In recent years, the Vietnamese tax authorities have shifted significantly from manual inspections to Risk management based on electronic invoice data.This means that: Businesses are no longer able to "fix mistakes as they happen."which must be proactively identified and controlled. invoice risk indicators from the beginning

Even just one risky invoice can cause a business to:

- Bag type of costVAT is not deductible.

- Bag Tax collection, penalties, and tax assessment.

- Bag classified as high riskThis entails pre-completion inspections and special monitoring.

This article will help you Understanding what constitutes a risky invoice and how tax authorities identify high-risk businesses., and most importantly: What should businesses do to take early preventive measures under the legal framework applicable from 2026?.

Below is A completely redesigned, coherent, and "professional blog-style" version. give Part IWhile retaining the original meaning, it enhances the analytical depth, helping the reader. Understand – grasp – perceive the risks as real.Suitable for core SEO articles.

I. Why should businesses identify early signs of invoice risk?

Before going into each invoice risk indicators Specifically, businesses need to understand this clearly. The nature of the concept of "risk invoice" And here's why this is becoming one of the critical issues in current tax administration.

What is a risk invoice?

In tax administration practice, risk invoice These aren't just invoices with "technical errors," but invoices that... It is highly likely that the legal requirements for tax approval will not be met..

Specifically, a risky invoice is an invoice that has the potential to:

- Illegitimate (Issued by ineligible businesses, businesses that have abandoned their address, or have ceased operations...)

- Invalid (Incorrect required information, incorrect timing, incorrect nature of the transaction)

- Not eligible to:

- Input VAT deduction

- Included in deductible expenses when determining corporate income tax.

The important point to note is: An invoice may look "good on the outside" but if the nature of the transaction is problematic, it will still be classified as a risky invoice.

What happens if the business continues to use risky invoices?

In the current context of tax risk management, the use of risky invoices almost certainly leads to the following consequences:

- Expenses were exposed. when settling corporate income tax

- Input VAT is not deductible., even though it had been declared previously

- Subject to tax arrears collection and administrative penalties., even tax assessment if the transaction cannot be proven to be genuine.

- The tax refund application has been moved to the "pre-refund verification" stage.This prolongs the completion time and seriously impacts cash flow.

Even more worrying, just one a small number of risky invoicesBusinesses can also be affected. classified as a high-risk taxpayer.This led to a significant increase in the frequency of inspections in subsequent periods.

Why are invoice risks becoming increasingly serious?

The core reason lies in the role of invoices in the tax system.

The invoice is original basis For the tax authorities to record and verify:

- Revenue

- Expense

- Input and output VAT

When a problematic invoiceThe consequences extend beyond accounting practices, spreading to:

- Financial report (Incorrect costs, incorrect profits)

- Tax obligations (VAT, Corporate Income Tax)

- Cash flow (Tax arrears collected, tax refund suspended)

- Enterprise risk ranking on the tax authority's risk management system (TMS)

During the period tighten Electronic invoice, applying big data risk managementThe tax authorities no longer evaluate each individual invoice, but look at them. The entire history of a business's invoice usage over time..

Subtle insights from business reality

Practical implementation in many businesses shows that:

- What accountants fear most.:

Receiving risky invoices without knowing it, only to be asked for explanations and have payments rejected en masse during inspections and audits. - What CFOs fear most.:

Tax refund applications are held up for months, even years, simply because... A few invoices are "at risk" in the entire file..

That is why, Identify early signs of invoice risk. It is no longer an "advanced" skill, but has become... mandatory requirement For businesses, if they wish:

- Cost protection

- Protecting cash flow

- And avoid being classified as a high-risk taxpayer.

II. 25 signs risky businesses Regarding invoices and VAT refunds

The invoice risk indicators This is not subjective speculation, but is based on Official summary from the General Department of Taxation in Official Document 1873/TCT-TTKTThis document lists... 25 signs Used to screen businesses with high risk regarding invoices and VAT refunds.

The key point is: These signs targeting the nature of the transaction, not just a formal error on the invoice.

It is possible to group 25 signs together. 5 major risk groups hereafter.

1. Risks associated with changes in business structure and operations.

This group reflects the unusual changes in legal, organizational, and personnel matters.This often appears in businesses that show signs of "setting up a legal entity shell".

Common signs

- Change legal representative two or more times in 12 months

- Business Temporarily suspended – operations resume. several times a year

- Business Newly established but has already generated significant revenue.

- Relocating the company headquarters multiple times within 1–2 years.

- Head office address Difficult to define, does not exist in reality.

- Many businesses in the chain have: A representative who is spouse, siblings

- The current director or business owner was formerly the company's representative:

- Abandon the business location.

- Taxes still owed

- Forced to pay the bill

These are the signs that indicate structural risk, often associated with businesses that exist only for the sake of invoice, which does not serve actual business operations.

2. Risks related to revenue, finances, and tax obligations.

This group focuses on the non-wave data The discrepancy between revenue, VAT, and tax payable is something that a tax risk management system (TMS) can detect very quickly.

Typical signs

- Revenue increased dramatically, but the VAT payable was very low.

- Tax/Revenue Ratio < 1% over many periods

- High revenue (e.g., > 10 billion VND/year) but very low total tax payable.

- Output VAT approximately input VAT for many consecutive periods

- Frequent negative VAT

- Multiple transactions occurred:

- Money is deposited and withdrawn within the same day.

- Cash flow does not reflect business operations.

Perspective on tax refunds: Tax refund applications with these signs are almost certainly rejected. Switch to pre-completion check.

3. Risks in using and managing invoices

Business approach Issuing, adjusting, and managing invoices It is also a major source of risk.

Common symptoms

- Use a very large number of invoices in a short period of time

- The rate of cancelled and adjusted invoices is high (≈20% invoice numbers).

- Issued the invoice, but:

- Failure to notify the public of release on time.

- Delayed reporting of invoice usage status.

- Issuing invoices for natural resources and minerals:

- But no mining license

- Model:

- 1 Tax Identification Number (MST) – multiple invoices distributed across provinces.

4. Risks due to mismatch between assets and resources

When revenue is very high but Their practical skills are almost non-existent.This is a very strong risk signal.

Warning signs

- High revenue, but:

- No warehouse

- No warehouse rental documents.

- Almost no fixed assets

- The workforce is too small compared to the scale of revenue and industry.

- There are no machines or means of transport suitable for exporting goods.

Typical case:

A transportation company issued invoices worth hundreds of billions, but... None of the vehicles are registered under the company's name..

5. Goods and services listed on the invoice do not match.

When The registered business activity, geographical location, and invoice content do not match.The risks are increasing very rapidly.

Common signs

- The goods sold are not suitable for the conditions of the province, region, and infrastructure.

- Purchase raw material A but sell an unrelated service B.

- Constantly changing majors

- Focus on sensitive cost groups:

- Advise

- Advertisement

- Transport

- Comprehensive services

Below is Full deployment version – professional blog standard give Part III and Part IV, with additions introductory paragraph after each heading, explain clearly the significance of risk management and practical consequences The goal is for readers (accountants, CFOs, business owners) to understand the seriousness of the situation, not just to read for information.

III. 5 criteria that classify taxpayers as "high risk"

Not all businesses with erroneous invoices are classified as "high risk". However, according to Circular 32/2025/TT-BTC, if the taxpayer fall into one of the core criteria belowThe tax authorities may apply special monitoring mechanism, even Restrict or prohibit the registration for using electronic invoices..

The key point to note is: This is no longer a "warning" level., which is high risk classification thresholdThis directly affects the right to issue invoices, claim tax refunds, and operate the business.

Summary of 5 high-risk criteria according to Circular 32/2025/TT-BTC

| Token | Management significance | Actual risk |

| The tax authorities have concluded that there was invoice fraud. | The risk has been confirmed. | Subject to special monitoring, restrictions on electronic transactions. |

| There was a suspicious transaction under the Anti-Money Laundering (AML) Act. | Related to unusual cash flows | Tax-bank cross-checking |

| The registered address is unclear and cannot be verified. | "Virtual" businesses are difficult to control. | Enforcing invoices, rejecting electronic invoices. |

| The owner/representative has a history of serious tax and invoice violations. | History of high risk | Placed on a long-term watchlist. |

| Failure to provide, or providing unconvincing, explanations of the reported risks. | Non-cooperation with tax authorities | Tax assessment, large-scale inspections |

- Just one criterion is needed. In the table above, the business was able to:

- The application for the new electronic invoice system was rejected.

- Placed on the list of key surveillance targets.

- If 2-3 criteria are met simultaneously.The risk increases exponentially:

- Not only were their bills scrutinized, but they were also... Examine the entire transaction chain, cash flow, contracts, inventory, and personnel.

- Direct impact Ability to issue invoices → collect payments → maintain cash flow

For this group, No longer processing invoices individually., which is processed according to the company's overall risk profile.

IV. Internal risks within businesses are often overlooked.

When it comes to invoice risk indicatorsMany businesses often only look outward:

"Due to supplier risk", "The partner issued the invoice incorrectly.".

However, the reality shows that Many invoices become risky simply because of internal errors.This is entirely preventable if the business has good control procedures in place.

1. Incorrect required information on the invoice.

These are basic errors, but they occur very frequently.

Common mistakes include::

- Incorrect business name, address, or tax identification number of the buyer or seller.

- Incorrect tax rate, VAT amount

- Incorrect unit price and total amount due to confusion between PDF and XML documents.

These mistakes may seem minor, but if:

- Failure to follow proper adjustment/replacement procedures.

- Failure to notify the tax authorities in a timely manner.

→ The invoice may be considered invalid, which leads to VAT and other charges are excluded..

2. Incorrect invoice issuance time.

The timing of invoice issuance is a factor. often overlooked, but it is an important inspection criterion.

Common risks:

- Invoice too soon compared to the time of delivery/service provision

- Invoice Too lateeven after months

When the invoice is issued does not match the nature of the transaction.The tax authorities have the right to:

- Suspicions arise that the transaction was not genuine.

- Adjusting revenue and expenses for incorrect periods.

- Imposing administrative penalties for issuing invoices at the wrong time.

3. Risks from input invoices

Even if the business issues the invoice correctly, risky input invoices It is still possible to bring businesses under scrutiny.

Common scenarios:

- Receive invoices from businesses on the high-risk list

- The supplier has:

- Cease operations

- Remove business address

- Forced to pay the bill

- The input invoice has:

- Deleted

- Adjusted

- Replaced

But The accountant was unaware or not informed.Accounting and reporting will continue as usual.

The consequence is:

- Input VAT is excluded.

- Expenses that are deducted during final settlement.

- The business is being evaluated. Unable to control counterparty risk.

4. Errors in document declaration and storage.

The risks lie not only in the content of the invoice, but also in... Procedure for handling errors after they occur.

Common internal errors:

- Do not create a written agreement when adjusting/replacing invoices.

- Failure to report errors to the tax authorities. during a workday according to regulations

- Do not retain invoices and related documents. at least 10 years

When inspections and audits take place, missing archival documents synonymous with:

- Transaction cannot be proven.

- Loss of expense and VAT protection rights.

Below is Detailed deployment version – in-depth blog standard give Parts V, VI and VII, Have introductory paragraph after each heading, explain clearly Tax, legal, and operational impacts, in the spirit of updating Invoice risk management for the period 2025–2026.

V. How do risk invoices affect a company's tax obligations?

Many businesses only truly "feel" the extent of the danger. risk invoice when entering the stage tax settlement or refundIn fact, the impact of the risk bill It doesn't stop at one bill., which extended to the entire tax obligation and level of oversight of the business for many years to come.

1. Input VAT is not deductible.

This is a common and often the first consequence to occur.

- When an invoice is reviewed:

- Illegitimate

- Invalid

- Or the actual transaction cannot be proven.

→ Input VAT will be completely disallowed., even if:

- Goods/services used

- The business has paid.

The direct consequences are:

- Taxes payable increase

- Cash flow was affected during the audit period.

2. Expenses disallowed during corporate income tax settlement.

In parallel with VAT, costs corresponding to the risk invoice These expenses are often excluded from deductible expenses when calculating corporate income tax.

This leads to:

- Taxable profit increased

- Corporate income tax payable has increased.

Particularly dangerous for:

- Low-margin businesses

- The business is currently operating at a loss but has expenses disallowed, thus it turns into a taxable profit.

3. Subject to tax recovery, penalties, and tax assessment.

When risky invoices appear systematically or repeatedly, the tax authorities may apply stronger measures:

- Tax collection related periods

- Penalty for late payment according to the Tax Administration Law

- Administrative penalty with actions related to invoices

In the following case:

- The transaction does not prove its nature.

- The transaction price does not follow the market price.

The tax authorities may tax assessmentInstead of accepting the figures declared by the business.

4. The tax refund application has been moved to the "pre-refund verification" category.

This poses a particularly significant risk for export or investment businesses.

Simply:

- Some input invoices show signs of risk.

- Or the supplier is on the warning list.

→ Your VAT refund application may be affected by:

- Switch to pre-completion check

- Hanging up for months, even years

Consequences:

- Cash flow is "frozen".

- The financial plan was disrupted.

5. The applicable legal framework

The current handling of risky invoices is no longer flexible, but adheres very strictly to the following legal framework:

- Tax Administration Law 2019: regulations on risk management principles and tax assessment

- Decree 70/2025/ND-CP: Amend and tighten the management of electronic invoices

- Circular 32/2025/TT-BTC: Guidelines for identifying high-risk taxpayers

- Official Document 1873/TCT-TTKT25 Risk Signs Regarding Invoices and VAT Refunds

The common feature of these texts is: targeting the nature of the transaction, not just the form of the invoice.

VI. The 6-step process for reviewing input invoices to detect risks early.

Before accounting or filing taxes, businesses should apply The process for reviewing input invoices must have at least 6 steps.This is a basic but extremely effective line of defense for reducing risk.

Step 1. Verify buyer and seller information.

Matching:

- Company's name

- Address

- Tax code

with data from the tax system.

Incorrect basic information is the first sign of risk.

Step 2. Check the provider's operational status.

Currently active or:

- Cease operations

- Remove address

- Forced to pay the bill

Invoices from "problematic" businesses are easily rejected, even if the transactions are genuine.

Step 3. Verify that the invoice exists in the tax system.

- Look up your invoice here:

- hoadondientu.gdt.gov.vn

- Comparing XML data

Unable to find the information = very high risk.

Step 4. Check the supplier's business activities.

Is the registered occupation suitable for:

- Goods

- Is the service included on the bill?

For example: a consulting company issuing invoices for large quantities of goods → risk.

Step 5. Match PDF and XML data.

Check:

- Quantity

- Unit price

- Total amount

- Tax rate

A PDF-XML discrepancy is a technical error, but it can render an invoice invalid.

Step 6. Check the invoice status.

The invoice also includes:

- Original bill

- Hay has been deleted, replaced, or modified.

Many businesses use invoices for accounting purposes. has been replaced without knowing.

Advanced test (recommended)

- Check QR code on the invoice

- Check digital signer:

- Is this the legal entity of the supplier?

VII. Measures to improve invoice risk prevention for businesses

To achieve sustainable risk control, businesses cannot rely solely on scrutinizing every invoice. They need to implement solutions. systemic measures.

1. Regularly check the electronic invoice portal.

- Don't just check when you receive the invoice.

- And search periodically according to the supplier list

It helps to identify partners who are at risk early on.

2. Standardize the documentation proving the transaction.

A "clean" transaction requires:

- Contract

- Handover/Acceptance Report

- Warehouse In/Out Slip

- Non-cash payment voucher

Bill never stand alone when giving an explanation.

3. Develop an internal checklist of "12 signs of risky invoices".

For example:

- New supplier, but the invoice is of high value.

- Negative VAT for multiple periods

- Issue invoices close to the end of the month.

- The invoice was adjusted too many times.

Checklist helps accountants so fast in a few minutesInstead of being emotional.

4. Create a supplier whitelist/blacklist.

- Whitelist: long-standing partner, clean record

- Blacklist: partner whose invoices have been rejected or flagged

Reduce risk right from the partner selection stage.

5. Invoicing liability in contracts.

The contract should clearly state:

- Obligation to issue legal invoices

- Accountability

- Compensation obligation if the invoice is rejected.

This is an important but often overlooked "legal shield."

Below is Complete deployment version – standard in-depth blogging give Part VIII and FAQ, written in the following way clearly explain the practical use value., non-advertising, suitable for placement in The end of the pillar content discusses risk indicators for invoices..

VIII. How does Bizzi help identify and control risk indicators in automated invoices?

In practice, invoice risk not from a single invoice, which comes from accumulation of errorsSupplier risks, incomplete records, and inadequate manual reconciliation make it almost impossible to require accountants to manually scrutinize every single invoice, especially given the ever-increasing volume of invoices.

Instead of manual processing, platforms like Bizzi Designed to support businesses Early identification and control of invoice risk indicators right from the receipt stage., before the risks spread to tax filing and settlement.

1. Automatically download, read, and reconcile input invoices.

As soon as an invoice is issued or sent to the business, the system can:

- Automatically download electronic invoices from multiple sources.

- Read invoice data (XML + PDF)

- Standardize information: Tax identification number (MST), supplier name, amount, tax rate, date of issue.

This eliminates the risk of manual data entry and errors – common causes of invoices becoming internal risks.

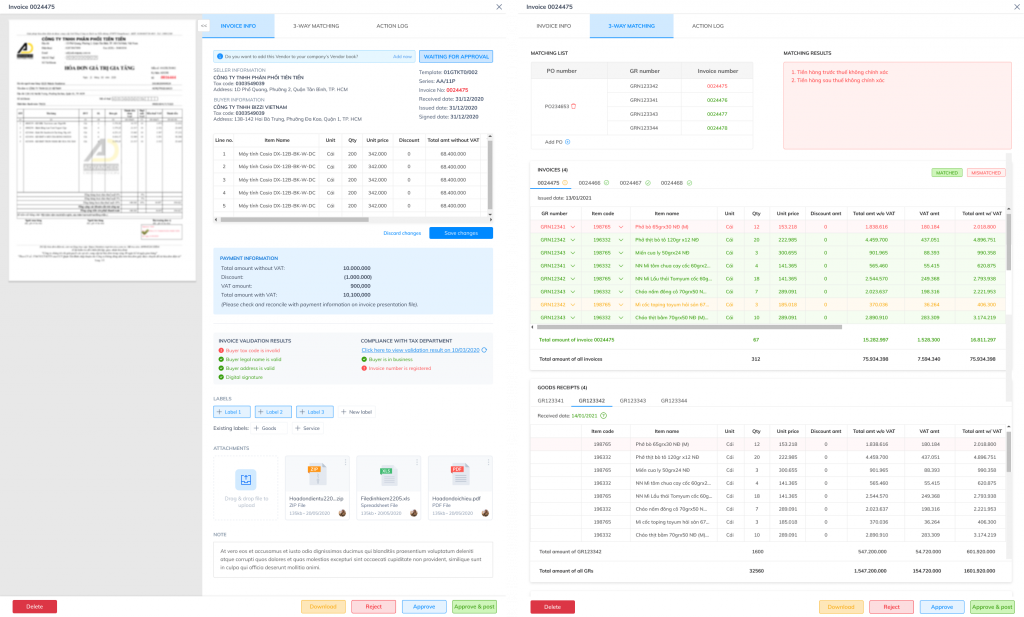

2. Three-way reconciliation: Invoice – Purchase Order – Retail Price

One of the biggest indicators of invoice risk is Invoice not linked to actual transaction.

Bizzi supports automatic reconciliation:

- Invoice

- Purchase Order (PO)

- Handover/Acceptance Record (GR)

The system will:

- Highlight discrepancies in quantity, unit price, and type.

- Discovering invoices with no delivery receipt or incomplete delivery receipt.

This is the layer of control that tax authorities typically use when assessing the nature of a transaction.

3. Verify the tax identification number (MST) and the supplier's operational status.

Many bills become a risk. not due to content, which is due to supplier.

Bizzi supports:

- Look up the supplier's tax identification number.

- Check status: active, inactive, abandoned address, bill enforcement

- Record the supplier's risk history.

Thanks to that, businesses can Early detection of invoices from risky partners.Instead of only finding out when the tax authorities notify them.

4. Flag risky invoices and suppliers.

Based on reconciliation and historical data, the system allows:

- Flag invoices showing signs of risk.

- Label suppliers as belonging to the monitoring group.

This flagging helps:

- Accountants don't accidentally make accounting errors.

- The CFO has a clear list of risks to manage.

5. Retain invoices and records for a minimum of 10 years.

According to regulations, invoices and related documents must be stored for a minimum of 10 years.

Bizzi supports:

- Electronic invoice storage

- Attach invoices to contracts, purchase orders (PO), general merchandise (GR), and payment documents.

- Quick lookup by tax code, invoice number, project, or supplier

This is especially important when businesses need to. Explaining the risk bill after many years.

6. Synchronize with ERP and accounting software

Invoice data is:

- Synchronize with ERP/accounting software

- Limit duplicate data entry.

- Reduce discrepancies between accounting, tax, and management reporting.

Thanks to that, Risk indicators for invoices are controlled from the data source., not just deal with problems after they arise.

Frequently Asked Questions about Invoice Risk Indicators

How can you quickly identify a risky invoice?

You should quickly check these four points:

- Is it possible to look up invoices on the tax portal?

- Is the supplier operating legally?

- Does the invoice have a purchase order (PO) or a gross receipt (GR)?

- Are there any discrepancies between the invoice figures and the actual transactions?

If One of the four points is problematic.The invoice needs to be tracked.

What should you do if you receive an invoice from a business that has been "abandoned" by the sender?

- No additional accounting entries.

- Hang up the invoices for tracking.

- Prepare all necessary documents to prove the actual transaction (contract, delivery, payment).

- Proactively provide explanations if requested by the tax authorities.

Early action helps reduce the risk of having the entire expense disallowed.

If an invoice cannot be verified on the tax portal, is it a fake invoice?

Not that 100% is fake, but very high risk.

Businesses need:

- Request the supplier to recheck the invoice status.

- Do not file tax returns until verification is complete.

Is it permissible to temporarily account for invoices related to risks?

In principle:

- Maybe hang up monitor, should not be included directly in deductible expenses.

- Only record the transaction formally when:

- Valid invoice

- The transaction is clearly documented.

Can a risky invoice cause a pre-refund audit of a tax refund application?

Have.

Just a few risky input invoices, VAT refund applications may be reclassified. pre-completion checkThis prolongs the completion time and seriously impacts cash flow.

Is there any software that automatically alerts you to potential risks associated with invoices?

Yes. Expense and bill management platforms like Bizzi are designed to:

- Automatic testing

- Reconciliation

- Flag risks

- Storage and accountability support

This solution helps businesses Shift from “incident response” to “risk prevention”.

Conclusion: Early identification of invoice risk indicators is crucial for tax management in 2026.

In the context of tax authorities increasingly tightening regulations on electronic invoices, VAT refunds, and taxpayer risk ratings, invoice risk indicators It is no longer a purely technical issue for accounting, but has become... strategic risk This directly impacts cash flow, financial reporting, and the company's reputation.

A risky bill can have a range of consequences:

- Expenses disallowed during final settlement.

- Input VAT is not deductible.

- Subject to tax arrears, penalties, and tax assessment.

- The tax refund application has been moved to the pre-refund verification stage.

- Businesses are classified as high-risk and subject to prolonged monitoring.

The important point to understand is: Invoice risk doesn't only come from "bad" partners., which in many cases stems from internal vulnerability – Incorrect invoicing timing, lack of reconciliation, incomplete record keeping, or failure to promptly identify suppliers that have fallen into the high-risk category.

Therefore, the effective approach in the 2026 period is not to "wait for inspection and then provide explanations," but rather:

- Identify early signs of invoice risks according to the criteria currently applied by the tax authorities.

- Standardize the process of reviewing input invoices right from the moment of receipt.

- Combine human control with automated tools to reduce reliance on manual inspection.

Which business Proactively manage invoice risks from the start.This not only reduces the risk of rejection and penalties for the business, but also:

- Protecting cash flow

- Shorten the tax refund processing time.

- Improve compliance levels and risk ratings within the tax system.

- Reduce the workload for accountants and CFOs during audits and inspections.

In short, invoice risk indicators Not to be "scared," but to Proper identification – prevention – controlThe sooner businesses develop a systematic approach to invoice risk management, the less they will have to pay in terms of money, time, and reputation in the future.

To receive personalized solutions tailored specifically to your business, register here: https://bizzi.vn/dang-ky-dung-thu/