Advances and reimbursements are two common transactions in most businesses, but they are also the source of many risks related to costs, financial reporting, and working capital losses if not properly controlled. In reality, many businesses still view these as purely accounting transactions, to be processed later. costs incurredMeanwhile, from the CFO's perspective, advances and reimbursements are a cycle. managing cash flow in a businesscompliance and operational performance.

Understanding the true nature of advances and reimbursements helps businesses not only reduce risks but also improve forecasting and utilize capital more efficiently.

What is an advance payment in business, and why is an advance payment considered an asset?

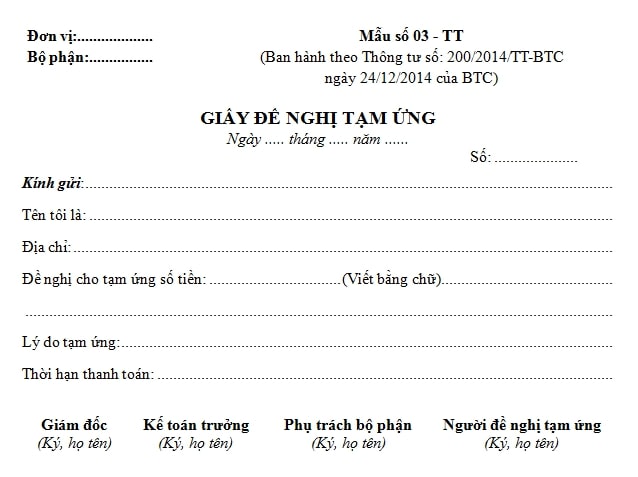

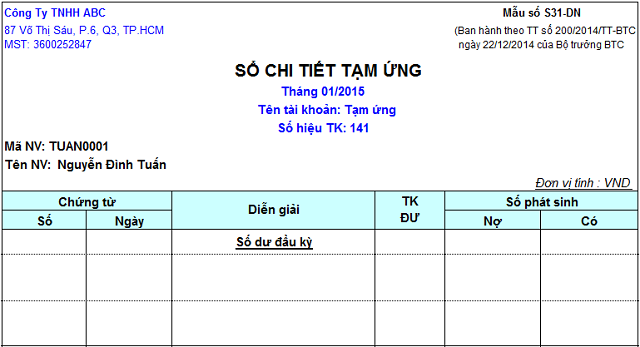

An advance payment is a sum of money that a business pays in advance to an employee or department to perform approved work. In accounting terms, it is essentially a short-term asset because the business still has the right to recover it or request settlement. The core problem with advances lies in this: the money has already left the fund, but... Not yet eligible to be recognized as an expense.This amount is merely an "advance" for a specific purpose, and can only be converted into an expense when there is actual spending with valid documentation. Therefore, in the accounting system, advances are tracked as follows: advance view and are categorized into the group Current assets.

From a financial management perspective, advances are directly related to working capitalEach outstanding advance payment means a portion of working capital is locked up, unavailable for other needs. If the advance payment period is prolonged, the efficiency of capital utilization decreases, and it also affects liquidity indicators such as the quick ratio.

Therefore, the role of approval workflow And the purpose of the expenditure is a crucial factor. When the purpose of an advance payment is unclear or the approval is merely a formality, the business is shifting control risk from the “pre-expenditure” stage to the “post-expenditure” stage – where recovery and handling of discrepancies become much more difficult. An advance payment, after all, is a commitment of responsibility.opposition) and not simply an act of spending money.

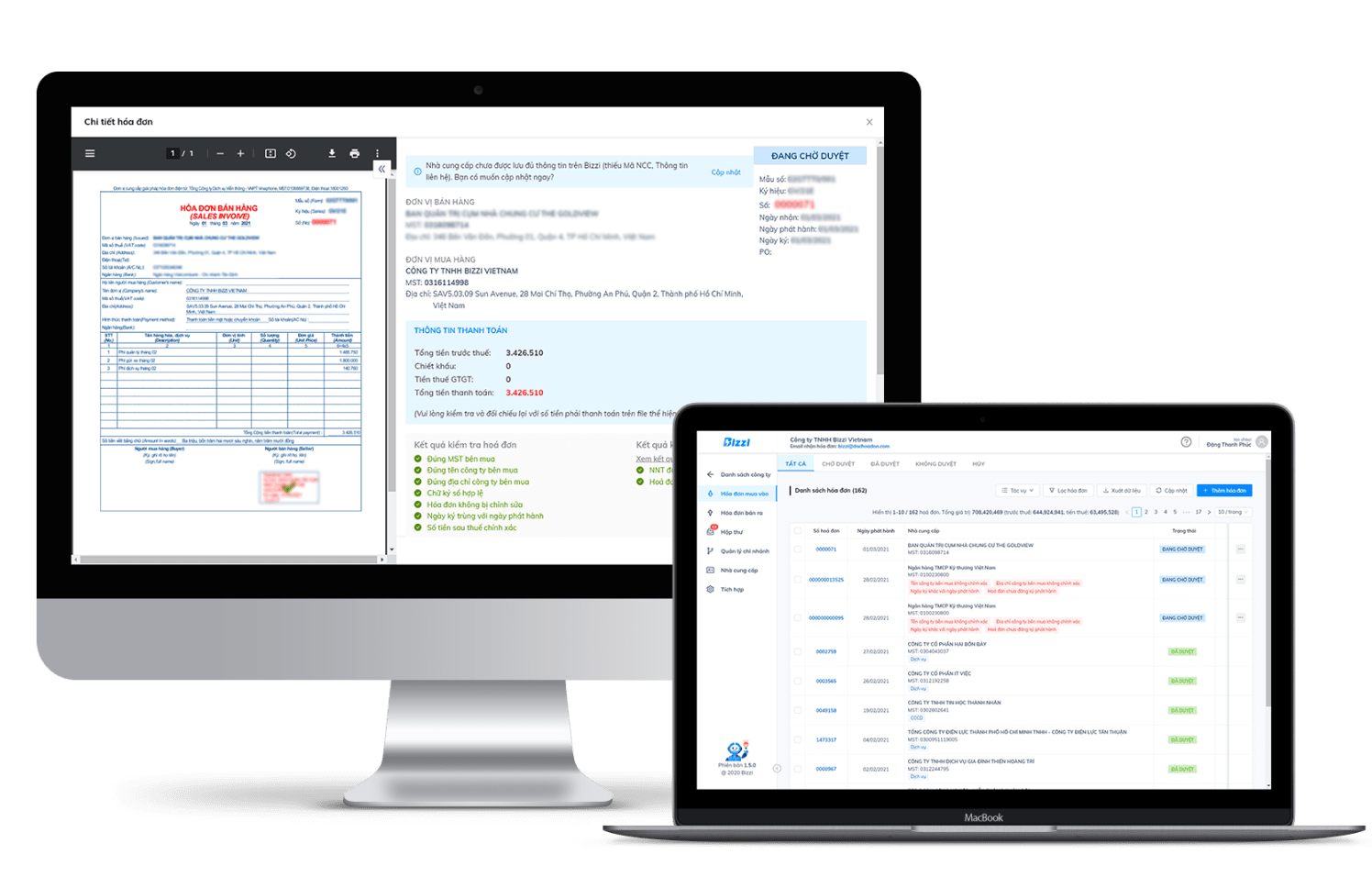

In practice, many CFOs choose to require employees to create advance payment requests directly on the Bizzi Expense system, mandating the purpose and budget to be declared. The system automatically verifies departmental limits before approval and allows CFOs to track real-time aging of outstanding advance payments, instead of waiting for end-of-period reports.

Instead of letting advances become a "pay first, control later" practice, Bizzi takes a fundamental approach: Standardize data and payment conditions at the time of request.When an employee creates an advance payment request on Bizzi Expense, the system requires them to clearly state the purpose of the expenditure, the project or department involved, and the projected budget. This transforms the advance payment from an "open" payment into a conditional commitment.

After disbursement, the entire advance payment is tracked. real-time agingThe CFO can see this immediately:

- Total amount of outstanding advances

- Which payments are overdue according to the policy?

- Which department or individual has a high rate of outstanding advances?

As a result, advances are managed in the right way, which is Current assetsInstead of being "hidden" in separate tracking sheets, advances are considered assets. The next question is: when are these assets "closed" and transferred to become legitimate expenses?

What is reimbursement and how is an advance payment settled?

Reimbursement is the process of settling an advance payment using actual expenditure documents, aiming to offset any excess funds or request additional payment when there is a shortfall, thereby ending the advance payment cycle.

Contrary to popular understanding, reimbursement is not simply "paying the bill." It's a crucial settlement and clearing step: whether the expense is recognized or disallowed from the financial statements. The outcome of a reimbursement can only fall into two categories: the employee returns the excess money to the company, or the company makes additional payments if actual expenses exceed the amount advanced.

The key lies in receipt validation. Only when the documentation is legally valid and consistent with the approved purpose will the expenditure be recognized as an actual expense in the correct accounting period (cut-off). Otherwise, the expenditure may be suspended, disallowed, or reclassified as an internal receivable.In the automation model, employees upload documents to Bizzi, and the Bizzi Bot OCR checks basic criteria such as tax identification number, invoice date, and expenditure details. More importantly, Bizzi automates the process. clearing between actual costs and the advance payment granted. The system clarifies three states:

- The expenditure is valid and recorded.

- The amount the employee needs to refund.

- Additional expenses required by the business (if the advance payment is exceeded).

As a result, reimbursement is not just an administrative procedure but has become a crucial decision-making step. actual expense Whether it will be accepted or not.

When considering advances and reimbursements side-by-side, the difference between these two concepts becomes very clear.

Comparing advances and reimbursements according to financial management criteria.

Advances and reimbursements differ in timing, purpose, input data, and control risks. Advances involve providing funds upfront, while reimbursements determine whether an expense is legitimately recognized.

| Criteria | Advance | Refund |

| Time | Before spending | After spending |

| Nature | Asset | Settlement |

| Main risks | Capital suspension | Expenses that have been excluded |

| Management KPIs | Aging | miracle rate |

From a financial control perspective, advances directly impact the risk exposure of cash flow, while reimbursements reflect the level of compliance with tax policies and regulations. Tracking these two transactions separately makes it difficult for CFOs to assess cycle time and overall control effectiveness.

Bizzi helps CFOs simultaneously monitor the amount of open advances and the on-time repayment rate on a single dashboard, while also alerting them to SLAs before they become a real risk. On one screen, CFOs can monitor:

- The number and value of outstanding advances

- On-time reimbursement rate by department

- Cycle time from the time of advance payment to the time of final settlement.

Alerts are set up according to SLAs, helping to detect early advances that are at risk of becoming risky. suspended capital or violation of complianceInstead of waiting until the financial statements are affected.

However, for effective control, CFOs need to view advances and reimbursements as a complete process, not two separate operations.

What are the steps involved in the standard internal control process for advances and reimbursements?

A standard advance payment and reimbursement process should include request, approval, disbursement, monitoring, reimbursement, reconciliation, and final settlement, ensuring both speed and risk control.

The difference between a "controlled" and a "formal" process lies in the segregation of duties (SoD), the audit trail, and the ability to handle exceptions. In practice, bottlenecks often lie not in the disbursement of funds but in the approval and reconciliation of documents – where manual processes are prone to delays and errors.

With Bizzi, businesses can standardize approval flows by level, automatically set reimbursement deadlines, and log comprehensive information for internal audits.

Instead of viewing advances and reimbursements as two separate transactions, Bizzi designed a dashboard for CFOs in a way that... entire lifecycle costOn the same screen, the CFO can monitor:

- The number and value of outstanding advances

- On-time reimbursement rate by department

- Cycle time from the time of advance payment to the time of final settlement.

Alerts are set up according to SLAs, helping to detect early advances that are at risk of becoming risky. suspended capital or violation of complianceInstead of waiting until the financial statements are affected.

Standard procedures are fundamental, but without a financial perspective, CFOs can still lose money without realizing it.

What are advances and how do they affect working capital and cash flow for a business?

Long-term outstanding advances slow down working capital turnover, reduce short-term solvency, and make it difficult for CFOs to accurately forecast cash flow.

Two often overlooked metrics are Outstanding Advances (total advances minus total repaid advances) and advance turnover. When these are not tracked in real-time, cash flow forecasts and working capital cycles become less accurate.

In the integrated model, Bizzi provides real-time advance payment data, while SACTONA incorporates this data into the Plan–Actual–Variance report, helping CFOs improve the reliability of cash flow forecasts. Advance and reimbursement data on Bizzi is updated in real time, giving CFOs a clear view. Outstanding Advances and advance payment turnover – two indicators often overlooked in cash flow forecasting. When integrated with SACTONA, this data is fed directly into the Plan–Actual–Variance report, helping CFOs:

- More accurate cash flow forecasts.

- Identify unnecessary locked-up funds early.

- Improve governance working capital cycle

Advance payments are no longer just "temporary expenses," but have become a measurable and optimizeable variable.

Besides cash flow, reimbursements are also directly related to tax risks.

What is a reimbursement and how does it relate to tax compliance and the risk of expense disallowance?

Incomplete or incorrect documentation for reimbursements can lead to expenses being disallowed during corporate income tax settlement, increasing the risk of back taxes and penalties.

Common errors include invalid invoices, incorrect information, or invoices that do not conform to the approved purpose. These errors directly impact tax compliance and the deductible expense of the business. Bizzi Bot helps check invoice status and warn of risks before accounting, instead of waiting until a tax audit. With Bizzi Bot checking invoice validity right from the reimbursement stage, businesses significantly reduce the risk of recording ineligible expenses. CFOs and accountants no longer have to react passively during tax audits, but can proactively eliminate risks before accounting.

This helps to raise the level. tax complianceThis also reduces the risk of back taxes and penalties due to documentation errors. To thoroughly address these risks, many businesses are shifting to automation and real-time data.

How can we shorten the advance payment/reimbursement cycle to under 24 hours?

The advance payment-reimbursement cycle can only be shortened to under 24 hours when the business... Eliminate paper approvals., Automated document reconciliation and Implement mobile approvals according to a clear policy.If we still rely on handwritten signatures, fragmented emails, and manual verification, processing times will almost certainly be extended from 3–7 days, or even longer during peak periods.

In fact, the "bottleneck" doesn't lie in the accounting staff, but in... The process lacks digitalization and standardized control.To shorten the cycle time to under 24 hours, businesses need to address three layers of problems simultaneously:

- First, approvals must take place in real time.

Managers can't wait to return to the office to sign off on approvals, and accountants can't wait for emails to arrive. Approvals need to be mobile-centric, instantly notified, and adhere strictly to established limits and policies. - Secondly, documents should be processed automatically instead of being checked manually.

Manually reconciling invoices, verifying expenditure information, and detecting discrepancies will always be the slowest step in the reimbursement process. When documents are digitized and processed automatically from the start, verification time can be shortened from several hours to just a few minutes. - Third, CFOs need to monitor SLAs in real time, not wait for end-of-period reports.

Without a dashboard to measure processing time at each step, businesses won't know where the cycle is slowing down and who is responsible. Transparent SLAs are essential for controlling and improving reimbursement speed.

Bizzi is designed to directly address these three layers of problems, helping businesses shorten their advance payment-reimbursement cycle. within 24 hours in a practical and sustainable way.:

-

Expense Mobile Approval: The entire advance payment and reimbursement approval process is conducted on mobile, strictly adhering to the configured limits and policies. Approval management is available anytime, anywhere, eliminating the need for signatures or email forwarding.

-

Document processing bot: Invoices and supporting documents are automatically read, compared, and checked for validity as soon as employees submit them. The bot helps reduce the workload for accountants, minimize errors, and eliminate lengthy manual verification processes.

-

SLA Dashboard for CFOs: The CFO monitors the real-time processing time of each step in the advance payment-reimbursement cycle, immediately identifying bottlenecks and ensuring that the commitment to reimburse within 24 hours is fulfilled as required.

With mobile approvals, automated document processing, and transparent SLAs, shortening the advance payment-reimbursement cycle is no longer an ideal goal, but becomes a reality. new financial operating standards Bizzi helps businesses implement this consistently.

What metrics are used to measure the ROI when automating advance payments and reimbursements?

When comparing advances and reimbursements, ROI is also a concept worth considering. The ROI of automated advances and reimbursements is not only measured by reducing operating costs, but also by its ability to shorten processing cycles, reduce tied-up capital, improve compliance, and enhance the quality of financial data for CFOs.

First and foremost, the most obvious indicator is cycle time – the time from when an employee requests an advance until that amount is reimbursed and settled. When the process is manual, cycle time often lasts for days, even weeks, tying up working capital and creating risk. Automation shortens this cycle to a few hours or even a day, directly improving capital turnover.

The second indicator is personnel costs (FTE) is dedicated to business process handling. In a manual model, accountants and finance professionals spend a significant amount of time on data entry, document reconciliation, reimbursement deadline reminders, and error handling. With automation, most of these tasks are handled by the system, helping businesses reduce labor hours on non-value-adding tasks and reallocate resources to financial analysis.

Another important indicator is the error rate and compliance level. ROI is not just about cost savings, but also about reducing the risk of expenses being disallowed during tax settlements or errors being discovered during audits. When the system checks documents from the outset, the error rate drops significantly, meaning businesses avoid hidden costs related to back taxes, penalties, and retroactive adjustments.

From a CFO's perspective, the greatest value of ROI comes from reducing capital tied up in advances. When advances are tracked in real-time and repaid on time, Outstanding Advances decrease, improving working capital and the accuracy of cash flow forecasts. This is a direct financial benefit that is often overlooked when viewing ROI solely in terms of operating cost savings.

Ultimately, ROI is also reflected in data quality and decision-making capabilities. An automated system provides consistent spending data, has an audit trail, and can be analyzed in real time. This helps CFOs shift from a "business process" role to a "data-driven financial management" role, a value difficult to measure in monetary terms but with long-term impact on business performance.

What are frequently asked questions about advances and reimbursements?

Below is a summary of answers to some questions regarding the two concepts of advance payment and reimbursement.

Is an advance payment an asset or an expense?

Advances are short-term assets, not expenses, as businesses still have the right to recover them or request settlement. These funds are only recognized as expenses when actual spending is supported by valid documentation. Confusing advances with expenses will lead to inaccurate financial reporting regarding the efficient use of capital.

What is an advance payment and why does it determine whether an expense is recognized?

Reimbursement is the process of settling an advance payment using actual expenditure documents to determine the amount to be reimbursed or reimbursed. This step determines whether the expense is eligible for accounting and tax recognition. If the reimbursement is incorrect or lacks supporting documents, the expense may be disallowed even if the money has already been spent.

Can salary advances be processed using account 141?

No. Salary advances are essentially payments due to employees and are accounted for in account 334, not account 141. Incorrect accounting could distort the asset and liability structure on the financial statements.

How long do I have to repay the loan to avoid violating internal regulations?

The repayment period depends on each company's policy, usually ranging from 7 to 30 days from the date of disbursement. Without clear regulations or proper tracking of aging, advances can easily become outstanding for extended periods. This reduces control effectiveness and increases working capital risk.

What should I do if I lose the receipt when getting a refund?

In most cases, expenses without valid invoices will not be recognized as deductible expenses when calculating taxes. Businesses may request explanations, create a record, or hold the individual responsible for the expense depending on their internal regulations. This is why CFOs need to control documentation from the reimbursement stage, not waiting until tax settlement.

How do long-term outstanding advances affect financial statements?

Long-term advances inflate short-term assets without generating real value, locking up working capital. This impacts short-term solvency and distorts cash flow forecasts. For CFOs, this is a sign that spending processes are out of control.

Should I use my company card instead of an advance payment?

Company cards can reduce the need for cash advances, but this is only effective when accompanied by a clear policy and a spending control system. Without proper control, the risk of exceeding limits and misuse of funds remains. Many businesses integrate company cards with systems like Bizzi to track expenses in real-time.

What KPIs should a CFO use to track advances?

Key KPIs include advances aging, on-time repayment rate, and outstanding advances. These metrics directly reflect compliance levels and capital efficiency. Monitoring KPIs in real time helps CFOs detect risks early rather than dealing with the consequences.

Does the reimbursement affect corporate income tax?

Yes. Only reimbursements with valid documentation and consistent with business purposes are considered deductible expenses when settling corporate income tax. Incorrect or incomplete reimbursements may result in the expense being disallowed, leading to the risk of tax arrears and penalties.

How are advances and reimbursements related to internal auditing?

Advances and reimbursements are among the areas of greatest concern for both internal and independent auditors due to the high risk of fraud and errors. Without an audit trail and clear delegation of authority, businesses find it very difficult to prove the validity of these expenditures. Therefore, digitizing the process significantly reduces audit risk.

Conclude

Understanding what advances and reimbursements are helps businesses move beyond a purely accounting approach and view them as a complete financial management cycle. Advances are not expenses, but short-term assets linked to the responsibility of using capital. Reimbursement is not simply about paying the invoice, but is a crucial step in determining whether an expense is legitimately recognized, directly impacting tax compliance and the reliability of financial reporting.

When comparing advances and reimbursements, it's clear that these two transactions differ in timing, nature, and risk, yet they are closely intertwined within the same expenditure lifecycle. Disjointed management of each stage can easily lead to capital stagnation, cash flow discrepancies, and audit risks. Conversely, approaching advances and reimbursements as a unified process allows CFOs to better control working capital, shorten cycle time, and improve internal compliance.

In this context, platforms like Bizzi serve as infrastructure to help businesses transition from manual control to data-driven and automated cost management. Bizzi not only supports the standardization of advance requests, approvals, and real-time aging tracking, but also assists in document verification, reimbursement offsetting, and providing a full audit trail for auditing and tax purposes. More importantly, data from Bizzi helps CFOs clearly see tied-up capital, improve cash flow forecasting, and make more accurate financial decisions.

In summary, when businesses understand the true nature of advances and reimbursements, and apply appropriate tools to control the entire process, costs are not only accurately recorded but also effectively managed. This is the foundation for CFOs to protect working capital, reduce risk, and improve long-term financial performance.

To receive personalized solutions tailored specifically to your business, register here: https://bizzi.vn/dang-ky-dung-thu/