A “tripartite contract” is a contract involving three parties, in which all three parties jointly agree, establish, change or terminate rights and obligations in the transaction.

To better understand the nature of a 3-party contract, let's analyze the definition, classification and especially the solution with Bizzi. corporate financial management effective.

Definition of Tripartite Contract: Nature and Legal Basis

Tripartite contracts are a popular form of cooperation in modern business models such as supply chain, trade finance (Supply Chain Finance) good corporate financial transactions.

This section will help you understand the nature of a 3-party contract, its core differences from a traditional 2-party contract, and the important legal basis under it. Civil Code 2015.

What is a 3-party contract? Core differences with a 2-party contract

A tripartite contract is an agreement involving three independent entities, sharing rights, obligations and benefits in a unified transaction.

Unlike a two-party contract that is only binding between the buyer and seller, a three-party contract is often used in situations where have an intermediary factor – for example, businesses, suppliers and financial institutions working together in the payment chain.

Core distinction between two types of contracts:

| Criteria | Bilateral contract | 3-party contract |

| Number of subjects | 2 parties (buyer - seller) | 3 parties (enterprise – partner – sponsor) |

| Binding relationship | Bilateral, unilateral | Multilateral, cross-linked |

| Legality | Simple, easy to identify obligations | More complex, requiring detailed terms |

| Practical application | Buying and selling goods and services | Supply chain finance, three-party cooperation: enterprise - supplier - bank |

From a legal perspective, the “core distinction” does not lie in the number of subjects, but in the multi-dimensional binding relationship between the parties, in which an act or obligation of one party can directly affect the other two parties.

A tripartite contract is a civil agreement involving three parties to establish, change or terminate the rights and obligations of the parties involved, with equality in discussion and signing. Its nature is more complex cooperation and coordination than a two-party contract, requiring the consent of all three parties to be legally binding. The legal basis of this contract is the general provisions on civil contracts in the Civil Code and related specialized laws.

Constitutive elements and conditions of validity (according to the 2015 Civil Code)

For a 3-party contract to be legally valid, the parties must ensure that all constituent elements and conditions of validity are stipulated in Article 117 of the 2015 Civil Code. Understanding these elements not only helps businesses prevent legal risks, but also increases transparency and efficiency when cooperating with multiple parties in a financial ecosystem.

These are two core legal attributes that help determine whether a contract can be recognized, enforced and protect the rights of the parties involved.

Elements of a 3-party contract

A valid 3-party contract typically includes the following key elements:

- Participants: There are at least three independent parties, each with their own rights and obligations established in the same written agreement.

- Contract subject: Goods, services, assets or obligations agreed to be exchanged or performed by parties.

- Agreement content: Clearly define rights, obligations, responsibilities and coordination mechanisms between parties.

- Form of expression: Can be in the form of a written document, an electronic contract or a certified document digital signature.

The above factors not only help the contract have legal value but also ensure transparency and risk control in multilateral relations.

Conditions of validity (according to Article 117 - Civil Code 2015)

The four basic conditions for a 3-party contract to be considered legal include:

- Legal entity: The parties involved must have full legal capacity and civil conduct capacity.

- Voluntary commitment: The signing of a contract must be based on consensus, not coercion or deception.

- Legitimate purposes and contents: Do not violate the law or social ethics.

- Legal form of contract: Established in the correct form prescribed by law, may be in writing or certified if necessary.

Ensuring the constituent elements and conditions of validity This not only helps businesses avoid disputes, but also serves as a foundation for implementing new models. 3-party contract in corporate finance — for example supply chain finance (SCF), where three entities (business, supplier, financial institution) coordinate on the same agreement.

Common types of 3-party contracts in business activities

In modern business, tripartite contract Not only appearing in the financial sector, but also playing an important role in supply chains, purchasing, investment cooperation, and services. Each type of contract reflects a different legal structure and coordination mechanism between the parties, helping to optimize cash flow, minimize risks and ensure transparency in transactions.

Here are three most common form of 3-party contract that businesses often encounter in reality:

1. Loan contract: Relationship between Bank - Enterprise - Customer

This is tripartite contract most common in the field corporate finance and credit.

The three participating entities are:

- Bank (Lender): Provide capital or credit financing.

- Enterprise (Borrower or Guaranteed Party): Receive capital to serve production and business activities.

- Customer (Beneficiary): It can be the buyer, supplier or partner who is paid directly by the bank.

2. Contract of sale of goods: The role of the intermediary or the carrier

In 3-party sales contract, outside seller and buyer, often with the appearance of intermediary or carrier — an element that helps optimize the delivery and payment process, and ensures that obligations are performed accurately.

The three main entities in this contract are:

- Seller: Provide goods or services.

- Buyer: Payment and receipt of goods.

- Intermediary/Shipper: Responsible for receiving, delivering, inspecting or making payments on behalf of others.

3. Business cooperation contract (BCC) between three parties

Business Cooperation Contract (BCC) is the form tripartite contract strategic, often used in investment projects, joint ventures or market exploitation cooperation.

Unlike a capital contribution or assignment contract, a BCC allows the parties to cooperate and share profits and risks without establishing a new legal entity.

3-party structure in BCC contract may include:

- Party A: Domestic enterprises – providing markets or operating resources.

- Party B: Foreign enterprises – providing capital or technology.

- Party C: Intermediary unit – takes on the role of coordination, project management, or financial management.

Understanding types of three-party contracts not only help businesses ensure legal compliance, but also lays the foundation for transparent financial management and application of automation technology in the cooperation process

What are Liability and Risk Management in Tripartite Contracts?

In a tripartite contract, the legal relationship is not simply “bilateral” between two entities, but also intertwined with the responsibilities and rights of the third party. Therefore, clearly identifying legal responsibilities, coordination mechanisms and risk handling plans are key factors to ensure the smooth operation of the contract and minimize disputes.

Rights and Obligations of Each Subject: Cross-Responsibilities Analysis

In a 3-party contract, each party is not only responsible for its direct obligations but also must coordinate with the other parties to ensure common interests. “Cross liability” here refers to the fact that a breach by one party can simultaneously affect both other parties.

Cross-responsibility:

- Party A may be held vicariously liable if B or C fails to perform its obligations.

- Cross-obligations should be clearly defined in the contract, including inspection, monitoring and penalty mechanisms.

Objective: Reduce the risk of disputes and ensure transparency in coordination among the three parties.

Common Risks and Effective Dispute Resolution Solutions

Three-party contracts pose many risks such as: breach of payment obligations, delays in implementation, miscommunication between parties or conflicts in terms.

- Common risks:

- Delay in implementation due to one party being slow or lacking capacity.

- Error in payment obligation or provision of products/services.

- Disputes of interests due to unclear contracts or lack of settlement mechanisms.

- Dispute resolution:

- Internal negotiations: The parties agree on a solution before submitting it to law enforcement.

- Commercial arbitration: Applicable if the contract has an arbitration clause, shortening the processing time.

- Court: Resolve according to law if the dispute cannot be resolved.

- Combining risk management and dispute resolution mechanisms helps businesses minimize losses and protect legitimate rights.

Optimize Process and Financial Management with 3-Party Contracts

To optimize the process and financial management with a 3-party contract, you need to clearly define the purpose of cooperation, draft a detailed contract with clear payment terms and benefits,

Checklist for Signing a Safe 3-Party Contract for Businesses

Before signing a three-party contract, the business needs a detailed checklist to ensure the validity and legal security of the transaction. Some important steps include:

- Identify all parties involved and the rights and obligations of each party.

- Check the legal basis and conditions of validity of the contract (according to the 2015 Civil Code).

- Ensure dispute resolution and risk mechanisms are clearly stated in the contract.

- Confirm financial details and payment terms to avoid future conflicts.

- Ensure the contract has a valid electronic signature or seal to increase its legality;

- Store and track on a digital system to avoid loss and easily check when necessary.

Applying a “signing checklist” not only helps businesses limit errors but also improves contract management capacity in the digital context.

Automate Payment and Contract Debt Management

One of the biggest challenges of a 3-way contract is management. Cash flow and liabilities involve multiple entities.. With financial automation solutions such as Bizzi, businesses can:

- Automate payment and debt processes for each 3-party contract.

- Track and reconcile receivables in real time, minimizing manual errors.

- Automatic warning when debt is due or overdue, helping businesses proactively manage cash flow.

Thanks to that, businesses can control the entire financial cycle arising from 3-party contracts in a transparent, accurate and timely manner.

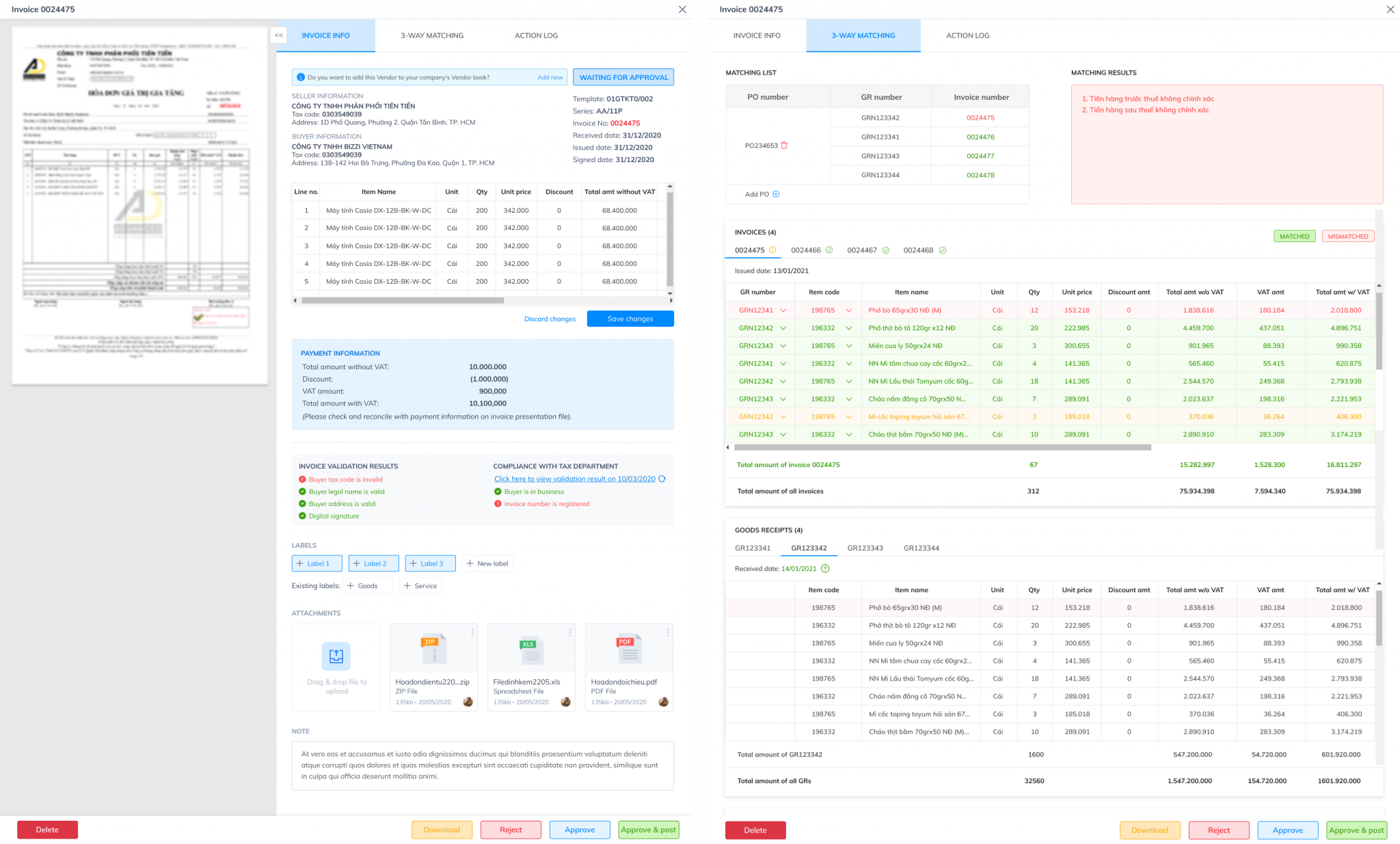

3-way matching and cost control in 3-party transactions

3-way matching is an effective method of controlling costs in multi-party transactions, by comparing data between Contract – Invoice – Receipt of goods/services.

- 3-way reconciliation: Compare invoices – orders – receipts to ensure data is accurate before payment.

- Cost control: Track expenses, limit overspending and increase capital efficiency.

- Applying 3-way matching combined with automation software helps businesses reduce financial risks, optimize processes and ensure transparency in 3-party transactions.

It can be seen that technology optimizes the process and financial management in tripartite contracts by automating the process, enhancing coordination, improving transparency and providing accurate data analysis tools. The application of solutions helps create smart contracts, automate financial transactions, minimize errors and bring significant competitive advantages to the participating parties.

Conclude

Hopefully, through the above article by Bizzi, managers have a new perspective on the concept of what a 3-party contract is as well as classify the types of 3-party contracts.

Tripartite contracts should be used to clearly define the rights and obligations of the parties, increase transparency and accountability, minimize legal risks, and effectively support complex transactions such as home purchases, loans, or supply chains. The 3-party contract is a solid legal basis for the parties to check and monitor each other's financial activities, preventing fraud or misuse of capital.

Modern businesses need flexible and standardized financial management to avoid missing out on business opportunities and be ready to thrive, and solutions like Bizzi help achieve this by providing tools to support budgeting, cash flow control, in-depth cost analysis, and digitize processes to optimize resources and enhance financial stability.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/