In the process of business operations, controlling and accounting for sales costs plays an important role in determining the profit and financial efficiency of the enterprise. However, not everyone clearly understands what sales costs include and how to classify and record them specifically according to current regulations. The following article will help you understand each item of sales costs according to Circular 200/2014/TT-BTC - an important legal document guiding the enterprise accounting regime that is commonly applied today.

1. What is cost of sales?

Selling costs are all expenses incurred in the process of bringing products, goods or services to customers. This is a necessary cost to support sales activities, contributing to maintaining and increasing revenue for the business. Understanding the concept and components of selling costs helps businesses effectively control costs, optimize profits and build sustainable business strategies.

Tracking and accounting for sales costs not only ensures financial transparency but also provides a basis for businesses to analyze business performance and adjust sales strategies to suit each stage of development.

2. Types of detailed sales expenses according to Circular 200/2014/TT-BTC (Account 641)

What does selling cost include? Selling cost includes all expenses directly related to the consumption of products, goods or provision of services. According to Circular 200/2014/TT-BTC, specifically in Clause 2, Article 91, these expenses are recorded and monitored through Account 641 - Selling cost.

Understanding what sales costs include will help businesses account for sales costs transparently, in accordance with regulations, and easily compare with the sales cost accounting diagram.

Below are the expenses included in Cost of Sales:

2.1 Employee costs (Account 6411)

This is the payment for personnel directly involved in the process of consuming products and goods. Understanding this item is an important basis in cost of sales accounting according to regulations

- Salaries, wages and allowances for sales staff, packaging, shipping and product preservation staff.

- Meal allowance for sales staff.

- Salary deductions: social insurance, health insurance, unemployment insurance, union fees.

- Other benefits: life insurance, voluntary retirement insurance for employees.

2.2 Cost of materials and packaging (Account 6412)

Reflecting the costs of materials used to store, package and ship products to customers – this is an essential part of answering the question What does cost of sales include?.

- Packaging materials: paper, plastic, carton, tape.

- Materials and fuel for storage, loading and transportation of products.

- Materials for repair and maintenance of fixed assets used by the sales department.

2.3 Cost of tools and supplies (Account 6413)

This item includes tools to support the sales process, warehousing, and delivery of goods, serving the goal of optimizing sales performance.

- Measuring instruments such as electronic scales and gauges.

- Computing devices: handheld calculators, payment support devices.

- Working tools such as trolleys, display shelves, mobile billboards.

2.4 Fixed asset depreciation expense (Account 6414)

Reflects the depreciation value of fixed assets of the sales department, contributing to the completion cost of sales accounting chart.

- Warehouse, store for storing and displaying goods.

- Wharf, loading and unloading vehicles, transporting goods.

- Equipment for quality control, measurement and testing at the point of sale.

2.5 Warranty costs (Account 6415)

Record expenses to fulfill warranty obligations for sold products. This is a part that is often overlooked when businesses do their own research. What does cost of sales include?.

- Cost of product repair during warranty period.

- Cost of replacement parts and components.

- Outsourcing service to perform warranty work.

- (Note: Construction warranty costs are not reflected in this account but recorded in Account 627 - General production costs.)

2.6 Outsourced service costs (Account 6417)

Record outsourcing costs that directly serve sales activities, consistent with the entire system. Accounting for sales expenses according to Circular 133 and Circular 200.

- Cost of renting and repairing fixed assets for sales purposes.

- Warehouse rental costs, storage costs.

- Cost of outsourcing loading, unloading and transporting goods.

- Commission paid to sales agents and export consignees.

- Other service costs such as: electricity, water, advertising, fax, software maintenance used in the sales department.

2.7 Other cash expenses (Account 6418)

Reflects cash expenditures incurred in sales activities, but not included in the above expense groups.

- Sales department reception costs.

- Cost of advertising on newspapers, radio, social networks, printing leaflets, banners.

- Cost of organizing customer conference.

- Cost of organizing fairs, exhibitions, promotions, gifts.

- Sponsorship and brand development costs.

- Other cash expenditures for product consumption activities.

3. General provisions on Account 641

Account 641 is used to reflect the entire cost of sales arising during the accounting period of the enterprise, helping to monitor and control expenses related to the consumption of products, goods or services. Understanding What does cost of sales include? as well as specific accounting methods to help businesses comply with regulations and optimize financial efficiency.

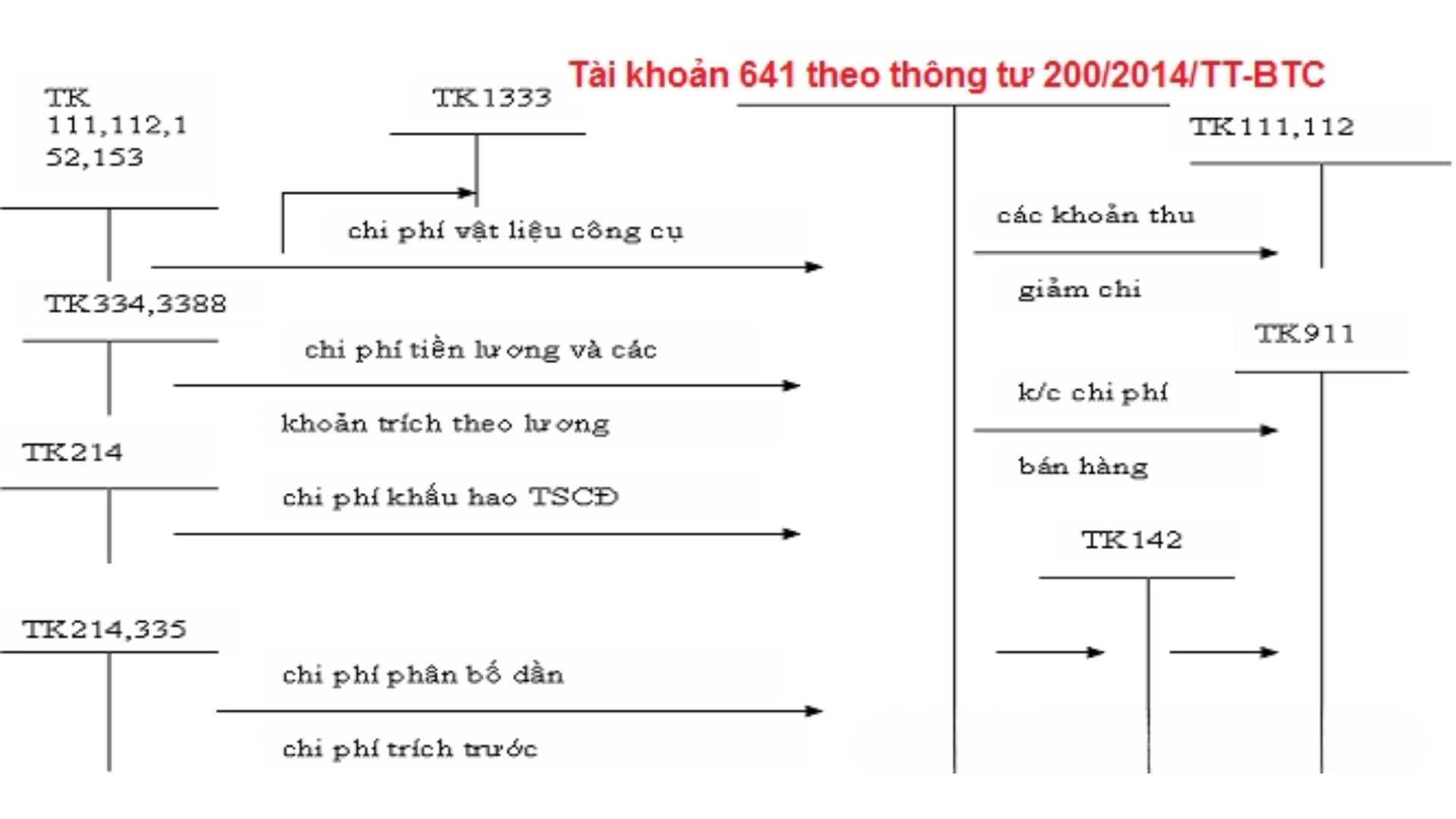

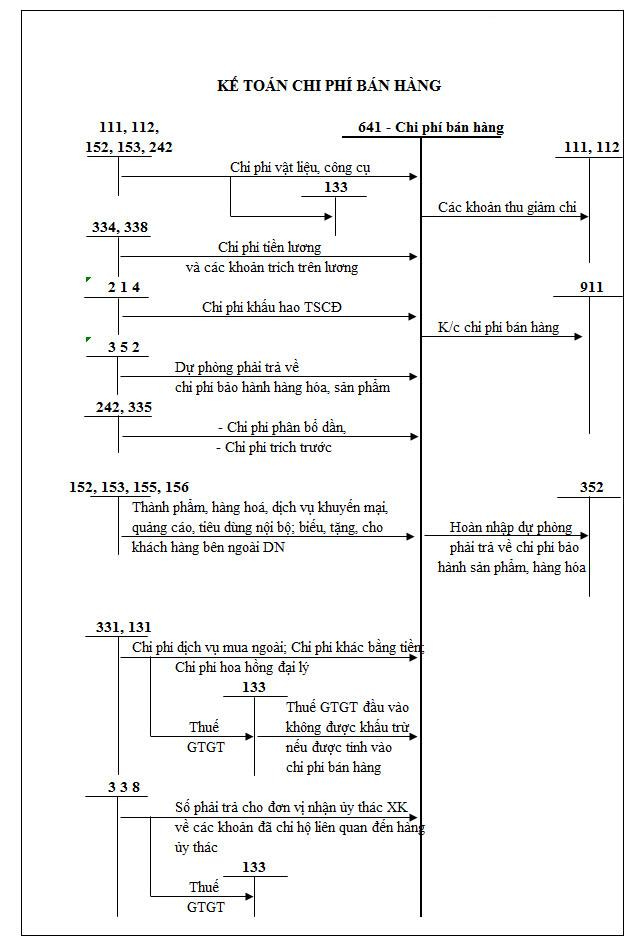

Structure of Account 641:

- Debit side: Record all payments Actual costs incurred in connection with the sales process during the period such as sales staff salaries, material costs, advertising, promotions, shipping costs, warranty, gift costs, etc.

- Creditor: Record sales expenses as reversed or adjusted.

- Transfer: At the end of the period, the total cost of sales will be Transfer to Debit account 911 “Determine business results”.

Ending balance of Account 641:

Account 641 no ending balanceAll expenses recorded during the period are transferred to account 911 to determine business profit or loss.

Accounting for some basic transactions:

In fact, cost of sales accounting can be performed for many tasks such as:

- Calculate salary and bonus for sales department;

- Issue materials and tools for sales activities;

- Depreciation of assets used for sales;

- Outsourcing costs, advertising, promotion costs, agent commissions;

- Product warranty costs;

- Cost of giving away sample products.

For small and medium enterprises, the Accounting for sales expenses according to Circular 133 It is necessary to comply with specific instructions, in which Account 641 is also a key account in the accounting system.

Note on corporate income tax:

Although some sales expenses are not included in reasonable expenses when determining corporate income tax (CIT) according to regulations, if there are complete invoices and documents and they are accounted for correctly, Accounting mode, then the business not excluded from accounting costs but only make adjustments when preparing corporate income tax settlement.

Importance of Managing Selling Costs:

Understanding cost of sales accounting chart and closely monitor each item to help businesses control costs well, thereby optimizing profits and making more accurate business decisions. This is also an important factor in the sustainable development strategy of the business.

Diagram of accounting for sales costs

4. Bizzi – Smart solution to help businesses manage sales costs effectively

In business, controlling sales costs is an important factor that helps businesses maintain profits and optimize performance. Although not managing all costs in the business, Bizzi is still a powerful support tool for non-trade sales expenses such as entertaining guests, purchasing office supplies, organizing events, printing POSM or giving gifts to customers. Thanks to the ability to automate accounting and invoice management processes, Bizzi helps businesses save time, avoid loss and easily control budgets.

Bizzi is especially useful for:

- Centrally manage daily sales expenses such as stationery, drinking water, and consumables, helping accountants easily summarize and classify.

- Control event expenses such as printing documents, designing POSM, buying customer gifts, etc. to ensure compliance with the approved budget.

- Automate approval and accounting processes, ensuring expenses are recorded promptly and accurately according to current accounting standards.

If you are wondering what the cost of sales includes, in addition to expenses such as sales staff salaries, transportation costs, advertising, etc., the above non-trade expenses are also indispensable. When applying software such as Bizzi, accountants can easily perform more transparent accounting for sales costs, while complying with the regulations on accounting for sales costs according to Circular 133 or Circular 200 depending on the applicable accounting regime.

Conclude

Clearly understand What does cost of sales include? According to Circular 200/2014/TT-BTC, this is an important foundation to help businesses accurately account, effectively control budgets and comply with accounting laws. From expenses such as sales staff salaries, transportation costs, advertising to hospitality and promotion expenses - all need to be clearly classified and recorded at the right time. To support transparent management and accounting of sales costs, businesses can apply technology solutions such as Bizzi, which helps automate processes, reduce risks and improve overall financial efficiency.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/