Employee training costs are an important investment that helps businesses improve their team's capacity and maintain a competitive advantage. However, Where is the cost of employee training accounted for? Optimizing finances while complying with accounting and tax regulations is something that many accountants and business owners are concerned about.

This article will provide detailed instructions on how to account for employee training costs in accordance with current accounting standards. Understanding Where is the cost of employee training accounted for? Not only does it help businesses easily manage costs, it also maximizes tax benefits.

1. What is the cost of employee training?

Employee training costs are expenses that businesses spend to improve the qualifications, skills and expertise of employees, in order to meet job requirements and develop the business. According to Clause 3, Article 62 of the Labor Code, training costs include:

- Tuition fees for instructors: Remuneration or salary for lecturers.

For example: A business hires an expert from abroad to train management skills for its leadership team, paying an hourly teaching fee. - Cost of documents and textbooks: Purchase or print study materials.

For example, a company organizes a soft skills course for employees and purchases textbooks from publishers to distribute to students. - Training venue rental costs: Rent classrooms and halls.

For example, a business holds technical training for employees at a convention center and incurs the cost of renting a conference room for two days. - Cost of purchasing equipment and practice materials: Invest in machinery and support tools.

For example, a manufacturing company purchases new machinery to train workers to operate a modern production line. - Employee support costs: Salary, social insurance.

For example: Employees sent for internal training during working hours still receive salary and are fully insured. - Travel and living expenses: For employees going for training away.

For example: The company sends employees to Japan to learn about new technology, including airfare, hotel, and daily living allowance.

2. Tax regulations on employee training costs

Understanding tax regulations will help businesses know Where is the cost of employee training accounted for? to enjoy tax incentives

2.1 Corporate income tax (CIT)

Conditions for deduction:

As prescribed in Article 4 Circular 96/2015/TT-BTCExpenses for vocational education and vocational training for employees are included in deductible expenses when determining taxable income for corporate income tax if they meet the following conditions:

- Related to the production and business activities of the enterprise: Training costs must directly serve the business operations of the enterprise.

- Have full legal invoices and documents: Including tuition bills, decisions to send employees to study, labor contracts and valid payment documents.

- Cashless payment for expenses of 20 million VND or more: Applicable to large value expenses as prescribed.

Specific example (Case Study):

- Exemptions: The company sends its accounting staff to attend an advanced accounting course at a professional training center. The course costs 15 million VND, with full invoices and valid payment documents. This expense is included in deductible expenses when determining taxable income.

- Cases not deductible: The company pays for English training for employees that is not related to their professional work and does not have a specific training plan. This expense does not meet the conditions related to business activities and is not deductible.

Quote:

“Expenditures for vocational education and training activities for workers include: costs for teachers, learning materials, equipment used for vocational education activities, practice materials, and other costs to support learners.”

2.2 Value Added Tax (VAT)

Deduction conditions:

According to Article 14 of Circular 219/2013/TT-BTC, input VAT of goods and services used for production and trading of goods and services subject to VAT is fully deductible.

However, Clause 13, Article 4 of Circular 219/2013/TT-BTC stipulates that teaching and vocational training services are not subject to VAT. Therefore:

- In case there is no VAT on the invoice: If the training facility is not subject to VAT and issues invoices without VAT, the enterprise has no input VAT to deduct.

- In case there is VAT on the invoice: If the training facility is subject to VAT and issues invoices with VAT, the enterprise is entitled to deduct input VAT if it meets the prescribed deduction conditions.

Specific examples:

- Cases eligible for VAT deduction: A company sends employees to attend a course at a VAT-taxable training center. The invoice clearly states the tuition fee and VAT. The company is entitled to deduct input VAT on this expense.

- Cases where VAT is not deductible: The company sends employees to attend a training course at a training facility that is not subject to VAT. The invoice only shows the tuition fee, not VAT. The company has no input VAT to deduct.

Quote:

“Input VAT of goods and services used for production and trading of goods and services subject to VAT is fully deductible.”

2.3 Personal income tax (PIT)

According to Clause 2, Article 2, Circular 111/2013/TT-BTC, benefits in cash or non-cash other than salary and wages paid by the employer that the taxpayer receives in any form must be included in personal income taxable income.

However, Point d.6 Clause 2 Article 2 Circular 111/2013/TT-BTC regulations:

- Not included in taxable income: Payment for training to improve the qualifications and skills of employees in accordance with their professional work or according to the employer's plan.

Specific examples:

- Cases not included in taxable income for personal income tax: The company pays for training to improve technical skills for technical staff according to the company's training plan. This expense is not included in the employee's taxable income.

- Cases of calculating taxable income for personal income tax: The company pays for the employee's yoga training, which is not related to professional work and is not part of the company's training plan. This expense is considered another benefit and must be included in the employee's taxable income.

Quote:

“For payment of training fees to improve qualifications and skills for employees in accordance with the employee's professional work or according to the unit's plan”

3. Where are staff training costs accounted for?

3.1. According to Circular 200/2014/TT-BTC

According to Circular 200/2014/TT-BTC, the Where is the cost of employee training accounted for? will depend on the extent and nature of the expenditure. Staff training costs may be recognised directly in the business management costs or allocated over time through prepaid expenses, depending on the extent and nature of the expenditure.

Explain “costs incurred that provide future economic benefits”:

Costs that generate future economic benefits are expenses incurred by the business now but that will generate benefits in subsequent accounting periods. In the case of employee training costs, if the training program is expected to improve the skills and performance of employees over several accounting periods, the business may consider amortizing the cost over time rather than recording it in full in one period.

3.2. Two ways to account for employee training costs

Method 1: Direct recording

When training costs are insignificant or primarily affect the current accounting period, the enterprise can record them directly in business management expenses.

Entry:

- Debit account 642 – Business management expenses

- Debit account 133 – Deductible VAT (if any)

- There are accounts 111, 112, 331,…

Accounting chart:

| Account | Interpretation | In debt | Have |

| 642 | Business management costs | xxxxx | |

| 133 | Deductible VAT (if any) | xxxxx | |

| 111/112/331 | Cash/Bank/Payables to Vendors | xxxxx |

Note: For this expense to be accepted when calculating corporate income tax, there must be full invoices and valid documents such as decisions to send employees to study, training contracts, financial invoices and valid payment documents.

Method 2: Gradual allocation

For large training costs that bring economic benefits over many accounting periods, businesses should record them as prepaid expenses and gradually allocate them to the following periods.

Accounting entries when training costs arise:

- Debit account 242 – Prepaid expenses

- Debit account 133 – Deductible VAT (if any)

- There are accounts 111, 112, 331,…

Periodic allocation entries:

- Debit account 642 – Business management expenses

- Credit account 242 – Prepaid expenses

Accounting chart:

| Account | Interpretation | In debt | Have |

| 242 | Prepaid expenses | xxxxx | |

| 133 | Deductible VAT (if any) | xxxxx | |

| 111/112/331 | Cash/Bank/Payables to Vendors | xxxxx | |

| 642 | Business management costs | xxxxx | |

| 242 | Prepaid expenses | xxxxx |

Note: The maximum allocation period shall not exceed 3 years from the date the expense is incurred.

3.3 Comparison of two accounting methods

| Criteria | Live Recording | Gradual Allocation |

| Advantage |

|

|

|

|

|

| Disadvantages |

|

|

|

||

| When to apply |

|

|

Choosing the method Where is the cost of employee training accounted for? These factors need to be carefully considered.

3.4 Notes when choosing accounting method

- Nature and scale of training costs: Consider the impact of costs on business results during the period to decide on the appropriate accounting method.

- Compliance with accounting and tax regulations: Ensure accounting complies with current regulations and has full valid documents.

- Consult an expert: In complex cases, it is advisable to consult an accounting or auditing expert to ensure accuracy and reasonableness.

Choosing the right accounting method will help businesses manage their finances effectively and comply with current accounting regulations.

IMAGE

4. Necessary documents and certificates

To account for employee training costs In order to comply with regulations and in a reasonable manner, businesses need to prepare all necessary documents and certificates. Below is a list of important documents and corresponding forms:

4.1 List of required documents

- Decision to send employees for training: Official document from the company stating information about the employee sent to study, the course attended, time and place of training.

- Labor contract: Copy of the employment contract between the company and the employee sent for training.

- Training contract: Agreement between the enterprise and the training institution on the curriculum, costs and related terms.

- Employee commitment: Commitment document from employee to continue working at the business after completing the training course.

- Invoices and payment documents: Valid financial invoice from the training institution and corresponding payment documents. Note, for expenses over 20 million VND, payment must be made via bank transfer.

- Corporate training regulations: Internal documents specify training policies, conditions and benefits for employees when participating in training.

4.2 Reference form

- Sample decision to send employees for training: Download here

- Sample training contract between business and training facility: Download here

- Sample commitment letter of employee after training: Download here

Preparing the above documents completely and accurately will help businesses account for employee training costs reasonably, while ensuring compliance with current tax and accounting regulations.

5. Special cases

In business operations, employee training costs can arise in many different cases. Accounting for these costs must comply with accounting and tax regulations to ensure validity. Below are special cases that businesses should pay attention to:

5.1 Training employees before establishing a business

When a business has not yet officially started operating but has incurred employee training costs, these expenses are considered long-term prepaid expenses. The business can gradually allocate these expenses to business expenses within a maximum period of 3 years from the date of starting operations.

Accounting:

When training costs arise:

- Debit account 242 – Long-term prepaid expenses

- Debit account 133 – Deductible VAT (if any)

- Credit account 111, 112, 331 – Cash, bank deposits, payables to suppliers

When allocating costs:

- Debit account 642 – Business management expenses

- Credit account 242 – Long-term prepaid expenses

5.2 Advanced training for working staff

Training costs to improve the qualifications of current employees are included in the reasonable expenses of the enterprise if they meet the conditions of practicality, are related to business activities and have full legal invoices and documents.

Accounting:

- Debit account 642 – Business management expenses

- Debit account 133 – Deductible VAT (if any)

- Credit account 111, 112, 331 – Cash, bank deposits, payables to suppliers

5.3 Training of new recruits

Training costs for new employees may include expenses such as the cost of hiring instructors, learning materials, training support equipment, etc. These expenses are considered reasonable expenses if they directly serve the employee's work at the enterprise.

Accounting:

- Debit account 642 – Business management expenses

- Debit account 133 – Deductible VAT (if any)

- Credit account 111, 112, 331 – Cash, bank deposits, payables to suppliers

5.4 Overseas employee training

When a company sends employees for training abroad, the costs incurred may include tuition, travel, and accommodation. If these expenses are directly related to the job and meet the requirements of invoices and documents, the company can include them in the reasonable expenses.

Accounting:

- Debit account 642 – Business management expenses

- Debit account 133 – Deductible VAT (if any)

- Credit account 111, 112, 331 – Cash, bank deposits, payables to suppliers

Choosing the method Where is the cost of employee training accounted for? The factors and circumstances listed above need to be carefully considered.

5.5 Training not directly related to business operations

If a business sponsors or supports training costs for employees but does not directly serve business operations, these expenses will not be included in reasonable expenses when determining corporate income tax.

Accounting:

- Debit account 421 – Undistributed profit after tax

- Credit account 111, 112 – Cash, bank deposits

6. Planning and budgeting for training

6.1 Implementation steps:

Step 1: Identify training needs:

- Assess current employee skills and knowledge.

- Identify areas for improvement to meet business goals.

Step 2: Set training goals:

- Set specific, measurable, relevant, realistic and time-bound (SMART) goals.

- Example: Improve communication skills for sales department within 3 months.

Step 3: Choose training methods and forms:

- Decide between in-house or outsourced training.

- Choose in-person or online training depending on your conditions and goals.

Step 4: Detailed planning:

- Determine the time, location, content and person in charge of training.

- Schedule specific training activities.

Step 5: Estimated training costs:

Calculate expenses such as:

- Instructor or training specialist fees.

- Cost of materials, equipment and facilities.

- Travel and accommodation expenses (if any).

- Opportunity cost of employee time spent in training.

Create a detailed cost estimate table to control your budget effectively.

Step 6: Approval and implementation:

- Submit plans and cost estimates to management for approval.

- After approval, proceed with implementation according to the proposed plan.

Step 7: Evaluation of training effectiveness:

- Collect feedback from participating employees.

- Evaluate the level of achievement compared to the original goal.

- Adjust and improve for future training programs.

6.2 Employee training plan template

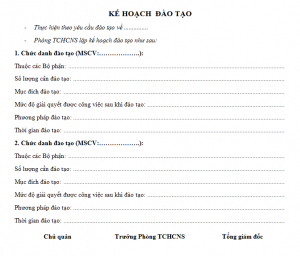

Below is a sample Training Plan that businesses can refer to:

7. Optimize employee training costs

During the operation, training and improving skills for employees is an important factor to help businesses develop sustainably. However, management and optimization employee training costs is always a challenge for managers and accountants. Below are some methods to help businesses control and optimize training costs effectively.

7.1 Use cost management software

Bizzi Expense is an advanced cost management solution that helps businesses automate processes and control budgets effectively. Applying this software brings many benefits such as:

- Process automation: Bizzi Expense helps automate the steps from payment request to approval, reducing errors and saving time.

- Accurate cost tracking: The software provides the ability to track, record and update cost data in real time, helping to tightly control spending.

- Detailed report: Bizzi Expense provides comprehensive and detailed reports on spending, supporting management in making smart financial decisions.

With the above features, Bizzi Expense not only helps businesses optimize training costs but also improves overall financial management efficiency.

Businesses can sign up for a trial of Bizzi Expense at: https://bizzi.vn/dang-ky-dung-thu

7.2 Other methods

- Internal training: Take advantage of available resources within the business to organize training sessions, share knowledge among employees, helping to save costs of hiring outside instructors.

- Combining online and in-person training: Use online training platforms to minimize travel and venue costs, and combine with in-person training sessions when necessary to ensure quality.

- Negotiate price with supplier: When needing to outsource training services, businesses should negotiate to get the most reasonable price and favorable terms.

By applying the above methods, businesses not only optimize employee training costs but also ensure the quality and effectiveness of training programs.

Conclude

Accurately accounting for employee training costs helps businesses control finances effectively, ensure transparency in accounting books and comply with tax laws. When businesses invest properly in training, employees will have the opportunity to improve their skills, contributing to improving work productivity and increasing value for the organization. At the same time, tracking and fully recording training costs also helps businesses take advantage of tax incentives, reducing financial burdens in the long term. Therefore, business owners and accounting departments need to clearly understand current regulations, plan reasonable training and perform proper accounting to optimize the budget, improve operational efficiency and maintain sustainable development.

In short, the precise determination Where is the cost of employee training accounted for? is crucial to effectively manage finances, comply with accounting and tax regulations, and help businesses take advantage of tax benefits.

FAQ (Frequently Asked Questions):

- Are employee training costs VAT deductible?

If the training service is subject to VAT and the business has a valid invoice, the input VAT is deductible. However, many training services are not subject to VAT, so there is no input VAT to deduct.

- Does a business need to sign a training contract with its employees?

Signing a training contract with employees is necessary, especially when the company is sponsoring the training costs. This contract helps define the rights and obligations of both parties, including the commitment to work after training.

- If an employee leaves after training, can the business be asked to reimburse the costs?

If the training contract or commitment between the two parties contains a provision on the refund of training costs when the employee leaves the job before the committed period, the business has the right to request the employee to repay according to the agreement.

- Do employee training costs need to be allocated?

If the training cost is of large value and brings economic benefits over many periods, the enterprise should record it in the prepaid expense account (TK 242) and gradually allocate it to the corresponding accounting periods, not exceeding 3 years.

- What documents are required to account for employee training costs?

The dossier includes: decision to send employees for training, training contract with the service provider, valid financial invoice, payment documents and commitment of the employee after training (if any).