Financial statements (FS) are an indispensable document in business management, providing a clear, comprehensive view of the financial situation, business results and cash flow of the organization. With a central role in the decision-making process, FS support business owners and accountants in evaluating operational efficiency, analyzing payment capacity and forecasting future financial trends. This article will explore with you “what is a financial report”, as well as its importance and essential role in business management – especially useful for business owners and accountants.

1. What is a Financial Report?

Financial statements (FS) are a system of economic and financial information of an enterprise, prepared and presented in accordance with the provisions of the Accounting Law and accounting standards. FS reflects the financial situation, business performance and cash flow, thereby helping managers and stakeholders have a comprehensive view of the current state of the enterprise.

What is the legality of Financial Statements?

Financial statements are not only a management tool but also have an important legal significance in the enterprise accounting system. This is the basis for the authorities to inspect, monitor and evaluate the transparency of financial activities.

- Financial statements are mandatory legal documents for all businesses.

- This is an important tool used to present financial information to tax authorities, banks, auditors, investors and government agencies.

- Enterprises that fail to submit or submit financial statements late may be subject to administrative penalties according to regulations.

Requirements for information on Financial Statements:

Information in financial statements must meet the following requirements:

- Honest and reasonable: Accurately reflects the financial performance of the business.

- Full: Includes assets, liabilities, equity, revenue, expenses, profits and cash flows.

- Objective and verifiable: No bias, no errors, verifiable by accounting documents.

- Timely: Prepared in the correct accounting period and submitted on time.

- Easy to understand: Information is clear and transparent, making it easy for stakeholders to analyze and use.

2. 05 Main Components of Financial Statements

When learning about what a financial report is, businesses need to understand that a complete set of reports usually includes 5 basic components. This is the basis for comprehensively reflecting the financial situation and operating efficiency of the business:

- Balance Sheet: Provides an overview of assets, liabilities, and equity at a specific point in time. It is a measure of solvency and financial safety.

- Income Statement: Reflects revenue, expenses and profits during the period. Through this report, managers can evaluate business performance and make timely adjustment decisions.

- Cash flow statement (Cash Flow Statement): Presents details of a company's cash inflows and outflows, classified by operating, investing and financing activities. This is an important tool for monitoring cash generation and ensuring liquidity.

- Notes to the Financial Statements: Explain in detail the accounting indicators, policies and specific issues that are not clearly shown in the data. This section helps increase the transparency and reliability of the report.

- Statement of Changes in Equity: Record changes in equity during the period, including retained earnings, dividends, or changes due to issuance of additional shares.

Understanding and fully analyzing these 5 components will help business owners and accountants have a comprehensive view, thereby creating sustainable management and development strategies.

3. Purpose and Role of Financial Reporting

Through clearly and transparently presented figures, financial reports help businesses shape strategies, control risks, and build trust with regulators, investors, and partners. It can be said that this is the “financial language” that any business needs to operate sustainably and develop in the long term.

3.1 Purpose of financial statements

Financial statements aim to provide comprehensive information on the financial situation, business performance and cash flows of an enterprise. This is an important tool to meet the economic decision-making needs of many subjects such as business owners, accountants, management agencies or investors.

Important information includes:

- Assets, liabilities and equity

- Revenue, expenses and profits (profit – loss)

- Cash inflows/outflows during the accounting period

3.2 What is the role of financial reporting?

What is the role of financial reporting? This is the foundation that helps businesses better manage resources, control risks and increase transparency in business operations.

- Support accurate financial decision making: Allows managers to detect trends, monitor business performance and make timely adjustments.

- Effective debt management: Provides clear visibility into assets and liabilities, thereby optimizing debt management and cash flow balance.

- Simplify tax procedures: Accurate reporting helps minimize errors in declarations, limit risks and reduce tax burden for businesses.

- Ensuring legal compliance & financial transparency: Contribute to ensuring that businesses comply with accounting and tax regulations, while enhancing reputation and building trust with investors, banks and related parties.

4. Financial Report Users

Users of Financial Statements are divided into two groups:

- Internal business subjects Business owners, management and accounting departments are the direct users of financial reports. Business owners need to understand what financial reports are to evaluate profits and losses, capital efficiency and plan development strategies. Management relies on data to control operations and optimize costs, while accounting departments and financial managers are responsible for preparing and analyzing reports, ensuring transparency and compliance with regulations.

- External entities Financial statements are also of particular interest to investors and shareholders. Investors and shareholders use them to assess returns and risks; banks and suppliers use them to assess solvency; tax and statistical authorities use them to monitor obligations and compile macroeconomic data; auditors look for accuracy; and employees look for financial health to ensure their income and welfare rights.

5. Classification and Principles of Financial Reporting

When learning about what financial statements are, businesses need to clearly understand the classification methods as well as the principles of preparation to ensure transparency and compliance with legal regulations.

Classification of financial statements:

- According to the content: Including consolidated financial statements (applicable to parent companies and subsidiaries) and separate financial statements (for each independent enterprise).

- By time: Including annual financial reports (mandatory by law) and interim financial reports (quarterly or semi-annually, to provide more updated information to investors and regulators).

Principle financial reporting:

- Accrual basis: Revenues and expenses must be recorded as they arise, regardless of when the money is actually received or paid.

- Continuous operation: The report is prepared on the assumption that the business will continue to operate normally for the foreseeable future.

- Consistent and material: The presentation style should be consistent across periods, while emphasizing and clarifying key information.

- Comparable: Data should be organized and presented in a consistent manner between periods to help managers and investors easily track fluctuations.

Understanding the classification and principles of financial reporting not only helps businesses comply with regulations, but also increases transparency and creates trust with shareholders, partners and regulators.

>> See more: Detailed Instructions on How to Make a Quick and Standard Financial Report in 2025 – Bizzi

6. Financial Report Submission Process and Deadline

Financial reporting is not only a legal obligation but also a tool to reflect the health of the business. Understanding the process and deadlines helps businesses comply with regulations, avoid risks and improve financial transparency.

Financial Reporting Process

The process of preparing financial statements includes the following basic steps:

- Arrange documents: Collect, check and classify invoices, vouchers, contracts, accounting journals to ensure validity.

- Accounting for arising transactions: Fully record all economic transactions arising in accounting books according to standards.

- Data classification and synthesis: Clearly classify items such as assets, liabilities, revenue and expenses; then summarize to prepare a report.

- End of period: Transfer necessary indicators on business results and undistributed profits.

- Prepare financial statements: Complete required forms including balance sheet, income statement, cash flow statement and notes to financial statements.

- Submit financial statements: Submit reports to tax authorities, statistical agencies, business registration agencies and other management agencies as prescribed.

Financial Report Submission Deadline

The deadline for submitting financial statements depends on the type of business:

- Private enterprise, partnership: Submit within 30 days after the end of the fiscal year.

- Other enterprises (non-state): Submit within 90 days after the end of the fiscal year.

- State-owned enterprise: Submit within 30 days from the end of the fiscal year.

- Parent company, state-owned corporation: Submit within 90 days.

- Consolidated financial statements: Submit within 90 days and make public no later than 120 days after the end of the fiscal year.

- Enterprise separation, merger, conversion, dissolution: Submit within 45 days from the date of decision.

Penalties for Late or Incorrect Financial Statement Filing

If a business makes incorrect or late submission of financial reports, it may be subject to administrative penalties from 5 million to 50 million VND depending on the severity of the violation. In addition, serious violations can affect the reputation and ability to borrow capital, audit or call for investment capital of the enterprise.

7. Bizzi's Role in Improving the Quality of Financial Reporting

Accurate, transparent and timely financial reporting is the foundation for businesses to manage cash flow, evaluate operational efficiency and make strategic decisions. However, reality shows that many businesses, especially SMEs, encounter common difficulties such as:

- Errors in manual data entry lead to inaccurate figures.

- The process of controlling invoices and documents is cumbersome and time-consuming.

- Lack of timely information to make timely financial decisions.

Compliance risks when working with tax and audit authorities.

Bizzi born as one smart AI assistant dedicated to the accounting and finance department, helping automate accounting processes, minimize risks and optimize resources. With an ecosystem including expense & travel management, invoice processing & 3-way reconciliation, debt management, capital connection platform and multi-system integration platform, Bizzi plays an important role in improving the quality of financial reporting through 5 main aspects:

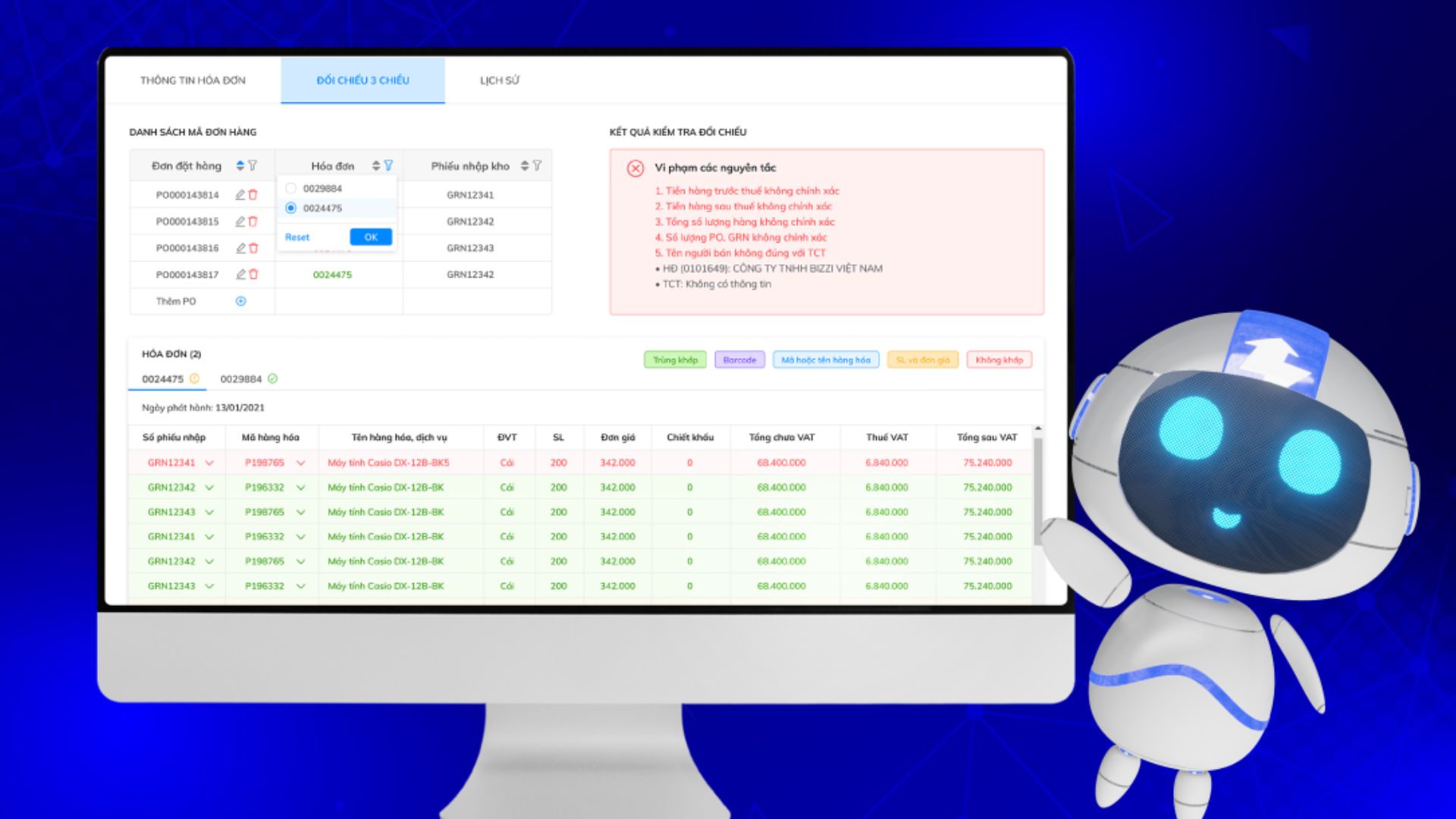

7.1. Automatic invoice processing & 3-way reconciliation – The foundation for accurate data right from the start

Processing invoices and data from invoices is the first and most important step to ensure Financial statements accurately reflect the actual financial situationBizzi supports businesses:

- Automatically download and process invoices from multiple sources: email, ERP systems, suppliers or online trading portals, reducing 90% of manual operations.

- Smart reconciliation with PO (Purchase Order) and GR (Goods Receipt): Check the validity of invoices before posting, helping to detect discrepancies or fraud immediately.

- Detect and eliminate error risks: The system warns of duplicate invoices, unusual values, or tax rate errors.

- Ensure data accuracy right from the start: Minimize errors in final reporting steps, saving time on checking and editing.

→ Results: Final financial statements are prepared on the basis of accurate, transparent and verifiable data.

7.2. Expense & Travel Expense Management – Tight Budget Control

One of the reasons why financial reports lack transparency is Internal spending is not controlled in time. Bizzi provides solutions:

- Set up a budget at multiple levels: Businesses can allocate budgets according to department, project or individual, ensure spending according to plan.

- Track spending in real time: All expenses such as business travel, entertainment, or internal purchases are updated as they occur.

- Automatic data synthesis and analysis: Compare actual costs with approved budget, provide visual reports to management.

- Transparent and timely data: Helps accountants have an accurate basis when accounting and preparing financial statements.

→ Benefits: Businesses control costs more effectively, avoiding loss or overspending.

7.3. Electronic Invoice Management – Ensuring Transparency and Compliance

Bill is an important legal basis for financial reporting and tax declaration. Bizzi supports businesses in comprehensively managing electronic invoices:

- Automatically issue standard invoices as required: B-invoice helps to create and send invoices quickly, meeting format and legal requirements.

- Convenient storage and retrieval: Invoices are stored scientifically, easy to search by contract, customer or time.

- Ensure revenue is recorded accurately: All transactions are transparent, minimizing tax and audit risks.

Reduce the risk of legal penalties: Invoices are stored and managed in accordance with tax authority regulations.

→ Meaning: Help financial statements reflect Eligible revenue and expenses, increasing confidence from investors and regulators.

7.4. Accounts Receivable Management (ARM) – Proactive cash flow and risk control

An accurate financial report cannot lack clear debt figures. Bizzi provides the feature ARM (Account Receivable Management) to support businesses:

- Track detailed accounts receivable and payable: Continuously updated and categorized by customer, supplier or contract.

- Warning of due and overdue debts: The system sends automatic notifications, helping businesses collect debts promptly and avoid interest penalties.

- Cash flow balance support: Provides visual information about expected cash flow, helping businesses proactively plan their finances.

- Instantly update figures to the Balance Sheet: Ensure debt indicators are always accurate and timely.

→ Value brought: Minimize bad debt risk, improve transparency and liquidity of businesses.

7.5. Data integration & synchronization – Accelerate financial reporting

In many businesses, data is scattered across multiple systems such as ERP, accounting software, CRM or banking, making it difficult to consolidate. Bizzi solves this problem by:

- Cross-platform integration: Direct connection to ERP, accounting software, sales systems, banking and other management tools.

Automatic data synchronization: Minimize manual data entry and repetitive errors. - Shorten reporting time: Helps accountants summarize data quickly, especially useful at the end of the month/quarter/year.

- Ensuring timeliness and accuracy: Data is always updated real-time, support leaders to make quick and correct decisions.

→ Direct impact: Businesses save time, reduce pressure on the accounting department and improve the quality of financial statements.

Conclude

Financial statements are not only a mandatory administrative document, but also a strategic tool that helps businesses be transparent about assets, capital, cash flow and business results. Understand clearly What is financial reporting? help business owners have a comprehensive view to make effective management decisions, and support accountants in preparing accurate and transparent reports. Financial statements are also the foundation for risk assessment, debt management, legal compliance and building trust with stakeholders such as investors, banks and authorities. Mastering financial statements will help businesses operate effectively, strengthen governance and move towards sustainable development.

Learn more at: finance.bizzi.vn