If cash flow is the “lifeblood” of a business, then working capital is a measure of the health of that blood vessel. Net Working Capital (NWC), also known as floating capital, is a core financial ratio that reflects a business's short-term liquidity and flexibility. Effective management of working capital helps optimize profits, while poor management can lead to liquidity risks and even bankruptcy.

This article Bizzi will delve into the definition, calculation formula, how to analyze the components and 7 proven effective working capital management methods.

1. What is working capital?

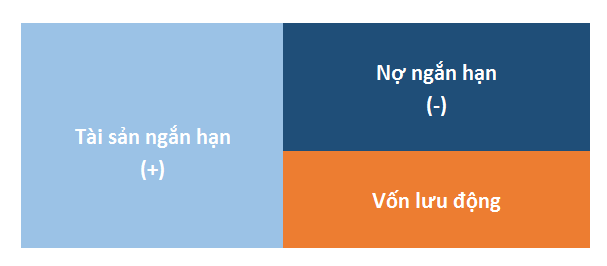

Working capital is the difference between Current assets and Current Liabilities. In essence, this is the capital that a business can use to finance its day-to-day operations after it has secured its upcoming debt obligations. All the figures used to calculate this ratio are presented on the Balance sheet, and it is an indispensable part of the operation. Administration, corporate financial forecasting and Financial Statement Analysis.

2. Formula for calculating working capital

How to calculate working capital very simple and easy to apply:

Working Capital = Current Assets – Current Liabilities

Illustration: ABC Company has total current assets of 5 billion VND and total current liabilities of 3 billion VND. So the company's working capital is:

Working capital = 5 billion - 3 billion = 2 billion VND.

This result shows that the company has 2 billion VND to maintain operations and cover expenses after securing debts that are about to mature. It should be noted that working capital expressed as a monetary figure, not a ratio.

3. Analysis of Components of Working Capital

To manage effectively, businesses need to understand the components that make up working capital.

3.1. Current Assets – Business Resources

- Cash and cash equivalents: This is an asset. Liquidity highest, ready to use for immediate payment operations.

- Accounts receivable from customers: Is the amount of money that customers still owe the business. This item needs to be managed closely to recover capital quickly, avoiding capital being occupied for too long.

- Inventory: Includes raw materials, work in progress and finished goods. This is the least liquid asset, with the potential risk of stagnation, damage and storage costs.

- Other assets: Including short-term financial investments, prepaid expenses… and other business expenses other.

3.2. Current Liabilities – Business obligations

- Payables to suppliers: Is a trade credit that businesses enjoy, a source of short-term, interest-free financing.

- Short-term loans and financial leases: Loans from banks or credit institutions are available. interest expense, need to be tightly controlled.

- Other payables: Includes taxes, payments to the government, and salaries paid to employees.

4. Meaning of working capital index

Numbers working capital After calculation, it is not just a result. It is an important indicator, telling a story about short term financial health of the business. Depending on whether the results are positive, negative or even too high, we will have different assessments of the operating situation and potential risks.

4.1. Positive working capital (> 0)

- Meaning: The business has enough short-term assets to cover its upcoming debts.

- Signal: This is a sign of good short-term financial health, high solvency, creating trust with suppliers and banks, ensuring business operations are profitable. rotation continuous.

4.2. Negative working capital (< 0)

- Meaning: Current liabilities are greater than current assets.

- Warning: Businesses face a high risk of liquidity loss and may have difficulty paying their obligations. However, some specific industries such as retail, supermarkets, and services can operate effectively with negative working capital thanks to fast cash conversion cycles.

4.3. Warning: Too high working capital is not necessarily good

A positive working capital level that is too high can be a sign of inefficient asset management. This may indicate that the business is holding too much inventory, bad receivables, or holding too much cash, leading to opportunity cost instead of investing for profit.

5. 7 effective working capital management methods

The objective of working capital management is to balance returns and risks, ensuring efficiency in capital use. Here are 7 proven methods.

- Optimize Accounts Receivable Management: Develop a clear credit policy, monitor and urge debt collection on time to reduce the average number of collection days.

- Efficient Inventory Management: Apply models such as JIT (Just-in-time), EOQ (Economic Order Quantity) to reduce inventory costs and increase inventory turnover.

- Leverage Vendor Payables: Negotiate to extend the payment term reasonably, taking advantage of this interest-free capital source.

- Accelerate Working Capital Turnover: The goal is to make every penny count. working capital generate as much revenue as possible, reflecting the efficiency of the business's use of capital.

- Tight Cash Flow Management: Plan and forecast cash inflows and outflows to ensure there is always enough cash for necessary operations, avoiding sudden shortages.

- Shorten the Cash Conversion Cycle: Optimize the entire process from spending money on raw materials to collecting sales revenue, helping to release capital faster.

- Use Short Term Loans Smartly: Borrow only when absolutely necessary to finance seasonal working capital needs or temporary projects, avoiding the burden of unnecessary interest costs.

See more: The role of cash flow in business

6. Key indicators used to measure the effectiveness of working capital management

To evaluate the effectiveness of the above mentioned management methods, businesses need to use specific measurement tools. The following financial indicators are indispensable measures to help monitor and evaluate the efficiency of working capital use.

- Current Ratio: Calculated by “Current Assets / Current Liabilities”. The recommended safety level is usually between 1.5 and 2.0.

- Quick Ratio: Calculated by “(Current Assets – Inventories) / Current Liabilities”This ratio eliminates inventories to assess liquidity more rigorously.

- Working capital turnover: Calculated by “Net Sales / Average Working Capital”. This index measures the number of times working capital rotated in a period.

- Cash Conversion Cycle (CCC): Measures the total time (in days) that a coin is “stuck” in the business production cycle.

7. Business loan support solution – Bizzi Financing

In many cases, even with good management, businesses can still face temporary working capital needs or need additional capital to expand. Fintech platforms were born to solve this problem, helping to connect businesses with capital quickly and effectively.

Bizzi Financing – Platform connecting businesses with investors

Bizzi Financing is a financial platform that connects businesses with investors, providing loan solutions Fast and efficient. This platform helps businesses access capital easily with competitive interest rates and simple procedures.

Advantages of Bizzi Financing:

- Quick loan process, just register online and the system automatically processes the application.

- Competitive interest rates help reduce borrowing costs for businesses.

- Professional financial consulting services help businesses optimize capital use.

Let Bizzi Financing help your business optimize capital and grow stronger! Sign up for Bizzi Financing consultation here: https://finance.bizzi.vn/

Conclude

Working capital is an important measure that reflects the short-term financial health and solvency of a business. effective working capital management is the art of balancing profit and risk, which is the key to sustainable development. Instead of just looking at the final number, managers need to analyze deeply into each component to make accurate strategic decisions, ensuring that the business always operates stably and is ready to seize every opportunity.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam