Financial invoices are one of the most important documents in accounting and tax management activities of enterprises. Not only is it evidence of transactions of buying and selling goods and providing services, financial invoices are also the legal basis for tax declaration, cost accounting and cash flow control. However, with the diversity of types and forms of issuance, along with constant changes in legal regulations, many business owners and accountants encounter difficulties in the process of processing and storing invoices.

In this article, Bizzi will help you understand: What is a financial invoice?, there are what kind of bill, the common form of use today, and also suggests effective invoice management solution, in line with the digitalization trend in corporate accounting.

1. What is a financial invoice?

What is a financial invoice? is a common question for newly established businesses or those in the process of standardizing accounting and tax procedures. This is an important type of document in business activities, clearly regulated by law in terms of content, form and role.

Definition of financial invoice: A financial invoice is a document created by the seller to record information about the business activities. sell goods or provide services, in accordance with the provisions of Decree 123/2020/ND-CPThis invoice can exist in the form of a paper invoice (traditional) or an electronic invoice with a tax authority code.

Purpose and role of financial invoices: For businesses, financial invoices are not only transaction documents but also important legal basis:

- To be legal basis to declare, account and settle taxes.

- Help accountants record revenue, cost and prepare accurate financial reports.

- Is a mandatory document when a business present tax records, financial audit or inspection.

- Support internal control and transparency of business operations.

Required content on financial invoice

According to Decree 123/2020/ND-CP, a valid financial invoice must contain the following information:

- Billing information: Invoice name, symbol, model number, invoice number.

- Seller information: Company name, head office address, tax code.

- Buyer Information: Name, address, tax code (if any).

- Product/service information: Name of goods or services, unit, quantity, unit price, total amount (excluding VAT).

- Tax Information: VAT rate, VAT amount, total payment after tax.

- Signature and time information: Time of invoice creation, digital signature (if electronic invoice), seller/buyer signature (if any).

- Other information: Tax authority code (for electronic invoices with codes), discounts, promotions (if any), printing unit information (for printed invoices), payment currency, clear writing and numbers.

2. Common types of financial invoices

When researching What is a financial invoice?, businesses and accounting departments need to understand the types of invoices currently being used to ensure that they are created - stored - declared in accordance with legal regulations. Below are common types of financial invoices according to instructions from the Ministry of Finance and practical use in businesses:

- Value Added Tax Invoice (VAT Invoice): This is the most common type of financial invoice, applied to organizations and businesses that declare taxes using the deduction method. VAT invoices are used when selling goods, providing domestic services, international transportation, exporting or exporting to duty-free zones. In practice, this type of invoice is also called a "red invoice". The invoice form may vary depending on the type of transaction (for example: retail invoice, service invoice, etc.).

- Sales invoice (Sales Invoice): For organizations and individuals who declare taxes using the direct method or operate in a duty-free zone. This type of invoice is also applicable when selling goods and providing services to entities not subject to VAT using the deduction method. When making a sales invoice for a duty-free zone, it is necessary to clearly state: "For organizations and individuals in a duty-free zone" to ensure legality and transparency.

- Other types of financial invoices: In addition to the two main types above, businesses can use many other types of documents that are also considered financial invoices according to regulations, including:

- Receipt: Applied in cash collection activities at the counter or at the service point.

- Stamps, tickets, cards: Used in passenger transport or services with special fee collection forms.

- Air freight receipts, bank service fee receipts, international freight charges, etc.: Managed according to international practices and legal regulations.

- Electronic invoice for sale of public assets and National reserve sales electronic invoice: Applied in special transactions related to State assets.

- Documents are managed as invoices.: Include internal delivery note, warehouse receipt for goods sent to agents for sale – Although not an invoice, it has equivalent function and value in management.

Clearly distinguishing between types of financial invoices will help business accountants control cash flow, declare taxes accurately and avoid legal risks during operations.

3. Form of financial invoice

In the current digital transformation trend, The only form that is recommended and almost mandatory to use is Electronic invoice (Contract), completely replacing traditional printed invoices which are no longer suitable for legal regulations and practical use.

Electronic invoice (E-invoice)

This is a type of invoice that is created, issued, sent, received and stored entirely electronically according to the Law on Electronic Transactions and Decree 123/2020/ND-CP. Electronic invoices have the same legal value as paper invoices, but superior in convenience, transparency and integration with accounting software and ERP systems.

Businesses can choose from the following types of electronic invoices:

- Electronic invoices with tax authority codes: Applicable to most businesses, with authentication code from the General Department of Taxation.

- Invoice without code: For businesses that meet specific conditions, self-issue and are responsible for managing invoices.

- Electronic invoice from cash register: Applicable to some retail, food and beverage, consumer services sectors.

Important Note: Currently, the use of printed invoices (printed or self-printed invoices) is no longer accepted in most cases, except for some special exceptions approved by the tax authorities during the transition period. Therefore, businesses need to completely switch to electronic invoices to ensure legal compliance and avoid tax risks.

4. Regulations on invoice number symbols and legal invoices

Clearly understand What is a financial invoice? and regulations on denominator symbols will help businesses and accountants ensure legality and transparency in invoice issuance, avoiding risks of violating the law.

- Regulations on invoice number symbols:Each invoice has a unique denominator symbol, showing the invoice type, year of issue and serial number for easy control and classification. The symbol structure usually includes:

- The first character is C or K (indicates invoice type).

- This is followed by the last 2 characters of the billing year (e.g. 23 for 2023).

- Characters representing the type of invoice used such as: T (consumer bill), D (service), L (link), M (new model), B, G, H…

- The next character is a number from 1 to 7, indicating the invoice type group.

- Finally, there are 2 characters that are self-identified according to the regulations of the issuing unit. For example: The invoice number symbol can be “CT23T1AA”, which clearly shows the type and year of issue.

- What is a legal financial invoice? Legal financial invoices must fully comply with the provisions of law, especially according to Decree 123/2020/ND-CP On invoices and documents, including:

- The form and content of the invoice must be in accordance with standards and must not be modified or erased.

- Use non-fading ink to ensure the longevity of the invoice.

- The content on the invoices must be consistent and not contradictory.

- Complete required information such as name, address, tax code of seller and buyer, details of goods/services, amount, signature and seal (if any).

- Invoices are issued at the correct time of economic transactions.

- Concept of fake invoice: A counterfeit invoice is an invoice not issued by a competent authority or organization, or an invoice that is forged or altered for the purpose of profiteering or tax fraud. The use of counterfeit invoices is a violation of the law and will be severely punished.

Understanding the regulations on legal financial invoice symbols and standards will help businesses operate transparently, protect legitimate rights and avoid unnecessary legal risks.

5. Some frequently asked questions about financial invoices

When researching What is a financial invoice?, many businesses and accountants still have difficulty distinguishing between types of invoices, How to issue electronic invoice regulations or handling in real situations. Below are answers to frequently asked questions to help you understand and apply more effectively in invoice management:

5.1 How to issue electronic invoices?

- To issue electronic invoices, businesses need to use software approved by the General Department of Taxation. The basic process includes:

- Log in to the electronic invoice software system;

- Create new invoice, enter buyer and goods/services information;

- Digital signature;

- Send invoices via email or share a lookup link with buyers;

- At the same time, the software will connect and send data to the Tax Authority to issue a code (if it is in the form of a code).

5.2 Can electronic invoices be issued to retail customers?

Yes. When an individual customer does not request an invoice or does not provide sufficient information, the accountant still needs to issue an invoice and clearly state: “The buyer did not take the invoice” or “Buyer did not provide name, address, tax identification number” in the buyer information section. This helps ensure regulatory compliance and makes it easier to control sales data.

5.3 Is the red invoice a value added invoice?

Yes. “Red invoice” was the previous popular name for VAT invoice printed directly on paper with a distinctive red color. Currently, when switching to electronic invoices, this term is still used informally to refer to VAT invoice.

5.4 What is a financial invoice in English?

Depending on the context, some English terms corresponding to financial invoice include:

- Invoice: General invoice (usually used for all types of transactions)

- Financial Invoice: Emphasizes the accounting/financial role of invoices

- Tax Invoice: Invoice with tax deductible value (usually corresponding to VAT invoice in Vietnam)

- Receipt: Receipt, payment document (different from invoice but often confused)

6. Manage financial invoices effectively with software solutions

What is a financial invoice? It is not only a question of definition, but also a question of how to manage it properly, effectively and economically. With the development of technology and the increasing demand for financial transparency, manual management of financial invoices has become outdated and prone to risks for businesses.

- The reality of manual management: Accountants must manually enter data, store documents, and manually compare and check documents. This process is not only time-consuming but also prone to errors, loss, or lack of legality if stored improperly.

- Benefits of using financial management - accounting software: Modern solutions help businesses automate processes, minimize manual errors, ensure information security and comply with accounting and tax standards. From there, accountants can track cash flow and spending more effectively, while optimizing operating time and costs.

6.1 Comprehensive solution from Bizzi in financial invoice management

As an AI assistant for the finance and accounting department, Bizzi provide comprehensive cost control systems, with special emphasis on operations related to financial invoice management:

- Purchase invoice processing (IPA + 3-way match): Automatic identification, checking and reconciliation input invoices with purchase orders (PO) and goods receipts (GR). The system verifies supplier information, detects risks, alerts against irregular invoices, stores valid data for 10 years, and integrates easily with accounting and ERP software.

- Create and manage sales invoices (B-Invoice): Allows creating standard electronic invoices, customizing templates, mass issuance, and authentication with tax authorities. Businesses can easily look up, download/print, track invoice status, and synchronize directly with the ERP - Accounting system.

- Bizzi Travel & Expense: Automate the entire process of processing internal expense invoices and business expenses, from submitting documents to approving and storing. The system has the ability to authenticate accompanying electronic invoices, helping accountants easily control the budget and validity of each expense.

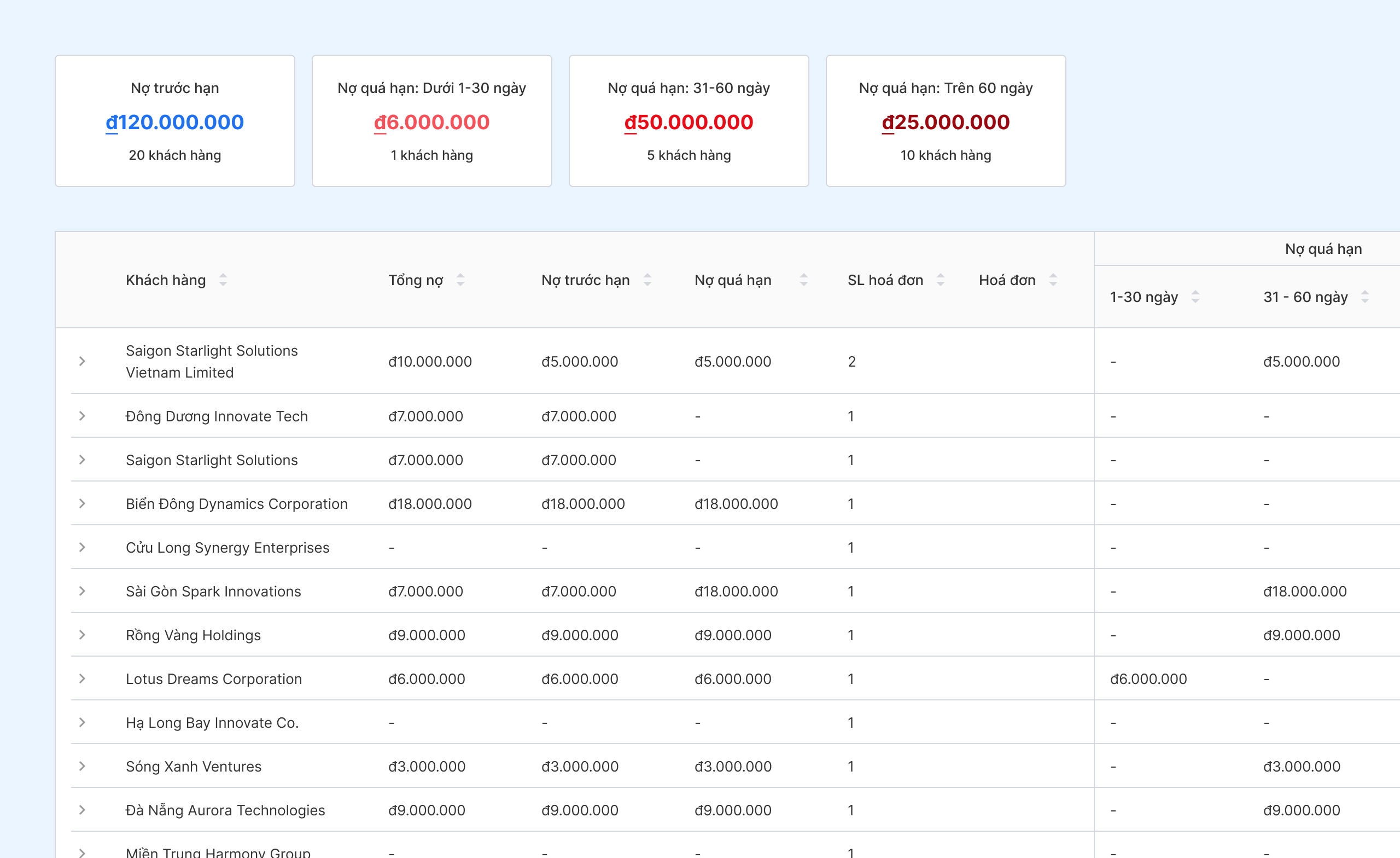

- Accounts Receivable Management (ARM): Track, classify, and reconcile supplier and customer debts. Automatically remind debtors, warn of invoices that are about to be due for payment or collection. Bizzi uses data from financial invoices to update debt status in real time.

6.2 Process Optimization – Legal Compliance – Increased Efficiency

Understanding What is a financial invoice? Now it's not just about the definition, but the story of Automate and standardize financial processes in your businessWith Bizzi, businesses can:

- Automate the entire purchase and sales invoice processing process

- Ensure compliance with legal regulations and accounting and tax standards

- Minimize errors due to manual operations

- Improve the performance of the accounting and finance department

Sign up for a trial today to get advice on solutions suitable for your business's financial and accounting operating model.

Conclude

Understanding and effectively managing financial invoices is a key factor in helping businesses operate transparently, comply with the law and optimize costs. From distinguishing the right type of invoice, choosing the right form to applying modern management tools - each step contributes to minimizing the risk of errors, losses and penalties during the tax declaration process.

In the context of digital transformation being an inevitable trend, using smart e-invoice solutions like Bizzi not only helps businesses save time and increase efficiency but also ensures legality, security and easy integration with existing accounting systems.

Let Bizzi accompany you in managing financial bills – faster, more accurate and safer every day.