Bills – especially Electronic invoice – plays a core role in the financial, accounting and legal activities of the enterprise. However, in the process of invoicing, sometimes businesses will encounter unavoidable errors, so the replacement invoice is the solution to overcome.

This article by Bizzi will provide detailed information about what a replacement invoice is, analyze the cases when a replacement invoice is issued, and how to issue a replacement invoice in accordance with the law.

What is a replacement invoice?

According to Decree 123/2020/ND-CP, a replacement invoice is an invoice issued to replace a previously issued invoice that has incorrect content or is lost.

Role of replacement invoice: Ensure the accuracy and legality of accounting documents, serve tax management.

- Buyer information (name, tax code)

- Item, unit price, tax rate

- Amount, invoice date, symbol.

According to Article 19, Decree 123/2020/ND-CP, if an electronic invoice has been sent to the buyer and the tax authority but an error is detected, then:

- The seller issues a replacement invoice for return shipping.

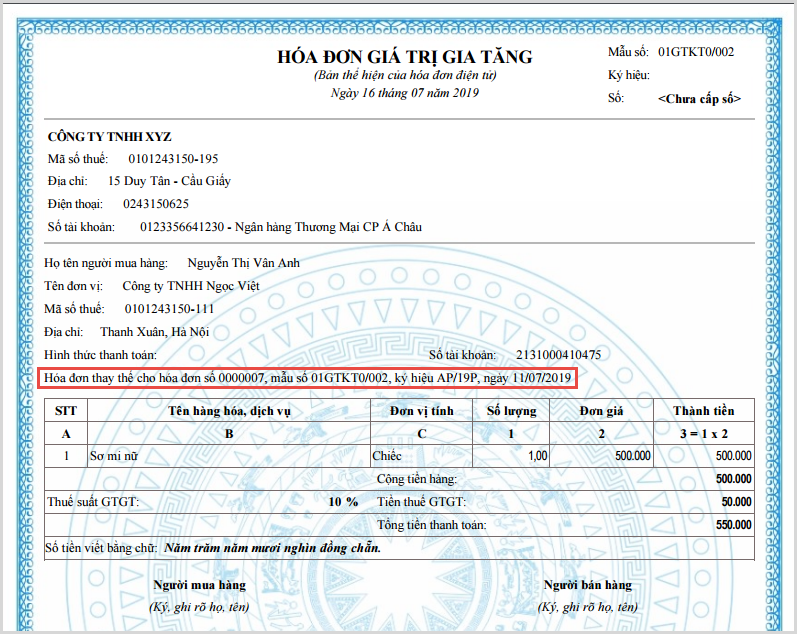

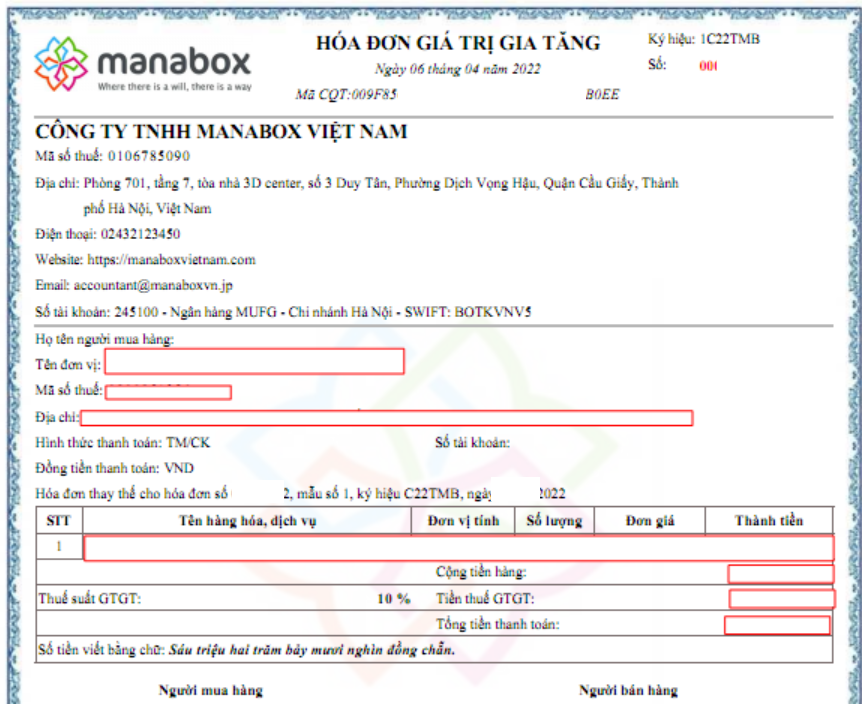

- The replacement invoice must have a clear note: “Replacing invoice number… symbol… date…”.

In addition to the concept of what a replacement invoice is, accountants also need to clearly understand the nature of the difference between a replacement invoice and a Adjustment invoice:

- Adjustment invoice is used when only part of the information (value, tax, quantity...) is adjusted.

- Replacement invoices are used when the invoice is completely incorrect or at the request of the buyer.

The example below will help you better understand what a replacement invoice is – as opposed to an adjustment invoice:

Enterprise A issues invoice No. 000123, code AA/24E to customer B. After sending it, the buyer's tax code is found to be incorrect. Enterprise A issues a replacement invoice, stating: "Replace invoice No. 000123, code AA/24E, dated April 15, 2024".

Cases requiring replacement invoices according to Decree 70/2025/ND-CP

According to Decree 70/2025/ND-CP (effective from June 1, 2025), replacement invoices are applied in the following cases:

| Period before June 1, 2025

(Applied according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC) |

|

| Period from 01/06/2025 onwards

(Applied according to Clause 13, Article 1 of Decree 70/2025/ND-CP amending Decree 123/2020/ND-CP) |

In case of detecting an incorrect electronic invoice (with or without a code, data has been sent to the tax authority):

|

Procedure for creating a replacement invoice when the electronic invoice has errors

Compliance with regulations on replacement invoices helps businesses ensure legality, avoid tax risks and enhance reputation in commercial transactions. Below is the procedure for creating replacement invoices when electronic invoices have errors, updated according to the latest Decree 123/2020/ND-CP and Decree 70/2025/ND-CP (effective from June 1, 2025):

General process:

- Step 1: Identify errors on the original invoice.

- Step 2: Agree with the buyer on the handling (if necessary and depending on the regulations of each stage). From June 1, 2025, it is mandatory to have a written agreement with the buyer who is an enterprise/economic organization, business household/individual. If the buyer is an individual, please notify.

- Step 3: The seller creates a new electronic invoice to replace the erroneous invoice via the electronic invoice software.

- Step 4: Sign and send replacement invoice:

-

- Invoice with code from the tax authority: Send to the tax authority to issue the code, then send to the buyer.

- Invoice without code of the tax authority: Sent directly to the buyer (after sending data to the tax authority according to regulations).

- Step 5: Store the original (replaced) invoice and the replacement invoice.

Do I need to send Form 04/SS-HĐĐT for replacement invoices?

Form 04/SS-HĐĐT is a form used to notify the Tax Authority about an issued electronic invoice that contains errors and cannot or does not need to be replaced.

- Full name: Notice of error in electronic invoice

- Denominator: 04/SS-HDDT (according to Appendix IA - Decree 123 and 70/2025/ND-CP)

Case Not Send Form 04/SS-HĐĐT when making a replacement invoice: When handling errors (wrong tax code, amount, tax rate, goods...) on electronic invoices with or without codes sent to buyers and sellers, choose to create a replacement invoice.

Case Right Send Form 04/SS-HĐĐT:

- When the electronic invoice has errors in the buyer's name and address but not in the tax code (applicable from June 1, 2025). (Before June 1, 2025, it also applies if the invoice has been sent to the buyer).

- When replacing invoices issued under old regulations (Decree 51/2010, Decree 04/2014, Circular 32/2011) with errors, use electronic invoices according to Circular 78, Decree 123.

When to issue replacement invoice?

According to Decree 123/2020/ND-CP and Decree 70/2025/ND-CP, enterprises need to issue replacement invoices in cases where they have issued and sent electronic invoices to buyers but discover errors in the contents affecting the payment value or important contents, such as:

- Name of goods, unit, quantity, unit price, total amount;

- Tax rate, tax amount, total payment;

- Invoice date;

- Buyer's tax code (if incorrect);

This error results in having to replace all old content with new content.

In case no replacement invoice is required: Incorrect name, address of buyer but correct tax code → does not affect tax declaration, only need to notify adjustment form 04/SS-HĐĐT (no need to create new invoice).

Instructions on how to issue a replacement invoice

Below are 05 steps to issue replacement invoices that businesses can apply:

Step 1: Check and confirm errors

- Determine where the original invoice is wrong, and whether a replacement invoice is required.

- Check invoice code, symbol, issue date, incorrect content.

Step 2: Negotiate with the buyer

- The two parties agreed on a solution to handle the error with a replacement invoice.

- Save the confirmation content between the two parties (if any).

Step 3: Create a replacement invoice on the software

- On the software interface, select “Create alternative invoice”

- Enter new content completely and accurately.

- Note clearly: “This invoice replaces invoice number …, symbol …, date …”

- Export invoices in XML and PDF formats.

Step 4: Sign and issue

- Sign the replacement invoice like a normal invoice.

- Send back to buyer and store internally.

Step 5: Store and update accounting system

- Link the original invoice and the replacement invoice in the system.

- Make sure not to declare duplicate or missing values.

Important notes when processing Replacement Invoices

Below are important notes when processing Replacement Invoices, to ensure businesses comply with legal regulations and avoid tax and accounting risks:

- Carefully check the contents of the replacement invoice before issuing.

- Make sure to write the correct line “In lieu of invoice…”.

- Keep the original (replaced) invoice and the replacement invoice, along with any relevant documentation such as the agreement (if any). The original invoice is not destroyed but is kept together with the replacement invoice.

- Update replacement invoice information into accounting system and report taxes promptly.

- Promptly notify the buyer of the replacement invoice and send a new invoice.

- If the replacement invoice continues to have errors, handle it in the same way as the first time (i.e. continue to issue a replacement invoice).

- Clearly distinguish between replacement invoices and adjustment invoices, use them in the right cases.

- Comply with the deadline for creating and sending replacement invoices (usually within 10 days of discovering errors, before inspection by the tax authority).

- Beware of common mistakes: wrong deadlines, missing information, insufficient conditions, not updating systems, incorrect storage, not notifying customers.

What is the application of technology in alternative invoice management?

Applying technology in alternative invoice management – especially through platforms such as B-Invoice, Misa, VNPT… – brings many practical benefits to businesses.

- Accurate & Legal: Reduce legal risks and errors in operations

- Automate processing: Save time, increase efficiency for the accounting department

- Transparent storage: Convenient for tracing and inspection

- Make Better Financial Decisions: Understand Costs, Cash Flow, Performance

- Flexible Integration: Meeting the needs of modern digital businesses

Among the current software, Bizzi is one of the comprehensive solutions, providing tools to automate all financial management needs of the business; from electronic invoices to cost control.

Bizzi B-Invoice – Create & Manage e-invoices: Cover the entire e-invoice lifecycle in a transparent and secure manner

- Issue electronic invoices in accordance with tax authority regulations (Decree 123/2020/ND-CP, Circular 78/2021/TT-BTC).

- Support for alternative and adjusted invoices with full XML and PDF formats.

- Track invoice status: issued, canceled, adjusted.

- Store valid invoices for at least 10 years as required by law.

Bizzi IPA + 3Way – Processing & managing input invoices: Helps ensure input invoices are processed correctly, minimizing the risk of errors and loss.

For business buyers, Bizzi offers:

- Automatically receive and reconcile input invoices, including replacement invoices from suppliers.

- Check the validity of suppliers and invoices on the General Department of Taxation system.

- Store, manage, and classify input invoices by time, status, and cost type.

Comprehensive cost control integrated platform

Bizzi doesn't stop at invoices, it also:

- Manage business expenses in real time.

- Transparent management of business expenses, advances and refunds.

- Control accounts receivable and budgets tied to invoice data.

Conclude

Understanding what a replacement invoice is and the types of invoices in general is the backbone of every economic transaction, directly affecting revenue, taxes, costs and business reputation. It is necessary to determine the importance of clearly understanding and correctly preparing a replacement invoice to comply with the law and ensure accuracy in accounting. At the same time, apply the electronic invoice management software Like Bizzi is the smart choice in optimizing invoice processing, minimizing errors and risks.

To improve the efficiency of invoice management as well as automate the financial and accounting processes of the business. Register to experience Bizzi's comprehensive solution suite today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/