An effective control framework needs to be: Identify the right risks – Focus on the right priorities – Be data-driven – Be digitized. Then, internal control will no longer be a "barrier," but a system that helps CFOs see clearly, make quick decisions, and effectively control the business.

When a company's internal control framework is well-functioning (especially when digitized by technology), the CFO can shift their role from "data auditor" to "strategic decision-maker" for the business.

What is an internal control framework and what is its true role for the CFO?

A corporate internal control framework is not just a set of rules or procedures to "get things right," but a system that helps CFOs control risks, protect cash flow, and ensure the business operates according to strategy in its daily operations.

What is COSO? What is an internal control framework for businesses?

An Internal Control Framework is a collection of principles, policies, procedures, and tools designed to:

- Ensure business operations are running according to objectives.

- Financial, operational, and compliance risk prevention and detection.

- Ensuring the accuracy and transparency of data.

- Protecting the company's assets and cash flow.

In short, this is How businesses protect themselves from within.Instead of just "putting out fires" when problems occur.

What is COSO? COSO (Committee Of Sponsoring Organizations of the Treadway Commission) It is an international standard framework for internal control, enterprise risk management (ERM), and fraud prevention.Founded by five major professional organizations in the United States, COSO helps businesses build effective governance systems, ensuring they achieve operational goals, produce reliable financial reports, and comply with the law. In addition, COSO provides guidelines and models (such as the COSO Cube) to help organizations design, implement, and evaluate their internal control and risk management systems.

The true role of the internal control framework for the CFO.

For the CFO, this is not a procedural burden, but a foundation for controlling risk, protecting cash flow, and elevating the role of finance from recognition to strategic operation. When properly designed and implemented with the right technology, an internal control framework becomes a sustainable competitive advantage, rather than just a compliance requirement.

Help CFOs control risks before money leaves the business.

The CFO cannot gain control by simply reviewing paid invoices. An internal control framework helps. Set a payment blocking point.:

- Authorization for approval

- Check the documents.

- Budget reconciliation

As a result, CFOs reduce the risk of losses and errors right from the start.

Protecting the CFO during inspections and audits.

A CFO is responsible not only for the results, but also for how the business achieves those results.

A clear internal control framework helps CFOs:

- Prove that the decision is well-founded.

- Full contact tracing process

- Providing logical explanations during tax inspections and audits.

This is a crucial "shield" for CFOs: transforming financial data into operational data.

Without internal controls, financial data often:

- Arriving late

- Lack of context

- Difficult to compare

An internal control framework helps standardize data right from the moment it is generated, enabling CFOs to:

- Track expenses by department and project.

- Evaluation of capital efficiency

- Make decisions faster and more accurately

Help CFOs transition from "error detector" to "strategic operator".

When internal controls are lacking, the CFO is drawn into:

- Check the invoice.

- Correcting documents

- Error handling

A good control framework helps the CFO:

- Rule design

- Set thresholds

- Track the signal.

The CFO doesn't do the work for someone else, but... system control.

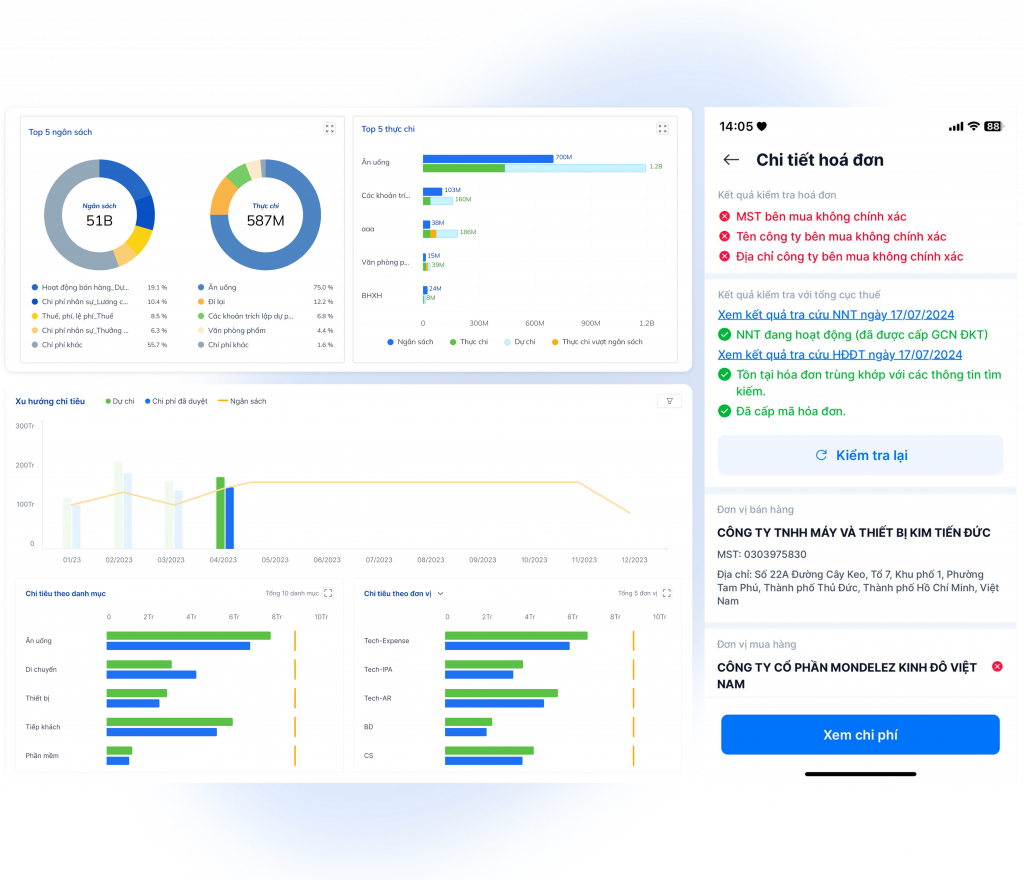

Bizzi is not just a tool, but a data platform that helps CFOs transform internal control. From "rules on paper" to "living control based on data." Below is a complete guide on how to apply Bizzi to build an internal operational control framework, adhering to the CFO logic – data – control – continuous improvement.

- Step 1: Identify critical control points

The CFO identifies the points of direct impact. expenses – invoices – accounts payable, following the entire flow from generation to payment/collection.

- Step 2: Data normalization as the "backbone"

Standardize Expense, Invoice, and AR/AP data on Bizzi and treat Bizzi as single source of truth, ensuring that every issue has an audit trail.

- Step 3: Design the workflow based on risk.

Set up approval flow based on risk level and threshold value, not based solely on rank; automatically includes deviations as exceptions.

- Step 4: Connect the control to the measurement indicator.

Each control point must be measurable using data (exception rate, cycle time, AP overdue, budget overspending).

- Step 5: Dashboard for early warning

Use the Bizzi dashboard to detect bottlenecks, expense anomalies, and debt risks before problems arise.

- Step 6: Standardize and expand the operating framework.

Standardize into SOPs, scale up to other units, and continuously optimize policies based on real-world data.

The mandatory components of an enterprise internal control framework according to international standards.

Below are the mandatory components of an enterprise internal control framework according to international standards (built on the COSO framework).

The CFO's controlling and "tone-at-the-top" environment

The controlled environment is foundation of the entire internal control framework. No matter how rigorous the process, if the "tone at the top" isn't clear, the system is still easily broken.

The CFO's "top-down tone" is evident in their daily decision-making: whether to accept unrecorded exceptions, whether to prioritize compliance or pursue short-term results. When the CFO is lenient with minor deviations, the implicit message sent to the organization is that control is merely a formality.

A well-controlled environment is characterized by:

- Clearly defined roles and responsibilities

- Do not allow a single individual to simultaneously propose, approve, and make payments.

- Ethical standards and compliance are applied consistently.

This is why the role of a CFO is not just about managing numbers, but about... person who establishes a culture of control in business

Risk assessment within the internal control framework of a business.

Risk assessment is a step that helps businesses answer the question: If there is a mistake, where is it made and what are the consequences?Risk groups that CFOs need to be aware of:

- Fraud risk

- Risk of invoice errors, expense

- Supplier risk

- Compliance and tax risks

From a CFO's perspective, risk assessment should not stop at simply listing risks on paper, but must be linked to key cash flows and processes: purchasing, payments, revenue, expenses, and taxes. Each risk needs to be assessed according to its impact and likelihood of occurrence to determine which risks require strict control and which are acceptable.

If this step is skipped, businesses often fall into a situation of scattered control and numerous procedures, but fail to prevent major risks.

Control activities and the concept of "key control" in businesses.

Control activities are specific actions This helps mitigate the identified risks. However, a common mistake is that businesses create too many controls without distinguishing which are critical controls.

Examples of common key controls:

- Payment approval

- Contract reconciliation – acceptance testing – invoices

- System access control

CFOs need to focus resources on these key controls instead of spreading resources too thinly, which is time-consuming and easily overlooked.

In practice, key controls are only effective when they are designed to fit the process and have clearly defined responsibilities. If a control exists but no one "owns" it, it is almost meaningless.

Information, data, and evidence of control within a business.

A good internal control framework is indispensable. reliable data and traceable evidenceInformation used for control must be timely, complete, and consistent; otherwise, control will be merely a formality.

From the CFO's perspective, control evidence is not only for audits or inspections, but also to protect the decision-maker themselves. Control evidence includes:

- Approval trace

- Related documents

- System logs (who – when – what did)

In today's environment, fragmented manual data storage makes control evidence easily lost and difficult to consolidate. This is why modern businesses need a technology platform to centralize data, automate tracking, and ensure retrievability when needed.

How does a company's internal control framework operate throughout each cycle?

An internal control framework is only truly effective when it is directly integrated into core processes such as Procure-to-Pay, Order-to-Cash, and Record-to-Report, rather than existing separately in documentation.

Internal controls in the Procure-to-Pay (P2P) cycle

P2P helps mitigate risk before spending money. From offer to purchase → purchase → receive goods/services → payment.

- Key risks that need to be controlled.

- Spending that is not needed or exceeds the budget.

- Purchasing fraud, collusion with suppliers.

- Incorrect, duplicate, or invalid invoice payments.

- Expenses with insufficient documentation will be disqualified during tax settlement.

- Key controls in the P2P cycle

- Approve the purchase/expenditure request before any commitment arises.

- Clear delegation of authority: proposal – approval – execution – payment

- Three-party reconciliation: contract/PO – acceptance – invoice

- Ensure payment methods comply with regulations (bank transfer, cashless).

- Check for supplier risks before making payment.

- The role of the CFO

- Set budget rules and alert thresholds.

- Identify which costs need to be tightly controlled.

- Ensure that controls occur before money leaves the business.

P2P payment control helps businesses prevent incorrect payments, reduce fraud, and ensure expenses are recorded correctly and for the right recipients. Bizzi provides supporting solutions:

- Step 1: OCR invoice & automatic reconciliation

Automatically reads invoice data and compares purchase orders (PO), product receipts (GR), and invoices, reducing manual errors and detecting discrepancies early.

- Step 2: Block payment if there is a discrepancy.

Invoices with data discrepancies are thrown as exceptions and Unable to pay until properly processed.

Internal controls in the Order-to-Cash (O2C) cycle

O2C helps Protect revenue and cash flow. From order placement → delivery/service → invoice issuance → payment collection.

- Key risks that need to be controlled.

- Recording revenue that is incorrect in period or does not exist.

- Issuing invoices for incorrect transactions.

- Loss of accounts receivable, delayed collection of payments.

- Discount fraud, price manipulation.

- Key controls in the O2C cycle

- Approve the terms of sale and pricing policy.

- Complete delivery/service control before invoicing.

- Task breakdown: sales – invoicing – cash collection

- Periodic reconciliation of revenue, accounts receivable, and actual cash collected.

- Track debt aging and receive overdue payment alerts.

- The role of the CFO

- Ensure that revenue accurately reflects the nature of the transaction.

- Protecting cash flow, not just profits on paper.

- Reduce the risk of being subject to tax audits due to incorrect revenue recording.

Controlling O2C helps businesses. Reduce the risk of overdue debt and improve cash flow. and Early detection of anomalies in revenue collection.Bizzi supports businesses:

- Step 1: Monitor accounts receivable (AR) in real time.

Centralizing AR data by customer, invoice, and deadline helps Finance see potential overdue situations early. - Step 2: Automatically send debt reminders according to policy.

Establish rules for debt reminders based on due dates and risk levels, reducing reliance on manual methods and increasing on-time collection rates.

Internal controls in the Record-to-Report (R2R) cycle

R2R helps Ensuring reliable data for decision-making. (From accounting recording → reconciliation → preparation of financial and tax reports)

- Key risks that need to be controlled.

- Accounting errors

- Unjustified adjustments

- Inconsistent financial statements

- Lack of evidence during audits and inspections.

- Key controls in the R2R cycle

- Standardize accounting recording and classification processes.

- Periodic reconciliation: detailed ledger – summary ledger – report

- Control year-end adjusting entries

- Approve the report before release.

- Maintain complete records of accounting and control documents.

- The role of the CFO

- Ensure the report accurately reflects the company's current situation.

- As the person ultimately responsible for the accuracy of the data.

- Be prepared to explain your position to auditors and tax authorities.

Solution Bizzi combination Sactona (EPM) This helps to link operational data with management reporting data.

- Step 1: Synchronize generated data

Automatically synchronize expenses, invoices, and AP/AR data from Bizzi to the R2R system, ensuring data consistency and audit trail capabilities. - Step 2: Compare Budget – Forecast – Actual

Use Sactona to compare plans, forecasts, and actual numbers in real time; detect deviations and their causes early. - Step 3: Control discrepancies & trace data sources

All discrepancies can be traced back to each transaction that occurred on Bizzi, for adjustment and explanation purposes. - Step 4: Quick closing – transparent reporting

Reduce manual adjustments, shorten closing times, and improve the reliability of financial and management reporting.

How does an internal control framework help CFOs make better decisions?

An internal control framework is not just for “risk prevention,” but is actually a foundation that helps CFOs make faster, more accurate, and more confident decisions. Below is how an internal control framework directly supports the quality of CFO decisions, categorized by value layer.

1. Transform financial data into "trustworthy data for decision-making".

- The data is generated through a controlled process, not compiled manually.

- Reduced discrepancies due to:

- Duplicate/Incorrect Data Entry

- Incorrect recording period

- Unjustified adjustments

- The CFO should not doubt the accuracy of the report before analyzing it.

2. Identify risks early – before risks become costs.

- Good internal controls create early warning points:

- Expenditure exceeds budget.

- Risk provider

- Overdue debts

- Unusual revenue

- CFOs don't just look at performance reports; they can identify trends and signals of deviation.

3. Make decisions based on cash flow, not just profit.

- Controlling P2P and O2C helps CFOs:

- Know When will the money actually be spent?

- Know When will the money actually arrive?

- Limit the following situations:

- High profits but short on cash.

- Good revenue but difficult to collect debts.

4. Reduce personal dependence – increase consistency in decision-making.

- Process and key control are standardized:

- It doesn't depend on "who does it".

- Not swayed by emotions or internal pressure.

- The CFO makes decisions based on:

- Rule has been established

- Defined risk threshold

5. Accelerate decision-making through transparency and readily available data.

- The information is:

- Standardization

- Fast access

- There is supporting evidence.

- The CFO doesn't waste time:

- Re-examine the data.

- Waiting for multiple rounds of verification.

- Internal Disclosure Explanation

6. Confidence in making decisions before the Board of Directors, investors, and auditors.

- A good internal control framework helps CFOs:

- Explained Why did you make that decision?

- Demonstrating data-driven decision-making and controls

- Enhance the CFO's personal credibility within the organization.

Bizzi connects operational data (actual transactions) with FP&A (planning, budget). By integrating with source systems such as ERP/Accounting and specialized FP&A platforms like Sactona, Bizzi helps businesses automate data collection, standardization, and consolidation, creating a transparent and seamless financial picture. This provides a foundation for CFOs and FP&A teams to analyze and forecast much more effectively than with traditional Excel..

Key benefits:

- Transparency: CFOs and FP&A have a comprehensive and clear view of business performance.

- Automation: Minimizes manual data entry effort and errors.

- In-depth analysis: Connecting business results with financial indicators (Financial-Business Linkage).

- Decision support: Standardized data facilitates budgeting and forecasting (rolling forecast).

Common mistakes when building an internal control framework for businesses.

The biggest mistake was designing too many manual controls, lacking real-time data, and being detached from the operational system, turning the control framework into a burden instead of a management tool.

1. Viewing internal control as "the job of accountants and auditors"

Many businesses delegate the entire task of building internal controls to the accounting department or Internal Audit, while:

- Major risks arise in purchasing, sales, and operations.

- Spending decisions are outside the finance department.

As a result, the control framework is technically correct but misaligned with business realities, and the CFO does not receive the right information to make informed decisions. An internal control framework should be a corporate governance system, not a tool solely for finance.

2. The design incorporates too many controls but lacks key controls.

Businesses typically:

- Set up multiple approval steps.

- Create multiple checklists

- Requires multiple types of documents

But it was not determined which core controls, if lost, would pose the greatest risk. The consequence:

- Slow process

- Personnel avoid compliance.

- The major risks still slip through.

3. Control is based on paper, not linked to actual data.

A good control framework on the document, but:

- Not connected to the system

- No logs, no electronic evidence.

- History cannot be retrieved.

This will cause the CFO to:

- Don't trust the data.

- Difficult to explain when inspected.

- Failure to detect the discrepancies early

Internal control It is only valuable if it leaves a data trail..

4. Applying international standards to machinery is not suitable for the scale of the business.

Many businesses copy the COSO/ISO framework:

- Too complex for the available resources.

- Many steps are not feasible in operation.

- Employees don't understand "why they have to do it."

The result is:

- Controls were ignored.

- Make it happen

- The CFO role is not suitable for management.

5. Not linking internal controls to business objectives.

When internal control serves only:

- Follow

- Auditing

- Inspect

without being associated with:

- Cost optimization

- Protecting cash flow

- Improve operational efficiency

Then the CFO would consider control as a "management expense," not a cost. decision leverage.

6. Lack of "tone at the top" from the CFO and the leadership team.

A culture of control begins with CFO's behavior, not text. If the leader:

- Flexibility to skip steps when folding.

- Breaking the established rules

- Non-compliance with internal policy

then the control framework:

- Invalid

- Become a form

- Not respected

7. Failure to update controls when the business model changes.

The internal control framework of a business must Evolution alongside business strategyAs the business expands:

- Add a branch

- Multichannel sales

- Digital conversion

but the control framework remains unchanged:

- old approval threshold

- Old process

- Old permission system

The consequence is new risks. uncontrolledThe CFO is passive in the face of errors.

8. Lack of technological support means control is dependent on human intervention.

When control relies entirely on:

- Manual reminders

- Handwritten signature

- Disjoint files

then:

- Error prone

- Difficult to expand

- The CFO does not have real-time data.

FAQ – Frequently Asked Questions from CFOs Regarding the Internal Control Framework

Below is a FAQ – Frequently Asked Questions from CFOs about the company's internal control framework.

1. Is the internal control framework mandatory according to COSO?

It's not mandatory. COSO is an international reference framework that helps businesses fully understand the components of internal control, but it's not a rigid template to be applied exactly as is. CFOs need to "customize" – adapt COSO to the size, industry, and actual risk level. A good control framework is one that the business can operate within, not one that's strictly "textbook-compliant."

2. Do medium-sized enterprises need a comprehensive control framework?

Yes, but It doesn't need to be as comprehensive as a large corporation.For medium-sized businesses, the control framework should lean and focusedPrioritize the biggest risks, such as costs, invoices, cash flow, and payment approvals. The thinking here is: scalability – Control can be scaled up as the business grows, rather than designing overly complex controls from the start.

3. How often should a company's internal control framework be reviewed?

Minimum once a yearFurthermore, the CFO needs to review internal controls immediately when major changes occur, such as rapid growth, branch openings, changes in business models, implementation of new systems, or tightening of tax policies. Internal control is not something to be built once and left as is, but rather something to be implemented. living systems.

4. How does an internal control framework differ from an internal audit framework?

They are fundamentally different. Internal control is preventative, helping to prevent errors and risks from occurring at the outset of a transaction. Internal auditing is post-audit, assessing whether those controls are working effectively. CFOs need strong internal controls to reduce reliance on auditing.

5. Does internal control slow down operations?

No, if designed correctly. Control only slows down when:

- Cumbersome process

- Document dependence

- Manual browsing

Conversely, when standardized and automated, control helps reduce errors, avoid rework, and actually speeds up operations.

6. How can the effectiveness of a company's internal control framework be measured?

Efficiency is not measured by prescribed numbers, but by operational results. The CFO can monitor:

- Number of exceptions/errors that occurred

- Transaction processing time (cycle time)

- The percentage of expenses that were disallowed or adjusted.

- The level of risk decreased over each period.

Good quality control means fewer errors – faster – and clearer control.

7. What is the role of technology in modern internal control?

Technology is the foundation, not an "addition." The system helps:

- Automation replaces human control.

- Providing real-time data to the CFO.

- Keep audit trail and sufficient control evidence.

- Early risk warning, rather than late detection.

Modern internal control cannot be separated from technology if businesses want to expand and manage sustainably.

Conclude

Ultimately, an internal control framework is not a tool for "tightening" operations, but rather a system for safeguarding the quality of the CFO's decisions. When properly designed, internal controls help the CFO see risks before they become costs, trust data before making decisions, and keep the business operating within a "safe zone" even during rapid growth.

Hopefully, through the above article, leaders have gained a more personal perspective on what COSO is and grasped the essence of the internal control framework for businesses. The internal control framework is not intended to "freeze operations," but rather to help CFOs clearly see risks, make quick decisions, and protect the business from the root.

However, internal control is only truly effective when supported by technology. In the context of large transaction volumes, increasingly stringent tax regulations, and ever-faster reporting requirements, control using Excel and human resources is no longer sufficient. This is where solutions like Bizzi come into play: standardizing spending, invoicing, and payment processes; automatically collecting and attaching documents to each transaction; creating early risk alerts; and storing complete audit trails for CFOs.

From the perspective of a modern CFO, the goal is no longer to "do it right when audited," but to do it right from the start. costs incurredA well-digitized internal control framework will help CFOs shift from the role of “ultimate controller” to a financial and strategic leader, where every decision is based on clean data, clear processes, and robust technological support.

Register here to receive personalized business solution advice from Bizzi: https://bizzi.vn/dat-lich-demo/