools such as:

- Set up spending policies easily: Allows businesses to set up and customize spending policies for each department or project, ensuring transparency and compliance with financial regulations.

- Build a smart expense approval process: Support setting up an automatic expense creation and approval process, helping to shorten processing time and ensure accuracy at every step.

- Detailed budgeting for departments and projects: Provides detailed budgeting tools, helping businesses allocate appropriate resources and control spending for each department and project.

- Real-time cost tracking: Allows users to capture costs instantly, providing an overview of the current financial situation, supporting businesses to make accurate and timely decisions.

- Intuitive cost and budget reporting dashboard: Integrated cost and budget reporting dashboard helps management easily track, analyze, and compare data, thereby developing appropriate strategies.

- Seamless ERP Integration: Bizzi Expense integrates with popular ERP systems, allowing for fast and accurate synchronization of financial data and centralized data management.

Conclude

In short, “Incurred costs” is not a completely negative concept for businesses. On the contrary, if we can control the incurred costs well, we can create opportunities to increase the value of products, services or customers.

Bizzi Expense is a comprehensive solution that helps businesses control arising costs effectively, optimize company budgets and improve employee satisfaction. Start implementing Bizzi Expense's arising cost management solution in particular and business costs in general today!